What are the Costs Involved in Using a Credit Card?

Credit cards might be the greatest financial product invented in the last century, but nothing’s perfect. Nearly every credit card offered will impose fees at various times, and it’s important to know the common costs with having a credit card account.

Here are 3 major types of credit card fees, and how to avoid them.

The 3 types of credit card credit card fees

There are typically three types of fees charged to credit card holders:

- Fees just for having an account, called an annual fee or membership fee.

- Optional fees for specific types of services, such as balance transfers or foreign transactions.

- Fees imposed as penalties for violating the terms and conditions, such as making a late payment.

Let's take a look at each credit card cost imposed on credit card users, what you can expect and how to avoid them. But first...

Let’s talk about merchant fees

In addition to fees imposed on cardholders by the credit card company, merchants also charge fees for paying by credit card, typically 2-4% of each transaction. Because of these merchant fees, some retailers offer cash discounts.

In some states, it’s legal for merchants to add a credit card surcharge to transactions, however this practice is illegal in other states. Even states that have laws prohibiting credit card surcharges typically allow government agencies and regulated utilities to add a surcharge to credit card transactions.

When you’re faced with a credit card surcharge or a cash discount, it usually makes sense to pay with cash or a debit card to save money.

Even when a cash discount or credit card surcharge isn’t specified, you can often negotiate a better cash price when buying an expensive item from a small business owner. For example, a home repair contractor may accept credit cards, but you’ll often receive a lower price if you ask for a cash discount.

Remember the interest charge

Another credit card cost can be interest charges. These aren’t fees, they are charges incurred when you borrow money.

By paying your statement balance in full each month, nearly all credit card issuers will waive those interest charges. If you just make the minimum payment though, interest will continue to accrue on a regular basis.

Now let’s break down the top 3 most common fees to watch out for when using a credit card.

Fee type #1 - annual fees

Many credit cards charge an annual fee, which is sometimes referred to as a membership fee.

Thankfully, the majority of credit cards don’t have an annual fee, but the cards that do have these fees typically fall into one of two groups.

First, there are premium cards that offer greater rewards and benefits than typical cards with no annual fee.

For those who are able to utilize the features of these premium cards, paying these fees can make sense. Plus, many premium rewards cards will waive the first year’s annual fee as an incentive to open an account.

Alternatively, some cards designed for people with poor or bad credit, like secured cards, will also charge an annual fee. The target market for these cards represent a greater risk of default, and the card issuer imposes an annual fee to reduce its overall losses.

Some of these cards impose membership fees in monthly installments, while others charge the annual fee to your first billing statement. If you plan to open a credit card with an annual fee, make sure you know when and how your card issuer charges the fee so you’re ready to pay when it’s due.

Fee type #2 - optional fees for services

There are a wide variety of optional fees that a credit card issuer can charge. These include:

- Balance transfer fees

- Cash advance fees

- Foreign transaction fees

Balance transfer fees

These fees are imposed when you transfer a balance from an existing account to another card. These fees are typically 3% to 5% of the amount transferred, for the cardmember, and there's usually a minimum fee of at least $5. The processing fee is added onto the new balance.

__There are 2 ways to avoid balance transfer fees: __

- Find a card that doesn’t have a balance transfer fee.

- Find an alternative to performing a balance transfer.

Let’s break these down a little more…

There are several cards that have no balance transfer fees when the standard interest rate applies. But when you’re looking at cards that offer 0% APR balance transfers, there are only a few cards that have no balance transfer fees.

The other way to avoid these fees is to find an alternative to performing a balance transfer. For example, many cards that offer interest-free financing on balance transfers also offer the same for new purchases.

If you can finance your new purchases, perhaps you can use the money you would have spent on them to pay off your existing balances. You might also find that a home equity line of credit will offer you a low enough interest rate that is more economical than paying a balance transfer fee.

Just make sure you weigh your options and choose the most cost-effective one for you, that way you don't put yourself deeper into credit card debt.

Cash advance fees

These fees are imposed when you use your card to get cash from an ATM. A typical cash advance fee will be either $10 or 5% of the amount transferred, whichever is greater.

__These fees are separate from any ATM fees charged. __

In addition to these fees, there's usually a higher cash advance interest rate imposed on these transactions. Furthermore, the interest charge applies immediately, and isn't waived when you pay your statement balance in full.

To avoid cash advance fees, never use your credit card at an ATM if you want to avoid a transaction fee. You may even want to avoid creating a PIN number for use at an ATM, and call your card issuer and request that your cash advance limit be set to zero to deter yourself from using this option.

Instead of using your credit card to access cash, you'd be better off using a debit card, which will likely have a lower transaction fee and will never incur interest charges.

Foreign transaction fees

These are transaction fees imposed by the card issuer any time you make a charge that’s processed outside of the United States. These aren’t foreign currency conversion fees as they can still be imposed on US dollar transactions processed by foreign companies.

Thankfully, many travel rewards cards no longer impose this kind of processing fee.

Fee type #3 - penalty fees

When you make a mistake and violate the account's terms and conditions as a cardmember, you could be charged one of several penalty fees, including:

- Late payment fees

- Returned payment fees

- Over-the-limit fees

Late payment fee

Late payment fees are assessed when your monthly payment is received after it’s due date, or when the payment is below the minimum required. The grace period ends on the payment due date, and there is no official grace period beyond that.

Most card issuers charge the maximum amount permitted by law for late payments, which is typically $39.

However, the law also says that the late fee can’t be more than the amount owed. So you can’t be charged a $39 late fee if your statement has a $20 minimum payment. The most it could be in this case is $20.

Thankfully, there are several ways to avoid late credit card payments. The easiest is to set your account to autopay from your checking account or savings account. Once you do this, you'll never have a late credit card payment so long as you have enough money in your account.

If for some reason you have a late payment, you should immediately correct it. Then, contact your card issuer and ask to have the late payment fee and any associated credit card interest charges removed.

Most card issuers will be happy to remove these charges for customers with otherwise strong payment histories.

Returned payment fee or returned check fee

If you made an electronic credit card payment, had an autopay, or wrote a check from an account that had insufficient funds, you could be assessed a returned or failed payment fee, which can be up to $39.

Your bank may also assess an insufficient funds fee, making this a very costly mistake.

Over-the-limit fees

In the past, it was common for credit cards to charge a fee for going over your credit limit. However, these fees are extremely rare today.

The CARD Act of 2009 states that card issuers can allow customers to opt-in to these fees, but most simply eliminated this fee instead.

What about other, hidden fees?

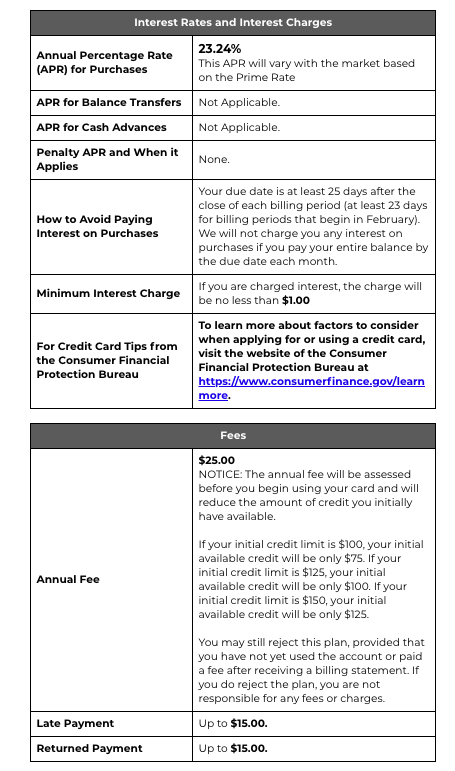

The good news about common credit card fees is that hidden ones aren't allowed. All credit card issuers are required to display all possible fees in a standard, easy-to-read format. In fact, even the size of the font is regulated so that card issuers can't bury these fees in the fine print.

Every time you look at a credit card application online, or even on paper, you should look for this table. It will show you not just all possible fees, but also the credit card interest rates and other key terms and conditions.

Here’s just one example of what this table looks like:

Source (accurate as of February 2020)

For all cards, this table shows the standard Annual Percentage Rate (APR), as well as the interest rates for balance transfers, cash advances and any penalty interest rate that can apply if you miss payments. If there is an introductory rate, it shows you that rate as well.

Bottom line

Credit card fees can sometimes be confusing or even scary, but not if you know some basic facts.

By understanding how these fees work, where you can learn about them and how to avoid them, you can use your credit card with confidence that it will never charge you more than you expect.

About the author

Jason Steele has been writing about credit cards and personal finance since 2008, poring through the terms and conditions of credit card agreements to understand the minutiae of how these products work. His work has appeared on Yahoo, MSN, HuffingtonPost and other major news outlets. In his free time, Jason’s a commercial pilot. He graduated from the University of Delaware with a degree in History. See Jason on Linkedin and Twitter.

About the reviewer

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.