6 Types of Bank Accounts Explained

Published on: 09/27/2021

When you opened your first bank account, it was probably a basic checking account. You may have opened a savings account at the same time. But did you know that there are actually six different types of bank accounts offered by financial institutions in the United States?[1]

You may not even think of some as bank accounts, but they’re all offered by banks — or credit unions — and are set up for a variety of purposes, depending on your goals and needs.

Here's how to choose which ones are right for you.

How many different types of bank accounts are there?

According to the FDIC, 95% of the 124 million U.S. households had a checking or savings account at a bank or credit union in 2019.[2]

And although checking accounts and savings accounts are the most well-known, there are other types of bank accounts that have specific uses and can help you build credit and manage your personal finances as well.

6 most common types of bank accounts

- Checking accounts

- Savings accounts

- Money market accounts

- Certificate of deposit accounts (CD)

- Individual retirement arrangements or individual retirement accounts (IRA)

- Brokerage accounts

Checking accounts

Checking accounts provide you with the quickest, easiest access to your money. Different banks require different minimum deposits to open an account and have varying withdrawal limits, so make yourself familiar with these before opening an account.

Also, be sure your account is insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), which provide up to $250,000 of protection per depositor. This keeps your money safe if the institution fails.

So, why should you open a checking account?

They’re designed as places to keep your money in the short term, so you can pay bills and conduct transactions easily. With many checking accounts, it’s smart to carry a minimum balance as one way to avoid fees.

And yes, banks do charge an array of fees.[3] The good news is that you can avoid most of them by knowing the rules and how to make them work to your advantage.

Maintaining a minimum balance is one way to avoid monthly service fees. Some banks also allow you to waive that fee in exchange for setting up a direct deposit, and you may qualify for a no-maintenance-fee account as a senior citizen (or if you’re over 55).

Overdraft fees and non-sufficient fund (NSF) fees are similar, and both can cost you $35 per transaction. They come into play if you overdraw your account or write a check that bounces. The easiest way to steer clear of them is to make sure you’ve got a cushion in your balance.

Other fees are fairly easy to avoid, too. Most banks don’t charge an ATM fee as long as you use an in-network machine, and you can avoid being charged for a paper statement by going digital. You can avoid overdraft fees by not overdrawing your account and NSF fees by making sure you have enough money to cover your checks.

Once you’ve got your account set up with an initial deposit and know the rules, you’re ready to start using it. This means you’ll be allowed to deposit money (sometimes electronically), write checks, use a debit card, and transfer money, among other things.

Types of checking accounts

- Free checking accounts don’t charge a monthly maintenance fee and don’t require a minimum balance. Some checking accounts are free with a monthly direct deposit fee. Some institutions may offer free checking accounts to students or those older than 55.

- Interest-bearing checking accounts can let you earn a modest interest rate on your funds. It’s not likely to be more (and will probably be less) than even what you can earn in a savings account, and isn’t likely to keep pace with inflation, either. But if you can avoid fees that offset any interest you may earn, it’s better than nothing.

- Premium checking accounts are for customers who want to keep a large sum of money — generally five figures or more — in their account. In exchange for maintaining a higher minimum balance, they can come with perks like free checks, reimbursement of ATM fees and slightly lower mortgage rates.

- Lifeline checking accounts are low-balance checking accounts that banks may offer you if you agree to limit how many checks you write and forgo things like overdraft protection and paper statements.

- Second chance checking accounts are available to some customers who have seen the bank close a previous account due to a continuing negative balance. You can get a “second chance” by paying as much as $20 a month, but if you maintain your account in good standing, you may be eligible to switch back to a regular checking account after a given period of time.

- Joint checking accounts are for people who share their finances and expenses, often married couples or parents with teen children. Both parties have check-writing privileges, and either one can withdraw as much money as they want. However, both parties must be present to close the account.

- Trust checking accounts are checking accounts trustees use to pay expenses incurred by a trust or to distribute assets from an estate.

- Student checking accounts give young account-holders a chance to learn the ropes, often by providing free checks and/or waiving minimum balance requirements, ATM fees or other typical expenses.

Pros of opening a checking account

Unless you want to hide money in your mattress, you’ll probably want a checking account. You can eliminate a lot of headaches by setting up options like direct deposit, automatic bill pay, and online banking. You’ll also get a debit card that can make transactions easier, and the ability to write checks instead of carrying large sums of money around in your pocket.

Besides, your money is insured, so you don’t need to worry about losing $1,000 to a pickpocket or because your mattress caught on fire.

Cons of opening a checking account

There are a few downsides to a checking account, most of which involve the potential for fees as mentioned above — but most of these fees are avoidable. If a debt collector wins a judgment against you in court and you don’t have a paycheck to garnish, your account could end up being garnished instead. Of course, this can be avoided, too, if you pay your bills.

Savings accounts

Savings accounts allow people to, well, save. They’re all about putting money aside for future use, and parents often open joint savings accounts for their kids to show them how to sock away money. They’re a good way to accumulate cash for large purchases or save for emergencies.

Pros of opening a savings account

In addition to giving you a place to save up money for a goal or an emergency fund, savings accounts let you earn interest on whatever money you deposit. And you can do so safely because, like checking accounts, they’re federally insured and guaranteed to pay the interest rate advertised — unlike higher-risk investments like stocks.

It’s also fairly easy to withdraw money from a savings account, although you may be limited to a certain number of withdrawals or transfers to your checking account per month before you incur a fee.

Cons of opening a savings account

Although they earn interest, don’t expect to pocket a lot of extra cash using a savings account. Low risk — as is normally the case — also means low yield.

For instance, as of August 2021, the top annual percentage yield (APY) for a savings account was just 0.5%, or half a percentage point.[4] Compare that to a normal rate of inflation, which has been between 0.7% and 3% since 2011 and stood at 5.4% in July 2021.[5]

Because it’s relatively easy to tap a savings account, and there are typically no penalties for doing so (unlike retirement accounts, for example), you may be tempted to deplete your savings through overspending. But for better or for worse, savings accounts don’t generally come with debit cards.

Money market accounts

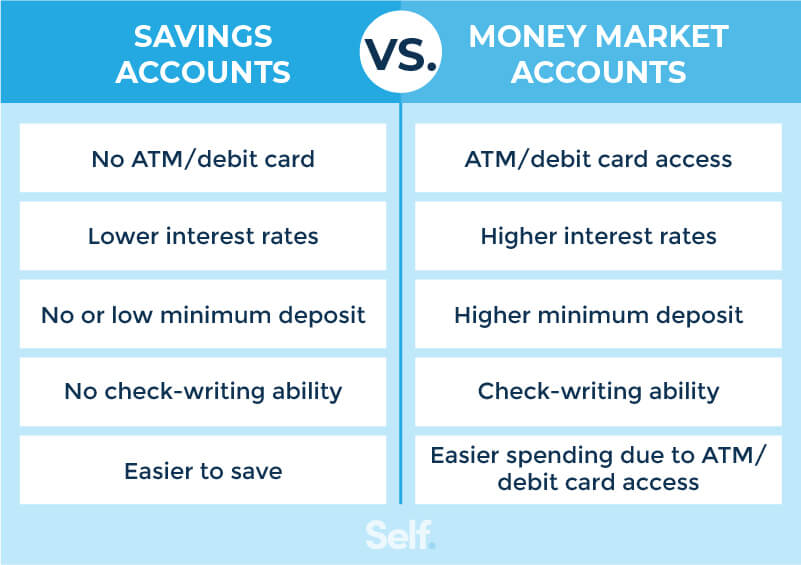

Money market accounts (MMAs) are another type of account offered by banks and credit unions. They can offer relatively high interest rates compared with a traditional savings account.

Pros of opening a money market account

These accounts offer a best-of-both-worlds hybrid of sorts, combining the ability to earn interest with debit card access and a limited ability to write checks. If you have a higher balance than a typical checking account but want to earn more interest than you would in a savings account, this may be a good option.

The transaction limit on these accounts, whether you’re using a debit card or check, withdrawing money, or transferring funds, is six per month. Like savings and checking accounts, they’re federally insured.

Cons of opening a money market account

You’ll have to have a decent amount of money to deposit because these accounts have higher minimum balance thresholds than savings or checking accounts. Check on interest rates, too. The best rates for money market accounts may not be much (or any) higher than a good savings account.[6]

Certificate of deposit (CD) accounts

Certificates of deposit, or CDs, are a form of savings account that keeps a fixed amount of your money for a specified period of time. It can be a few months or a period of years.

In exchange for committing to keep your money in the account for that period, the bank agrees to return your money with interest at the end of that time (when the CD matures). You’ll pay a penalty if you pull the money out early, and the longer you keep your money in, the better your interest rate is likely to be.

For example, as of August 2021, the highest available APY on a three-month CD was 0.5%, and the average was just 0.07%, but a five-year CD can yield as much as 1.35% or an average of 0.26%.[7]

You can purchase a CD at a bank or credit union, just like a savings account.

Pros of opening a certificate of deposit account

Say you’ve got a specific goal in mind, such as putting money away for a honeymoon or vacation that’s a year down the road. You can use a CD as a place to put your money where it can gather some interest, while the withdrawal penalties will help you resist the temptation to tap into it early.

Cons of opening a certificate of deposit account

In one sense, CDs work like retirement accounts: You have to wait for the maturity date to get your money, and you’ll pay a penalty for early withdrawal. This penalty can cut into your interest and even some of your principal if you’re not careful, so you need to be sure you won’t need access to the money you’re depositing.

But CDs may also earn less money than stocks or bonds, and fixed interest rates don’t allow for as much growth on your investment.

Are money market accounts and certificates of deposit accounts safe?

CDs, which are held by a bank or credit union, are insured by the FDIC and, therefore, safe up to $250,000. A money market deposit account is also insured by the FDIC, just like a savings or checking account.

However, a money market mutual fund is not. These are different from MMAs, though the name is somewhat similar. Money market mutual funds aren’t FDIC-insured accounts — they’re funds that invest in bonds, Treasury bills, and/or short-term CDs that are paid out earnings from those investments rather than by the financial institution where you’ve deposited your funds.[8]

Individual retirement accounts (IRA)

IRAs are another type of account where you can put your money, specifically for retirement. You can invest in an IRA through your bank or credit union, but they’re also available through stockbrokers, life insurance companies, and mutual funds.

Pros of IRAs

Depending on the type of IRA you choose, saving for your retirement can offer tax advantages, either on the front end or when you take disbursements. Anyone can contribute to an IRA and set one up relatively quickly. Once you’ve done so, you have a high level of control: You can transfer funds if you don’t like where they’re invested.

Cons of IRAs

There are contribution limits for IRAs, which (for 2021) are the smaller of $6,000 or your taxable compensation for the year. The limit rises to $7,000 if you’re 50 or older. Also, if you withdraw your money before you turn 59½, you’ll be subject to a 10% tax penalty unless you qualify for an exception.

Deductions may be limited based on your adjusted gross income (AGI), and investment opportunities may be limited.

Roth IRA vs. traditional IRA: What's the difference?

Put simply, with a traditional IRA, you’re generally able to defer taxes until you start making withdrawals, upon retirement. With a Roth IRA, you pay taxes now but won’t pay them later.

You keep on making contributions to a Roth IRA until you’re 70½ and can leave money in that account for your lifetime. If you think you’re likely to be in a higher tax bracket when you start receiving distributions, a Roth IRA is probably a good idea, but if you expect to be in the same tax bracket or lower when you begin receiving distributions, a traditional IRA is more likely the way to go.

Brokerage accounts

Brokerage accounts are traditionally the first step to investing by buying stocks and bonds. An investor opens an account with a brokerage in order to buy and sell securities.

Charles Schwab and Vanguard are two examples of brokerage firms, and there are online brokerage firms such as TD Ameritrade and E*Trade, as well. You’ll have to be 18 to open an account, and you can do so online quickly. You may be asked to verify a transaction by allowing the broker to deposit a nominal amount in your account, which you then confirm.

You can open a cash account, in which you pay the full amount of the securities you purchase. You can’t borrow money from your broker to fund transactions in an account of this type.

A margin account, by contrast, allows you to borrow money from the brokerage to buy securities. The securities in your portfolio are your collateral, and you’ll have to pay interest on the loan, just as you would on any other loan or on a credit card.

Pros of opening a brokerage account

Brokerage accounts can give you access to computer trading software and other research tools. You’ll also have reduced fees for account minimums and overdrafts. Investments in a brokerage account offer the potential for higher interest rates and, therefore, higher returns.

There’s no limit on the number of brokerage accounts you can have, and if you’ve maxed out your retirement contributions for the year but still want a place to invest, they can be a good option.

Cons of opening a brokerage account

If you choose to invest in a brokerage account, you’re not guaranteed a return on your investment, and you’ll likely have to pay a fee for financial advice. A brokerage firm also has the power to sell any securities in your account as a way to cover shortfalls without consulting or even notifying you.

Brokerage accounts don’t offer you access to mortgages or other loans.

Brokerage accounts vs. retirement accounts: What’s the difference?

A brokerage account allows you to make unlimited contributions, and you don’t have to worry about penalties or limits on withdrawals, either. Neither is true with a retirement account.

But there are disadvantages to brokerage accounts when it comes to taxes. Foremost among them: Unlike retirement accounts, they can be subject to capital gains taxes. A capital gains tax is a federal fee that is paid on the profit someone makes from selling off certain types of assets, such as real estate or stock investments.

The bottom line

Financial institutions offer a variety of account options depending on your situation and goals. From students starting out to workers saving for a vacation, from professionals planning for retirement to investors wanting to explore the stock market, there are options available for just about everyone.

Some options offer more flexibility than others. Some offer more high-yield options. Some offer more security. There are tax advantages to some, and these may act as a down payment on your future, but on the flip side, they may carry an early withdrawal penalty.

Whatever decision you make, it pays to read the fine print and make an informed decision.

Sources

- Consumer.gov. “Opening a Bank Account,” https://www.consumer.gov/articles/1003-opening-bank-account. Accessed August 12, 2021.

- FDIC. “How America Banks: Household Use of Banking and Financial Services,” https://www.fdic.gov/analysis/household-survey/index.html. Accessed August 12, 2021.

- CNBC. “7 common fees of checking accounts and how to avoid them,” https://www.cnbc.com/select/how-to-avoid-common-checking-account-fees/. Accessed August 12, 2021.

- U.S. News. “Best Savings Accounts — August 2021,” https://money.usnews.com/banking/savings-accounts. Accessed August 12, 2021.

- US Inflation Calculator. “Current Inflation Rates: 2000-2021,” https://www.usinflationcalculator.com/inflation/current-inflation-rates/. Accessed August 12, 2021.

- U.S. News. “Best Money Market Accounts — August 2021,” https://money.usnews.com/banking/money-market-accounts. Accessed August 12, 2021.

- Investopedia. “Best CD Rates,” https://www.investopedia.com/best-cd-rates-4770214. Accessed August 12, 2021.

- FDIC. “Insured or Not Insured?” https://www.fdic.gov/consumers/consumer/information/fdiciorn.html. Accessed August 12, 2021.

About the Author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).