What Is The 15/3 Credit Card Payment Hack And Does It Work?

Published on: 12/12/2022

YouTubers and bloggers who promote the 15/3 credit card payment hack say it can help you improve your credit score quickly, but the hack doesn’t live up to its billing because it contains several flaws and false assumptions.

If you’ve got bad credit, making more than one payment a month — as the hack suggests — can sound appealing. This article explains why it fails to deliver as advertised. Some credit hacks do work, but building good credit takes time and a commitment to sound practices such as making your payments on-time on a regular basis.

What is the 15/3 credit card hack?

The 15/3 credit hack gets its name from the practice of making your monthly payment in two installments: the first half 15 days before your due date and the second half three days before your due date.[1] This hack, popular on various social media platforms, claims to be a shortcut to good credit.

The hack assumes that you can impress the credit bureaus by making more than one on-time payment a month, increasing the amount of on-time payments banks report to the credit bureaus. However, banks only report one on-time payment a month, regardless of whether you break it into 2 or 20 payments. So making multiple installments won’t help your payment history.[1]

You should pay at least the required minimum payment and ideally your last statement balance by your due date — regardless of whether you pay in incremental payments or all at once. Your credit will reflect positive payment history because you paid on time and if you do pay in full you will not accrue interest on the balance.

Even though it won’t impact your payment history, making an additional payment before your closing date may help your credit score in another way. Doing so may reduce your credit utilization, the amount of money you owe relative to your credit limit, which counts for 30% of your FICO® score.[2]

15/3 credit hack example

The 15/3 credit hack claims to work like this: If Joe has a credit card balance of $2,000 and pays half of that 15 days before his due date, that would leave him with a $1,000 balance, which he could then pay three days before his due date.

Keep in mind, even if Joe paid the statement balance of his card three days before his due date, any charges Joe made to the card between his last statement balance will be added to his balance up until the statement closing date. These charges will become his current balance and thus his next current bill. Typically, this is the balance that gets reported to the credit bureaus.

What is true about the 15/3 credit hack?

Making an early payment may positively affect your credit, but not in the way the hack describes. You may build a positive credit history by lowering your credit utilization if you pay your current balance or make additional payments after your pay on your due date before the statement closing date.[2]

Credit utilization measures the amount of your debt as a percentage of your available credit on a revolving credit account, such as a credit card. Experts advise keeping your credit utilization rate under 30% as a step toward maintaining good credit. Anything higher can be an indication to potential lenders that you are taking on too much debt.[3]

However, assuming you’re not carrying a balance month-to-month, you first need to pay your last statement balance by your due date. You can then determine based on your new charges, what your next statement balance will be. If you want to lower your CUR, you could make an extra payment before your statement closing date to lower the balance that will typically be reported to the credit bureaus.

To avoid interest and late fees, you only need to pay your statement balance by your due date, assuming you’re not carrying a balance over from the previous statement. If you are carrying a balance, devise a strategy to pay down your balance and minimize new charges.

The most important step you can take toward better credit is to make your payments on time, which counts for 35% of your FICO® score.[4] The second biggest factor in your score is “amounts owed,” which includes your credit utilization ratio. Making on-time payments and keeping the amount you owe against your available credit as low a percentage as possible helps more than using hacks to build credit.[5]

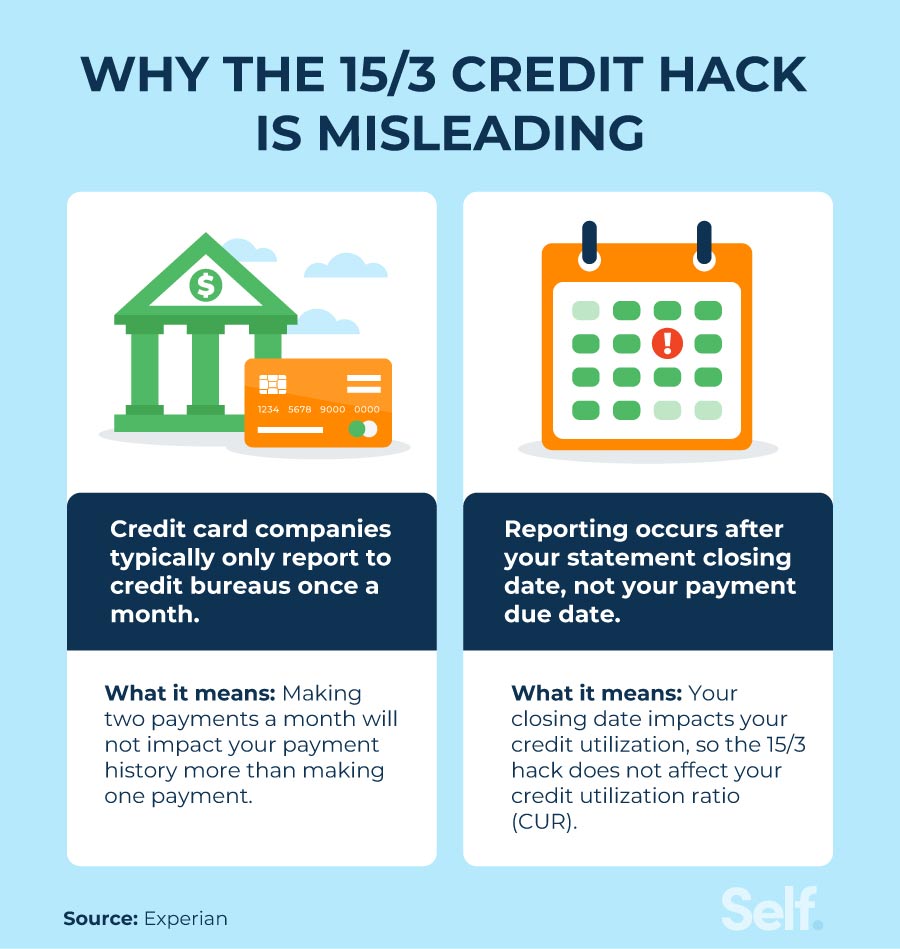

Why the 15/3 credit hack is misleading

The 15/3 credit hack relies largely on false assumptions and empty promises.[6] The facts tell a different story:

- Credit bureaus only record one on-time payment a month. Making a second payment does not improve your payment history, because no matter how many payments you make in a month, they only count as one.[1]

- Credit card companies report to bureaus on or shortly after your statement closing date. The 15/3 credit hack suggests counting back from the due date which in turn, by making two payments in a month, it may lift your credit score.[2]

- When you pay is more important than how often you pay. Knowing the difference between your closing date and your due date is important. Missing the payment due date or failing to pay your minimum payment by that date may lead to late fees and interest charges. Then making an additional payment before the closing date may help lower your credit utilization.[2]

Alternatives to improve your credit score

Rather than relying on the 15/3 credit hack, you can work to improve your credit over time by knowing what factors most affect your score. Then you can take action in each of those areas to improve your position.

Pay your credit card bills on time

Paying your credit card bills on time is most important because it counts for the biggest portion of your FICO® score.[4] You can protect yourself against negative marks for late or missed payments by making each payment by its due date. By doing so, you may also avoid any late fees or penalties that can further hurt your finances.

Keep your credit utilization ratio low

Your credit utilization counts for a larger portion of your FICO® score than any other factor except your payment history. Keeping it below 30% or lower can be a helpful tool in raising your credit score, whether or not you pay it twice a month as the 15/3 hack suggests.[3]

Use your credit cards responsibly

If you use your credit card judiciously, you may keep your CUR low and avoid building up so much credit card debt that you have trouble making on-time payments. To keep your balances low, consider using your cards only when you need to do so.

Avoid maxing out your cards, and think about paying more than the minimum payment. Doing so may lower your credit utilization, save you money on compounding interest, and leave you a cushion for emergencies.[7]

New credit card accounts also play a role. Applying for too many new accounts with too many credit card issuers in a short period may hurt you by suggesting you are a greater risk to lenders.[8]

Should you use the 15/3 credit card hack?

The 15/3 credit hack isn’t a shortcut to a good credit score or lower interest rates, but it may help you stay current or pay your balance in full. However, to make it even easier, instead of calculating days, if you get paid biweekly, just make a payment after each pay period and be sure those payments equal your last statement balance or at least the minimum payment.

No hack or secret can instantly elevate your credit score because improving your credit takes time. Use that time to establish good habits by making on-time payments and if you are carrying a balance, developing a plan to pay off those balances.

Sources

- Fox19. “Allworth Advice: Does the 15/3 credit card hack work,” https://www.fox19.com/video/2022/05/26/allworth-advice-does-credit-card-hack-work/. Accessed on June 11, 2022.

- Experian. “Should I Pay My Credit Card Bill Early?” https://www.experian.com/blogs/ask-experian/what-happens-if-i-pay-my-credit-card-early/. Accessed on June 11, 2022.

- Experian. “What is a Credit Utilization Rate?” https://www.experian.com/blogs/ask-experian/credit-education/score-basics/credit-utilization-rate/. Accessed on June 11, 2022.

- MyFICO. “What is Payment History?” https://www.myfico.com/credit-education/credit-scores/payment-history. Accessed on June 11, 2022.

- CNBC. “3 ways to keep your credit utilization low and boost your credit score,” https://www.cnbc.com/select/how-to-keep-credit-utilization-low/. Accessed June 17, 2022.

- MarketWatch. “The truth about the 15/3 credit card hack is that it doesn’t help your credit, but here’s what does,” https://www.marketwatch.com/story/the-truth-about-the-15-3-credit-card-hack-is-that-it-doesnt-help-your-credit-but-heres-what-does-11653074575?mod=personal-finance. Accessed June 21, 2022.

- Experian. “How to Use a Credit Card Responsibly,” https://www.experian.com/blogs/ask-experian/how-to-use-a-credit-card-responsibly/. Accessed on June 11, 2022.

- MyFICO. “What's in my FICO® Scores?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed on June 11, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).