A Guide to the Average American Credit Card Debt

You would never have to worry about credit card debt in a perfect world, but things don’t always go according to plan. Emergencies happen. Budgets go by the wayside. Without noticing, you have a significant amount on your credit card bill.

You may be thinking:

“Isn’t it normal to have some credit card debt? How do I know if I have too much credit card debt?”

Whether or not you have too much debt depends on a few factors. So first, we will look at those factors and then explore options such as a credit builder program or a credit builder card. If you’re trying to figure out how to pay off credit card debt and what you can do to reduce your credit card debt to a healthier level, continue reading.

How much credit card debt does an individual have on average?

How much credit card debt does the average American have? The national averages are not the be-all, end-all - the acceptable level of credit card debt varies for each person - but they are a good starting point.

According to Experian [1][2] here are the numbers on the average American credit card debt:

- The average American holds 3.84 credit card accounts, with a credit card debt of $5,313.

- The average credit card utilization - which is your average credit card balance divided by your credit limit - is 25.3%

- The average credit card limit is $21,000.

How much credit card debt does the average household have?

If you have a family, the average credit card debt per household is more relevant to you: it is $5,888.[3][4]

That number is not much higher than the average American credit card debt for individuals. Still, families often have other financial obligations such as mortgages, child care, and college savings plans, putting more stress on their budgets.

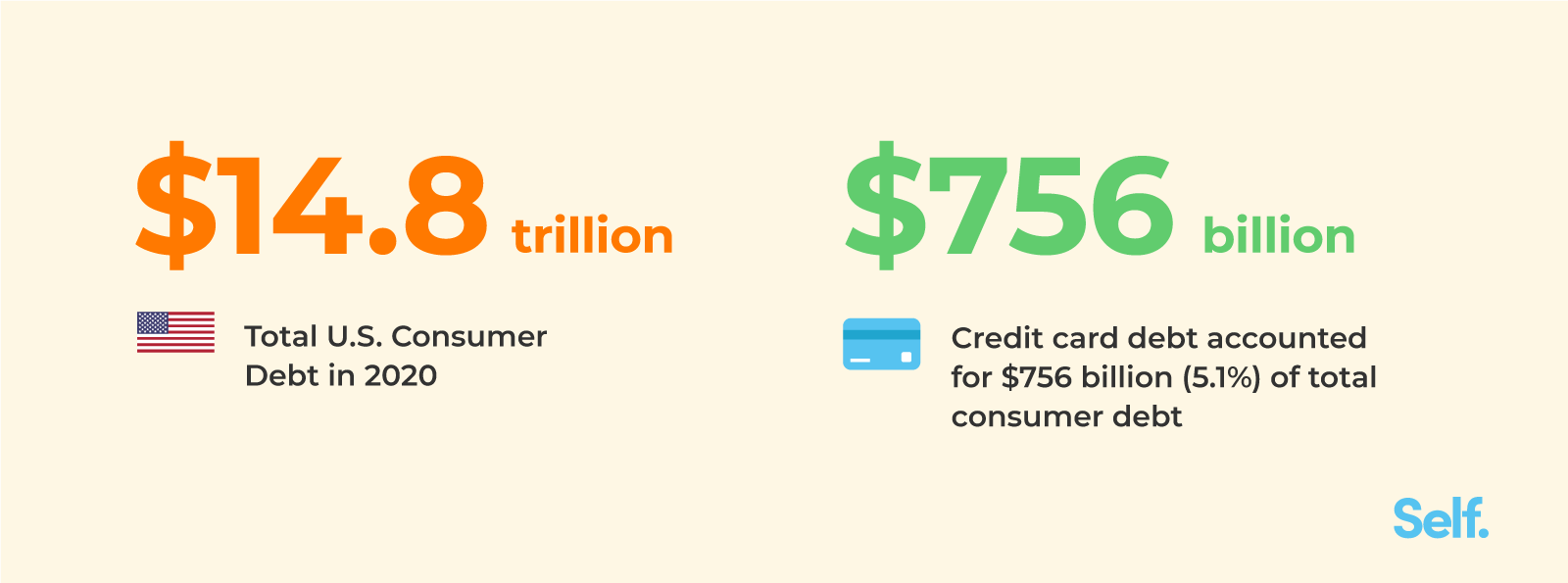

How much of Americans’ debt is from credit cards?

In 2020, the total U.S. consumer debt balance was $14.88 trillion. Credit card debt accounted for $756 billion, or just 5.1% of that number. That sounds like a low percentage, but it’s important to note that mortgage debt made up $10.31 trillion, or 69.3% of that $14.88 trillion. The student loan and auto loan segments added up to almost another $3 trillion.[5]

A mortgage loan, student loan, or auto loan are typically a better type of debt than credit card debt for a couple of reasons:

- They are often the only pathway towards buying something with excellent long-term value, particularly mortgage loans (house) and student loans (education).

- As of May 2021, the average APR for credit card accounts that incurred interest worked out to 16.30%.[6] Interest rates on the other three types of loans are usually a fraction of that rate. [7][8][9] This means that credit card debt can add up quickly.

Okay, now that we’ve looked at many country-wide statistics, let’s drill down and look at how to determine if you have too much credit card debt.

How much is too much credit card debt?

If you have less total credit card debt than the national average, that’s great, but you’ll be more financially resilient when you have no credit card debt. And if you have more credit card debt than the average, you may not be in as bad shape as you think.

Earlier, we touched on how families often have more financial commitments than individuals. Whether you have a family or not, you have to consider your whole financial situation to see if you have too much debt. Your debt-to-income (DTI) ratio is an excellent indicator; it is calculated by taking all your monthly payments on your credit report and dividing them by your gross monthly income.

But how do you know if your DTI is too high?

According to certified financial planner Marguerita Cheng, “Having a DTI ratio of 50% and above is considered an unhealthy and unsustainable level of debt… You want to have some money left over at the end of the month, so you can continue to build your cash reserves and pay down debt.”

Other clear signs that you have too much credit card debt are:

- You can only afford the minimum payment.

- Your credit card debt is more than 30% of your credit card limit.

- Credit card companies are rejecting your new credit applications.

A less clear sign that you have too much total credit card debt is that you can’t see a path out of debt. If that sounds like your situation, it may be time to develop a plan to reduce your debt.

What are the biggest risks of too much credit card debt?

You know that credit card debt is bad, but maybe you aren’t aware of the specific risks that come with it. It’s important to learn - not to scare yourself, but to know the impact it can have on your life.

Here are some significant risks:

- High interest: as mentioned earlier, credit cards frequently have high APRs, so the interest can quickly increase the size of the debt. For someone who has $20,000 in credit card debt at the average APR of 16.30%, the interest would add $268 a month to the debt. And due to compounding (interest on interest), the amount of interest owed per month would increase even more over time.

- Lower credit score: your credit card debt has a major impact on your average credit score. The more credit card debt you have, all things being equal, the lower your credit score. With a low average credit score, lenders are unlikely to lend you money with favorable terms, and you could even struggle to rent an apartment.

- It might negatively impact health and happiness: not everyone who gets into credit card debt experiences a decrease in their health and happiness, but it’s far from a rare occurrence. According to a NerdWallet survey, 38% of respondents who were in credit card debt said it negatively impacted their general happiness, and around 20% said it negatively impacted their health.[10]

The most common paths into debt?

Even if you have little or no credit card debt, it’s important to learn about the common ways that people get into debt so that you can try to avoid those paths yourself. If you already have a bit too much debt, taking stock of how you got into debt is one of the steps towards getting out of it.

Here are three common ways that people get into credit card debt:

No budget

If you don’t have a budget, it’s easy to overspend by a few hundred dollars a month, and before you know it, you’re looking at thousands of dollars in credit card debt. If budgeting sounds intimidating or too time-consuming, check out these free apps that make it easy (and sometimes fun) to save money.Financial emergency

In some cases, people are doing okay financially, and then, out of nowhere, they’re hit with a major car repair… or a global pandemic. Without the savings to handle the emergency, a credit card is often the only option. Fortunately, there’s a way to reduce this risk: starting an emergency fund.Only paying the minimum

A common mistake is thinking you’ll be fine as long as you make the minimum payment on your credit card. While it’s true that your account would stay in “good standing” if you only make the minimum payments, you could end up paying a lot of interest in the long run. Ideally, you would pay off your full credit card balance every month, but if you can’t do that, you should pay as much as you can to reduce the amount of interest you end up owing.

The best ways to get out of debt

Do you know how to negotiate credit card debt? If you have a manageable amount of credit card debt you might not have to do this, as the following strategies may be able to help you get out of it - or at least significantly reduce it.

As discussed in the last section, creating a budget is one of the best ways to get out of credit card debt. But how does creating and using a budget actually work for getting out of debt?

The easiest way to trim your budget is to eliminate any unnecessary spending. Do you have a few subscriptions that you never use? Maybe you should cancel them. Are you eating out a lot? Maybe cook at home more often.

After cutting your expenses, you may have something left over every month to put towards paying down your credit card debt.

If you’re having trouble with your spending, you may want to use spending hacks. For example, you could make a pact with yourself to wait 24 hours before making any purchase over $100. Or you can leave your credit cards at home when you go out.

For some people, willpower is a finite resource. So, by putting clear rules into place and taking away temptation, you may be able to cut your spending and put the savings towards credit card debt reduction.

The debt snowball strategy, championed by Dave Ramsey, is another debt reduction hack. The idea is to pay down your smaller debts before your larger debts. By doing this, you get a few quick wins, giving yourself the motivation to stick with your debt repayment and ultimately pay it off.

Through the use of budgeting and hacks, you can pay down your credit card debt over time, but they’re not going to reduce your interest - which, as you’ve seen, can be quite high. That’s where credit card debt consolidation comes in.

If you “consolidate” your debt, you can make one single payment - typically at a lower interest rate - instead of multiple payments. So, you not only save money on interest payments but also simplify your payments. For example, with a balance transfer, you might be able to move all of your existing debt to a card with a 0% APR introductory offer for 12-18 months.

Where can people get help with credit card debt?

If you want help making a precise payment plan, you have options.

Cheng says it sometimes makes sense to work with a credit counselor from the National Foundation for Credit Counseling (NFCC) - a non-profit organization. The organization has a mission of “bringing access to financial health to anyone who seeks it.”

If you’d prefer to do it yourself but aren’t sure where to start, you may want to use a credit card payoff calculator like this one from Experian. The calculator can help you figure out how long it will take to pay off your credit card debt.

But what if you feel like you won’t ever be able to pay off your credit card debt? If that’s how you’re feeling, you may want to talk to a credit card debt lawyer about debt settlement options.

There isn’t a single best path to credit card debt repayment, but picking a course as soon as possible is important. It may be cliché, but if you have high-interest credit card debt, “there’s no time like the present” to start getting out of it.

Article Sources

Experian. “Experian 2020 Consumer Credit Review”.

https://www.experian.com/blogs/ask-experian/consumer-credit-review/ - Accessed August 17, 2021Experian. “What Is the Average Number of Credit Cards per US Consumer?”

https://www.experian.com/blogs/ask-experian/average-number-of-credit-cards-a-person-has/ - Accessed August 17, 2021. To calculate the average credit card limit, we took the average credit card debt of $5,313 and divided it by the credit utilization ratio (.253).Experian. “Average U.S. Consumer Debt Reaches New Record in 2020”.

https://www.experian.com/blogs/ask-experian/research/consumer-debt-study/ - Accessed August 17, 2021United States Census Bureau. “America’s Families and Living Arrangements: 2020”. https://www.census.gov/data/tables/2020/demo/families/cps-2020.html Accessed August 17, 2021. To calculate the average credit card debt per household, we took the total credit card debt of $756.31 billion and divided it by the number of households (128,451,000).

Experian. “Average U.S. Consumer Debt Reaches New Record in 2020”. https://www.experian.com/blogs/ask-experian/research/consumer-debt-study/ - Accessed August 17, 2021

Federal Reserve. “Consumer Credit - G.19”. https://www.federalreserve.gov/releases/g19/current/ - Accessed August 17, 2021

NerdWallet. “Mortgage Interest Rates Forecast”. https://www.nerdwallet.com/article/mortgages/mortgage-interest-rates-forecast - Accessed August 17, 2021

NerdWallet. “Current Student Loan Interest Rates and How They Work”. https://www.nerdwallet.com/article/loans/student-loans/student-loan-interest-rates - Accessed August 17, 2021

NerdWallet. “Average Car Loan Interest Rates by Credit Score”. https://www.nerdwallet.com/article/loans/auto-loans/average-car-loan-interest-rates-by-credit-score - Accessed August 17, 2021

NerdWallet. “Survey: Credit Card Debt and Regret Go Hand in Hand”. https://www.nerdwallet.com/article/credit-cards/credit-card-debt-psychology-2018 - Accessed August 17, 2021

About the author

Nick Vasco is a freelance writer with a financial analysis background who specializes in creating fintech and personal finance content. See Nick on LinkedIn and his website.

About the reviewer

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).