For many people, buying a car requires taking out a car loan. And it’s not unusual to have several auto loans over the course of your life. Some people even apply for a new auto loan every few years. Yet despite the fact that car loans are so common, many consumers don’t have a clear picture of how car loan interest works.

It’s important to understand how a lender calculates the interest it charges you on the money you borrow, especially with larger loans like auto loans. The following guide provides an overview of how car loan interest works, the typical interest rates you might expect to see on auto loans, how your credit score can impact auto loan interest rates, and more.

What is car loan interest?

Interest is the cost of borrowing money from a lender or credit card company. Car loan interest is the price you pay to borrow money from a lender in order to purchase a motor vehicle.

Getting a lower interest rate on an auto loan has the potential to save you money—often hundreds or even thousands of dollars over the course of a loan. So, you’ll want to pay attention to the interest rate a lender offers you and compare multiple financing options before deciding which car loan to accept.

How is interest calculated on a car loan?

So, how does car loan interest work? If you’ve ever asked this question, you’re not alone. The answer to the previous question, however, can be complicated because lenders may calculate interest on auto loans in two ways—simple and precomputed.

Simple interest method

With simple interest auto loans, the lender bases the interest it charges on your outstanding loan balance on the day your payment is due. Therefore, if you opt to pay more than your minimum required monthly loan payment each month, you could decrease the interest you pay along with your principal loan balance.

Before you take out an auto loan you should ask yourself if there’s a chance you might want to pay off your car loan early. If your answer is yes, it’s important to seek an auto loan that uses the simple interest method.

Precomputed interest method

When you take out a car loan that uses the precomputed interest method, the lender calculates interest charges upfront, based on the total amount you borrow. Paying extra or early payments won’t reduce the interest you pay to the lender nor save you money in the long run.

Most banks and credit unions do not use precomputed interest, according to the Consumer Financial Protection Bureau (CFPB). [1] Consumerfinance.gov. “What’s the difference between a simple interest rate and precomputed interest in an auto loan contract?” https://www.consumerfinance.gov/ask-cfpb/whats-the-difference-between-a-simple-interest-rate-and-precomputed-interest-in-an-auto-loan-contract-en-841/ But some lenders may opt for this financing method which is less favorable to consumers. This is another reason why it’s important to review loan terms closely before financing a vehicle.

What is a typical interest rate on a car loan?

In the third quarter of 2022, the average interest rate on a 60-month new car loan was 5.50% according to the Federal Reserve. For 72-month auto loans, the average rate for the same period was 5.61%. [2] Federalreserve.gov. “Consumer Credit, Release Date: January 9, 2023” https://www.federalreserve.gov/releases/g19/current/

Of course, the interest rate a lender offers you on a car loan can vary based on numerous factors. The economy plays an important role in auto loan interest rates. The Federal Reserve raised its benchmark interest rate seven times in 2022. [3] CBSNews.com. “Fed hikes key interest rate for seventh time this year.” https://www.cbsnews.com/news/federal-reserve-hikes-interest-rates-seventh-time-2022/ And while those rate hikes didn’t have a direct impact on auto loan interest rates, they did influence them.

According to Edmunds, the average APR on a new financed vehicle rose to 6.5% in Q4 2022. A year earlier, in Q4 2021, the average APR on new financed vehicles was just 4.1%. The increase in financing costs for used vehicles was even more pronounced. Edmunds reports that the average APR on used financed vehicles increased from 7.4% in Q4 2021 to 10% a year later (Q4 2022). [4] Edmunds.com. “Rising Auto Loan Interest Rates Drive Share of $1,000+ Monthly Payments to Record Levels in Q4, According to Edmunds.” https://www.edmunds.com/industry/press/rising-auto-loan-interest-rates-drive-share-of-1000-monthly-payments-to-record-levels-in-q4-according-to-edmunds.html

How to Build Credit When You Have None

Building credit from scratch can be a lot easier when you understand where to start and which mistakes to avoid.

Download our guideCar loan interest with good credit

Your credit score can also have a significant impact on the interest rate a lender offers you on a car loan (and other types of financing). A standard FICO® Score (the type of credit score 90% of top lenders use in the United States), ranges from 300 to 850. [5] myFICO. “90% of top lenders use FICO® Scores when making lending decisions.” https://www.myfico.com/credit-education/fico-scores-bridge In general, lenders consider a FICO Score of 670-739 to be good, a score of 740-799 to be very good, and a 800-850 FICO Score to be exceptional. [6] Self.inc, "Credit Score Range" https://www.self.inc/info/credit-score-range/

Lenders tend to reserve their best interest rates on car loans for borrowers with excellent credit. The table below shows the average interest rates that auto loan borrowers with good, very good, and exceptional FICO Scores paid in Q2 2022.

| Average Auto Loan Interest Rate for Good Credit (Q2 2022) | ||

|---|---|---|

| Credit Score Range | Avg. Used Car Interest Rate | Avg. New Car Interest Rate |

| 720-850 (Super Prime) | 3.68% | 2.96% |

| 660-719 (Prime) | 5.53% | 4.03% |

*Based on Experian’s quarterly State of the Automobile Finance Market report, Q2 2022 data. [7] Experian.com. “What Auto Loan Rate Can You Qualify for Based on Your Credit Score?” https://www.experian.com/blogs/ask-experian/auto-loan-rates-by-credit-score

Keep in mind that interest rates are higher than they were when the data in the table above was released. So, even with excellent credit you’ll likely pay higher interest rates on an auto loan than those reflected above. Your loan term, loan amount, down payment, and other factors may influence the interest you pay on an auto loan as well.

According to myFICO’s Loan Savings Calculator (January 17, 2023 estimates), a borrower with a 720-850 FICO Score might pay around 6.422% for a 48-month new $30,000 auto loan. That same borrower would pay an estimated 6.982% for a 48-month used auto loan of the same amount. [8] myFICO. “Loan Savings Calculator.” https://www.experian.com/blogs/ask-experian/auto-loan-rates-by-credit-score/

Car loan interest with bad credit

With certain types of financing, it can be a struggle to qualify for a loan when you have a low credit score. Yet it may be possible to get a car loan with bad credit. If you can qualify for a car loan with bad credit, however, you should generally expect to pay a much higher interest rate than you would if your credit were in better shape.

Borrowers with FICO Scores between 579-300 are typically considered to have poor credit. Yet Experian classifies those with credit scores of 580-619 as “subprime” borrowers and those with credit scores between 620-659 as “nonprime” borrowers. So, we’ll consider the interest rates those borrowers might face as well, even though these consumers would traditionally fit into the fair credit category.

The table below shows the average interest rates that auto loan borrowers with fair and poor FICO Scores paid in Q2 2022.

| Average Auto Loan Interest Rate for Bad Credit (Q2 2022) | ||

|---|---|---|

| Credit Score Range | Avg. Used Car Interest Rate | Avg. New Car Interest Rate |

| 620-659 (Nonprime) | 10.33% | 6.57% |

| 580-619 (Subprime) | 16.85% | 9.75% |

| 579 or Below (Deep Subprime) | 20.43% | 12.84% |

*Based on Experian’s quarterly State of the Automobile Finance Market report, Q2 2022 data.

Again, it’s important to remember that there have been more interest rate hikes by the Federal Reserve since Q2 2022. That means if you have fair or bad credit and you applied for an auto loan today, the interest rate a lender offered you would likely be higher than those above.

Based on January 17, 2023 estimates from the myFICO Loan Savings calculator, a borrower with a 500-589 FICO Score might pay around 18.252% for a 48-month new $30,000 auto loan. Meanwhile, borrowers with FICO Scores between 590-619 would pay an estimated 16.093% and those with lower FICO Scores could struggle to qualify.

No credit interest rate on a car loan

Trying to buy a car without a credit score can also be difficult. Some lenders may be unwilling to approve consumers who do not have a credit score for a car loan—at least not without a co-signer or a large down payment.

However, no-credit auto loans do exist. That means it’s not impossible to finance a car without a credit score. But in general, borrowers who take out these types of car loans will pay higher interest rates compared with borrowers who have worked to build good credit. Depending on the lender and your loan details, you might have to provide a larger down payment in this situation as well.

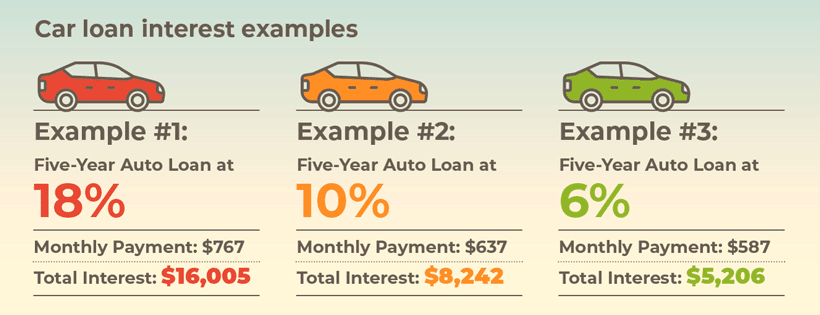

Car loan interest examples

You probably understand that getting a lower interest rate makes sense from a financial standpoint. But you might not realize just how much savings a lower interest rate could mean for your monthly budget.

So, it can be helpful to take a closer look at the math. Below are some examples of how much different interest rates on a car loan could cost you, both on a monthly basis and over the life of a five-year new auto loan.

Example #1: Five-Year Auto Loan at 18%

According to the myFICO Loan Savings Calculator, if you have a FICO Score between 500-589, you might receive a new car loan offer with an APR of around 18.303% (depending on other factors) as of January 17, 2023. Here’s how much you would pay for a $30,000, 60-month auto loan each month and in overall interest charges.

- Monthly Payment: $767

- Total Interest: $16,005

Example #2: Five-Year Auto Loan at 10%

With a better FICO Score, you are likely to receive more competitive interest rate offers from lenders. If you have a FICO Score between 660-689, you might qualify for an estimated APR of 9.997% on a $30,000, 60-month new auto loan.

Here’s what that APR translates to in terms of monthly payments and overall interest charges.

- Monthly Payment: $637

- Total Interest: $8,242

Compared with the previous loan of 18.303%, this lower APR could save you $130 every month. Over the course of five years, you would save a total of $7,763 in interest charges by qualifying for the loan with the lower interest rate.

Example #3: Five-Year Auto Loan at 6%

The final example we’ll review is a five-year auto loan with an APR of 6.485%. According to myFICO’s estimates, you might qualify for this interest rate (at the time of writing) with a FICO Score of 720-850.

On a $30,000, 60-month new auto loan, here is what an APR of 6.485% would cost you.

- Monthly Payment: $587

- Total Interest: $5,206

When you compare this APR to example #1 above (18.303% APR), the monthly payment would be $180 less per month on the same vehicle purchase. And overall you might pay $10,799 less simply by improving your FICO Score.

How can I pay less interest on an auto loan?

Average vehicle prices and interest rates have been on the rise. The combination has put a strain on consumers in recent months. But there are several ways to pay less interest on your auto loan and save money. Below are four smart strategies to consider.

1. Compare multiple loan offers

Before you apply for a car loan, it’s important to compare auto loan offers from different lenders. Shopping around for the best interest rates has the potential to save you hundreds, perhaps even thousands of dollars on large loans like car loans.

If you’re worried about damaging your credit scores from multiple credit inquiries, there’s good news. When you keep multiple car loan applications (aka hard credit inquiries) confined to a 14-day period, most credit scoring models will count them as a single inquiry for credit scoring purposes. [9] Consumerfinance.gov. “What effect will shopping for an auto loan have on my credit?” https://www.consumerfinance.gov/ask-cfpb/what-effect-will-shopping-for-an-auto-loan-have-on-my-credit-en-763/

2. Avoid long-term auto loans

Many industries were affected by inflation in 2022, including the auto industry. In fact, the average cost of a new car rose to a record high of $48,681 according to Kelley Blue Book. [10] Kbb.com. “Average New Car Price Sets Record.” https://www.consumerfinance.gov/ask-cfpb/what-effect-will-shopping-for-an-auto-loan-have-on-my-credit-en-763/

In response to soaring vehicle prices, some consumers have turned to long-term auto loans as a way to make monthly vehicle payments more manageable. Yet this approach is one that’s best to avoid if possible.

When you take out a long-term auto loan it could drop your monthly payment. But the trade off typically comes in the form of higher interest charges over the life of your loan.

3. Make extra payments

Another strategy that might help you pay less interest on an auto loan is to make extra payments. If your loan uses the simple interest method (see above), paying extra money toward the principal balance of your loan could help you save money and reduce the total amount of overall interest you pay to the lender. It might also help you pay off your debt sooner.

4. Improve your credit

Your credit score isn’t the only factor that affects the interest rate lenders offer you when you apply for a car loan. But a good credit score could improve your chances of qualifying for an auto loan with a low APR.

It’s best to work to improve your credit score before you go shopping for your next vehicle. But even if you can’t wait to buy a car, it’s still wise to try to address any credit issues even after you close on your loan. Once your credit is in better shape, you might be in a position to refinance your vehicle loan and potentially qualify for a lower APR in the future.

Next steps

It’s important to understand how car loan interest works before you commit to your next auto loan. For most people, a vehicle represents a major purchase. So, you’ll want to take your time to find the best loan for your situation.

Remember, you can shop around and compare loan offers from multiple lenders without fear of hurting your credit score (within a 14-day window). And it’s wise to review your own credit reports in advance of any loan applications to check for fraud or credit report errors as well.

Sources

- [1] Consumerfinance.gov. “What’s the difference between a simple interest rate and precomputed interest in an auto loan contract?” https://www.consumerfinance.gov/ask-cfpb/whats-the-difference-between-a-simple-interest-rate-and-precomputed-interest-in-an-auto-loan-contract-en-841/

- [2] Federalreserve.gov. “Consumer Credit, Release Date: January 9, 2023” https://www.federalreserve.gov/releases/g19/current/

- [3] CBSNews.com. “Fed hikes key interest rate for seventh time this year.” https://www.cbsnews.com/news/federal-reserve-hikes-interest-rates-seventh-time-2022/

- [4] Edmunds.com. “Rising Auto Loan Interest Rates Drive Share of $1,000+ Monthly Payments to Record Levels in Q4, According to Edmunds.” https://www.edmunds.com/industry/press/rising-auto-loan-interest-rates-drive-share-of-1000-monthly-payments-to-record-levels-in-q4-according-to-edmunds.html

- [5] myFICO. “90% of top lenders use FICO® Scores when making lending decisions.” https://www.myfico.com/credit-education/fico-scores-bridge

- [6] Self.inc, "Credit Score Range" https://www.self.inc/info/credit-score-range/

- [7] Experian.com. “What Auto Loan Rate Can You Qualify for Based on Your Credit Score?” https://www.experian.com/blogs/ask-experian/auto-loan-rates-by-credit-score

- [8] myFICO. “Loan Savings Calculator.” https://www.experian.com/blogs/ask-experian/auto-loan-rates-by-credit-score/

- [9] Consumerfinance.gov. “What effect will shopping for an auto loan have on my credit?” https://www.consumerfinance.gov/ask-cfpb/what-effect-will-shopping-for-an-auto-loan-have-on-my-credit-en-763/

- [10] Kbb.com. “Average New Car Price Sets Record.” https://www.consumerfinance.gov/ask-cfpb/what-effect-will-shopping-for-an-auto-loan-have-on-my-credit-en-763/