How Long Does It Take To Build Business Credit?

Published on: 09/12/2022

Just as individuals need good consumer credit to take out loans, companies need to establish a solid business credit history to operate successfully. This article will discuss how it takes nearly two to three years to build good business credit and what you’ll need to do to get there.

How long does it take to build business credit?

If you’re just starting out in business, your creditworthiness will be based on your personal credit score and history.[1] In general, it takes two to three years to build business credit before you’ll be considered for a business startup loan.[2] That said, there are ways you can build business credit fast (or at least faster); for more information, read on.

Why do I need business credit?

You might wonder why entrepreneurs wouldn’t just use personal credit to take out a small business loan. In fact, many do: Of small businesses, 46% do use personal credit cards.[3] But separating your personal and business finances is important if you want to protect your own assets and your credit.[4]

Establishing business credit can protect your personal assets from legal liability. It can also allow you to take advantage of tax benefits, help track your business cash flow, and streamline your accounting.[5] Business credit cards also typically have higher credit limits than personal cards, which gives you a greater source of funding as you invest in and expand your business.[6]

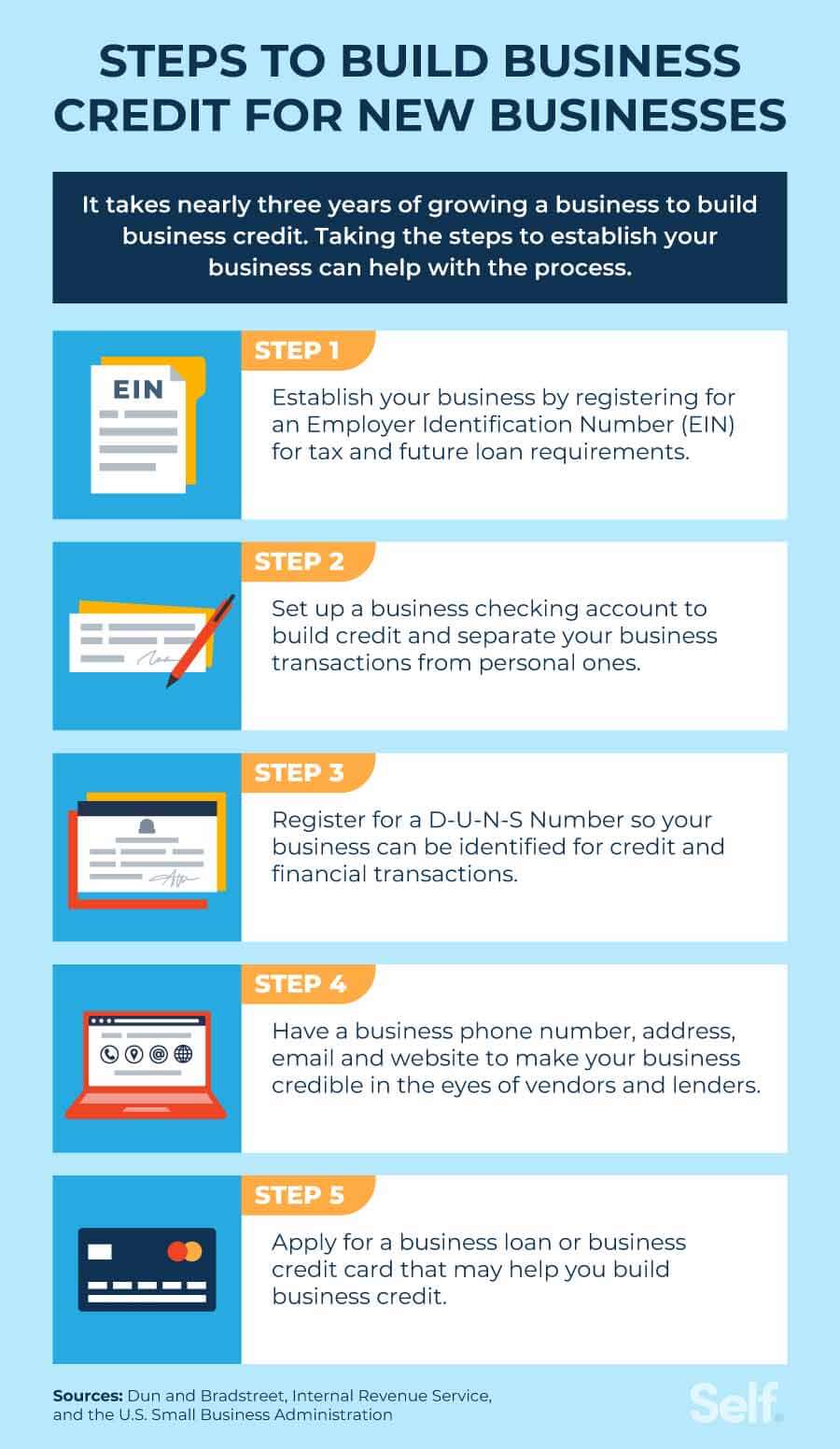

Steps to build business credit

Building business credit is a process: By going through these five steps, you can set your business entity up for success.

1. Establish your business

In setting up your business as a legal entity, it’s important to choose the structure that works for you: limited liability company (LLC), limited liability partnership (LLP), or corporation. (There’s no separation between individuals and sole proprietorships.)[7] Then apply for an Employer Identification Number or EIN. This is a nine-digit number used by the IRS for tax purposes.[8]

2. Set up a business checking account

Once you have your EIN, you can use it to open a business bank account. This will be useful for keeping your business finances separate from your personal account. (You will also be able to use your EIN to apply for permits and licenses as well as to apply for credit.)

3. Register for a D-U-N-S Number

A D-U-N-S Number is another nine-digit business identifier generated by business credit scoring company Dun & Bradstreet. This will identify your company’s Dun & Bradstreet business credit file, which lenders can access when you apply for a loan or business line of credit. Your D&B file will also include basic information about your company such as its address and phone number, along with any branches or subsidiaries.[9]

(Note: Equifax and Experian, which compile personal credit reports, are also business credit reporting agencies. The Fair Isaac Corporation, or FICO®, provides a Small Business Scoring Service in addition to compiling personal credit scores.)[10]

4. Have a business phone number, address, email and website

Establishing a physical address enhances your company’s credibility with both customers and potential credit issuers. Adding contact information — such as a phone number, email address and website — allows them to learn more about you and get in touch with you if necessary. Your business website and email address should be separate from your personal contact information.

5. Apply for a business loan or business credit card

A business credit card can help you build credit and provide important protection against fraud, among other things. There are many types of business credit cards out there for different types of businesses. To apply for one, you’ll need to supply the following[11]:

- Business name and address

- Your position in the company

- Your tax identification number (TIN), which may be your employer identification number (EIN) or Social Security number (SSN)

- Social Security numbers for any partners, typically just those who own over 20%

- Annual revenue

- How long you’ve been in business

- An estimate of how much in monthly expenses you’ll put on the card.

You may also need to provide:

- The industry your business is in

- What type of business you conduct (for example, for profit)

- Number of employees

- Number of additional cardholders

How to improve business credit

Once you’ve established business credit, it’s important to build on it to enhance your business credit profile and secure lower interest rates. Here are some ways you can do that:

- Make on-time payments — As with your personal finances, your payment history is crucial to building your credit. Late payments can be a red flag to potential lenders that your business may not be able to meet its expenses and can damage your credit.

- Pay down debt — Maintaining low credit utilization (how much of your credit limit you’ve used) is another way to help build business credit. Credit providers are likely to see a high credit utilization ratio as a sign you’ve overextended yourself.

- Avoid using personal credit — If you use your personal credit for business purchases, that won’t be reflected on your business’s credit. It can also create accounting headaches and potential tax issues for your personal finances and your company.

- Review your credit report — Your business credit reports, like your personal credit reports, can contain errors or evidence of fraud. You can purchase a report from Experian for a one-time charge or sign up for an annual subscription that allows more frequent access to reports. This allows you to identify and fix any errors you may find.

- Establish friendly communication with vendors — While vendors aren’t required to report transactions and payments to credit reporting agencies, staying on good terms may make it easier to request that they do. If you have a positive payment history record, you may consider asking if they will report to the credit bureaus.[10]

FAQs for building business credit

Whether you’re a new business or an established company trying to improve your credit, you may have questions about how to build credit. Here are some common questions and answers that can help.

What is a good business credit score?

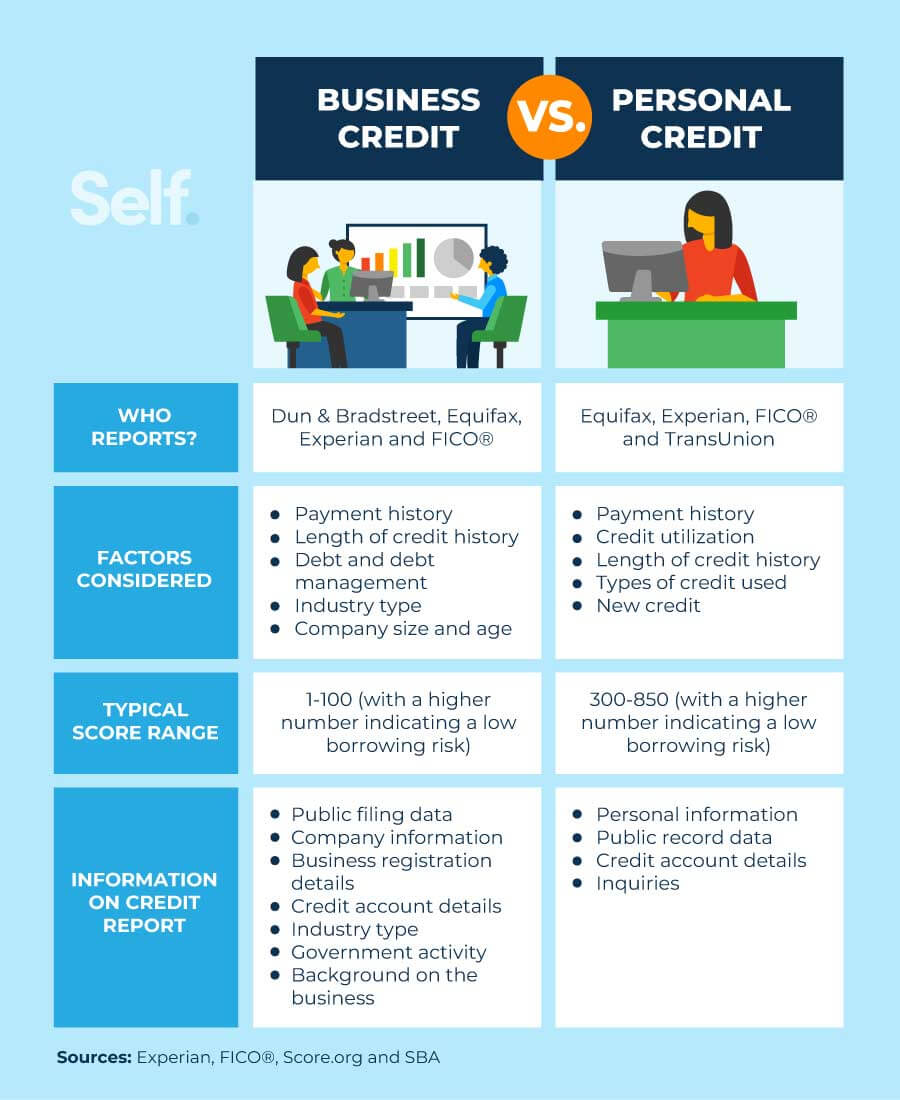

Scales used for business credit scores differ from those employed for personal credit scores. Agencies use different formulas, with scores most often ranging from 0 to 100 (as with the Dun & Bradstreet Paydex score) and FICO’s going from 0 to 300.[12] On Experian’s scale, a score of 76 to 100 indicates a business is a low-risk borrower.[13]

Which credit accounts do I need to build credit?

In order to build credit, you’ll want to open accounts that report to the credit reporting agencies. It’s a good idea to set up a minimum of two or three accounts (or trade lines) with companies that send in reports. These can include business loans, supplier accounts and business credit cards.

How is business credit calculated?

Different credit scoring models emphasize different factors when compiling scores. Some things that are likely to be considered include your payment history, credit utilization, and how long you’ve had your accounts.[14]

Experian considers factors like your outstanding balances and payment habits, as well as public records (including liens, bankruptcies and judgments) and Company background information from independent sources.[15]

How is business credit different from personal credit?

As mentioned earlier, the scoring system for business credit is different from that for personal credit, although some of the same factors are considered. In addition, information stays on your business credit report for varying lengths of time that aren’t the same as for a personal credit report. Payment trends over 12 months are among the factors considered.[16]

Which types of businesses can have business credit?

Business credit cards are available to most company owners with good credit. This includes freelancers, LLCs, corporations, and small or large business owners.[17]

Build business credit

Building business credit is an important priority for small business owners. Whether you need to buy office supplies, pay for inventory or shipping, rent space, or pay staff, you can improve your business credit in much the same way you build personal credit: by consistently making payments on time and keeping your debt low. If you do, your business will have a leg up on success as you head into the future.

Sources

- U.S. Small Business Administration. “Establish business credit,” https://www.sba.gov/business-guide/plan-your-business/establish-business-credit. Accessed April 9, 2022.

- Investopedia. “Best Startup Business Loans,” https://www.investopedia.com/best-startup-business-loans-5112018. Accessed April 9, 2022.

- U.S. Small Business Administration. “10 Stats That Explain Why Business Credit is Important for Small Business,” https://www.sba.gov/blog/10-stats-explain-why-business-credit-important-small-business. Accessed April 9, 2022.

- U.S. Small Business Administration. “5 Ways to Separate Your Personal and Business Finances,” https://www.sba.gov/blog/5-ways-separate-your-personal-business-finances. Accessed April 9, 2022.

- TD Bank. “Top 6 Benefits for Keeping Your Personal and Business Finances Separated,” https://www.td.com/us/en/small-business/benefits-of-separating-personal-and-business-finances/. Accessed April 9, 2022.

- Chase. “Eight differences between personal and business credit cards,” https://www.chase.com/personal/credit-cards/education/basics/personal-vs-business-credit-cards. Accessed August 26, 2022.

- U.S. Small Business Administration. “How to Build Business Credit Quickly: 5 Simple Steps,” https://www.sba.gov/blog/how-build-business-credit-quickly-5-simple-steps. Accessed April 9, 2022.

- IRS. “(Circular E), Employer’s Tax Guide,” https://www.irs.gov/pub/irs-pdf/p15.pdf. Accessed April 9, 2022.

- Dun & Bradstreet. “What Is a D‑U‑N‑S Number?” https://www.dnb.com/duns-number.html. Accessed April 9, 2022.

- Forbes. “How To Build Business Credit In 5 Simple Steps,” https://www.forbes.com/advisor/credit-score/how-to-build-business-credit/. Accessed April 9, 2022.

- Business.com. “How to Apply for a Business Credit Card,” https://www.business.com/articles/how-to-apply-for-a-business-credit-card/. Accessed April 9, 2022.

- Forbes. “Your One-Stop Shop For Business Credit Scores,” https://www.forbes.com/advisor/credit-score/business-credit-scores/. Accessed April 9, 2022.

- Experian. “What Is a Good Business Credit Score?” https://www.experian.com/blogs/small-business-matters/2021/08/12/good-business-credit-score/. Accessed April 9, 2022.

- CNBC. “How to check your business credit score for free,” https://www.cnbc.com/select/free-business-credit-score/. Accessed April 9, 2022.

- Experian. “Understanding Business Credit,” https://www.experian.com/small-business/business-credit-score/. Accessed April 9, 2022.

- Score. “Understanding the Three Major Business Credit Bureaus,” https://www.score.org/resource/understanding-three-major-business-credit-bureaus. Accessed April 9, 2022.

- Forbes. “8 Things To Know Before You Get A Business Credit Card,” https://www.forbes.com/advisor/credit-cards/things-to-know-before-you-get-a-business-credit-card/. Accessed April 9, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).