A Complete List of Coronavirus (COVID-19) Scams

As anxiety around coronavirus increases, more scammers are taking advantage.

While scams can happen any time, many companies are now preying on people’s fear about contracting COVID-19 and the financial uncertainty due to job and income loss caused by the virus, among others.

Here’s what you need to know to help protect yourself from scams related to the Coronavirus.

List of all known Coronavirus (COVID-19) Scams

Here’s a detailed list of scams related to COVID-19, which you can filter by the type of scam, how the scams are being sent and the form of security breach.

-

Vital Silver Product to Cure Coronavirus

Vital Silver promises miracle at-home cures for COVID-19, this scam preys on peoples' fears of contracting the potentially deadly Coronavirus via targeted social media or other online ads.

According to the FDA, these products are not approved and are misbranded. Their Facebook page makes false claims such as:

“So it’s actually widely acknowledged in both science and the medical industry that ionic silver kills coronaviruses. And it’s now known that the Chinese are employing ionic silver in their fight against the spread of the coronavirus.”

-

Essential Oil Coronavirus Cure Scam

Quinessence Aromatherapy promises at-home cures for COVID-19. This scam preys on peoples' fears of contracting the potentially deadly Coronavirus via targeted social media or other online ads.

According to the FDA, their website specifically claims:

“Essential Oils to Protect Against Coronavirus . . . There are a wide range of essential oils that have been clinically proven to possess antiviral properties. Whilst these essential oils do not all offer the same level of defence (sic), many have been proven to 1 COVID-19 is the official name for the disease that is causing the 2019 novel coronavirus outbreak, first identified in Wuhan, China, have a measurable effect on a wide range of infective agents such as influenza A and B, parainfluenza strains 1, 2 & 3, vaccinia, herpes simplex and polio.”

-

Social Media Cures from N-ergetics

N-ergetics promises miracle at-home cures for COVID-19 via targeted social media or other online ads.

-

Company 'Gurunanda' Offering Cures on Social Media

Gurunanda promises miracle at-home cures for COVID-19, preying on peoples' fears of contracting the potentially deadly Coronavirus via targeted social media or other online ads.

-

Product to Prevent Infection from Vivify Holistic Clinic

Vivify Holistic Clinic offers at-home cures for COVID-19 via online ads and social media.

According to the FTC, their website promises, among other things, that each 100 ml dose of product lasts 16 days for a preventative dose and 8 days for an infection dosage.

-

Herbs to Prevent Viruses including COVID-19

Herbal Army promises miracle at-home cures for COVID-19, preying on peoples' fears of contracting the potentially deadly Coronavirus via targeted social media or other online ads.

Per the FTC, their site claims "a number of the herbs are strongly antiviral for corona viruses..." and the formulas can be used for both prevention and treatment.

-

At Home 'Cures' For Coronavirus

The Jim Bakker Show, which shares, according to their site, "prophetic end-time news," promises at-home cures for COVID-19 via targeted social media and online ads.

-

COVID-19 Tests for Medicare Patients

Widespread testing, much less at-home testing kits for COVID-19, are not yet available. Yet this scam promises testing to Medicare patients, who are targeted with phone calls.

-

Free Test Kits Overnight

Widespread testing, much less at-home testing kits for COVID-19, are not yet available. Yet this scam promises to overnight a Coronavirus test to your home, for a price.

-

Delivery of Sanitation Supplies Overnight

As demand for sanitation tools and products outpaces supply in some areas, scammers are increasingly targeting people promising overnight delivery of these staple products.

Once they have your personal information and payment though, your supplies never show up.

-

Health Insurance Enrollment

Some scammers now make calls to enroll uninsured or underinsured people for fake health insurance, taking their personal information (and money) in the process. They target people under the age of 64, and claim that "due to the current national health crisis" healthcare options in some areas have expanded, according to the call recording posted by the FTC.

-

Refinancing Mortgages

While there are legitimate organizations who could help you refinance your mortgage at a lower interest rate right now, plenty of scammers are also taking advantage of peoples' desires to reduce their monthly payments.

Do plenty of research and shop around for options before committing to a refinance.

-

Problem with SSN during COVID-19

Some scammers mimick government agencies or other trusted institutions to steal Social Security numbers and other personal information during the Coronavirus pandemic.

They trick people into calling back to provide more info by threatening that they received "an order to suspend your socials" due to fraudulent or suspicious activity, according to the FCC.

-

Fix Small Business Google Listings

This common scam, which can occur at any time, targets small business owners and promises to fix their business listing on Google.

-

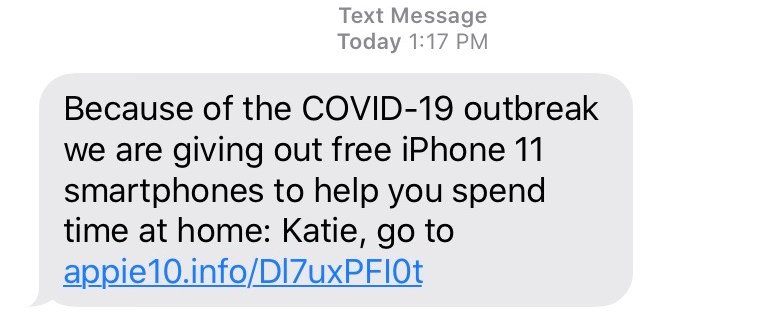

Free iPhone

Promising free iPhones, this scam targets potential victims via text.

Here's what this looks like, according to Forbes:

-

PayDay Loans of $5,000

Promising high-dollar payday loans, this scam targets potential victims via text.

-

Fake site promoting COVID-curing CBD oil

Spoofing a Fox News site, this scam promises a CBD oil that can cure Coronavirus – for a price.

-

Phishing Emails from the "World Health Organization"

Phishing is usually an attempt to steal personal information, spread a computer virus or gain unauthorized access to networks.

By pretending to come from a trusted organization, like WHO, these email scams can cause serious damage.

-

Phishing Emails from the "Centers of Disease Control"

Phishing is usually an attempt to steal personal information, spread a computer virus or gain unauthorized access to networks.

By pretending to come from a trusted organization, like the CDC, these email scams can cause serious damage.

-

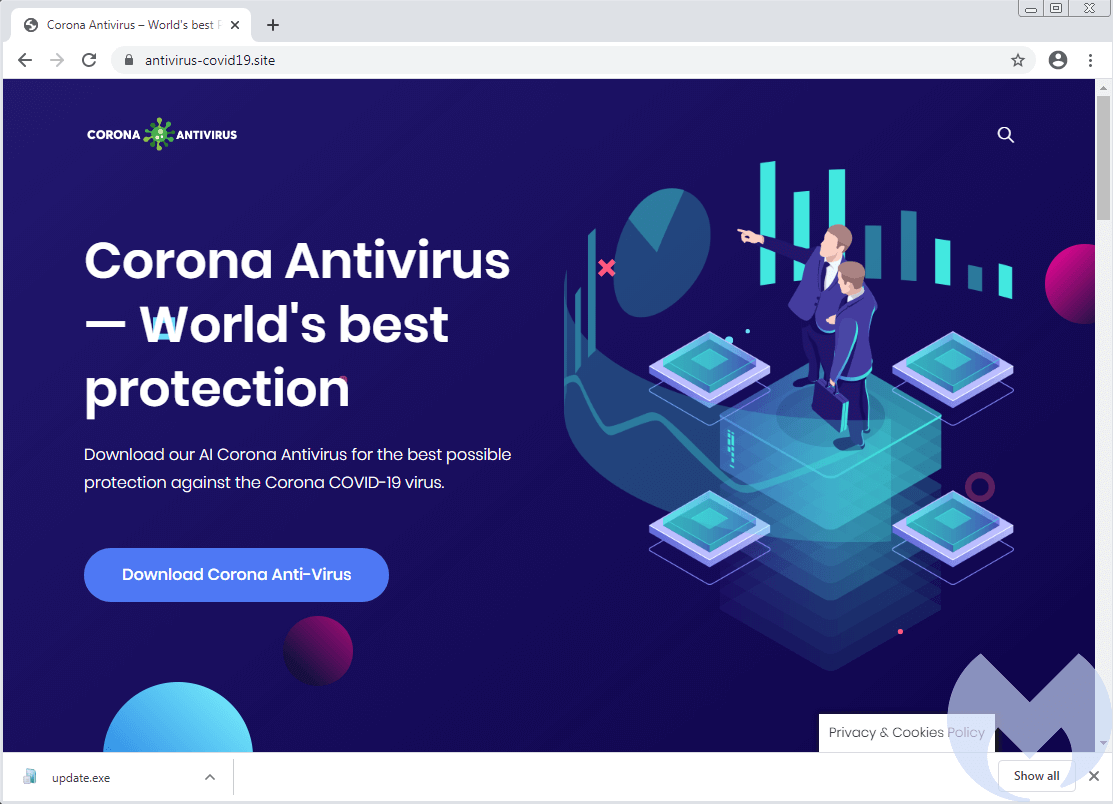

Internet anti-virus protection

This email scam promises to provide a Corona-Antivirus, which can protect your internet with anti-virus software.

According to TripWire, their website claims:

"Our scientists from Harvard University have been working on a special AI development to combat the virus using a windows app. Your PC actively protects you against the Coronaviruses (Cov) while the app is running."

-

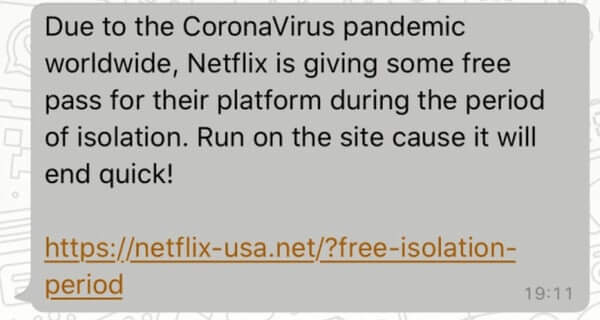

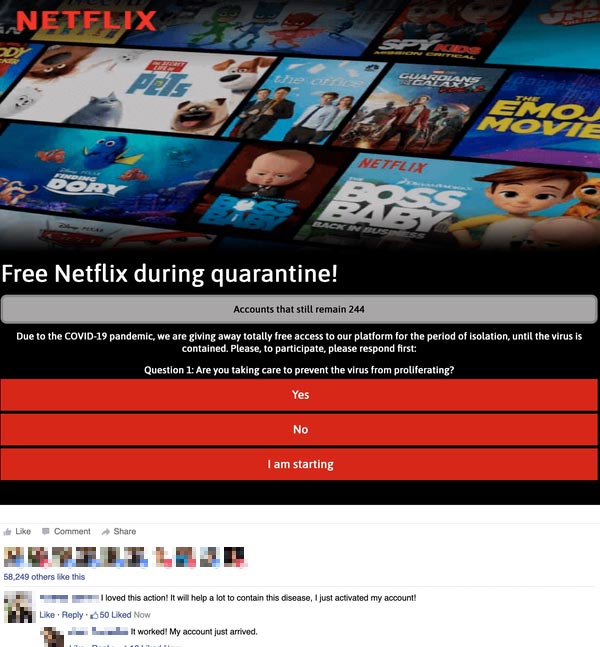

Free Netflix

This text message baits potential victims with promises of free Netflix.

-

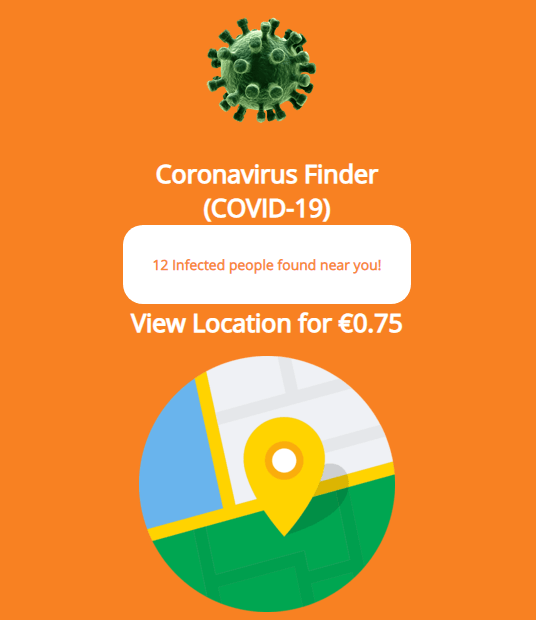

CoronaFinder Trojan virus

This website advertises a program claiming to reveal people infected by Coronavirus in their local area for a small fee. What it really cost victims? The sharing of their private credit card details.

-

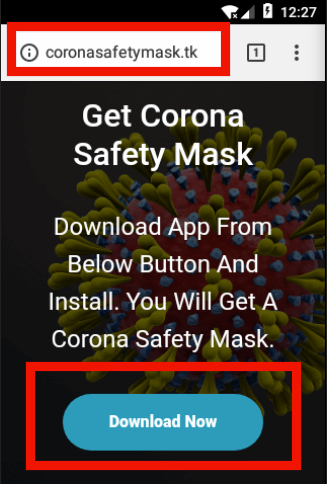

Face masks in exchange for app download

In exchange for downloading an app, this website promises to provide highly sought after personal protective equipment – a mask. What it really does, however, is steal your contacts to spread the scam even further.

The domain for this scam is hxxp://coronasafetymask[.]tk according to TripWire.

-

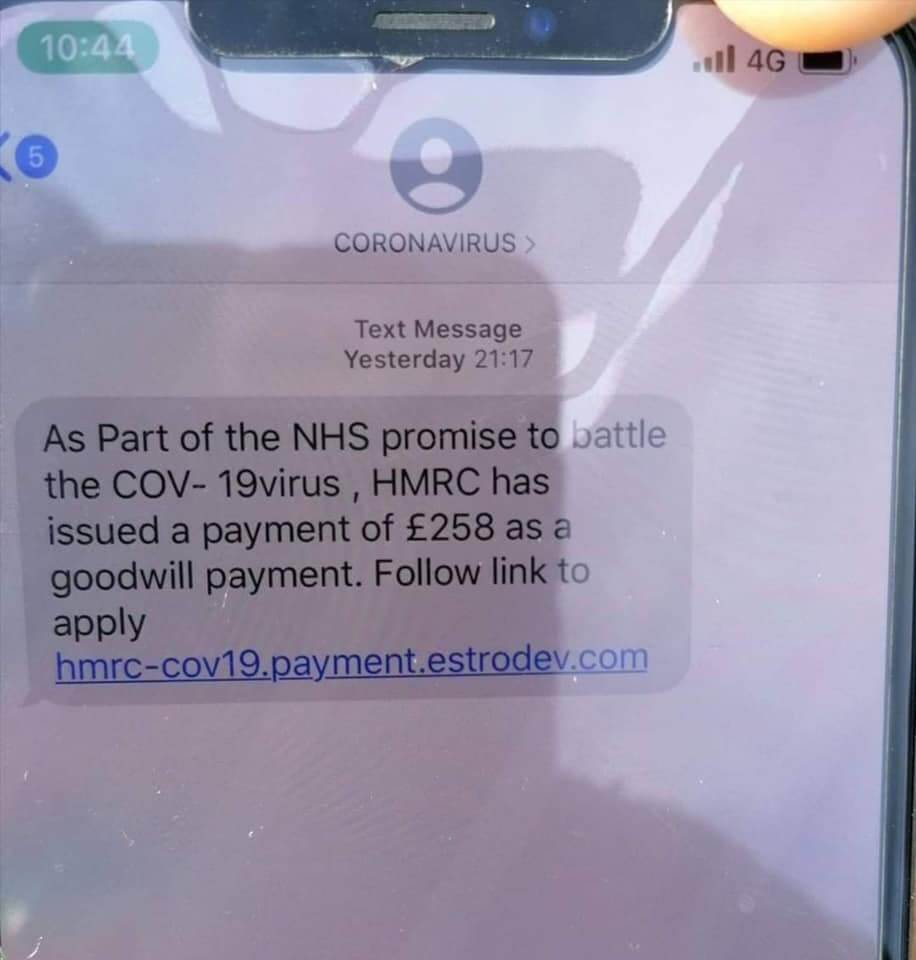

Messages spoofing Her Majesty’s Revenue and Customers (HMRC)

For the U.K. audience, these text messages spoof Her Majesty's Revenue and Customers (HMRC), and promise to offer payouts during the current pandemic. In exchange for credit card information, of course.

-

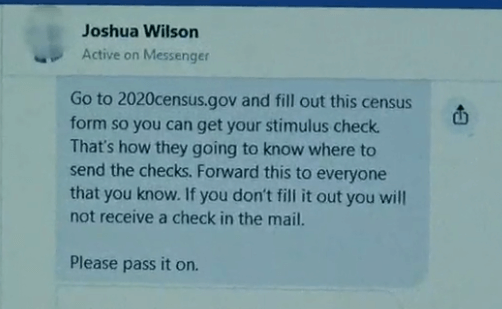

U.S. census in exchange for a stimulus check

This Facebook scam sends targets messages promising a COVID-19 stimulus check with just one caveat – you have to fill out a fake U.S. Census first.

-

School meal support

This U.K.-focused email and internet scam preys off parents' fears of losing their child's school-provided free lunches.

This scam promises financial support to replace those lunches, in exchange for bank account information.

-

Threats for breaking quarantine

This phone scam threatens residents of Burien, WA and accuses them of breaking quarantine, saying the police have a warrant out for their arrest. The scammer then demands you pay the fine over the phone and provide them with your bank details.

-

Door-to-Door Sales of Test Kits

Not only is this door-to-door, in-person scam dangerous in a time of extreme social distancing measures, these Red Cross volunteer impersonators also promise at-home COVID-19 test kits, which don't exist yet. They then fraudulently charge victims for tests that never happened.

-

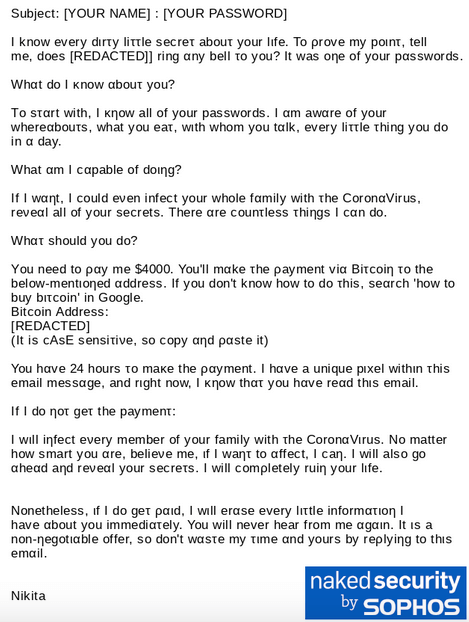

Emails threatening to infect you with Coronavirus

This email scam threatens to infect people with Coronavirus if the victim doesn't meet certain demands, including paying them about $4,000 in bitcoin.

-

Calls to reserve COVID-19 vaccines

This scam tries to convince California residents to reserve their COVID-19 vaccination in advance, even though a vaccine hasn't been invented yet.

-

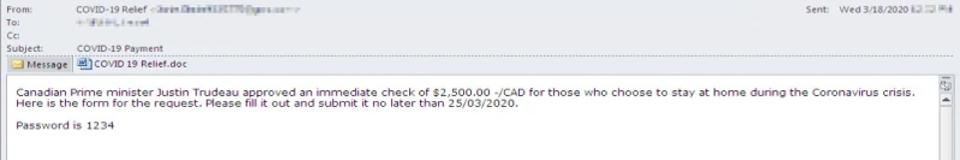

Emails offering $1000 from Economic Stimulus

Promising people $1,000 from the economic stimulus package, these emails target people in desperate financial straits. Their purpose? To steal personal information, such as bank details and Social Security numbers.

-

Sale of Pills to Cure COVID-19

In true "snake-oil salesman" style, this scam sells pills promised to cure COVID-19, even though such a cure doesn't exist.

-

Social Security COVID-19 Relief

These robocalls mimic certain government agencies, like the Social Security department or the IRS and threaten to withhold a person's COVID-19 stimulus check – unless the victim provides detailed personal information.

-

Sale of N95 Masks

Em General promises to provide highly sought after personal protective equipment – a mask. Just place an order, they'll take your money...and the mask will never arrive.

-

Goods from Costco

This texting scam promises $130 of freebies from Costco, in exchange for personal customer information.

-

Sale of N95 Masks

This scam promises to provide highly sought after personal protective equipment – a mask. Just place an order, they'll take your money...and the mask will never arrive.

The website promising N-95 masks is medical-secure.com, according to the Better Business Bureau.

-

Unsubscribable Emails Selling Snake Oil

This email scam sells literal snake oil, promising that it can cure Coronavirus. On top of that, consumers can't even unsubscribe.

While the exact company name is unknown, the IP address is 87.253.233.164, according to the Better Business Bureau scam tracker.

-

Advance Fee Loan Scam

Promising advance loans to people suffering financially from the Coronavirus pandemic, this scam is designed to steal personal information.

-

Tech Support

This email scam mimics an order confirmation offering tech support.

According to one victim, the email came from order@geeksquadteam.com with a subject line thanking them for their subscription.

The email body read:

"Here's your confirmation for your order number 2015390786. Review your receipt and get started using your products. Computer protection $29.99. If you wish to cancel your subscription, and claim for your refund then call us in our number 1-785-626-8598 make sure your computer is on when you call us.

Stay safe from Corona you are precious to us."

-

Sale of Masks

This scam promises to provide highly sought after personal protective equipment – a mask. Just place an order, they'll take your money...and the mask will never arrive.

The scammers market these products under a number of different websites. According to one victim, the text looked suspicious since it was:

- Poorly worded

- Provided little detail

- A web search for the product couldn't locate the seller

-

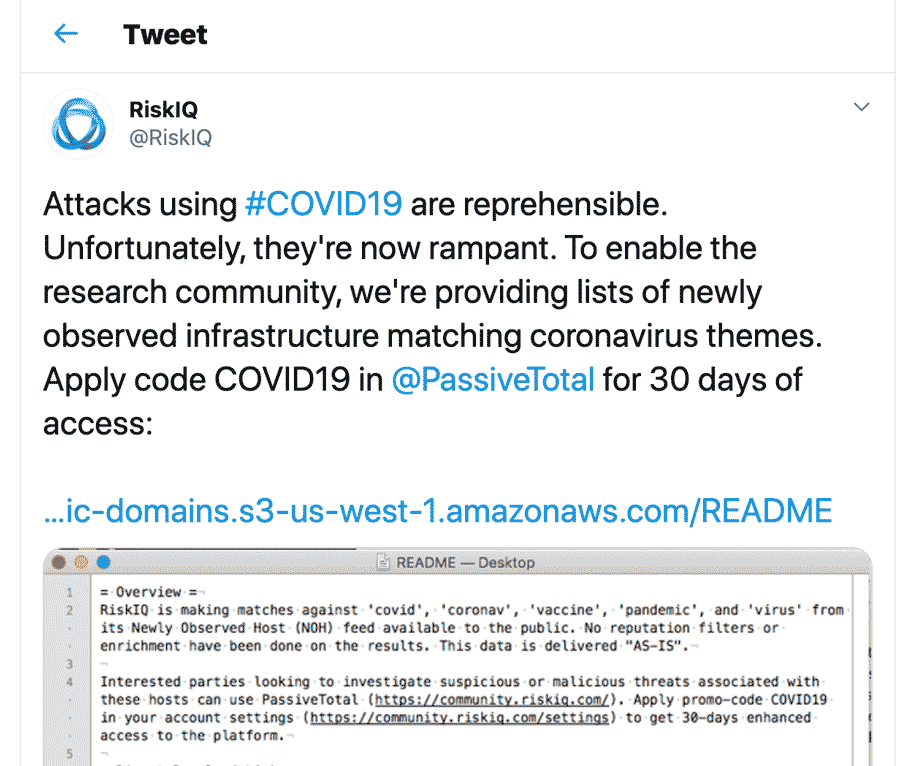

Website to "track" malicious sites

RiskIQ promises to track malicious websites, masking the fact that RiskIQ itself is malicious. If that's not ironic enough, their Twitter also calls out how "reprehensible" attacks using COVID-19 are.

Perhaps you should take a dose of your own medicine, RiskIQ. Or malware, as it were.

-

Metasploit mobile virus

Instead of downloading a helpful app to your phone, this scam downloads a hurtful virus to your Android device.

-

Adware mobile virus

Instead of downloading a helpful app to your phone, this scam downloads a hurtful virus to your Android device.

-

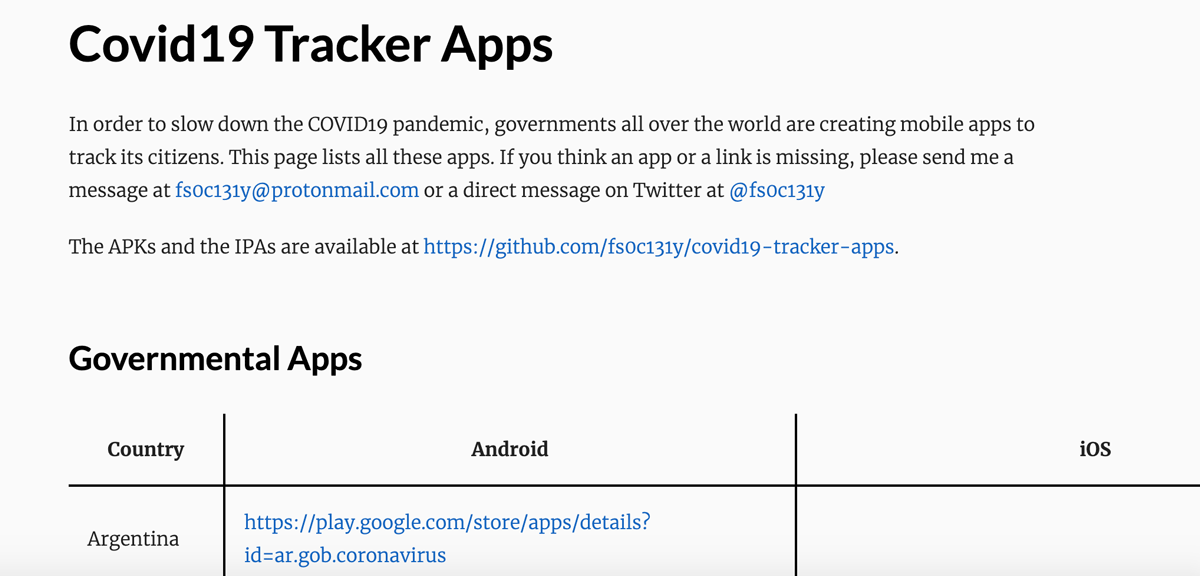

COVID-19 tracker app virus

Instead of downloading a helpful app to help you track the spread of COVID-19, this scam downloads a hurtful virus to your phone.

The webpage lists a country-by-country version of each "app."

-

Stop Corona adware virus

Instead of downloading a helpful app to your phone, this scam downloads a hurtful virus.

-

Stop Corona Trojan virus

Instead of downloading a helpful app to your phone, this scam downloads a hurtful virus.

-

Excel file with malware virus

Scaring victims into believing they have been exposed to the Coronavirus by a friend, family member or colleague, this phishing email downloads a malicious program when opened.

Specifically, the email instructs its victims to download an Excel attachment, fill out the form, and go to the hospital. The downloader is actually a malicious program currently detected by only a handful of anti-virus applications.

-

Misinformation about a national quarantine

This misinformation scam sends texts stating that the U.S. will face a 2 week quarantine – A.K.A. a complete and total shutdown.

Its purpose? To sow fear and unrest.

-

COVID-19 testing appointments

In New York City, scammers are contacting people to set up appointments for COVID-19 testing.

-

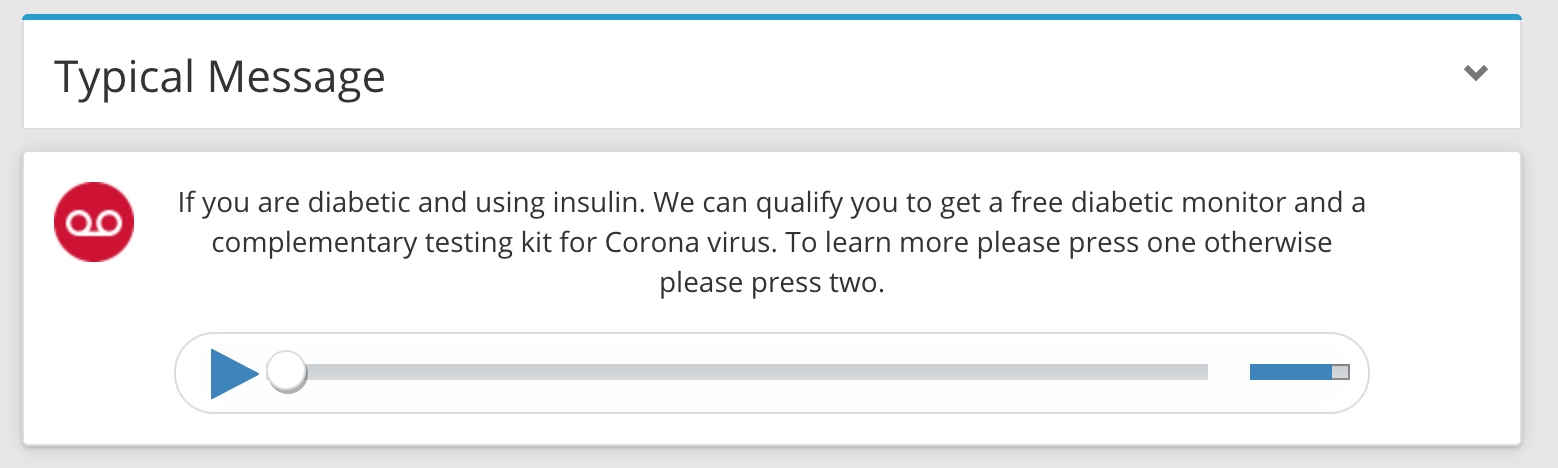

Free COVID-19 test kit for diabetes patients

Targeting high-risk people with diabetes, this robocall scam promises free COVID-19 testing kits and diabetic monitors. What they really want, however, is your personal and health insurance information.

Specifically, according to the FCC, the recording says:

"If you are diabetic and using insulin, we can qualify you to get a free diabetic monitory and a complementary testing kit for Coronavirus. To learn more, please press 1. Otherwise, press 2."

-

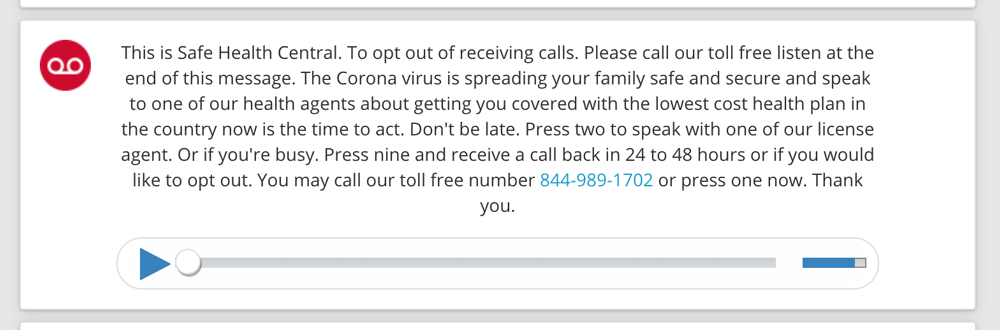

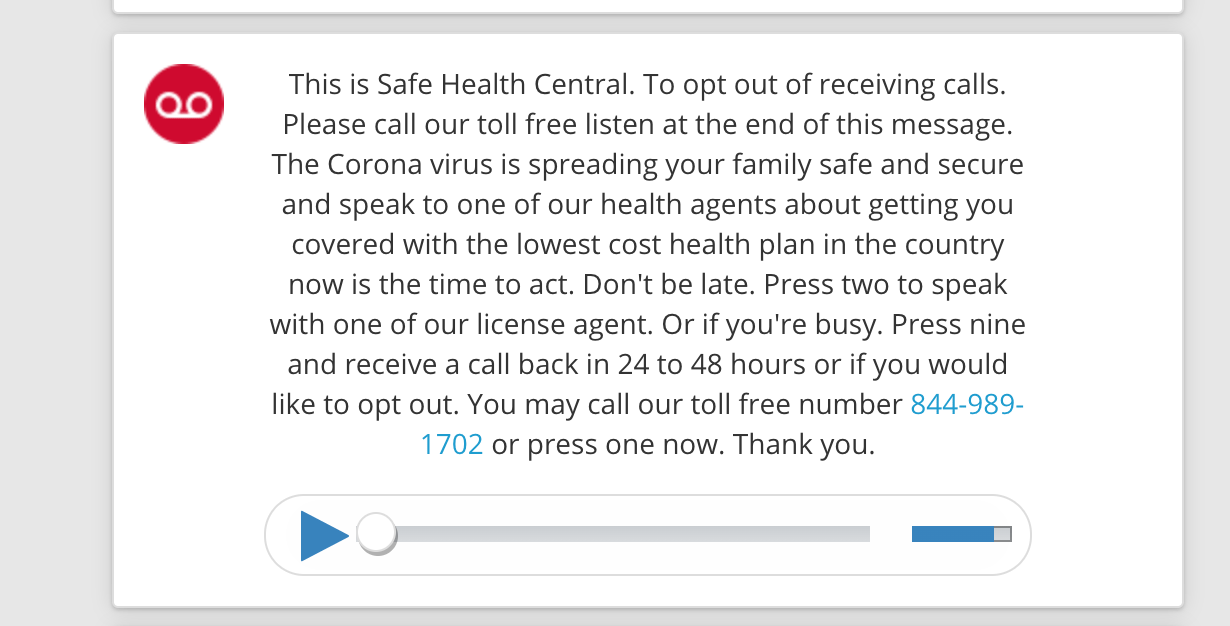

Fake health insurance coverage

This robocall scam promises to sell nonexistent health insurance coverage to people scared of getting sick from Coronavirus.

The robocall goes something like this:

"This is Safe Health Central. To opt out of receiving calls, please call our toll-free listen at the end of this message. The Coronavirus is spreading your family safe and secure and speak to one of our health agents about getting you covered with the lowest cost health plan in the country now is the time to act. Don't be late. Press 2 to speak with one of our licensed agents. Or if you're busy, press 9 to receive a call back in 24-48 hours or if you would like to opt out..."

In the words of Monopoly, do not pass go, do not collect $200....do not call them back or press any of the numbers provided in their options.

-

Virus-related small business funding and loans

Another robocall scam, this one targets small businesses and promises to offer virus-related funding and loans.

Their script?

"I know this might be an intrusive way to contact your business but this is a very important message if you think that your business is going to be financially affected all that you'll sales might decline as a result of the coronavirus pandemic we might be able to help you with fast capital for your business well a program to refer more customers you'll wait Press one if you're interested in hearing more details or press 2 if you're not interested thank you."

-

Phishing scam promising to protect against scammers

This phishing email promises to provide information to help you avoid scams. When opened, it installs a banking Trojan virus. The email comes from contact@affmote.com, according to Phishlabs.

-

Testing ploy to gain personal Medicaid and Medicare information

In Michigan, scammers posing as local health officials are calling people to offer Coronavirus testing and treatment.

According to the Attorney General's office, this scam is a ploy to gain access to personal Medicare and Medicaid information.

-

Free Netflix phishing survey

This phishing attempt baits potential victims with promises of free Netflix and a survey to steal their data.

-

Door-to-door "CDC" workers offering free test kits

Not only is this door-to-door, in-person scam based in South Florida dangerous in a time of extreme social distancing measures, it also promises at-home COVID-19 test kits, which don't exist yet.

Perhaps the worst part? These scammers wear white lab coast and mimic CDC officials.

-

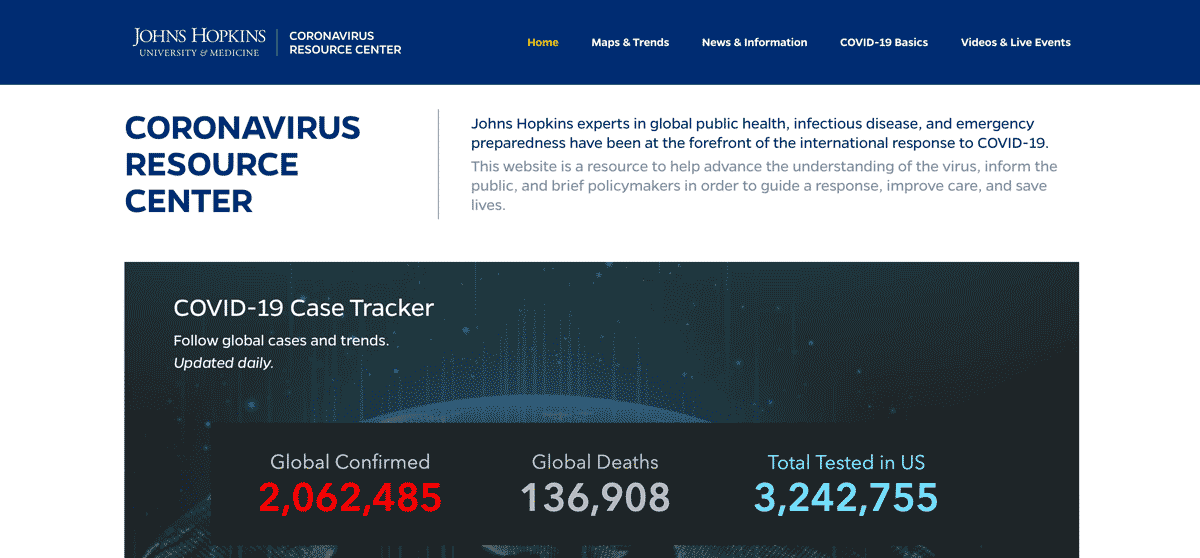

Coronavirus tracking malware

Spoofing Johns Hopkins University's Coronavirus tracking map, this fake website downloads malware to your device if you visit the site or launch the map.

-

Phishing for nude actors

This email scam from a company called Impossible Casting targets aspiring actors with fake calls from the Screen Actor's Guild for nude audition videos and passport information for a fake future fashion show in Paris.

-

FDIC impersonators requesting personal information

These robocalls mimic the Federal Deposit Insurance Corporation (FDIC) and banks to request personal information and financial details.

-

Student loans call back scam

These robocalls entice potential victims to call back and provide personal information to learn how the current pandemic will impact student loan payments.

-

Misinformation: National Quarantine warning telling people to stock up

This misinformation scam sends texts stating that the U.S. will face a 2 week quarantine – A.K.A. a complete and total shutdown.

Its purpose? To encourage stockpiling of supplies.

-

Work from Home Opportunity

This robocall mimics Amazon and promises work from home opportunities in exchange for personal information.

-

Robocall offering debt consolidation

With many Americans concerned about the effect of job loss on their debt, this robocall scam promises fake debt consolidation loans to help them out.

-

Cleaning service to eliminate COVID from air

This cleaning service scam promises to eliminate COVID-19 from the air in your home for just $79.

According to ABC, the call says:

"For only $79 our highly trained technicians will do a full air duct cleaning and sanitation to make sure that the air you breathe is free of bacteria."

-

Mandatory online COVID tests

Under the guise of the U.S. Department of Health and Human Services, this scam offers mandatory online COVID-19 testing.

-

Impersonating Banks

This text scam impersonates your bank to solicit sensitive personal and financial information.

-

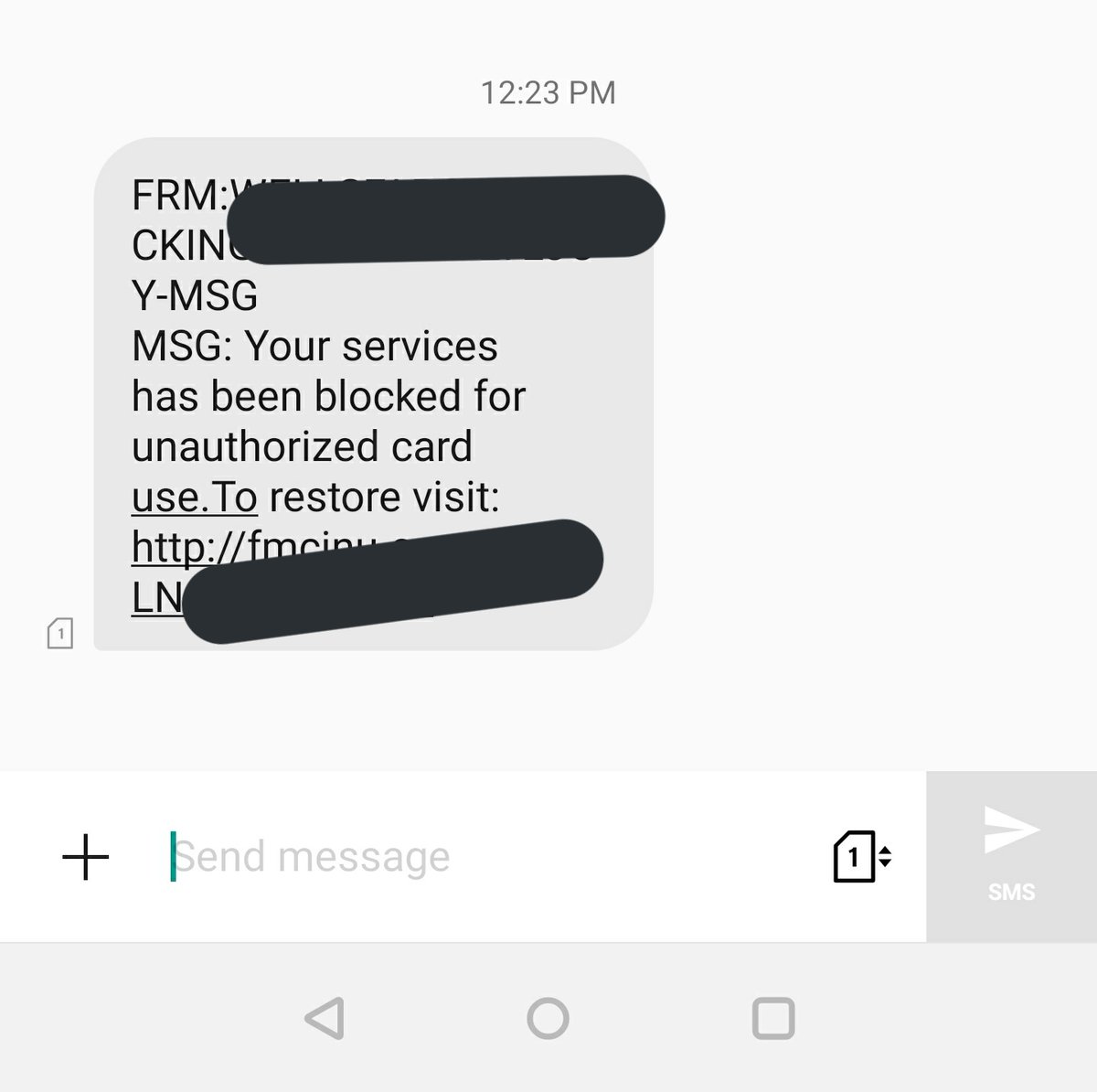

Fake login to restore bank account

Inducing fear about unauthorized card use, this scam mimics card issuers and encourages users to visit a fake website to "restore their account.

-

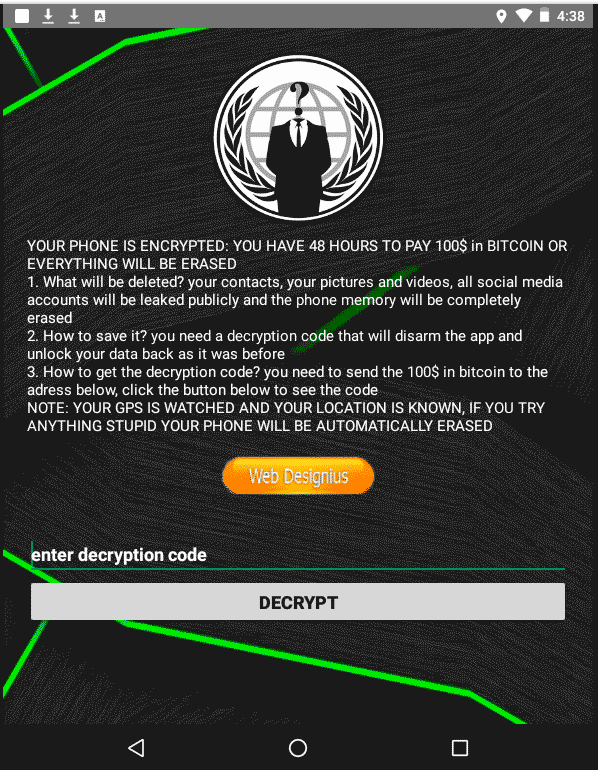

CovidLock Malware

This malware infects Android devices by changing the unlock password so users can't access their devices.

It then charges about $100 in bitcoin to unlock the device.

-

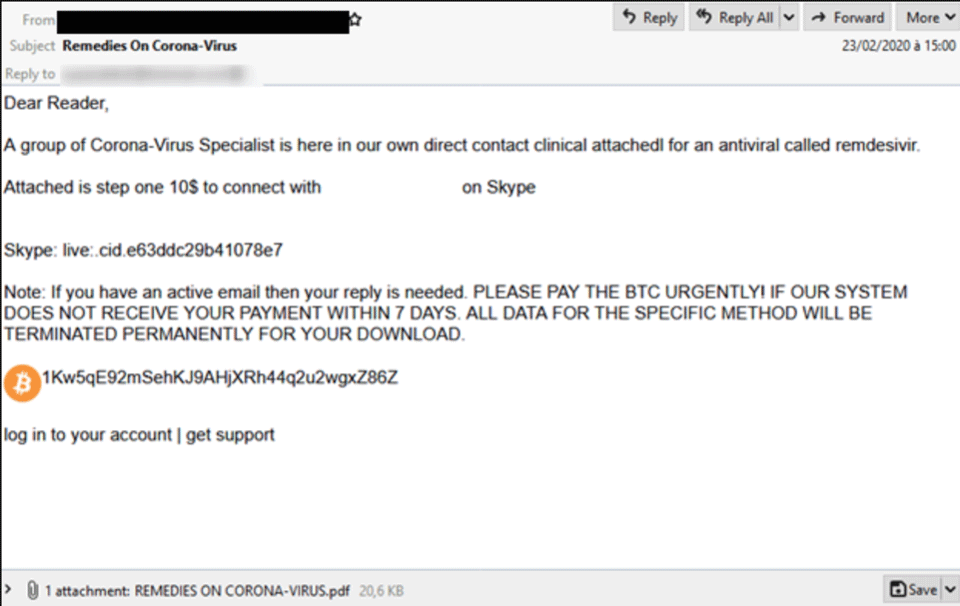

Bitcoin payments for Coronavirus remedies

This email phishing scam demands bitcoin payments in exchange for nonexistent Coronavirus remedies.

-

Fake vaccine kit

Offering visitors a free vaccine kit for the Coronavirus, this fake website charges people who order $4.95 for "shipping", from CornavirusMedicalKit.com.

Many scammers create websites that look close to legitimate but have one or two characters that are off. If you spot typos in the domain name, it could indicate the site isn't legitimate.

-

Social Security Scam

These robocalls mimic Social Security to steal personal information.

The audio transcript for these calls looks like this:

"Hello this is a call from the Social Security Administration. During these difficult times of the coronavirus, we regret to inform you that we have got an order to suspend your socials immediately within 24 hours due to suspicious and fraudulent activities found on your socials. We are contacting you as this case is critical and needs your urgent attention. To get more information about this case please call immediately on our department number 888-991-XXXX. I repeat 888-991-XXXX."

-

Pop-up Coronavirus Testing Sites

These phone calls from BCK Marketing promise pop up Coronavirus testing sites and charged people who exhibited symptoms about $250 for a test. Not only do they charge these victims money, they also walk away with their health insurance information and Social Security number.

One victim in USA Today said:

"I'm upset. I was planning on having this (test) done so I could go back to work."

-

At-home Coronavirus testing by "trained professionals."

Scammers in Virginia who pose as local hospital representatives warn residents of possible coronavirus exposure and ask to come over and conduct a test.

According to a Sentara health care press release quoted in News Leader however:

"No one from Sentara will call and ask to come to your home to conduct a coronavirus test. If someone tries this tactic, deny the request and hang up. We are heartsick that in the midst of a national health crisis, scammers would use our name to prey on worried people."

-

Herbal defense against Coronavirus

A Utah company known as Finest Herbalist advertises that its Pure Herbal Total Defense Immunity Blend protects people from Coronavirus.

-

Toothpaste that can kill Coronavirus

Conspiracy theorist Alex Jones said on his talk show that his “Super-Silver Whitening Toothpaste” kills “SARS-Corona family viruses,” and that it was backed by the Pentagon and Homeland Security.

-

COVID-19 defender patches

For $49.99, Frequency Apps Corporation and Biores Tehnologies, Inc., sell a fake patch they promise will help the immune system defend itself against COVID-19.

-

Fake travel insurance

These scammers pitch fake travel insurance that covers trip cancellations due to Coronavirus. According to Forbes, most travel insurance doesn't cover pandemic-related cancellations.

-

COVID-19 donation requests

A suspect in Door County, Wisconsin posed as a local government official and emailed a business owner to request COVID-19 donations.

-

Products to prevent Coronavirus

Steven Baker, a chiropractor in Idaho, ran Facebook ads claiming his products prevent Coronavirus.

He also said his “silver spray” is more effective than hand sanitizer.

-

Homeopathic drugs to prevent and cure COVID-19

A homeopathic product site claimed its drugs prevent, treat, diagnose, and cure Coronavirus.

The site claimed its drug was the "Best homeopathy preventive medicine for Corona Virus Infection," and that it is "highly recommended to treat respiratory complaints."

-

Essential oils to treat and prevent Coronavirus

Health Mastery Systems DBA Pure Plant Essentials claims its essential oils can treat and prevent Coronavirus.

Specifically, they calim their nasal defnese "kills viruses of the Coronaviridae family including the 2019 Novel Coronavirus and SARS at their point of entry into your body."

-

Financial assistance for small business owners

In Charlotte, North Carolina, scammers are posing as Small Business Administration representatives and offering small business owners financial assistance in exchange for a processing fee.

-

Malware email attachments

These malicious email attachments promise COVID-19 updates from vendors or other companies that allow attackers to install malware to “harvest credentials, install keyloggers or lock down the system with ransomware.”

-

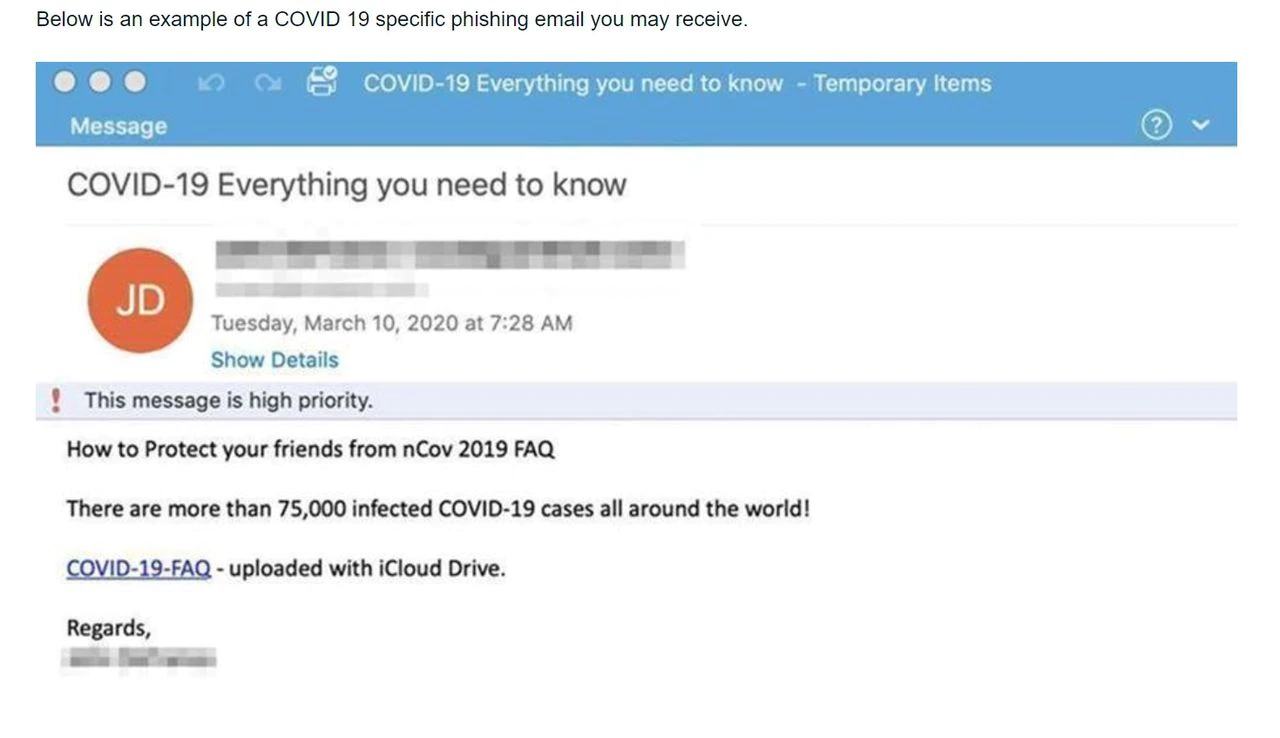

Phishing email about protecting yourself during COVID-19

Phishing emails tell people to click a link to learn how to protect themselves from COVID-19.

-

Fake drive-through testing sites

BCK Marketing and Community Outreach Marketing are contacting organizations to set up fake drive through testing sites that offer "same day results". They even set up a tent on-site and everything.

-

Home testing for Medicare members

This telephone scam offers home COVID-19 testing for Medicare members and their spouses.

-

Low-rate mortgage refinancing

While there are legitimate organizations that could help you refinance your mortgage at a lower interest rate, plenty of scammers are also taking advantage of peoples' desires to reduce their monthly payments.

Do research and shop around for options before committing to a refinance.

-

24 hour sanitation supply delivery

Yet another scam related to the sale of essential products, such as toilet paper, sanitizers, soap and face masks, this phone scam promises to deliver within 24 hours of purchase.

-

COVID-19 grants

Pay an upfront fee by prepaid gift card or wire transfer and this scammer promises to provide an immediate COVID-19 grant of $50,000 to $300,000.

Their scam channel of choice? Contacting people via Facebook Messenger while posing as a government official.

-

Stimulus check phishing message

A "friend" contacts Facebook members via Messenger and tells them they can call a specific telephone number to find out when their stimulus check will arrive. All they need is their Social Security number when they call.

-

$50,000 for seniors affected by coronavirus

Text messages targeting seniors promise $50,000 from the Bill and Melinda Gates Foundation for those impacted by Coronavirus. To "see if they qualify," these scammers request a Social Security number.

-

Expedited stimulus check receipt

This text message scam promises to expedite COVID stimulus checks if consumers confirm their bank account information and pay $50.

-

Bogus Costco link

Another ploy for Costco fans, these text messages promise $100 worth of spending at the chain by clicking on a link. Instead of free goodies though, the link downloads malware onto your device.

-

Utility shut-off threat

Scammers in West Virginia are posing as utility service employees who threaten to shut off utilities if they don't receive immediate payment in the form of a prepaid debit card.

In reality though, utility companies in West Virginia have agreed not to shut off services during the Coronavirus crisis.

-

Social Security suspension scam

Some Social Security beneficiaries are receiving letters through the mail that say their "payments will be suspended or discontinued unless they call a phone number referenced in the letter."

These letters claim you have to call because Social Security offices are closed during the outbreak.

-

Free meal scam

In Iowa, Total Care members are receiving texts that promise 2 meals per household member insured through them. If you click the link to sign up, there are no free meals. Instead, it's likely the link is malware.

-

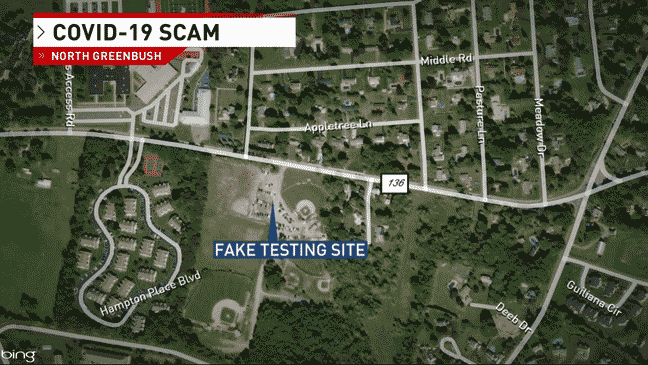

Fraudulent COVID-19 tests from government

Fake test sites are another common ploy during the COVID-19 pandemic. This scam goes all the way, from telling victims they need to be tested, to setting up fake test sites, administering fake tests and calling back with fake results.

Even worse? The scammers obtain insurance and identifying information from their victims.

Specifically, these scammers target residents of North Greenbush, NY.

-

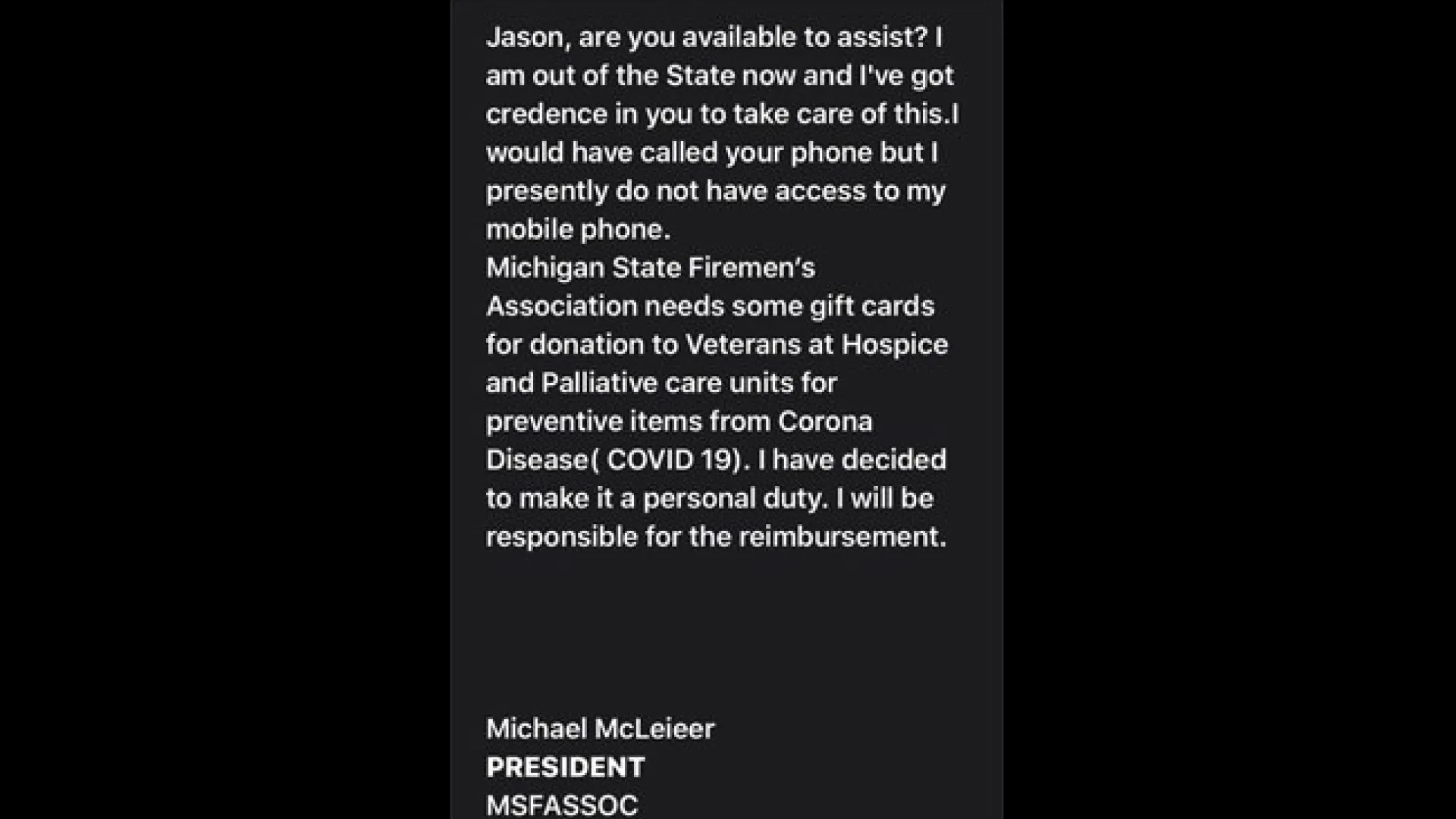

Gift card donation scam

In Michigan, scammers are impersonating the state Fireman's Association to sell gift cards for "donations" to the organization to help community members in need.

-

Pop-up Coronavirus Testing Sites

Fake pop COVID-19 testing sites have been appearing outside of churches in Kentucky. The scammers charge victims over $200 for fake tests, while collecting DNA and personal information.

-

Fake Instagram survey reward

An Instagram account with over 14 million followers called Best Memes posted fake tweets from President Trump and former President Obama promising $1,000 rewards via Paypal for filling out a survey.

The survey collected answers to three questions and victims' email addresses.

-

Cash App "cash flipping"

Scammers on Twitter target users who tweet celebrity-hosted COVID-19 giveaways. Their ploy? They want to "help" or offer money. The only tradeoff is, the user has to send a small sum of money to the scammer first via Cash App.

After the user sends their money in, the scammer blocks them and their money is lost.

-

Home visit test scam

Residents of Flagler County, Florida have been contacted by scammers claiming to be with Advent Health. They then offer to have a nurse come to their home to administer COVID-19 tests.

-

Phishing scam offering financial relief

Another scam mimicking government agencies or banks, victims are targeted via emails that offer financial relief for COVID-19. Compromised systems then become host to a banking Trojan virus.

-

Unemployment scam

Claiming to help people file claims for unemployment, this website asks for information not needed for unemployment consideration – like mortgage and credit card information.

-

Cryptocurrency pandemic essentials scam

Found via online marketplaces then contacted via third-party messaging platforms, these victims are offered hard-to-find items like face masks, hand sanitizer, and medication in exchange for payments in cryptocurrency. After paying, the victim receives nothing.

-

Sentara Healthcare home visit scam

Residents of Virginia have been contacted by scammers claiming to be from Sentara Healthcare. The scammer claims the victim has been exposed to COVID-19 and they would come to their home to test them for the virus.

-

"Mandatory" COVID-19 Text scam

Even though there's no online test for Coronavirus (it's not like a math test, you guys) this texting scam impersonates the U.S. Federal Government and demands you complete a mandatory online assessment.

-

Vaccine cover-up email scam

Claiming Chinese and UK governments are covering up a COVID vaccine and cure, targets who click the document attached to this email are taken to a fake website design to steal login details.

-

Airborne virus CDC spoofing scam

Using a legitimate CDC email address, this scam claims COVID-19 is now airborne.

-

CDC vaccine-donation scam

"Donate here to help the fight." This fake CDC email asks for donations to develop a vaccine and requests payments be made with bitcoin.

-

Stimulus check direct deposit

This scam comes from all angles – email, text messaging, and social media. The ploy? Confirm your bank account information in order to receive your stimulus check via direct deposit.

-

Business email compromise scam

Some scams now pretend to be CEOs directing their employees or business partners to make changes to how they process or direct payments due to the outbreak. If you're not careful, it can be hard to spot the real email from the fake, since some scam email addresses only change one letter from the authentic address.

-

Rental scam

Some fake online real estate and rental platforms now use social distancing as an excuse not to let people see properties before requiring a deposit or financial information.

-

Money mule scam

This is a classic money-mule scam where scammers try to convince victims to help them move stolen money.

Victims are asked to receive funds in their personal bank account and then “process” or “transfer” funds through wire transfer, ACH, mail or money service businesses like Western Union or Moneygram.

-

Home test kit scam

Yikon Genomics, Inc. uses its website and social media platforms to sell $39 COVID test kits. They claimed these kits can 'be used to confidently screen for the presence of 'antibodies in the blood stream, making it possible to detect current or recent viral infections of COVID-19," according to a Los Angeles city attorney.

-

Federal agency price-gouging scam

Scammers are falsely representing themselves as contract holders of the General Services Administration and marketing hand sanitizers and cleaning chemicals at exorbitant prices via email.

-

Grandparent scam

Scammers now target well-meaning grandparents posing as grandkids who are supposedly in trouble and need money wired to them immediately. A few of these "crises" include needing help to pay an emergency hospital bill or leave a foreign country in the midst of COVID-19.

-

Fake sale of medical masks

An Australian broker who supposedly represented a Middle Eastern company claimed to have about 39 million N95 masks in a Georgia warehouse. While the plan was to sell the "masks" to Kaiser Permanente, the Feds broke up the scam first.

-

Social security COVID-19 test results scam

Claiming to be from a COVID-19 hotline, these scammers are calling people ransoming test results in exchange for their Social Security and date of birth.

-

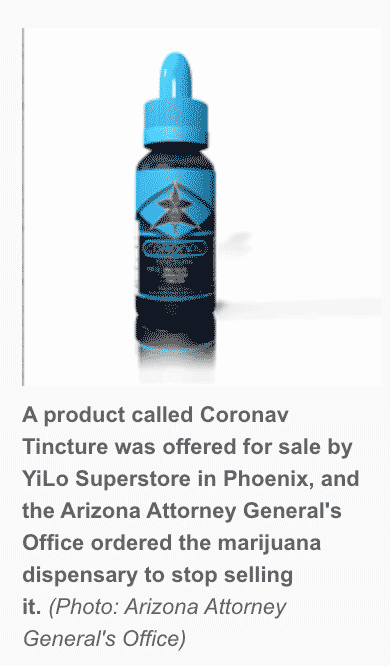

Immune stabilizer tincture to cure life-threatening virus

YiLo Superstore's website sells a tincture that can be mixed with water if you contract a life-threatening virus. They advertised the sodium chlorite solution as a virus killer and immune system builder under the headings "CoronaV instructions" and "a word on Coronavirus."

-

Paycheck protection loan fee scam

Scammers are calling businesses saying they need to pay a fee to access a paycheck protection loan.

-

Doordash COVID-19 bonus check scam

A special scam targeting DoorDash drivers promises they'll receive a bonus check for delivery. They then use the driver's phone number to take money via a money transfer app.

-

Health Insurance robocall scam

Yet another robocall scam that mimics health insurance companies to sell fake plans.

What they're saying?

"Time so that you can get a great insurance plan that's within your budget. We offer policies from top care providers that are best rank in the country for health insurance such as Cigna and Blue Cross Blue Shield. To hear more about the PPO policies we offer. Please press two now to get a free consultation nine for a call back and to be placed on our do not call list permanently. Please call our toll free number 844-989-1702 and press one when prompted. Or press one now to be taken off this call list."

-

ComEd Energy personal information phishing

Scammers are imitating ComEd, an Illinois energy company, and threatening to shut off service unless they receive sensitive personal and financial information.

A few ways they're doing it? They may call and:

- Demand a customer make a direct payment using a prepaid cash card

- Ask victims to call them back at a different phone number and provide personal information

- Duplicate a recorded message customers hear when calling a legitimate company, so it sounds like an actual business, not a scammer

-

Hemp products to prevent and cure COVID-19

Native Roots Hemp claims their products can prevent, treat, cure or diagnose COVID-19.

Their exact claim looks something like this:

“Cannabis Indica speeds up Recovery from Coronavirus . . . Severe acute respiratory syndrome (SARS) is a viral respiratory disease caused by the SARS coronavirus (SARS-CoV). . . . Curing coronavirus infection prevents clinical SARS. Cannabis indica speeds up recovery. . . . Two plants Cannabis sativa and Cannabis indica Their [sic] resins contain hundreds of cannabinoids. I recommend only cannabis indica extracts which are not psychoactive . . . ‘Cannabis indica resin is antiviral and inhibits cell proliferation’”

-

Natural products to prevent and cure COVID-19

Cathay Naturals claims their products can prevent, treat, cure or diagnose COVID-19.

They claim:

“Surprisingly, several hospitals designated for mild-moderate COVID-19 patients that are dominated by and fully implemented with Traditional Chinese Medicine (TCM) treatments reported zero medical worker infection and very low or zero conversion rate to severe cases. This was in vast contrast with significant medical worker infections and about 15-20% conversion to sever [sic] cases in certain hospitals that do not use the TCM treatments. Such a big contrast let [sic] many frontline doctors to call for mandatory implementation of Chinese herbal medicine treatments, which eventually become part of the CDC official guide for diagnosis and treatment of COVID-19 in China.”

-

Products to cure and prevent Coronavirus

Alternative Health Experts claim their products can prevent, treat, cure or diagnose COVID-19 via their social media and other online channels.

-

CBD oil to "Crush Corona"

NeuroXPF claims their CBD oil can help your body fight Coronavirus infection.

Specifically, their marketing claims:

“Crush Corona . . . While scientists around the world are working 24/7 to develop a COVID-19 vaccine, it will take many more months of testing before it’s approved and available. However, there’s something you can do right now to strengthen your immune system. Take CBD...CBD can help keep your immune system at the stop of its game. . . . We want everyone to take CBD and take advantage of its potential to help prepare your body to fight a coronavirus infection. So, we’re making all of our products more affordable.”

-

Colloidal Silver to treat and prevent COVID-19

This scam promises a Coronavirus protection and prevention care package.

-

The "only solution" to prevent Coronavirus

Gaia's Whole Healing claims its colloidal silver product is the "only solution to protecting yourself from the Coronavirus," encouraging website visitors to purchase it now.

-

Saline therapy to treat and prevent COVID-19

Halosense claims saline therapy helps the lungs fight against the Coronavirus in its social media and online ads.

-

Products to treat Coronavirus

Not only does this site claim its products can treat Coronavirus, it also claims COVID-19 is no worse than the flu. A fact that, at least to date, has been proven not to be true.

-

A "magic key" to beating Coronavirus

"What if you had a magic key to help keep your immune system strong and less likely to succumb to illness?" social media ads from Ananda Apothecary ask.

While a magic key to cure COVID-19 would be nice, no cure exists at this time. Yet this site claims its essential oils can help prevent and cure respiratory illness, claiming:

"Essential oils are unique allies in times of airborne illness because of their volatile natures and their inherent...anti-viral qualities...This quality makes them extremely effective for respiratory conditions by way of inhalation. It is this inherent, diffusive quality that allows essential oils to be used to strengthen the immune system."

Source: FDA

-

Site makes false claims over CBD treatment for COVID-19

Beginning in or around March 2020, Thrive positioned itself as an "anti viral wellness booster" that treats, prevents, or reduces the risk of COVID-19, despite there being no scientific evidence that Thrive or any of its ingredients can treat, prevent, or reduce the risk of COVID-19.

-

Nursing home residents on Medicaid being advised to sign stimulus checks over to facilities

Nursing homes and assisted living facilities are claiming that they require residents who are on Medicaid to sign their stimulus checks over to the facilities.

The FTC is encouraging consumers to check with loved ones who receive Medicaid and live in these facilities, and to file a complaint with their state attorney general if they or a loved one have experienced this issue.

-

Scammers posing as Medicare representatives making calls offering coronavirus test kits

Posts circulating widely on Facebook claim that scammers are making calls posing as Medicare representatives, offering coronavirus test kits and asking for social security numbers.

The FTC is advising Americans to remain vigilant to unsolicited telemarketing calls that offer tests for COVID-19 or PPE equipment such as face masks and report anything suspicious to the relevant authorities.

-

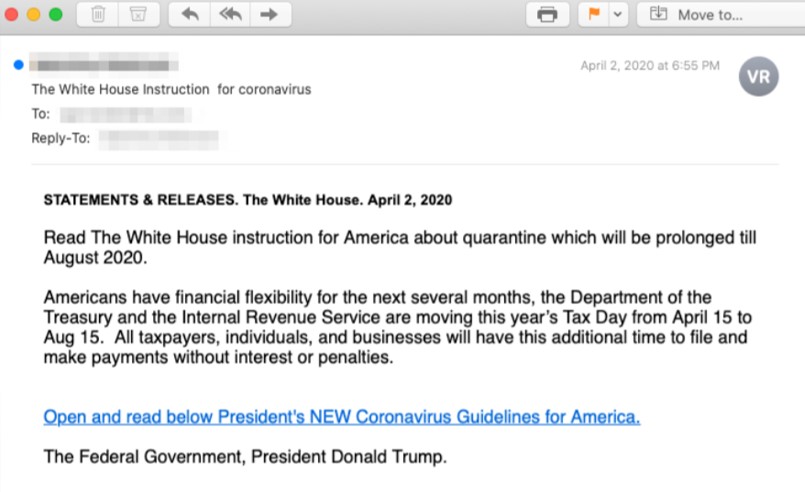

Fake coronavirus instructions from the White House

An email purporting to be official communication from the White House informed recipients that the IRS and the U.S. Department of the Treasury had decided to push Tax Day off until August 15, 2020. They then instructed users and businesses alike to click on a link in order to view the President's updated guidelines on the coronavirus.

When a user clicked on the email's embedded link, they were sent to a site that used the exact same HTML and CSS code as what's employed by the White House's official COVID-19 informational website, however the "Download and read full document" button summoned a Microsoft Office document that leveraged malicious macros to load malware onto the user's computer.

-

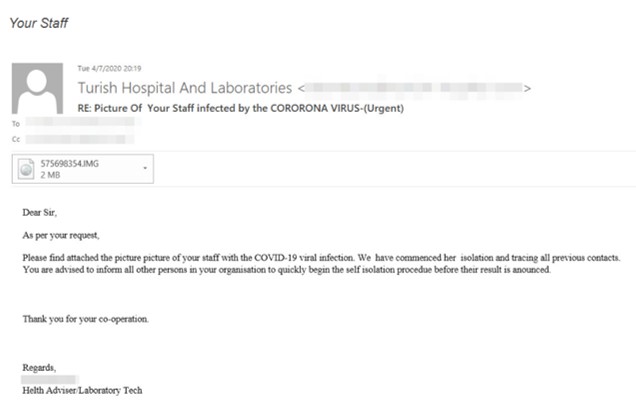

Fake hospital email claims to idenfity 'infected staff'

Digital fraudsters are sending emails claiming to share a picture of the recipient's coronavirus-infected staff "per their request." The malicious actors used the disguise of a health adviser/laboratory technician from "Turish Hospital and Laboratories" to then inform the recipient that everyone else in the organization should place themselves into self-quarantine.

When opened, the .IMG file mounted as a DVD and revealed an executable file for the purpose of infecting the recipient's machine with malware.

-

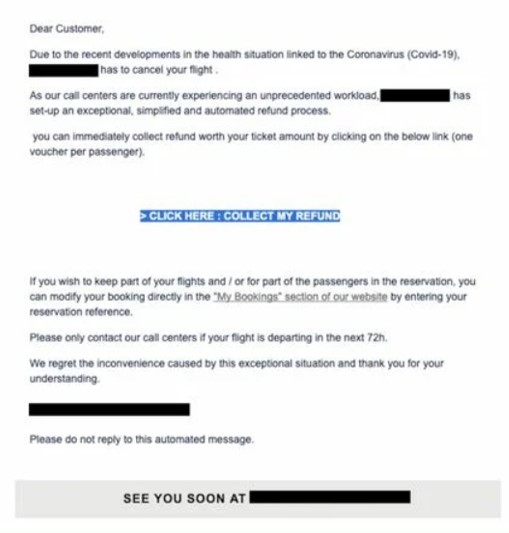

Email scam offering flight refunds for those whose travel plans have been disrupted

Consumers have reported receiving emails from flight companies offering refunds for those impacted by the pandemic. When the user clicked on the link to a refund form, they were prompted to submit their personal information, mobile phone number, email address and payment card information. It then delivered the victims data to the attackers. This gave nefarious individuals the ability to conduct credit card fraud and identity theft, among other attacks.

-

Tech support scam exploiting individuals working from home

With more Americans working from home since the start of the pandemic, employees who are attempting to solve IT technical issues from home say that they are receiving pop-up messages with instructions to contact a company for help.

The company then targets the individual via a phone call or an online prompt which will download malware onto the user's computer.

-

Nigerian fraudsters filing unemployment claims using stolen personal social security data

The Secret Service has issued an alert about a massive operation to file fraudulent unemployment claims in states around the country, like Washington and Massachusetts. Officials have attributed the activity to a Nigerian cyber-criminal group known as 'Scattered Canary' and said millions of dollars had already been stolen.

Individuals have been urged not to share personal information such as addresses or social security numbers with anyone they don't recognise.

-

Public warned about fake contact tracing scams, with scammers posing as Public Health representatives

The FTC has issued a warning to the public to be vigilant of scammers taking advantage of contact tracing to steal information.

There has been a rise in the number of scammers sending text messages to the public, posing as Public Health representatives and requesting social security of financial details as part of the contact tracing process. The FTC has reiterated that official communication would never ask for personal details via text message.

-

Scammers posing as energy company workers are praying on public fears about rising utility bills

The public have been advised to stay alert to telephone scammers, posing as representatives from energy companies such as PECO and Dominion Energy. Capitalising on growing public anxiety about the cost of living amidst surging unemployment, scammers are pretending to call from common utility companies and demand payments from unsuspecting customers.

-

Text messages claim that Target is offering free groceries for customers

The public have been warned that text messages claiming to be from Target and offering free groceries are a scam. The message says that the recipient of the text qualifies for $175 worth of free groceries amid the coronavirus pandemic and comes with a clickable link to redeem the offer.

Anyone receiving the text message should delete and block the number, as clicking on the link could compromise personal data.

-

Rental assistance scam

People in need of government provided rental assistance have been targeted in numerous ways, including scammers charging fees in order to 'expedite' applications or asking people to provide financial information outside of the application process.

This method of spoofing makes it look like the communication comes from official sources. People have been targeted by phone, text message and emails.

No federal government official will get in touch to request this information outside of your application, so do not provide it anywhere other than on the application form. Separately, no governmental agency has the capability to speed up an application process, so take extra precautions if anyone is claiming they can expedite your application.

What scammers want

According to the Federal Trade Commission (FTC), common types of information scammers seek include:

- Passwords

- Social Security numbers

- Account numbers

- Other payment information

If scammers get that information, they could access your email, social, bank or other private accounts.

Another common thread among scammers? A desire to steal your money.

How to spot a scam and red flags to watch for

With so many scams already out there, and new ones constantly developing, it’s important to know some of the tell-tale signs so you can spot – and report – scams right off the bat.

While this isn’t an exhaustive list, here are 4 red flags that could indicate a scam.

-

Someone’s trying to push you into an immediate action or decision.

Scammers will usually try to push you into a quick decision. Don’t let anyone bully you or threaten you into giving them private information. If they try to push you to take action right now, it might be a scam.

Instead, take time, ask around and do your research before making a decision.

-

They want you to use payment methods that have little or no fraud protection.

Before paying for anything, think about how you pay, since some payment methods have almost zero fraud protection.

If someone requires you to pay up front, wire money, or pay by cash or gift card, it could be a scam. It’s very unlikely anyone could trace that money and get it back to you if something went wrong.

On the other hand, credit cards have excellent fraud protection. While fraud protection on debit cards is more limited, it’s still available to a certain extent.

-

You get a robocall

Robocalls with recorded sales pitches are illegal, according to the FTC.

The FTC also encourages you not to press 1 to speak to a person or be taken off their list, since that could lead to more calls.

When in doubt, hang up or don’t answer in the first place.

-

You get an email from someone you don’t know (or worse, one that mimics a person or brand you do know)

If you get an email (or text) from someone you don’t know, or an email mimicking a person or brand you trust, this could be an example of phishing. According to the FTC, phishing is an attempt to trick you into giving away personal information.

These messages will often ask you to:

- Click on a link

- Download an attachment

- Or provide a link for you to “log in” to your account

If you take any of these actions, you could end up with a malicious computer virus or stolen identity, just to name a couple consequences. So if you get an email, message or text message that looks “phishy,” don’t take the requested action.

Instead, try to handle the situation in one of the following ways, depending:

If it looks like someone you know, contact the person you know directly via their personal phone or email (not as a reply to the original message) and ask.

If it looks like one of your account providers, open a fresh browser window and go to the company’s website directly (or their mobile app) to log into your account. Or contact their customer service via the information on their website (not in the suspicious-looking email) to check up.

If you don’t recognize it at all, just don’t open it, mark it as spam and delete it. Sometimes it’s better to be safe than sorry.

Some common COVID-related scams

Now that we’ve gone over a few major red flags for spotting scams in general, let’s take a closer look into a few examples of scams related to coronavirus – and what they have in common.

While you can find a detailed list of current COVID-related scams at the bottom of this page, here are a few more-detailed examples.

-

Pretending to be a government agency to steal your personal info

The Better Business Bureau reports that many scammers are now pretending to be a government agency, such as Social Security or the IRS.

These scams involve calling, emailing or texting people and telling them that failing to call and provide personal information will result in them not receiving their coronavirus stimulus check.

Let’s refer back to those red flags we talked about earlier.

Notice the red flag here?

These scammers are trying to pressure you into an immediate action with little time to think it over. It’s also a robocall.

Here’s an audio transcript (reported by ABC news) of what this type of call sounds like:

"Hello this is a call from the Social Security Administration. During these difficult times of the coronavirus, we regret to inform you that we have got an order to suspend your socials immediately within 24 hours due to suspicious and fraudulent activities found on your socials. We are contacting you as this case is critical and needs your urgent attention. To get more information about this case please call immediately on our department number 888-991-XXXX. I repeat 888-991-XXXX."

-

Email stating you’ve been infected with COVID-19 by someone you know

A security research firm found this phishing effort sends emails to target victims telling them they came into contact with a friend, colleague or family member who was infected by coronavirus.

In this example, the email warns people to download an attachment and go to a hospital. If you click on the attachment, it then downloads malware to your computer.

Malware is a broad name for a number of malicious softwares, including viruses, ransomware and spyware, according to Wikipedia. It consists of code designed to damage data and systems or gain unauthorized access to a network.

Red flag present: It’s an email from someone you don’t know asking you to take immediate action by clicking on a link or downloading an attachment.

-

Sales pitch that promises to protect you from COVID-19

There are many, and I mean many, of these types of scams running currently.

While some of these attempts focus on selling you fake test kits, protective equipment, etc., the most unique of these scams I’ve found so far is a cleaning service that promises to eliminate COVID-19 bacteria from the air in your home. (See the report from ABC news.)

Here’s the audio transcript of the robocall, so you can see exactly what this looks like:

“Protect your loved ones from the coronavirus. For only $79 our highly trained technicians will do a full air duct cleaning and sanitation to make sure that the air you breathe is free of bacteria. So don’t hesitate, press 0 and have your duct system cleaned and sanitized now. Press 9 to be removed from this list.”

(Audio source: YouMail)

And those are just a few examples. There are literally dozens of these types of scams out there.

What do these COVID-19 scams have in common?

While on the surface, these scams seem very different, they are all essentially trying to:

- Steal your personal information

- Steal your money

- Steal both at the same time

Don’t make it easy for them.

How to protect yourself from COVID-19 (and other) scams

Now that you know how to spot a scam from a mile away, here’s some general guidance on how to protect your security and privacy, taken largely from various FTC guidelines (see resources below).

- Don’t share personal information just because someone asks for it

- Monitor your bank and credit accounts regularly

- Protect your computer using security software

- Protect your mobile phone, set the software to automatically update

- Use complex passwords and change them often

- Sign up for fraud alerts on your credit cards and bank accounts to stop suspicious activity

- Don’t open emails from people you don’t know

- Don’t answer or respond to robocalls

- Hang up on unwanted or unknown callers

- Don’t click on links from sources you don’t know

- Protect accounts using multi-factor authentication (see Wikipedia’s definition)

- Talk to someone about a possible scam before you take action. In fact, the FTC reports that people who talked to someone else about suspicious offers were less likely to lose money than someone who didn’t.

How to avoid COVID-19 scams specifically, per the FTC:

- Don’t respond to texts, emails or calls from “the government” about stimulus checks

- Don’t respond to online offers for home vaccinations and test kits. There aren’t any right now

- Watch for emails claiming to be from the CDC or WHO

- Do your homework before donating money

Additional resources for protecting yourself from scams

- What the FTC’s doing about Coronavirus scams How to recognize and avoid phishing scams Self-defense against scams

Concerned about protecting your credit from identity theft in particular? Read THIS.

Where to report potential scams

The Federal Trade Commission (FTC) is the main government agency that collects scam reports for the U.S.

While the FTC is on high alert to find and stop scammers, if you suspect you’ve been a target of, or have fallen victim to a scam, report it HERE.

Learn more about how the FTC is working to stop COVID-19 scams HERE.

If your credit, bank account information or other finances have been compromised in a scam, be sure to report the situation to your financial institution or lender as soon as possible. You might also consider placing a credit freeze or signing up for fraud alerts.