The Best Metropolitan Areas for Affordable Housing

Homeownership is the ultimate aspirational dream for millions of Americans. A 2023 Lending Tree survey found that 84% of Americans aspired to own a home. [1] LendingTree: 94% of Americans Say Owning a Home Is Part of the American Dream, but 51% Who Don’t Own Fear They Never Will https://www.lendingtree.com/home/mortgage/homeownership-dreams-survey/ While ownership rates have steadily recovered from the recession-induced lows of the early 2010s, not everyone is able to get on the property ladder.

According to the Federal Reserve [2] St Louis Federal Reserve: Homeownership Rate in the United States, 1980-2024 https://fred.stlouisfed.org/series/RSAHORUSQ156S, around two-thirds of Americans are homeowners, but millennials have struggled to buy homes as consistently as previous generations. This may be exacerbated by the fact that there has been a 42% surge in new house prices over the last five years. [3] Investopedia: Millennial Homeownership Still Lagging Behind Previous Generations https://www.investopedia.com/millennial-homeownership-still-lagging-behind-previous-generations-7510642

Affordable housing is a major policy challenge for both state and federal government, to bridge the generation gap and create better-value communities for years to come. But which cities in 2024 have the most affordable homes?

To find out, researchers on behalf of Self Financial analyzed Zillow average house prices from both June 2023 and January 2024, ranking each metropolitan area based on the percentage of properties that can be considered affordable based on the average city salary.

Key findings

- Just 16 of the 100 largest cities in the U.S. have more than 50% of housing stock classed as affordable.

- Rochester, NY has the most affordable housing market in the U.S., with 81.7% of homes for sale affordable for 30% of the city’s median income.

- San Diego and Los Angeles are the most unaffordable cities in the U.S., with just 1.1% of stock classed as affordable in the Southern California metros.

- Affordable housing in America’s 100 largest cities dropped by 7.8% between June 2023 and January 2024.

What is affordable housing?

According to The National Association of REALTORS®, median house prices hit record numbers in 2023, with the average home costing $389,800. [4] National Association of Realtors: Existing-Home Sales Slid 1.0% in December https://www.nar.realtor/newsroom/existing-home-sales-slid-1-0-in-december For many Americans however, getting on the housing ladder at this cost is out of reach. While a record 40% of U.S. homes are mortgage-free, mortgage prices are at 20-year highs; compounding the problem further. [5] Business Insider: ‘Will mortgage rates go down in 2024?’ https://www.businessinsider.com/personal-finance/will-mortgage-rates-go-down-in-2024?r=US&IR=T

But what is an affordable home? The U.S. Department of Housing defines it as a property that costs no more than 30% of household income, and they state that this is “intended to ensure that households have enough money to pay for other non-discretionary costs”, including taxes, medical costs and groceries. [6] U.S. Department of Housing: Defining housing Affordability https://www.huduser.gov/portal/pdredge/pdr-edge-featd-article-081417.html

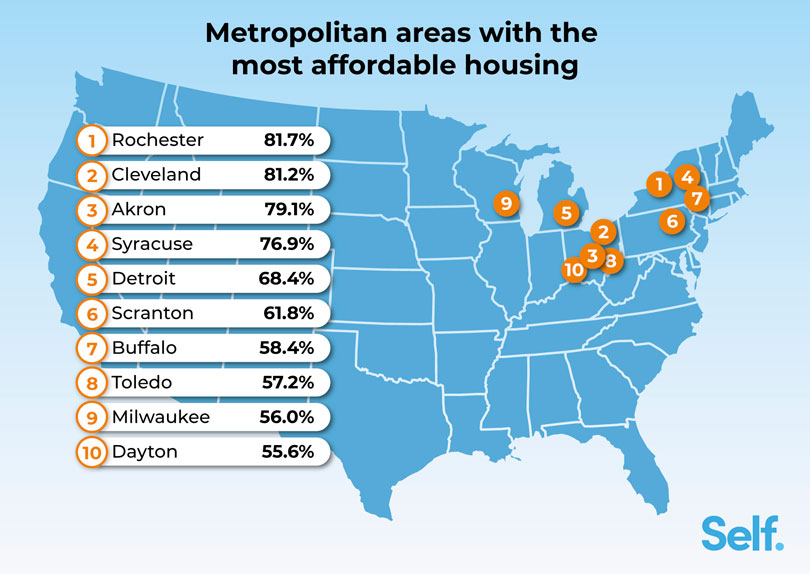

Metropolitan areas with the most affordable housing

If you’re looking for the most affordable housing market, it seems that buyers should consider living in one of the Great Lakes states. Overall, just 11 of the 100 largest metropolitan areas in the U.S. have an affordable housing majority, and the 10 highest proportions can be found in cities in New York, Pennsylvania, Ohio, Michigan and Wisconsin.

Rochester, New York, has the largest share of homes that can be bought for 30% of the city’s median income or less, with 81.7% of liveable properties on a budget of $1,985 per month — around 30% of the city’s median income level. This means it has a high chance of being the best affordable housing market in the U.S.; with Cleveland, Ohio in second, which came out on top in a separate study, as measured by cost-per-square-foot, on home affordability in 2023. [7] Cleveland.com: Ohio city is most affordable housing market in U.S., report says https://www.cleveland.com/news/2023/09/ohio-city-is-most-affordable-housing-market-in-us-report-says.html

| Rank | Metro area | State | Percentage of housing as affordable | Income threshold (30% of median) |

|---|---|---|---|---|

| Rank 1 | Metro area Rochester | State New York | Percentage of housing as affordable 81.7% | Income threshold (30% of median)$1,985 |

| Rank 2 | Metro area Cleveland | State Ohio | Percentage of housing as affordable 81.2% | Income threshold (30% of median)$1,535 |

| Rank 3 | Metro area Akron | State Ohio | Percentage of housing as affordable 79.1% | Income threshold (30% of median)$1,548 |

| Rank 4 | Metro area Syracuse | State New York | Percentage of housing as affordable 76.9% | Income threshold (30% of median)$1,503 |

| Rank 5 | Metro area Detroit | State Michigan | Percentage of housing as affordable 68.4% | Income threshold (30% of median)$1,606 |

| Rank 6 | Metro area Scranton | State Pennsylvania | Percentage of housing as affordable 61.8% | Income threshold (30% of median)$1,477 |

| Rank 7 | Metro area Buffalo | State New York | Percentage of housing as affordable 58.4% | Income threshold (30% of median)$1,549 |

| Rank 8 | Metro area Toledo | State Ohio | Percentage of housing as affordable 57.2% | Income threshold (30% of median)$1,456 |

| Rank 9 | Metro area Milwaukee | State Wisconsin | Percentage of housing as affordable 56.0% | Income threshold (30% of median)$1,703 |

| Rank 10 | Metro area Dayton | State Ohio | Percentage of housing as affordable 55.6% | Income threshold (30% of median)$1,550 |

Nestled on the shores of Lake Ontario, Rochester is one of three cities upstate New York, including Syracuse (76.9%) and Buffalo (58.4%) that offer value for money in the market. In 2022, state Governor Kathy Hochul announced a $25 billion pledge to tackle the state’s affordable housing crisis. [8] Democrat & Chronicle: Rochester has made massive progress on affordable housing. There's more to do https://www.democratandchronicle.com/story/opinion/2022/10/10/rochester-ny-affordable-housing-more-to-do/69552507007/ State funding for Rochester specifically has included $72.7 million for affordable housing in October 2023, [9] WHEC News 10, ‘State will provide over $70M for affordable apartments in downtown Rochester’ https://www.whec.com/top-news/state-will-provide-over-70m-for-affordable-apartments-in-downtown-rochester/ with other initiatives continuing to be announced.

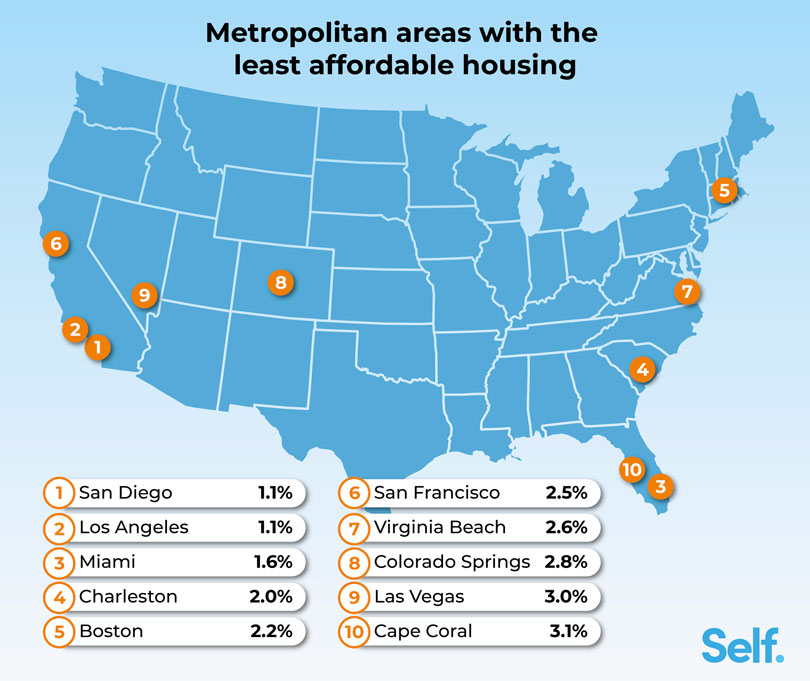

Metropolitan areas with the least affordable housing

While lakefront cities were among America’s most affordable, it appears that coastal communities are among the most priciest to live. Seven of the 10 most expensive metropolitan areas face either the Atlantic or Pacific Ocean.

House prices in Southern California consistently defied national trends in recent years despite borrowing highs, with the average SoCal home costing $831,080 in October 2023 [10] Los Angeles Times: Southern California home values near record despite the high cost of borrowing https://www.latimes.com/california/story/2023-11-16/southern-california-home-values-near-record-despite-the-high-cost-of-borrowing — more than double the median price for the U.S. overall.

| Rank | Metro area | State | Percentage of housing affordable | Income threshold (30% of median) |

|---|---|---|---|---|

| Rank 1 | Metro area San Diego | State California | Percentage of housing affordable 1.1% | Income threshold (30% of median) $1,876 |

| Rank 2 | Metro area Los Angeles | State California | Percentage of housing affordable 1.1% | Income threshold (30% of median) $1,682 |

| Rank 3 | Metro area Miami | State Florida | Percentage of housing affordable 1.6% | Income threshold (30% of median) $1,632 |

| Rank 4 | Metro area Charleston | State South Carolina | Percentage of housing affordable 2.0% | Income threshold (30% of median) $1,224 |

| Rank 5 | Metro area Boston | State Massachusetts | Percentage of housing affordable 2.2% | Income threshold (30% of median) $2,239 |

| Rank 6 | Metro area San Francisco | State California | Percentage of housing affordable 2.5% | Income threshold (30% of median) $2,730 |

| Rank 7 | Metro area Virginia Beach | State Virginia | Percentage of housing affordable 2.6% | Income threshold (30% of median) $1,390 |

| Rank 8 | Metro area Colorado Springs | State Colorado | Percentage of housing affordable 2.8% | Income threshold (30% of median) $1,550 |

| Rank 9 | Metro area Las Vegas | State Nevada | Percentage of housing affordable 3.0% | Income threshold (30% of median) $1,485 |

| Rank 10 | Metro area Cape Coral | State Florida | Percentage of housing affordable 3.1% | Income threshold (30% of median) $1,631 |

This research shows that just 1.1% of housing stock is considered to meet the 30% affordability threshold in the San Diego and Los Angeles metropolitan areas. Despite a median household income of $98,000 among San Diego residents in 2022, [11] United States Census Bureau: QuickFacts: San Diego, California https://www.census.gov/quickfacts/fact/table/sandiegocitycalifornia/INC110222 the area is approximately 97,000 homes short of its 108,000 requirement to meet the state’s state Regional Housing Needs Allocation covering April 2021 through April 2029. A city council report also acknowledged that housebuilding will need to triple if it is to meet national targets. [12] San Diego Union Tribbune: Just how far behind is San Diego on building new housing? Just 62 middle-income homes were permitted citywide in 2 years https://www.sandiegouniontribune.com/news/politics/story/2023-11-30/just-how-far-behind-is-san-diego-on-building-new-housing-just-62-middle-income-homes-were-permitted-citywide-in-2-years

Top 100 metropolitan areas and their affordable housing

Since the 2008 financial crisis, the supply of housing stock has failed to keep pace with demand. Most states have adapted their city planning and zoning laws to encourage housebuilding. [13] NPR: The U.S. needs more affordable housing — where to put it is a bigger battle https://www.npr.org/2023/02/11/1155094278/states-cities-end-single-family-zoning-housing-affordable

This research analyzed house prices across the country at two separate points — June 2023 and January 2024. In this period, the data saw a 7.8% drop in the quantity of affordable housing stock. This is, however, a snapshot of two months and may not be indicative of trends in 2024 moving forward.

Two central Florida cities - Deltona (28%) and Lakeland (23%) saw the sharpest reduction in affordable housing, according to these figures. The Orlando area has seen prices surge by 200% between 2012 and 2023 — among the highest rates in the country. [14] Habitat for Humanity Greater Orlando and Osceola County: The Housing Crisis https://www.habitatorlando.org/face-the-housing-crisis/the-housing-crisis/

| Rank | Metro area | Percentage of housing affordable | January 2024 | June 2023 | Income threshold (30% of median) |

|---|---|---|---|---|---|

| Rank 1 | Metro area Rochester | Percentage of housing affordable 81.7% | January 2024 83.7% | June 2023 79.7% | Income threshold (30% of median) $1,985 |

| Rank 2 | Metro area Cleveland | Percentage of housing affordable 81.2% | January 2024 80.1% | June 2023 82.2% | Income threshold (30% of median) $1,535 |

| Rank 3 | Metro area Akron | Percentage of housing affordable 79.1% | January 2024 81.8% | June 2023 76.5% | Income threshold (30% of median) $1,548 |

| Rank 4 | Metro area Syracuse | Percentage of housing affordable 76.9% | January 2024 74.8% | June 2023 78.9% | Income threshold (30% of median) $1,503 |

| Rank 5 | Metro area Detroit | Percentage of housing affordable 68.4% | January 2024 74.9% | June 2023 61.9% | Income threshold (30% of median) $1,606 |

| Rank 6 | Metro area Scranton | Percentage of housing affordable 61.8% | January 2024 72.3% | June 2023 51.4% | Income threshold (30% of median) $1,477 |

| Rank 7 | Metro area Buffalo | Percentage of housing affordable 58.4% | January 2024 70.1% | June 2023 46.7% | Income threshold (30% of median) $1,549 |

| Rank 8 | Metro area Toledo | Percentage of housing affordable 57.2% | January 2024 85.4% | June 2023 29.0% | Income threshold (30% of median) $1,456 |

| Rank 9 | Metro area Milwaukee | Percentage of housing affordable 56.0% | January 2024 77.4% | June 2023 34.6% | Income threshold (30% of median) $1,703 |

| Rank 10 | Metro area Dayton | Percentage of housing affordable 55.6% | January 2024 64.4% | June 2023 46.7% | Income threshold (30% of median) $1,550 |

| Rank 11 | Metro area St. Louis | Percentage of housing affordable 51.6% | January 2024 58.5% | June 2023 44.7% | Income threshold (30% of median) $1,701 |

| Rank 12 | Metro area Birmingham | Percentage of housing affordable 48.2% | January 2024 47.4% | June 2023 49.1% | Income threshold (30% of median) $1,394 |

| Rank 13 | Metro area Baltimore | Percentage of housing affordable 47.4% | January 2024 56.1% | June 2023 38.7% | Income threshold (30% of median) $1,798 |

| Rank 14 | Metro area Hartford | Percentage of housing affordable 45.2% | January 2024 61.8% | June 2023 28.6% | Income threshold (30% of median) $1,760 |

| Rank 15 | Metro area Kansas City | Percentage of housing affordable 44.9% | January 2024 66.7% | June 2023 23.1% | Income threshold (30% of median) $1,768 |

| Rank 16 | Metro area Des Moines | Percentage of housing affordable 44.2% | January 2024 49.9% | June 2023 38.4% | Income threshold (30% of median) $1,729 |

| Rank 17 | Metro area Pittsburgh | Percentage of housing affordable 41.0% | January 2024 53.6% | June 2023 28.4% | Income threshold (30% of median) $1,852 |

| Rank 18 | Metro area Indianapolis | Percentage of housing affordable 39.9% | January 2024 53.4% | June 2023 26.4% | Income threshold (30% of median) $1,719 |

| Rank 19 | Metro area Harrisburg | Percentage of housing affordable 37.4% | January 2024 44.0% | June 2023 30.9% | Income threshold (30% of median) $1,714 |

| Rank 20 | Metro area Jackson | Percentage of housing affordable 36.7% | January 2024 40.5% | June 2023 32.9% | Income threshold (30% of median) $1,301 |

| Rank 21 | Metro area Cincinnati | Percentage of housing affordable 33.0% | January 2024 38.7% | June 2023 27.3% | Income threshold (30% of median) $1,790 |

| Rank 22 | Metro area Springfield | Percentage of housing affordable 32.1% | January 2024 27.4% | June 2023 36.8% | Income threshold (30% of median) $1,236 |

| Rank 23 | Metro area Philadelphia | Percentage of housing affordable 31.9% | January 2024 43.0% | June 2023 20.8% | Income threshold (30% of median) $1,926 |

| Rank 24 | Metro area Little Rock | Percentage of housing affordable 31.9% | January 2024 33.1% | June 2023 30.7% | Income threshold (30% of median) $1,376 |

| Rank 25 | Metro area Memphis | Percentage of housing affordable 31.7% | January 2024 36.3% | June 2023 27.1% | Income threshold (30% of median) $1,245 |

| Rank 26 | Metro area Allentown | Percentage of housing affordable 30.0% | January 2024 38.4% | June 2023 21.6% | Income threshold (30% of median) $1,748 |

| Rank 27 | Metro area Minneapolis | Percentage of housing affordable 29.9% | January 2024 46.8% | June 2023 13.0% | Income threshold (30% of median) $1,822 |

| Rank 28 | Metro area Bridgeport | Percentage of housing affordable 29.7% | January 2024 46.5% | June 2023 12.8% | Income threshold (30% of median) $2,058 |

| Rank 29 | Metro area Grand Rapids | Percentage of housing affordable 28.6% | January 2024 36.8% | June 2023 20.4% | Income threshold (30% of median) $1,795 |

| Rank 30 | Metro area Louisville/Jefferson County | Percentage of housing affordable 28.1% | January 2024 35.8% | June 2023 20.3% | Income threshold (30% of median) $1,559 |

| Rank 31 | Metro area Columbia | Percentage of housing affordable 27.7% | January 2024 29.9% | June 2023 25.6% | Income threshold (30% of median) $1,481 |

| Rank 32 | Metro area Augusta | Percentage of housing affordable 27.5% | January 2024 32.9% | June 2023 22.1% | Income threshold (30% of median) $1,206 |

| Rank 33 | Metro area Baton Rouge | Percentage of housing affordable 23.7% | January 2024 27.4% | June 2023 20.1% | Income threshold (30% of median) $1,437 |

| Rank 34 | Metro area Chicago | Percentage of housing affordable 22.9% | January 2024 29.6% | June 2023 16.2% | Income threshold (30% of median) $1,838 |

| Rank 35 | Metro area Wichita | Percentage of housing affordable 22.7% | January 2024 15.2% | June 2023 30.3% | Income threshold (30% of median) $1,419 |

| Rank 36 | Metro area Tulsa | Percentage of housing affordable 22.7% | January 2024 30.9% | June 2023 14.5% | Income threshold (30% of median) $1,425 |

| Rank 37 | Metro area Oklahoma City | Percentage of housing affordable 22.0% | January 2024 34.5% | June 2023 9.4% | Income threshold (30% of median) $1,472 |

| Rank 38 | Metro area Houston | Percentage of housing affordable 21.4% | January 2024 30.0% | June 2023 12.7% | Income threshold (30% of median) $1,715 |

| Rank 39 | Metro area New York | Percentage of housing affordable 21.2% | January 2024 39.1% | June 2023 3.4% | Income threshold (30% of median) $2,067 |

| Rank 40 | Metro area Winston | Percentage of housing affordable 20.9% | January 2024 26.2% | June 2023 15.6% | Income threshold (30% of median) $1,461 |

| Rank 41 | Metro area Lakeland | Percentage of housing affordable 20.8% | January 2024 9.3% | June 2023 32.3% | Income threshold (30% of median) $1,457 |

| Rank 42 | Metro area Poughkeepsie | Percentage of housing affordable 19.4% | January 2024 31.9% | June 2023 7.0% | Income threshold (30% of median) $2,143 |

| Rank 43 | Metro area Columbus | Percentage of housing affordable 19.4% | January 2024 22.5% | June 2023 16.3% | Income threshold (30% of median) $1,212 |

| Rank 44 | Metro area Deltona | Percentage of housing affordable 18.9% | January 2024 4.6% | June 2023 33.1% | Income threshold (30% of median) $1,490 |

| Rank 45 | Metro area Albany | Percentage of housing affordable 18.7% | January 2024 25.6% | June 2023 11.8% | Income threshold (30% of median) $1,098 |

| Rank 46 | Metro area Jacksonville | Percentage of housing affordable 18.2% | January 2024 21.1% | June 2023 15.3% | Income threshold (30% of median) $1,625 |

| Rank 47 | Metro area Omaha | Percentage of housing affordable 17.2% | January 2024 26.4% | June 2023 7.9% | Income threshold (30% of median) $1,691 |

| Rank 48 | Metro area San Antonio | Percentage of housing affordable 16.6% | January 2024 25.4% | June 2023 7.8% | Income threshold (30% of median) $1,619 |

| Rank 49 | Metro area New Haven | Percentage of housing affordable 16.4% | January 2024 16.9% | June 2023 15.8% | Income threshold (30% of median) $1,526 |

| Rank 50 | Metro area North Port | Percentage of housing affordable 15.3% | January 2024 15.9% | June 2023 14.7% | Income threshold (30% of median) $1,838 |

| Rank 51 | Metro area Greensboro | Percentage of housing affordable 14.8% | January 2024 24.8% | June 2023 4.7% | Income threshold (30% of median) $1,391 |

| Rank 52 | Metro area Madison | Percentage of housing affordable 14.2% | January 2024 11.7% | June 2023 16.7% | Income threshold (30% of median) $1,909 |

| Rank 53 | Metro area Atlanta | Percentage of housing affordable 13.9% | January 2024 17.9% | June 2023 9.8% | Income threshold (30% of median) $1,718 |

| Rank 54 | Metro area Orlando | Percentage of housing affordable 13.7% | January 2024 13.5% | June 2023 14.0% | Income threshold (30% of median) $1,576 |

| Rank 55 | Metro area Dallas | Percentage of housing affordable 13.0% | January 2024 19.9% | June 2023 6.1% | Income threshold (30% of median) $1,790 |

| Rank 56 | Metro area Stockton | Percentage of housing affordable 12.9% | January 2024 9.0% | June 2023 16.8% | Income threshold (30% of median) $1,547 |

| Rank 57 | Metro area Richmond | Percentage of housing affordable 12.3% | January 2024 12.3% | June 2023 12.4% | Income threshold (30% of median) $1,513 |

| Rank 58 | Metro area El Paso | Percentage of housing affordable 11.5% | January 2024 16.2% | June 2023 6.9% | Income threshold (30% of median) $1,320 |

| Rank 59 | Metro area New Orleans | Percentage of housing affordable 11.5% | January 2024 14.2% | June 2023 8.7% | Income threshold (30% of median) $1,343 |

| Rank 60 | Metro area Washington | Percentage of housing affordable 11.3% | January 2024 18.4% | June 2023 4.1% | Income threshold (30% of median) $2,319 |

| Rank 61 | Metro area Worcester | Percentage of housing affordable 11.3% | January 2024 10.0% | June 2023 12.5% | Income threshold (30% of median) $1,674 |

| Rank 62 | Metro area Palm Bay | Percentage of housing affordable 11.2% | January 2024 11.3% | June 2023 11.1% | Income threshold (30% of median) $1,700 |

| Rank 63 | Metro area Knoxville | Percentage of housing affordable 9.9% | January 2024 7.1% | June 2023 12.6% | Income threshold (30% of median) $1,564 |

| Rank 64 | Metro area Greenville | Percentage of housing affordable 9.8% | January 2024 15.2% | June 2023 4.4% | Income threshold (30% of median) $1,231 |

| Rank 65 | Metro area Raleigh | Percentage of housing affordable 9.8% | January 2024 16.4% | June 2023 3.1% | Income threshold (30% of median) $2,040 |

| Rank 66 | Metro area Albuquerque | Percentage of housing affordable 9.6% | January 2024 5.8% | June 2023 13.3% | Income threshold (30% of median) $1,474 |

| Rank 67 | Metro area Urban Honolulu | Percentage of housing affordable 9.6% | January 2024 10.3% | June 2023 8.8% | Income threshold (30% of median) $1,686 |

| Rank 68 | Metro area Tampa | Percentage of housing affordable 8.9% | January 2024 11.6% | June 2023 6.2% | Income threshold (30% of median) $1,634 |

| Rank 69 | Metro area Tucson | Percentage of housing affordable 8.7% | January 2024 9.0% | June 2023 8.4% | Income threshold (30% of median) $1,536 |

| Rank 70 | Metro area Oxnard | Percentage of housing affordable 8.2% | January 2024 14.0% | June 2023 2.5% | Income threshold (30% of median) $1,914 |

| Rank 71 | Metro area Fresno | Percentage of housing affordable 8.0% | January 2024 2.0% | June 2023 14.1% | Income threshold (30% of median) $1,235 |

| Rank 72 | Metro area Durham | Percentage of housing affordable 7.9% | January 2024 6.0% | June 2023 9.8% | Income threshold (30% of median) $1,748 |

| Rank 73 | Metro area Boise City | Percentage of housing affordable 7.9% | January 2024 6.8% | June 2023 8.9% | Income threshold (30% of median) $1,743 |

| Rank 74 | Metro area Austin | Percentage of housing affordable 7.5% | January 2024 8.8% | June 2023 6.1% | Income threshold (30% of median) $2,164 |

| Rank 75 | Metro area Ogden | Percentage of housing affordable 7.0% | January 2024 6.5% | June 2023 7.4% | Income threshold (30% of median) $1,785 |

| Rank 76 | Metro area Sacramento | Percentage of housing affordable 6.6% | January 2024 2.7% | June 2023 10.4% | Income threshold (30% of median) $1,724 |

| Rank 77 | Metro area McAllen | Percentage of housing affordable 6.3% | January 2024 8.3% | June 2023 4.3% | Income threshold (30% of median) $1,160 |

| Rank 78 | Metro area Providence | Percentage of housing affordable 6.2% | January 2024 10.1% | June 2023 2.4% | Income threshold (30% of median) $1,792 |

| Rank 79 | Metro area Portland | Percentage of housing affordable 5.9% | January 2024 8.2% | June 2023 3.6% | Income threshold (30% of median) $1,895 |

| Rank 80 | Metro area San Jose | Percentage of housing affordable 5.9% | January 2024 1.3% | June 2023 10.4% | Income threshold (30% of median) $3,139 |

| Rank 81 | Metro area Charlotte | Percentage of housing affordable 5.6% | January 2024 8.1% | June 2023 3.2% | Income threshold (30% of median) $1,713 |

| Rank 82 | Metro area Salt Lake City | Percentage of housing affordable 5.5% | January 2024 8.8% | June 2023 2.3% | Income threshold (30% of median) $1,907 |

| Rank 83 | Metro area Provo | Percentage of housing affordable 5.2% | January 2024 9.2% | June 2023 1.3% | Income threshold (30% of median) $1,880 |

| Rank 84 | Metro area Seattle | Percentage of housing affordable 4.9% | January 2024 5.2% | June 2023 4.5% | Income threshold (30% of median) $2,351 |

| Rank 85 | Metro area Denver | Percentage of housing affordable 4.6% | January 2024 7.5% | June 2023 1.7% | Income threshold (30% of median) $1,910 |

| Rank 86 | Metro area Spokane | Percentage of housing affordable 4.5% | January 2024 4.8% | June 2023 4.2% | Income threshold (30% of median) $1,458 |

| Rank 87 | Metro area Riverside | Percentage of housing affordable 4.4% | January 2024 0.0% | June 2023 8.7% | Income threshold (30% of median) $1,517 |

| Rank 88 | Metro area Bakersfield | Percentage of housing affordable 4.3% | January 2024 0.6% | June 2023 8.1% | Income threshold (30% of median) $1,160 |

| Rank 89 | Metro area Nashville | Percentage of housing affordable 4.3% | January 2024 7.9% | June 2023 0.7% | Income threshold (30% of median) $1,802 |

| Rank 90 | Metro area Phoenix | Percentage of housing affordable 4.1% | January 2024 4.8% | June 2023 3.3% | Income threshold (30% of median) $1,803 |

| Rank 91 | Metro area Cape Coral | Percentage of housing affordable 3.1% | January 2024 4.0% | June 2023 2.2% | Income threshold (30% of median) $1,631 |

| Rank 92 | Metro area Las Vegas | Percentage of housing affordable 3.0% | January 2024 4.5% | June 2023 1.5% | Income threshold (30% of median) $1,485 |

| Rank 93 | Metro area Colorado Springs | Percentage of housing affordable 2.8% | January 2024 3.1% | June 2023 2.5% | Income threshold (30% of median) $1,550 |

| Rank 94 | Metro area Virginia Beach | Percentage of housing affordable 2.6% | January 2024 3.1% | June 2023 2.1% | Income threshold (30% of median) $1,390 |

| Rank 95 | Metro area San Francisco | Percentage of housing affordable 2.5% | January 2024 3.2% | June 2023 1.8% | Income threshold (30% of median) $2,730 |

| Rank 96 | Metro area Boston | Percentage of housing affordable 2.2% | January 2024 3.8% | June 2023 0.7% | Income threshold (30% of median) $2,239 |

| Rank 97 | Metro area Charleston | Percentage of housing affordable 2.0% | January 2024 1.2% | June 2023 2.9% | Income threshold (30% of median) $1,224 |

| Rank 98 | Metro area Miami | Percentage of housing affordable 1.6% | January 2024 2.0% | June 2023 1.3% | Income threshold (30% of median) $1,632 |

| Rank 99 | Metro area Los Angeles | Percentage of housing affordable 1.1% | January 2024 1.9% | June 2023 0.4% | Income threshold (30% of median) $1,682 |

| Rank 100 | Metro area San Diego | Percentage of housing affordable 1.1% | January 2024 0.0% | June 2023 2.1% | Income threshold (30% of median) $1,876 |

While more than three-quarters of the country’s 100 largest cities saw an increase in affordable housing stock between June 2023 and January 2024, just 16 of those metropolitan areas had a majority of homes available for 30% of the U.S. median salary.

To make matters worse, two cities — Riverside and Bakersfield in California had no affordable homes available at all as of January 2024. While the data shows that prices fluctuate daily based on supply and demand; it does highlight a nationwide shortage that is of genuine concern for policymakers.

Methodology

This study took the top 100 metropolitan areas by population [15] United States Census Bureau, ‘Metropolitan and Micropolitan Statistical Areas Population Totals: 2020-2022’ https://www.census.gov/data/tables/time-series/demo/popest/2020s-total-metro-and-micro-statistical-areas.html and reviewed their respective housing stock on Zillow in January 2024 and June 2023, taking an average from both of these snapshots. [16] Zillow, ‘Real Estate & Homes For Sale’ (various cities) https://www.zillow.com/homes/ Researchers scraped available housing for sale in each area while removing vacant lots and land from the results.

Housing with a list price of $50,000 or less was ignored as this typically referred to housing that needed lots of renovation, which may be affordable, but not liveable. Manual analysis was performed to confirm this.

‘Affordable housing’ is classified by the U.S. Department of Housing as homes that cost no more than 30% of household income. Taking that definition,the study compared the number and percentage of homes listed that could be purchased with 30% or under of the local median household income to determine which metros have the most affordable properties available as a percentage

The following amortized mortgage formula was used to calculate affordability ((P = a / {[(1 + r) ^ n] - 1} / [r * (1 + r) ^ n])) where P: monthly payment, a: total loan amount, r: annual rate divided by annual payment periods, n: total number of payment periods.

This calculation uses a 660 credit score as it is a likely credit score for people looking to purchase affordable housing, not in the lowest brackets nor the highest. This would put the buyer in the prime category. [17] Consumer Financial Protection Bureau, ‘Borrower risk profiles’ https://www.consumerfinance.gov/data-research/consumer-credit-trends/student-loans/borrower-risk-profiles/ The data assumes a 30-year mortgage term as that is the most common. [18] Rocket, ‘The Average Mortgage Length In The U.S.’ https://www.rocketmortgage.com/learn/average-mortgage-length

Household income data refers to 25-44 year olds (the age range likely to purchase affordable housing) in each metropolitan area from the U.S. Census Bureau inflated to December 2023 (the latest available at the time of calculating via CPI Inflation Calculator).

Sources

- [1] LendingTree: 94% of Americans Say Owning a Home Is Part of the American Dream, but 51% Who Don’t Own Fear They Never Will https://www.lendingtree.com/home/mortgage/homeownership-dreams-survey/

- [2] St Louis Federal Reserve: Homeownership Rate in the United States, 1980-2024 https://fred.stlouisfed.org/series/RSAHORUSQ156S

- [3] Investopedia: Millennial Homeownership Still Lagging Behind Previous Generations https://www.investopedia.com/millennial-homeownership-still-lagging-behind-previous-generations-7510642

- [4] National Association of Realtors: Existing-Home Sales Slid 1.0% in December https://www.nar.realtor/newsroom/existing-home-sales-slid-1-0-in-december

- [5] Business Insider: ‘Will mortgage rates go down in 2024?’ https://www.businessinsider.com/personal-finance/will-mortgage-rates-go-down-in-2024?r=US&IR=T

- [6] U.S. Department of Housing: Defining housing Affordability https://www.huduser.gov/portal/pdredge/pdr-edge-featd-article-081417.html

- [7] Cleveland.com: Ohio city is most affordable housing market in U.S., report says https://www.cleveland.com/news/2023/09/ohio-city-is-most-affordable-housing-market-in-us-report-says.html

- [8] Democrat & Chronicle: Rochester has made massive progress on affordable housing. There's more to do https://www.democratandchronicle.com/story/opinion/2022/10/10/rochester-ny-affordable-housing-more-to-do/69552507007/

- [9] WHEC News 10, ‘State will provide over $70M for affordable apartments in downtown Rochester’ https://www.whec.com/top-news/state-will-provide-over-70m-for-affordable-apartments-in-downtown-rochester/

- [10] Los Angeles Times: Southern California home values near record despite the high cost of borrowing https://www.latimes.com/california/story/2023-11-16/southern-california-home-values-near-record-despite-the-high-cost-of-borrowing

- [11] United States Census Bureau: QuickFacts: San Diego, California https://www.census.gov/quickfacts/fact/table/sandiegocitycalifornia/INC110222

- [12] San Diego Union Tribbune: Just how far behind is San Diego on building new housing? Just 62 middle-income homes were permitted citywide in 2 years https://www.sandiegouniontribune.com/news/politics/story/2023-11-30/just-how-far-behind-is-san-diego-on-building-new-housing-just-62-middle-income-homes-were-permitted-citywide-in-2-years

- [13] NPR: The U.S. needs more affordable housing — where to put it is a bigger battle https://www.npr.org/2023/02/11/1155094278/states-cities-end-single-family-zoning-housing-affordable

- [14] Habitat for Humanity Greater Orlando and Osceola County: The Housing Crisis https://www.habitatorlando.org/face-the-housing-crisis/the-housing-crisis/

- [15] United States Census Bureau, ‘Metropolitan and Micropolitan Statistical Areas Population Totals: 2020-2022’ https://www.census.gov/data/tables/time-series/demo/popest/2020s-total-metro-and-micro-statistical-areas.html

- [16] Zillow, ‘Real Estate & Homes For Sale’ (various cities) https://www.zillow.com/homes/

- [17] Consumer Financial Protection Bureau, ‘Borrower risk profiles’ https://www.consumerfinance.gov/data-research/consumer-credit-trends/student-loans/borrower-risk-profiles/

- [18] Rocket, ‘The Average Mortgage Length In The U.S.’ https://www.rocketmortgage.com/learn/average-mortgage-length