Why Do I Have a Negative Balance on My Credit Card?

By Lauren Bringle

Published on: 09/16/2021

Published on: 09/16/2021

Usually, when you open your monthly credit card bill, you either owe money or have a zero balance. But there’s a third possibility: You could have a negative balance.

A negative balance on your credit card means that the credit card issuer owes you money. This may happen if you made returns, overpaid, or had fees canceled.

But maybe you paid off your balance — or paid your balance down below the amount of the refund you’ve received. For example, say you spent $75 for a pair of pants with your credit card, but you found they didn’t fit when they arrived, so you returned them.

In the meantime, you received your monthly statement, which included your purchase but not the credit for your return because it was a few business days behind. So you paid the balance you thought you owed but wound up overpaying because you didn’t account for the return. Then, you didn’t buy anything more in the month ahead, so your following statement included a negative balance, with the credit from the return now added.

Another example might involve a trip you had to cancel. You might receive refunds of several hundred dollars on your airfare and hotel reservations, which would make a big difference in your balance.

Suppose you typically pay your card off entirely or maintain a low balance. In that case, you might wind up with a negative balance of -$500 or -$1,000 or more. And you may not even realize it for seven to 14 business days, which is the amount of time it may take for your refund to go through.[1]

This is one way you can receive a statement with a balance below zero, but it’s not the only one.

More commonly, your balance drops if you earn a statement credit that more than offsets it. This can happen if you earn cash-back rewards with your card.[2] If you have a balance of $150 but then receive a $200 statement credit, you’ll end up with a balance of -$50.

However, you may not need to go through this formality. Often, a phone call to the company’s customer service division will set the process in motion. That phone call will save you the effort of writing a letter, and the time it would take to wait for a refund. You may receive a check or money order. But in many cases, you may be able to have the amount put into your bank account by direct deposit.

This is a good option to pursue if you have a large negative balance (as in the above example, you might have been refunded the cost of airline tickets or hotel accommodations). You could then use the extra money in ways that don’t involve using a credit card. For example, you could invest it in other financial products or even just earn a modest interest rate by putting it in a savings account.

You will want to be careful, however, to spend within your means. You don’t want to make too many future purchases and run up more interest charges on credit card debt you can’t pay. Another risk is that you forget to pay when it comes due because you mistakenly believe you still owe nothing.

Either scenario could damage your credit and personal finances.

You can’t do this indefinitely, though. After six months, the law requires lenders to make a reasonable effort to return any negative balance. This means you’ll likely be mailed a check in the amount they owe you.[4]

Consequently, while a negative balance may affect how much you can spend temporarily, it does not affect your credit limit.

On the other hand, you can keep the negative balance on the books for up to six months. Moreover, it won’t hurt your credit score because credit card companies don’t report negative balances to the three main credit bureaus. As a result, the information won’t appear on your credit report.

You’ll appear to have a zero balance, which will indicate a low credit utilization ratio and reflect that you’ve made your monthly payments.

As with anything else, you just have to be sure you keep an eye on your account for changes. Although it requires a little more effort, you may want to simply seek a refund, so you know where you stand and have a little extra cash to work with. But the choice is yours: If you have a negative balance, the credit card company can pay you now, or it can pay you later.

A negative balance on your credit card means that the credit card issuer owes you money. This may happen if you made returns, overpaid, or had fees canceled.

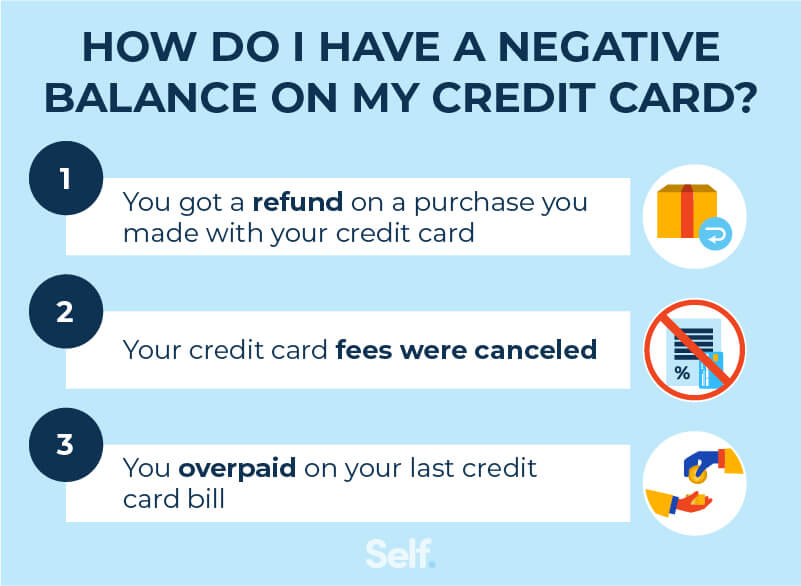

How do I have a negative balance on my credit card?

It might seem odd that a credit card company would send you a bill with an account balance that’s less than zero: a figure with a minus sign in front of it, such as -$50. But a negative credit card balance really isn’t strange. There are actually several reasons it could happen. Here are a few:You got a refund on a purchase you made with your credit card

If you purchased something with your credit card and later returned it, you may receive a refund in the form of a credit to your account.But maybe you paid off your balance — or paid your balance down below the amount of the refund you’ve received. For example, say you spent $75 for a pair of pants with your credit card, but you found they didn’t fit when they arrived, so you returned them.

In the meantime, you received your monthly statement, which included your purchase but not the credit for your return because it was a few business days behind. So you paid the balance you thought you owed but wound up overpaying because you didn’t account for the return. Then, you didn’t buy anything more in the month ahead, so your following statement included a negative balance, with the credit from the return now added.

Another example might involve a trip you had to cancel. You might receive refunds of several hundred dollars on your airfare and hotel reservations, which would make a big difference in your balance.

Suppose you typically pay your card off entirely or maintain a low balance. In that case, you might wind up with a negative balance of -$500 or -$1,000 or more. And you may not even realize it for seven to 14 business days, which is the amount of time it may take for your refund to go through.[1]

This is one way you can receive a statement with a balance below zero, but it’s not the only one.

Your credit card fees were canceled

Similarly, you may receive a negative balance if fees associated with your credit card account are canceled. For example, say the lender agreed to waive fees, such as late fees or an annual fee, associated with your account. Still, you paid those fees anyway after the agreement took effect. You would then receive a credit for the difference.You overpaid on your last credit card bill

It’s also possible that you accidentally overpaid your previous bill, leaving you with a negative balance. This overpayment will be reflected in your next statement. However, certain credit card providers, like Chase and Capital One, won’t let you make overpayments to your credit card balance.More commonly, your balance drops if you earn a statement credit that more than offsets it. This can happen if you earn cash-back rewards with your card.[2] If you have a balance of $150 but then receive a $200 statement credit, you’ll end up with a balance of -$50.

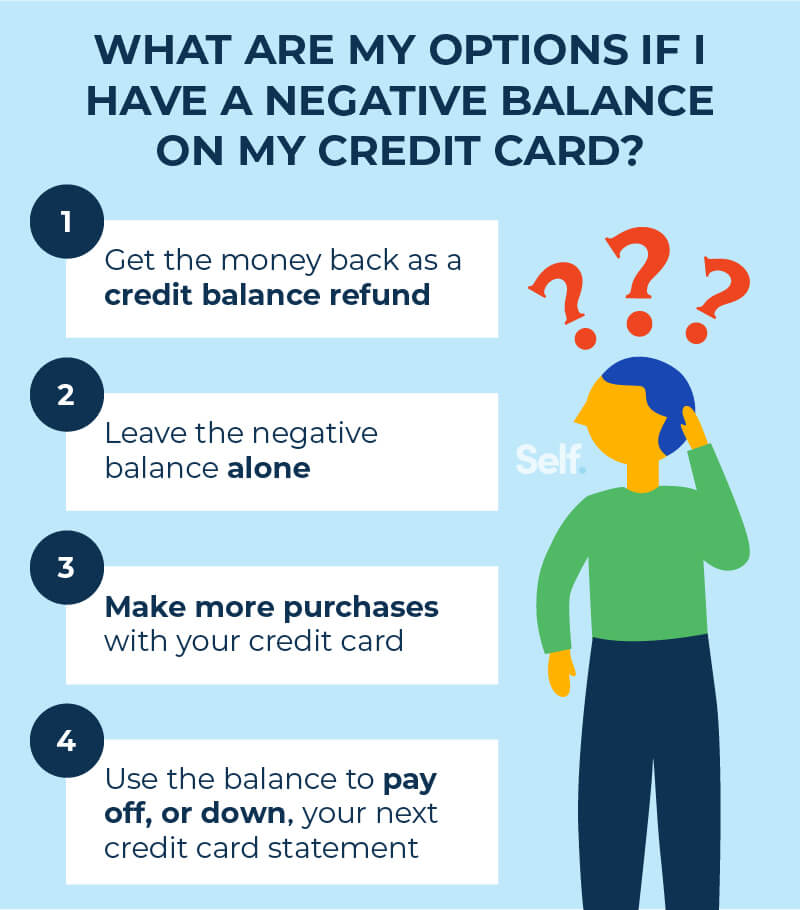

What are my options if I have a negative balance on my credit card?

Having a negative balance isn’t a bad thing. On the contrary, you have at least four options if you receive a credit card statement with a negative balance.Get the money back as a credit balance refund

The Truth in Lending Act requires a lender to refund any negative balance over $1 within seven business days of receiving a written request.[3] To take advantage of this provision, mail a letter to your credit card issuer asking for a refund.However, you may not need to go through this formality. Often, a phone call to the company’s customer service division will set the process in motion. That phone call will save you the effort of writing a letter, and the time it would take to wait for a refund. You may receive a check or money order. But in many cases, you may be able to have the amount put into your bank account by direct deposit.

This is a good option to pursue if you have a large negative balance (as in the above example, you might have been refunded the cost of airline tickets or hotel accommodations). You could then use the extra money in ways that don’t involve using a credit card. For example, you could invest it in other financial products or even just earn a modest interest rate by putting it in a savings account.

Make more purchases with your credit card

It’s easy to eliminate a negative balance by simply making new purchases on your credit card, thereby creating a zero or positive balance.You will want to be careful, however, to spend within your means. You don’t want to make too many future purchases and run up more interest charges on credit card debt you can’t pay. Another risk is that you forget to pay when it comes due because you mistakenly believe you still owe nothing.

Either scenario could damage your credit and personal finances.

Leave the negative balance alone

The easiest option is just to do nothing and leave the negative balance as it is. This can increase your available credit because your credit limit remains the same, plus you now have an extra cushion on top of that total amount.You can’t do this indefinitely, though. After six months, the law requires lenders to make a reasonable effort to return any negative balance. This means you’ll likely be mailed a check in the amount they owe you.[4]

Consequently, while a negative balance may affect how much you can spend temporarily, it does not affect your credit limit.

Use the balance to pay off, or down, your next credit card statement

If you have a negative balance on your credit card, use it to pay off or down your next statement. That way, you know you’ll be able to afford any purchase that costs up to your negative balance, and you won’t even have to dig into your bank account next month to make a payment.You decide

The best news about having a negative balance on your credit card is that you get to decide what to do. If you have a negative balance and you want your money back, credit card companies are required to refund the money they owe you.On the other hand, you can keep the negative balance on the books for up to six months. Moreover, it won’t hurt your credit score because credit card companies don’t report negative balances to the three main credit bureaus. As a result, the information won’t appear on your credit report.

You’ll appear to have a zero balance, which will indicate a low credit utilization ratio and reflect that you’ve made your monthly payments.

The bottom line

There’s nothing wrong with carrying a negative balance on your credit card. You can’t carry a negative balance indefinitely, but it can give you a temporary extra cushion. And it won’t hurt your credit because it will appear as a zero balance when reported to the credit bureaus.As with anything else, you just have to be sure you keep an eye on your account for changes. Although it requires a little more effort, you may want to simply seek a refund, so you know where you stand and have a little extra cash to work with. But the choice is yours: If you have a negative balance, the credit card company can pay you now, or it can pay you later.

Sources

- Insider. “Credit card refunds are usually pretty simple, but you'll want to be aware of 3 things — especially if you're counting on getting that money back,” https://www.businessinsider.com/personal-finance/how-credit-card-refunds-work. Accessed Aug. 3, 2021.

- Experian. “How Can I Get Cash Back From My Credit Card?” https://www.experian.com/blogs/ask-experian/how-do-i-redeem-cash-back-rewards-from-my-credit-card/. Accessed Sep. 10, 2021.

- Consumer Financial Protection Bureau. “1026.11 Treatment of credit balances; account termination,” https://www.consumerfinance.gov/rules-policy/regulations/1026/11/. Accessed Aug. 3, 2021.

- Forbes. “What To Do If You Have A Negative Balance On Your Credit Card,” https://www.forbes.com/sites/advisor/2020/03/21/what-to-do-if-you-have-a-negative-balance-on-your-credit-card. Accessed Aug. 3, 2021.

About the Author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).

Written on September 16, 2021

Self is a venture-backed startup that helps people build credit and savings.

Self does not provide financial advice. The content on this page provides general consumer information and is not intended for legal, financial, or regulatory guidance. The content presented does not reflect the view of the Issuing Banks. Although this information may include references to third-party resources or content, Self does not endorse or guarantee the accuracy of this third-party information. Any Self product links are advertisements for Self products. Please consider the date of publishing for Self’s original content and any affiliated content to best understand their contexts.