Soft Credit Inquiry vs. Hard Credit Inquiry

Published on: 09/28/2022

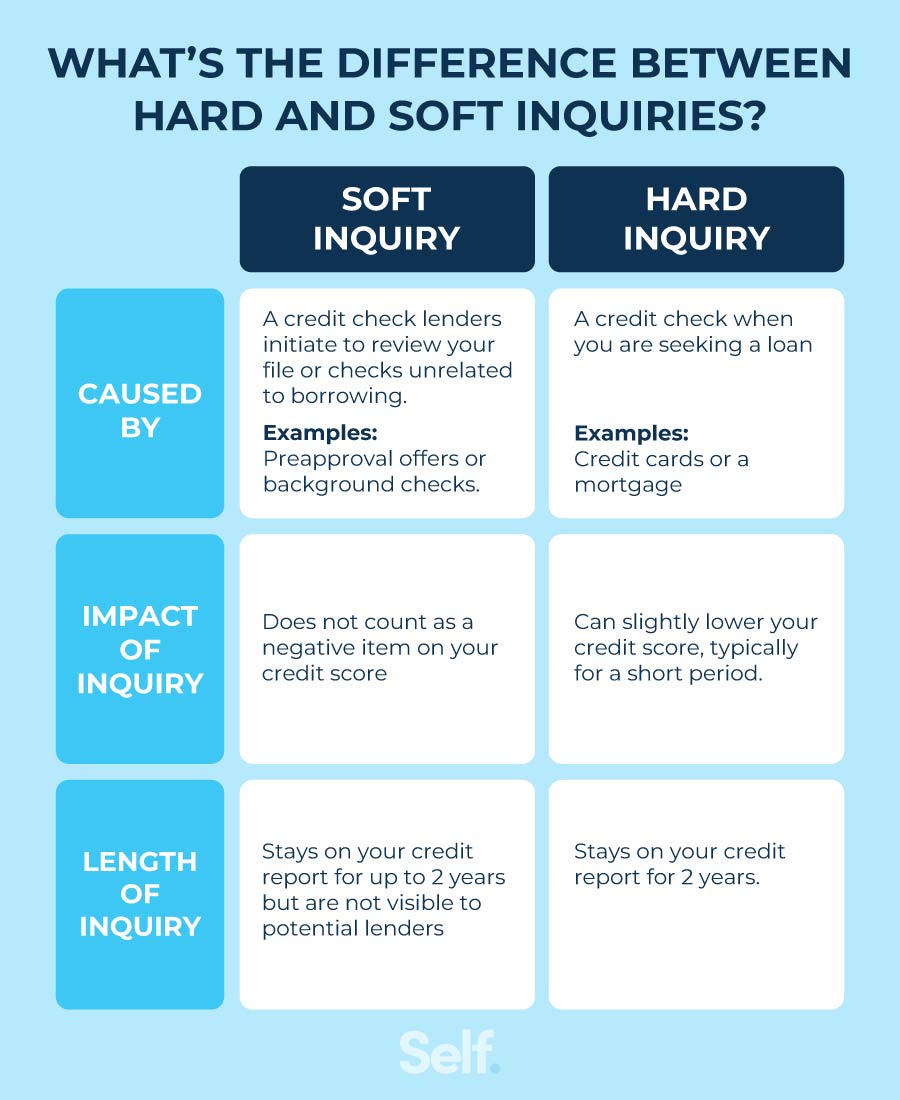

A credit inquiry happens any time potential employers, lenders, yourself or other entities check your credit report. Depending on its purpose, an inquiry into your credit may result in a hard inquiry or soft inquiry, and these two different types of credit checks each have distinct effects on your credit score.

By understanding the types of credit inquiries and how they affect your credit, you can better stay on top of your credit score. This post walks through the two types of credit inquiries — soft and hard — so that you know when they occur, how they impact your credit and what you can do to monitor your credit to help keep it as healthy as possible.

What is a soft credit inquiry?

Soft inquiries (also called “soft pulls”) generally occur for credit checks by financial firms wanting to extend to you offers of credit or to check your credit for existing obligations, but soft pulls can also occur for situations unrelated to financial loan applications. While they do show up on your credit report, soft credit inquiries do not hurt your credit score.

Soft credit inquiries may occur in the following situations:

- Applying for a new job that requires a background check

- Receiving offers of preapproved credit

- Applying for insurance

- Requesting a copy of your own credit report[1]

What is a hard credit inquiry?

Hard credit inquiries (also known as “hard pulls” or “hard credit checks”) occur when you apply for credit such as a credit card, mortgage or personal loan. Hard inquiries count for roughly 10% of your FICO® credit score.[2]

If you apply for too many new credit accounts in a short timeframe, lenders might view your multiple applications as a sign that you need credit to stay afloat and consider you a higher risk. However, sometimes you need to compare rates. When you check the rates of different lenders within a short period of time, this “rate shopping” counts as one hard inquiry, which can lower your credit score temporarily. Typically, the rate shopping window will vary between 14 to 45 days, depending on which scoring model is used by the lender.[3]

Hard credit inquiries may occur in the following situations:

- Credit card applications

- Auto loan applications

- Mortgage applications

- Loan applications[2]

- Requesting an increase in your credit limit on a credit card

- Phone or utility applications[4]

How much does a hard inquiry impact your credit score?

Although the impact differs from person to person and credit scoring models adjust differently, a single inquiry can take a few points off of your FICO® score. While each hard credit pull can impact your credit score, the effect generally doesn’t last long. Your score may bounce back within a few months even while the inquiry remains on your credit report.[2]

Several hard credit inquiries within 12 months can impact your own credit score as it may look like you’re trying to open credit accounts or take out loans that you can’t repay. Different scoring models affect people differently, but often individuals with a short credit history or those considered higher credit risks may notice a more pronounced impact.[2]

How long do inquiries stay on your credit report?

Both hard and soft inquiries stay on your credit report for two years, but only hard inquiries impact your credit score. The good news? While hard inquiries remain on your credit report for two years, they only impact your FICO® score for up to a year, according to Experian.[5]

Credit reporting bureaus don’t equate soft credit checks as an indicator of greater risk. Because soft credit pulls aren’t attached to a specific credit application or type of loan, they don’t impact your credit score like a hard credit pull does.[6]

How many inquiries is too many?

Your credit history is unique to you. So how hard inquiries impact credit will be different for each person. However, you reflect a greater risk if you have opened several different credit accounts in a short period. According to FICO®, people with six or more hard credit checks are eight times more likely than average to declare bankruptcy.[7]

Although inquiries help to assess risk, your credit score and the assessment of your creditworthiness rely on several factors, some more important than others. Your payment history, for example, impacts your FICO® score more than any other factor, accounting for 35% of your score.[7]

Soft inquiries don’t drop your credit score, so you don’t need to worry about how many of those occur. Because soft credit checks don’t impact your credit score, you can monitor your credit as often as you like.

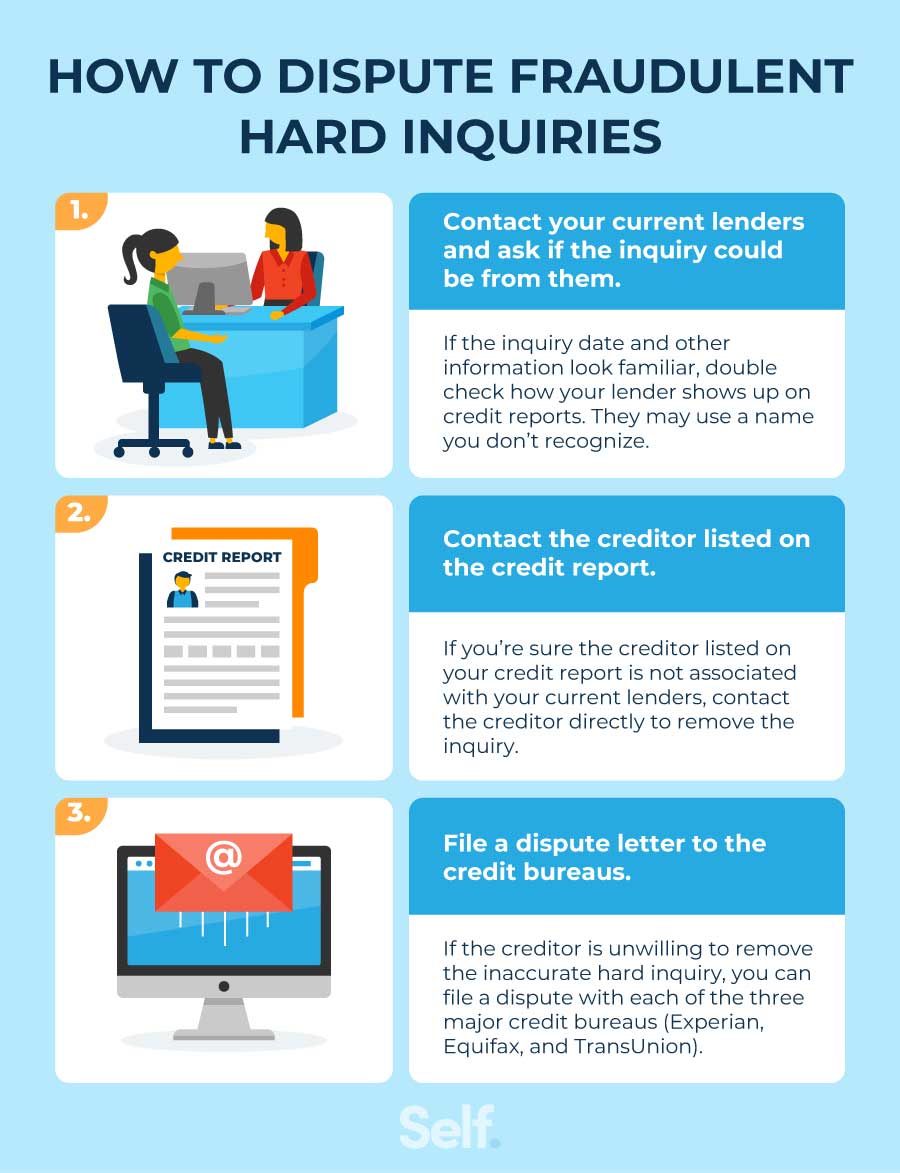

How to dispute fraudulent hard inquiries

By monitoring your credit regularly, you can keep tabs on your credit score and your credit report. Because different credit card issuers and lenders report to different credit bureaus, to get an accurate picture of your credit history, you need to check your credit reports from all three bureaus.

You can receive a free credit report from all three bureaus through annualcreditreport.com. You can also get a copy of your credit report and credit score by contacting the three major credit reporting bureaus individually (Experian, Equifax and TransUnion). Some of the bureaus will charge you for your credit report and score so read the information thoroughly on each site.

Examine your credit reports regularly in detail. If you notice any suspicious or inaccurate hard inquiries on your credit report, you can dispute them. We provide you with the steps you can take to remove an inquiry from your credit report.

1 - Contact your current lenders

Sometimes credit card companies and other credit providers report to bureaus under abbreviated names or parent companies you may not recognize. Make sure you recognize all of the creditor names listed on your report as well as what inquiry or account the creditor is associated with. If you spot an unrecognized name on your credit report, ask your current lenders to see if they made the inquiry.[8]

2 - Contact the creditor listed on the credit report

If you’ve determined that a hard inquiry is not connected to a legitimate account in your name, contact the creditor directly and ask them to remove it. You should be able to find the creditor’s contact information on your credit report.[8]

To protect yourself, follow up on any verbal requests in writing, keep a record of when you contacted the creditor with dates and notes and keep copies of everything.[8] Creditors may ask you for documentation to support your claim. So be prepared to offer documentation that confirms who you are, your address, and so on to help the creditor sort out the error.

3 - File a dispute letter to the credit bureaus

If you tried to resolve the issue with the creditor and the information remains on your report, you can dispute the inquiry with the credit bureaus. You can file a dispute letter with each credit bureau that lists the error on your credit report. Use the contact information below to report inaccurate inquiries with the three major credit reporting agencies:

Experian

- Online: Experian’s dispute online page

- Mail: Experian, P.O. Box 4500, Allen, TX 75013

- Phone: 888-397-3742 or the phone number listed on your report

Equifax

- Online: Equifax’s dispute information page

- Mail: Equifax Information Services, LLC, P.O. Box 740256, Atlanta, GA 30374

- Phone: 866-349-5191

TransUnion

- Online: TransUnion’s disputes page

- Mail: TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA, 19016

- Phone: 800-916-8800[9]

How to minimize the impact of hard inquiries

Hard inquiries are a natural part of the credit process. Since your credit can be harmed by too many hard inquiries, you can take steps to minimize their impact. The following suggestions can help keep your credit score strong and your creditworthiness looking good:

- Check to see if you have preapproval or prequalification offers for any credit cards before starting the application process. While a preapproval or prequalification offer doesn’t guarantee you qualify for the credit, you have passed the first step in the screening process.[10]

- Apply for credit accounts only when you need to. You have to use credit to build a credit history, so determine what constitutes “need” for your personal finances. Weigh that need when deciding whether you should apply for credit. If you need to buy a house, for example, you may not want to apply for store offers and impact your credit score for a discount of just a few dollars.[7]

- Don’t apply for several lines of credit at once. Spacing out your credit card and loan applications can help keep your credit score strong. Although having different types of credit for a good credit mix impacts your credit positively, you may hurt your credit score by opening them too close together.

If you’re looking for a mortgage to buy a home, take out a student loan, or apply for an auto loan, you may want to shop around for the best rates and options. After all, shopping around for the best interest rates makes financial sense, you might worry that shopping for the best rates may negatively impact your credit. Thanks to a process known as "rate shopping," you won’t impact your credit history or credit score, if you shop for rates within a short period.

Take shopping for a car loan as an example. If you make all of your car loan rate requests in a single “shopping period,” the requests count as just one hard inquiry on your credit report.[7] For the newer FICO® scoring models, this shopping period spans 45 days. VantageScore has a shorter window — just 14 days.[11]

Individual lenders determine which model they use, and that model defines the shopping period. Because you don’t know what model each lender uses, try to keep your requests in as small a period of time as possible.

Check your credit report regularly

To keep on top of your credit score, consider monitoring your credit reports regularly. A regular credit report check helps you improve your credit, spot suspicious activity, and even identify identity theft. Federal law gives you the right to a free annual credit report. You can request a free copy from the three major credit bureaus (Experian, Equifax and TransUnion) or at annualcreditreport.com.

Disclosure: FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Sources

- Forbes. “What’s The Difference Between A Hard And Soft Credit Check?” https://www.forbes.com/advisor/credit-score/soft-credit-check-vs-hard-credit-check/. Accessed August 23, 2022.

- Experian. “What Is a Hard Inquiry and How Does It Affect Credit?” https://www.experian.com/blogs/ask-experian/what-is-a-hard-inquiry/. Accessed May 20, 2022.

- Experian. “How Many Points Does an Inquiry Drop Your Credit Score?” https://www.experian.com/blogs/ask-experian/how-many-points-does-an-inquiry-drop-your-credit-score/. Accessed June 24, 2022.

- MyFICO. “4 Surprising Things That Cause A Hard Inquiry,” https://www.myfico.com/credit-education/blog/4-surprising-things-that-cause-a-hard-inquiry. Accessed May 20, 2022.

- Equifax, “Will Checking Your Credit Hurt Credit Scores?” https://www.equifax.com/personal/education/credit/score/will-checking-your-credit-hurt-credit-scores/. Accessed May 23, 2022.

- Experian. “What Is a Soft Inquiry?” https://www.experian.com/blogs/ask-experian/what-is-a-soft-inquiry/. Accessed May 20, 2022.

- myFICO. “Credit Checks: What are credit inquiries and how do they affect your FICO® Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries. Accessed May 20, 2022.

- Experian. “Unrecognized Inquiries and Fraud,” https://www.experian.com/blogs/ask-experian/unrecognized-inquiries-could-be-fraud-but-most-often-not/. Accessed May 20, 2022.

- Forbes. “How to Dispute Credit Report Errors Easily,” https://www.forbes.com/advisor/credit-score/how-to-dispute-credit-report-errors/. Accessed May 20, 2022.

- Experian. “What Are the Benefits of a Preapproved Credit Card?” https://www.experian.com/blogs/ask-experian/should-i-accept-apreapproved-credit-card/. Accessed May 20, 2022.

- Transunion. “How Rate Shopping Can Impact Your Credit Score,” https://www.transunion.com/blog/credit-advice/how-rate-shopping-can-impact-your-credit-score. Accessed May 20, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).