The Death Of The Banks

Advancements in technology and increased access to the internet have led to many changes in our lives over the past 20 years. From shopping to chatting with friends, there are no time limits or closing hours, but what impact have these changes had on our banks and banking habits?

To find out, we researched how consumer banking has been changing since 2000, highlighting how consumer bank branches have changed, and how the internet has revolutionized the way we bank and have access to banks.

Key Insights & Stats:

- Bank branch numbers in the US have fallen by 6.5% since 2012

- Based on current trends the number of physical banks could fall to fewer than 16,000 by 2030, a number not seen since 1965

- Current trends suggest that all bank branches could be closed by 2034

- Using these figures, 2030 could see over 22,600 people per bank branch, an increase of 18,000 people compared to 2020

- The number of citizens per bank branch has risen 13.2% since 2009

- Since 2000, 13,907 more banks branches exist, however, since 2013 the US has lost 5,413 banks

- 46% of Americans believe that the current way we bank needs to change

- 34% of Americans have opened an online-only bank account in the past 12 months

- More than half of Americans believe online banks will outnumber traditional banks

- 45% of Americans are concerned about their account’s security when creating an online bank account

- Bank Of America has seen mobile banking customers reach 29 million digital customers in the last decade, up from 4 million

Section 1: Historical Banking Trends Across The US

Since 2012, the US has lost over 5,400 bank branches

Our research started by looking at the number of banks in the US and how the number of bank branches has changed since 2000. We found that between 2000 and 2012 there was a 30% increase in the number of banks in the US, from 63,740 in 2009 to 83,060 in 2012.

However, since 2012 the number of bank branches open in the US has fallen by an average of 902 per year, with the latest figures showing a net loss since 2012 of 5,413 (6.52%) banks across the US, to 77,647 in 2018.

For every 15 banks in 2012, 1 has now closed and the data shows that the rate of bank closures has been doubling every 3 years. Between 2012 and 2015, the rate of banks closing was 0.81% per year, however, since 2015 (up to 2018) this closure rate had reached 1.6% per year. On this basis, it is predicted that by 2027 there could be less than 40,000 banks across the US and by 2030 fewer than 16,000 remaining.

If trends continue, the US may see its last physical bank branch close by 2034

We have also charted the decline in banks against the current population trends in the US, using official Census Bureau figures. This estimates that in 2030, there will be an average of 22,667 people per bank branch.

The number of people per bank branch will increase 393% from 2020 to 2030

Use the map below to click through each year to see how each state compares with their respective bank branch numbers. You can also see the percentage increase or decrease in bank branches over a 15 year period.

As our map shows, 45 states have seen an increase in the number of banks since 2000. Of these states that have seen an increase, there has been an average increase of 26%. However, as our data also shows, since 2012, 40 states have experienced a net decline in the number of bank branches open in their state.

As a nation, there was an average net loss of 6.5% bank branches between 2012 and 2018, with the highest rate of closures seen in Maryland; which has seen 12.62% (202) of bank branches close their doors. Close behind were South Carolina and Michigan, who have seen their number of banks fall by 170 and 330 respectively.

In terms of actual bank losses since 2012, six states (including South Carolina) have lost more than 300 banks in the past 6 years. Those being; Florida (529), Illinois (395), Pennsylvania (379), Michigan (330), California (325) and North Carolina (310).

In the last 6 years, Florida has seen the biggest loss in bank branches (529) out of all states

Section 2: Attitudes Towards Banking Today

To understand the shift in attitudes and ways we bank, we surveyed 1,114 respondents from across the US; asking them what they think of the traditional banking systems, how they feel towards the advancement in online banking and how they see the future looking.

46% of Americans believe that the current way we bank needs to change.

When asked whether they thought the current banking system needs to change, 46% of Americans believe that it does. The feeling that change is needed rises to 50.3% of Americans aged between the ages of 25 and 44, and 48% of Americans who earn under $50,000 a year.

In comparison, fewer than a third of Americans over the age of 55 feel the current systems need to change.

Some of this belief in change being needed is likely to be down to people not trusting the current banking system. When asked, 1 in 7 respondents indicated that they didn't trust the current system. This distrust is most felt in the younger generations, where 1 in 6 (15.7%) Americans under the age of 44 said they distrusted the current banking systems.

Despite 46% thinking banking needs to change, 47% don’t trust new systems like online-only banking

Despite this distrust and belief that the banking system as a whole needs shaking up, 69.9% of Americans surveyed still have trust in banks that have a physical presence. While trust for online banks is currently still quite mixed.

46.7% of Americans trust the new form of online-only banks, however, a third still do not. Compare this to the distrust in the current physical banking style, 13.6%, there is still a lot of work to be done to convince people online-only is the future and increase the number of people aware of it - currently 1 in 8 (13.2%) are still unaware that online-only banking is an option.

89.2% of Americans still use a banking company that has physical branches

With such distrust towards the current system and banking structures, you might think that people would be moving to online-only banks in their droves. However, our data found 89.2% of Americans still use a banking company that has physical branches, while only 8.8% don’t have a single account with a company with a physical presence.

87% have engaged in online banking at some point, despite a lack of trust in the systems

Physical banking companies are clearly still dominant but that doesn’t mean Americans aren’t taking advantage of the increase in online services. Our data showed that 86.9% of American banking consumers use online services, rising to as many as 88.8% of millennial age Americans.

Over half of Americans say that accessing cash and in-person advice are the main reasons they prefer physical bank branches

Access to cash (53.7%) and in-person advice (50.4%) are the two most popular reasons people are sticking to physical banks, followed by being able to deposit cash more easily (38.7%). These cash motivations are also shown in what people do when they visit the bank.

When going to the bank 51.7% of respondents said they made cash deposits, while 42.5% make withdrawals. This almost suggests that cash is still king and cash is still the main form of transaction, with over half of deposits and 2 in 5 visits to a consumer bank being cash related. However, as the Federal Reserve Bank San Francisco found, just 26% of consumer transactions are made in cash.

The main reason people go to a physical bank is to deposit cash (52%)

But, with so many going to the bank for cash purposes and cash purchases & transaction numbers down, how can this work? Our data suggests this might have something to do with the frequency of visits to the bank.

When asked how often they visited a physical bank in the past 12 months, almost a third (29.1%) of Americans visit their bank once per month, with 1 in 5 (17.9%) only going to the bank once every 3 months.

Almost 3 in 10 visit their physical bank monthly, with 12% visiting weekly

So, if banking consumers aren’t going to the bank all that frequently and cash is becoming less used by consumers, why aren’t more than 1 in 10 Americans currently using digital banks?

45% are concerned about security when using online banking

To understand why online-only banks aren’t more commonly used, we asked our respondents what puts them off signing up. Our data found that security (45%) is the key concern for consumers when it comes to switching to digital and online-only banks, followed by the lack of physical interaction with a human (43.3%), lack of free ATM access (34%) and account protection (28.3%).

Despite these concerns, our data found that in the past 12 months 34% of those surveyed had at some point, opened and trialed an online-only bank account, with 1 in 10 (9.61%) having already opened an online-only account.

More than half have never considered opening an account or decided against having an online-only account having used it.

While there has been an increase in online-only consumers over the past year, more than half (52.7%) of Americans have either never considered opening an account or ultimately decided against opening an online-only account.

To see how this could change, we asked our respondents which features they would look for in an online-only bank. 89.6% of respondents indicated 1 or more features that they would look for in a bank, with just 10.4% saying they would not use an online-only bank and no features would convince them.

As the chart shows, 24/7 access (68.9%) and payment services (52.5%) are the key functions that people consider before using an online-only bank or bank account. In addition to these functions, two fifths (41.6%) of Americans want online banks to provide free deposit services and more than one-third require app access (37.7%) and free ATM withdrawals (36.8%).

Many of these services are available already through some online platforms, however, there are a number of more specific features people would like to see in their online banks. These being; the ability to use a checking service in-app (25.3%), spending tracking (24%), discounts and partner company offers (23%), and credit score tracking and updates (20%).

With the potential for these features to soon appear in online banks and the current trends in consumer banking, we asked respondents whether they thought online banks could outnumber traditional ones in the next 20 years.

Over half are confident online-only banks will outnumber physical branches in the next two decades

More than half (55.2%) of respondents agreed that online banks will soon outnumber traditional banks, with less than 1 in 5 (16.4%) believing traditional physical banks will still be the most prominent.

Section 3 - Banking in the Future:

“Yes, banks are here to stay” - Anne Boden, the CEO of Starling bank

As our data shows, traditional banks with physical premises are on something of a decline, however, that’s not to the say the traditional banks (or companies) are going to soon disappear but they will still change.

According to various reports and commentary from a number of digital and traditional banks in the US, tech is going to be the main driver in banking innovations and its long term future, but what can we expect to see?

Changes We Expect To See In Bank Branches:

Less Face to Face with AI systems taking the role of clerks inside of banks

AI Advisors faster and interconnected systems will allow AI advisors to help provide and understand your needs more quickly, cutting waiting and approval times.

More ATMs Will Do More as additional services can be maintained and secured through automated systems, ATMs will take the place of bank clerks.

Biometric and Crypto Security will be further developed and installed to help secure accounts and services as the number of human authorizations in transactions increases.

Reduced Numbers of Brick and Mortar Banks as more services move to AI programs and the impact of COVID shows through, bank branches will reduce.

Changes We Expect In Home Banking:

Smart Management & Integrations will help provide information on the best products, times to buy and product variations for your financial means and usage.

AI Financial Advisors to help you understand and keep track of your investments and savings

More “At Home” Services with banks shutting, more services and products will move away from the bank manager and to the banking app

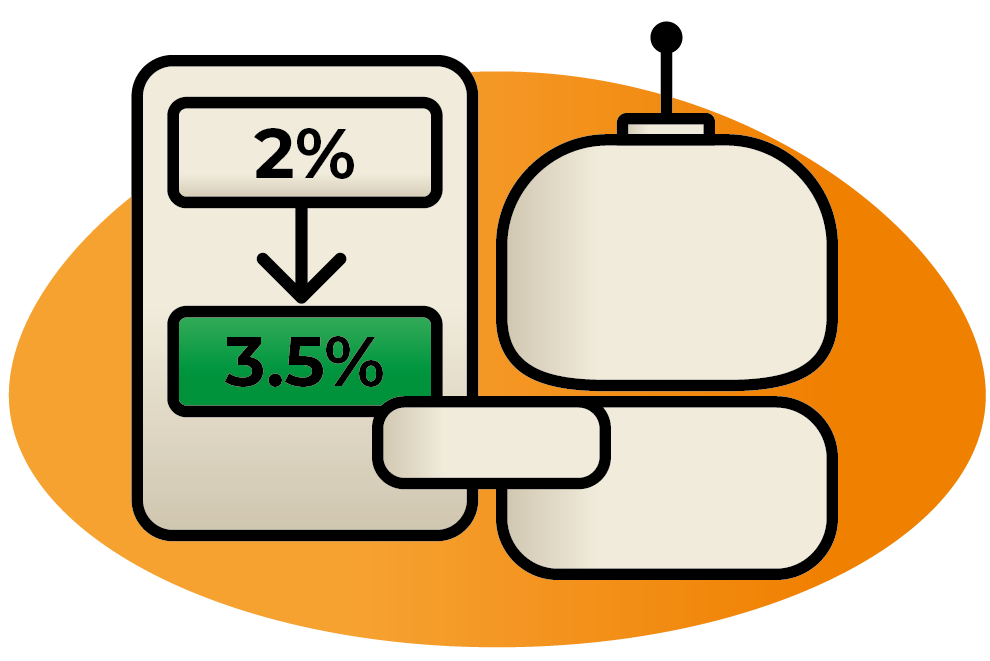

Reduced Fees as a result of reduced overheads the savings can be passed onto the customers in either interest rates or cuts in fees

What are the experts saying?

“If you think about the major types of technology that people talk about—voice recognition, artificial intelligence, machine learning, robotics—all of those apply to our industry.”

“[in light of the recent and predicted economic hardship] Physical branches will be on the chopping block. In 5 years, brick and mortar branches may not even exist - or at least not in their current format.”

“Where we have physical distribution and literally closed branches, [the question is] when the crisis abates - are some of them still needed?”

“We believe we have the model of the future – a light branch footprint, seamless digital capabilities and a network of partners that expand our reach to hundreds of millions of customers.”

“Personalization will become more important, and AI will make it possible to offer banking products tailored to individual needs, at better prices.”

Methodology

Data was researched by Statista over the course of August 2020. Data was analyzed by state, population and demographic to show the yearly number of banks open, opening and shutting, and how this compares across the nation. Extrapolated predictions we made on the future of banks by averaging the year net open/close of banks every 3 years.

Our survey of 1,114 Americans was performed via the Amazon Mechanical Turk platform, asking a proportionally representative user base, with respondents answering a range of questions regarding this attitude to traditional and online-only banking systems between 07/28/2020 and 08/01/2020.

Demographics of the respondents were:

Gender:

- Female 50%

- Male 49%

- Other or preferred not to say 1%

Age:

- 18 - 24 = 10%

- 25 - 34 = 39%

- 35 - 44 = 28%

- 45 - 54 = 13%

- 55 - 64 = 7%

- 65+ = 4%

Level of Income:

- $0 - $9,999 = 7%

- $10,000 - $19,999 = 10%

- $20,000 - $29,999 = 11%

- $30,000 - $39,999 = 13%

- $40,000 - $49,999 = 13%

- $50,000 - $59,999 = 13%

- $60,000 - $69,999 = 6%

- $70,000 - $79,999 = 8%

- $80,000 - $89,999 = 4%

- $90,000 - $99,999 = 4%

- $100,000+ = 9%

- Prefer not to say = 2%

Predictions and commentary was collated from a range of news and exclusive interviews. Experts were asked a range of questions pertaining to how they believe banking will change, the current and potential pitfall of traditional and digital banking now and in the future, and what they believe banking will look like in 20 years time.

Raw data and commentary can be provided upon request.

Sources

- https://www.frbsf.org/cash/publications/fed-notes/2019/june/2019-findings-from-the-diary-of-consumer-payment-choice/

- https://www.fdic.gov/deposit/deposits/

- https://banks.data.fdic.gov/explore/historical?displayFields=STNAME%2CTOTAL%2CBRANCHES%2CNew_Char&selectedEndDate=2018&selectedReport=CBS&selectedStartDate=1934&selectedStates=0&sortField=YEAR&sortOrder=desc

- https://banks.data.fdic.gov/explore/historical?displayFields=STNAME%2CTOTAL%2CBRANCHES%2CNew_Char&selectedEndDate=2018&selectedReport=CBS&selectedStartDate=1934&selectedStates=0&sortField=YEAR&sortOrder=desc

- https://banks.data.fdic.gov/explore/historical?displayFields=STNAME%2CTOTAL%2CBRANCHES%2CNew_Char&selectedEndDate=2018&selectedReport=CBS&selectedStartDate=1934&selectedStates=0&sortField=YEAR&sortOrder=desc

- https://economicinclusion.gov/custom-data/

- https://www.census.gov/data/tables/time-series/demo/popest/2010s-state-total.html

- https://www.pewresearch.org/internet/wp-content/uploads/sites/9/media/Files/Reports/2013/PIP_OnlineBanking.pdf

- https://www.pewresearch.org/internet/2013/08/07/51-of-u-s-adults-bank-online/

- https://www.responsemedia.com/millennials-and-finance-apps-budgeting-on-the-go/

- https://www.statista.com/statistics/946104/digital-banking-users-by-generation-usa/

- https://www.adweek.com/wp-content/uploads/2018/10/Accenture_Banking.pdf

- https://forecasts-na1.emarketer.com/5eeafb4d0055ef074c7aff0b/5eeac943e60f5d07540e2501

- https://www.finextra.com/newsarticle/30499/what-does-the-future-of-banking-look-like

- https://www.forbes.com/sites/forbesfinancecouncil/2018/11/14/banking-2028-what-banking-could-look-like-in-10-years/#7a9eeea15e3a

- https://uk.finance.yahoo.com/news/fintech-and-banking-bosses-debate-the-potential-death-of-banks-133202795.html

- https://thefinancialbrand.com/76040/retail-banks-relevant-artificial-intelligence-millennials/

- https://www.finance-monthly.com/2018/06/the-death-of-the-high-street-bank/

- https://www.forbes.com/sites/ronshevlin/2020/03/16/whos-better-digital-banks-or-traditional-banks/

- https://www.businessinsider.com/personal-finance/what-is-difference-between-online-banks-traditional-banks

- https://www2.deloitte.com/global/en/pages/financial-services/articles/bank-of-2030-the-future-of-banking.html#:~:text=New%20technologies%20are%20drastically%20changing,will%20continue%20to%20do%20so.

- https://medium.com/o-p/what-will-the-bank-account-look-like-in-2030-f9e8714d172a

- https://www.forbes.com/sites/forbesfinancecouncil/2018/11/14/banking-2028-what-banking-could-look-like-in-10-years/#7a9eeea15e3a

- https://www.forbes.com/sites/antoinegara/2020/06/08/the-worlds-best-banks-the-future-of-banking-is-digital-after-coronavirus/#6e139a232993

- https://www.protocol.com/colin-walsh-ceo-varo-neobank

Thank you to the following for their time and comments:

- Eric Taylor, director of UX research at Varo

- N26

Back to Data & Guides

Back to Data & Guides