Household Budget Statistics

Discover key household budget statistics, including average spending, saving trends and budgeting methods, and how they vary across different income levels.

Our articles explore money & debt in the US including its history, how it impacts your personal finance & technology. We dive into topics such as student debt, debt comparisons per President and provide resources for learning how to improve your own personal finance.

Discover key household budget statistics, including average spending, saving trends and budgeting methods, and how they vary across different income levels.

A survey of 1,078 Americans on behalf of Self Financial explores how many Americans are hiding debts and why.

This article discusses the largest credit unions in the U.S. alongside other credit union statistics like total assets, total members, and average outstanding loan amounts.

Survey of 1,001 people on behalf of Self Financial reveals how much it costs to maintain a social life in the modern world.

This article discusses the average income by age for Americans, how our income changes over time, and how it varies by state.

This report outlines the current state of homelessness in the U.S., with attitudes and opinions on the issue informed by a survey of 1,050 Americans.

A survey of 1,048 Americans explores the impacts of romance on finance.

An analysis of U.S. unemployment statistics broken down by year, state, and demographics like age, race, and education level.

This article explores digital banking statistics including how many people bank online, common concerns with digital banking, and how it is predicted to grow.

A look at the complete history of U.S. recessions, including what caused them and how they impacted unemployment and consumer behavior across the country.

A survey of 1,059 adults reveals how much Americans are spending on their favorite hobbies.

Gen Zers have entered the workforce, but what is their attitude towards work, and how do their older coworkers view them in the workplace? These statistics explore Gen Z in the workforce in more detail.

The cost of life insurance can vary based on a number of factors, this study looks into the average costs by age, term length, payout amounts, and more.

What kind of lifestyle can the minimum wage achieve in 2024, and has the minimum wage ever been enough to cover basic living costs?

How do your retirement savings stack up? This piece looks at how much the average person has saved by age, compared to what experts recommend they should have.

Unemployment rates in the U.S. have fluctuated over the years for many reasons, but how has each president impacted the unemployment rate?

Economic pressures have led some people to take on extra employment to make ends meet, but just how many Americans are working two jobs or more?

Personal loans can be used for a variety of expenses, but just how many people use them, and what are the most common reasons for them? This study looks into the topic in more detail.

This analysis looks at quotes from some of the top travel insurance providers to find out the average cost of travel insurance by age, trip length, and more.

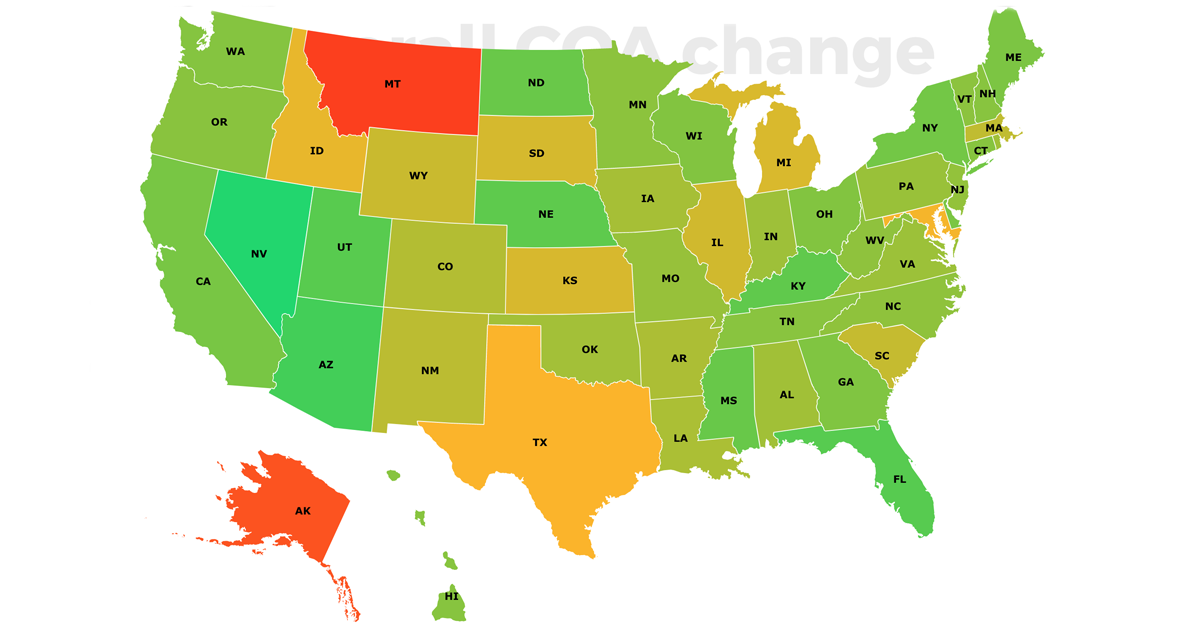

The number of hours you need to work to afford rent has changed dramatically over the past 20 years and varies from state to state. This study looks into how many hours workers need to put in to pay their rent.

The rise in inflation in the last few years has impacted us in many ways, but how have people’s spending habits changed to keep up with price rises?

This study analyzes the difference in income between single and married people in the U.S. using Census data to see who earns more on average.

The price of a home varies greatly depending on the state you live in, this analysis looks at the difference in home prices by state, and the change in prices over time.

What percentage of housing on offer is classed as affordable in each metropolitan area? Explore the answer in this study here.

This analysis looks at how bank branch numbers are declining and what the future might look like for retail banking. Explore the data here.

This study has calculated an average cost for what someone would pay renting for their whole life across America. See the findings here.

How transparent are Americans with their colleagues and friends about their earnings? See the results of the poll here.

If you’re wondering how your salary compares to workers in other states, or the average salary of popular U.S. jobs, this article explores it all in detail.

This study looks into the costs associated with living in areas prone to natural disasters, and how insurance premiums vary in these areas compared to the average.

JOMO. The Joy of Missing Out. A trend seeing people enjoy time alone, claiming time for relaxation and saving money. See what that looks like here.

This analysis uncovers the lifetime cost of the most popular tech devices across America. How much are your gadgets costing you?

The cost of college is on the rise, but how much does it cost to be a student at each U.S. university? This analysis looks into the various costs involved.

This study analyzes AAA Diamond-rated eateries across the U.S. to see who offers high-quality food for less. Explore the data here.

Millennial homeownership has faced some changes in recent years; this analysis looks into the statistics and trends on millennials buying their own homes.

This analysis of health insurance costs by state in the U.S. looks at which states have the most expensive health insurance costs, and how premiums have changed over time.

Supporting your favorite artist can get expensive with concerts, merch, and the music itself. But which artists are the most expensive to support?

Which is dirtier, your phone, your smartwatch, your cards or your cash? Microbiology study swabs payment methods to find out.

This survey analyzes the costs involved in first dates and date nights. Explore the findings here in The Cost of Dating report.

We’ve analyzed childcare costs in the U.S. to find out just how much families are spending on childcare in each state and the impact this has on finances.

This study analyzes over 152,000 social media posts to find out which states are the most stressed about finances. Explore the data here.

Can online travel agencies offer better deals for hotels and flights or is it better to book direct? This study reviews some examples of costs to find out.

This survey spoke to over 1,100 Americans to learn more about why people have a side hustle and how much stress it causes them. See the results here.

We’ve analyzed the latest data on debt to see which age groups are dealing with the most, and how debt types vary by generation.

What is the unbanked and underbanked population, and who is most likely to be in this category? This analysis looks into why some people don’t have a bank account.

Out of the top 100 largest cities, which one is best for first-time homebuyers currently renting? Find out in this analysis.

How much are graduates earning and how does this compare to their living costs? This analysis answers this very question.

An in-depth analysis of how banking fees have changed over time, and a look at how much we really spend on these charges just to use our bank accounts.

Credit card debt is an issue that affects millions of Americans, we looked into statistics relating to this type of debt and how it has changed over time.

How much do we spend on leisure activities? This analysis examines the cost of leisure across the U.S. and which states spend the most.

We've put together a list of the best items to sell on eBay in 2023 based on data from eBay listings and sales.

If you need to take out a loan but don’t have anyone to cosign for you, there are some options available; read our guide to find out more.

Our new study reveals the true cost of unused paid subscriptions in America. Take a look to discover the potential impact on your finances.

This new study uncovers what the most common home buying mistakes Americans are, the things that need repairing first in the home and the cost attached.

Medical debt and bankruptcy is an issue that affects millions of Americans. We looked at statistics on medical bankruptcies in the U.S. to find out more.

We’ve put together an in-depth guide of resources and information to help you navigate unemployment and find out what support is available in your state.

The survey analyzes Gen Z’s financial habits to see how much this generation is saving, how much they’re spending, and which financial issues worry them the most.

How much do people leave when tipping? That’s the question we’ve looked to answer in our survey on tipping culture, asking how much people tip, who people tip, and what motivates people to leave a tip.

We’ve delved deep into the statistics surrounding employee tenure in the U.S. to see how often people change jobs and why people decide to move to different careers.

Ever wondered how much food delivery apps are costing you? Find out in this study of 98 cities and four food delivery apps here.

With the cost of living on the rise, we’ve analyzed how much the average person spends on heating and cooling their home, and how it differs between states.

We asked 1,000 people what impact a lottery win would have on their relationships, likelihood of winning and ultimately, if they saw winning big as a good thing.

Student loan debt is on the rise in the U.S. with millions of Americans in debt. This piece takes a look at some key statistics you need to know relating to student loans and repayment.

We surveyed over 1,000 adults to discover how high medical bills are impacting the health of individuals. Explore the data here.

Do you have enough money in savings? We’ve put together some key stats and tips on how much people have in savings and how much you need to cover emergency costs.

Worrying about how to afford college? We discuss some of the options you could consider, with advice on saving to make college more affordable.

New research looks at the impact of financial worries on sleep and how the news may be affecting your sleep. See the findings here.

With side hustles in the U.S. growing, we looked at some key statistics from the industry to see how much people are earning and what the average side hustle looks like…

Our latest study looks at employee appreciation within the workplace, uncovering how workers feel and what would make them feel more appreciated

Valentine’s Day spending is worth billions annually, but how much is your partner spending on you? Our survey reveals how much is being spent and what is most appreciated

We’ve analyzed data across all five major sports leagues to discover the most expensive city to be a sports fan.

Did you know that your latest household purchase could already have lost value? To help we’ve analyzed the depreciation and lost value of products.

How wealthy is the average American baby boomer and how does their wealth compare to other generations? See the full report on the generational wealth gap here.

See how much food and gasoline one dollar could have bought from 1900 to today here as its purchasing power changes.

Putting together a Thanksgiving dinner with all the trimmings can be costly. What has this looked like over time and how does it compare today?

Though the bargains during Black Friday can offer value, more than 2 in 5 consumers regret their purchase, view our study into Black Friday shopping regrets

The U.S. poverty rates vary greatly from state to state and fluctuates over time. See our full report on U.S. poverty rates by state here.

Interest payments are a near-certainty for most people making large purchases. This analysis looks at how much the average person may pay in their lifetime.

Moving to the suburbs has become more and more popular, but which are the cheapest city suburbs? We’ve analyzed 25 major cities and their suburbs to find out.

To help you find the in-demand skills of the future, we’ve taken a look at the roles expected to see the most growth and which have a skills shortage in the US.

We’ve analyzed the highest paying graduate jobs in the country, how competitive they are, and what their future looks like. Find out more here.

We’ve worked out how much it would cost to design your home in some of the most popular home brands in the US. Find out the true cost of design here.

This analysis looks at how working hours have changed for remote workers during the pandemic. Read how this affected lives here.

Want to know how much your Star Wars collectibles are worth? See actual data from sold toys, figures, and more on eBay here.

The cost of dying can be much larger than many expect. Funerals, burials and cremations are all huge costs to consider. See our full report on this here.

Over 700,000 Americans get divorced each year, with many spending thousands of dollars on legal fees, but which state is the most expensive to get a divorce?

This study analyzes the content on all major TV streaming services to see which offers the best bang for your buck. Read the analysis here.

How much could the average person spend on taxes over their lifetime? This study answers the question. See the lifetime tax findings here.

A visual breakdown of the Biden administration’s proposed COVID-19 economic stimulus package, providing $1.9 trillion of support to Americans including $1,400 checks.

Collectibles from the 1990s can be worth a lot of money. We’ve compiled a list of toys, video games, sports, film, and music memorabilia worth money here.

Over 270k cases of credit card fraud, losses totaling $27.85 and a cost of $7,761 per victim. Here's all the need to know statistics across the US.

Since 2012, bank branches across the US have declined 6.5%, the equivalent of 902 per year. Discover all the facts around US retail bank branches.

Use our graphs & timeline to see what happened each year to increase national debt from $71 million in 1790 to approaching $30 trillion in 2020.

Our 2023 study reveals the true cost of mental health spending in the U.S. Take a look to discover how much Americans are investing in themselves.

We surveyed 1,198 people to find out how the stimulus checks are being spent and what people are using them for.

We've compiled the largest list of Coronavirus (COVID-19) scams anywhere online. Check if any suspicious activity you've seen has already been recorded.

We asked over a thousand people how they are spending money during COVID-19 and what lifestyle changes they will make after the pandemic is over.

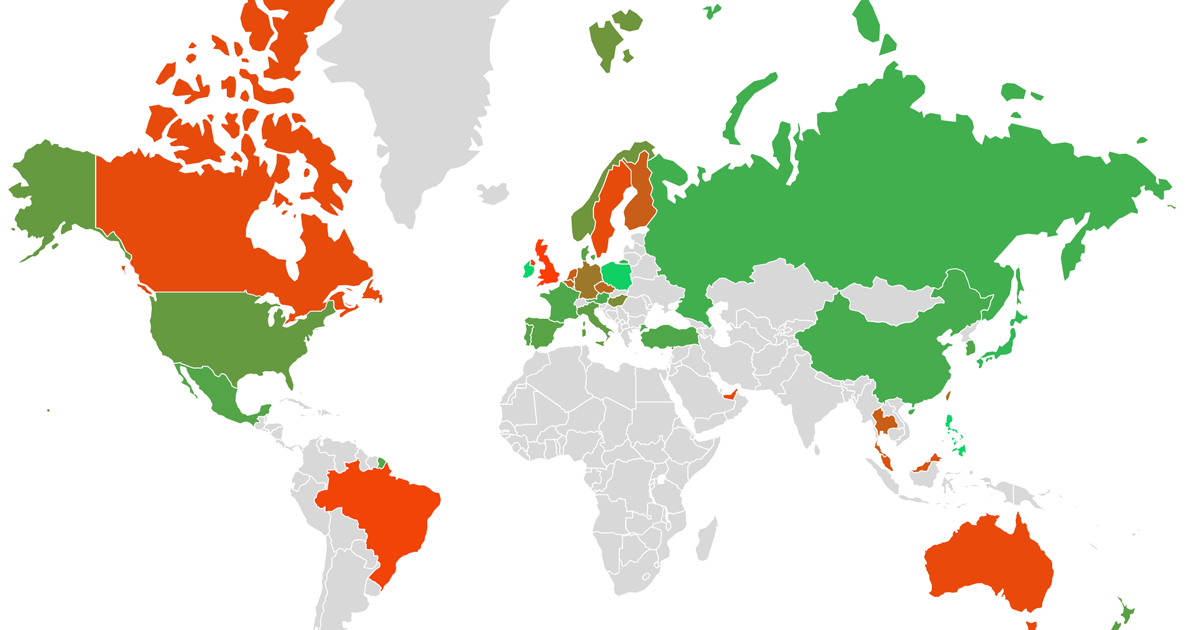

Using all launch prices for flagship iPhones since 2007 worldwide, you can find out where it's now more expensive than ever for the people than live there.

We've compiled a list of the best resources, including books, Youtube channels, podcasts, apps and more to help you learn money management. No list is more extensive!

Discover how much more expensive the cost of a university education across the US has increased since 2015, using data for tuition, books and accommodation.

Here’s how much each President has contributed to National Debt, including decisions, events and statistics.

Statistics on Trump’s National Debt impact, along with the CARES Act, China Trade War and key decisions.