How The Cost of Healthcare Affects Our Health

In 2020, the total spending on healthcare in the U.S. reached $4.2 trillion, averaging out at $12,530 per person.

While healthcare costs are known to be notoriously expensive, we conducted a survey to find out whether these extreme costs have a detrimental effect on people’s health and decision-making.

Key Findings

- Medical debt has contributed to 28.2% of people being medically diagnosed with a mental health disorder

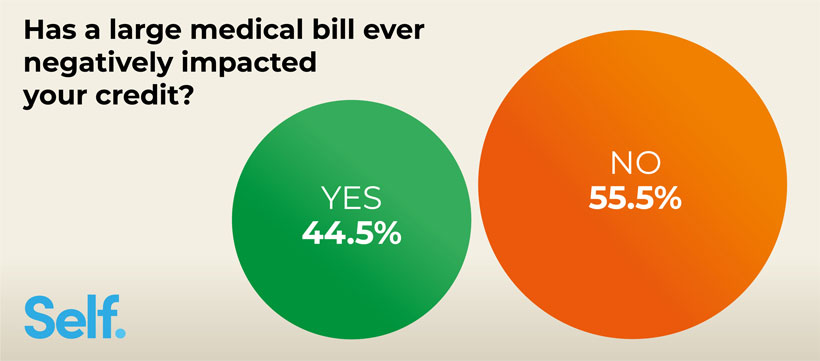

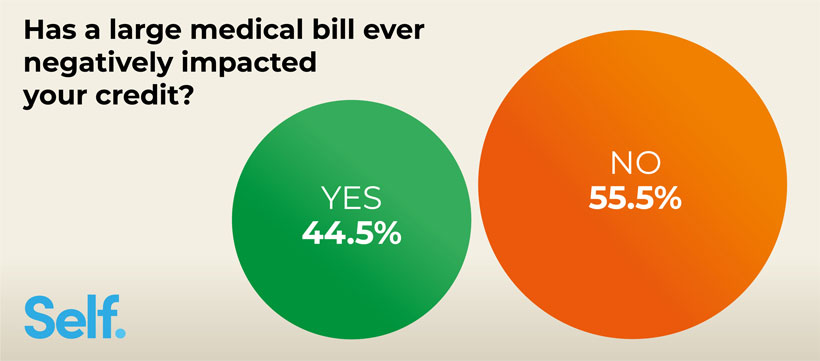

- Over four in ten (44.5%) Americans have had their credit negatively impacted due to being unable to keep up to date with repayments

- Just over one in ten (10.5%) wouldn’t be able to afford monthly prescription fees of any value

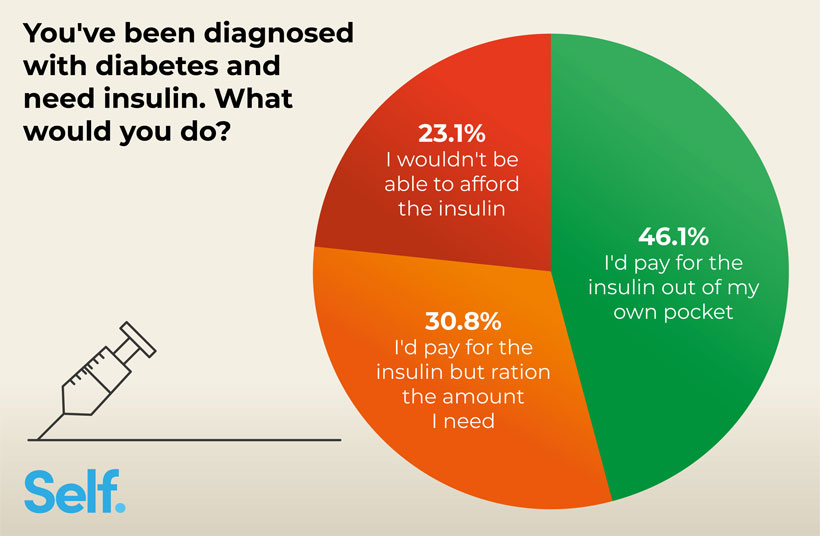

- One in four (23.1%) said they wouldn’t be able to afford insulin at all, and 30.8% said they would need to ration insulin if they ever needed it

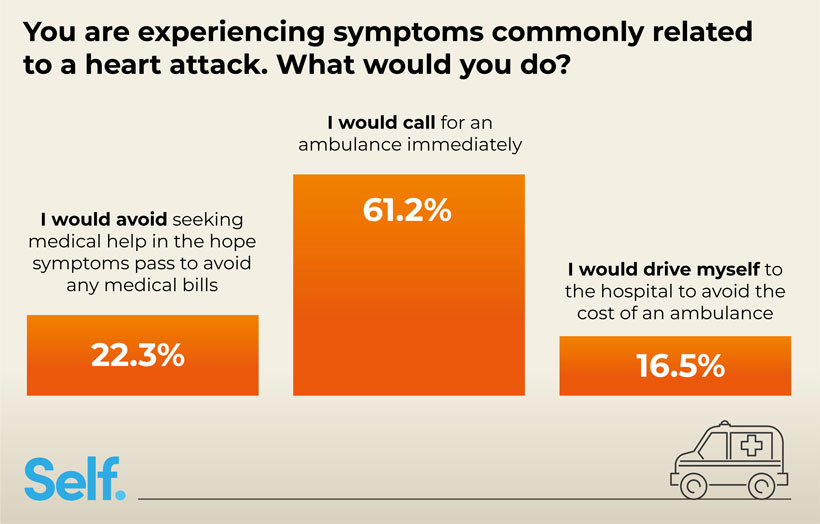

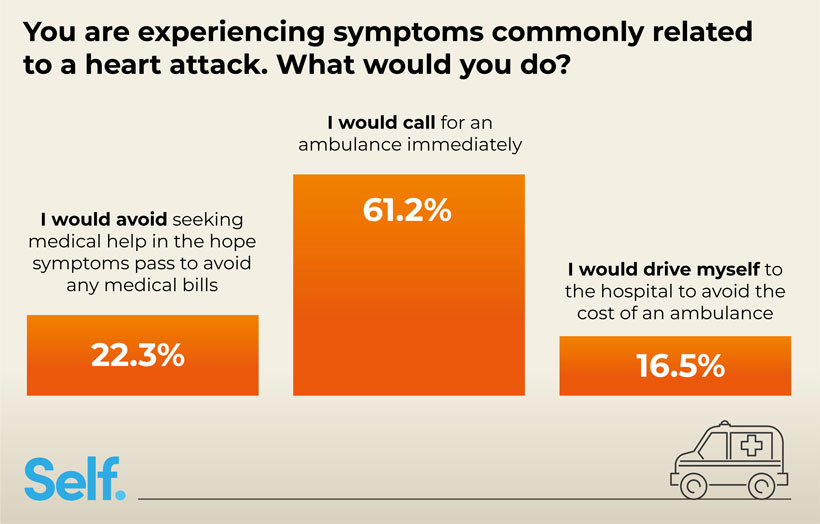

- If experiencing symptoms of a heart attack, 22.3% would avoid seeking medical help and over one in six (16.4%) would drive themselves to the hospital to lower costs

Medical debt has contributed to 28.2% being medically diagnosed with a mental health disorder

In 2019, nearly 50 million Americans experienced a mental illness. It’s no secret that this statistic has now risen due to the impact of the pandemic on America's day-to-day life, but the virus and effects of the pandemic are just one of a plethora of reasons why someone may suffer from a mental illness. In this case, the cost of health insurance is also having a huge impact on the mental health of the nation.

Being in debt can cause many unpleasant feelings such as stress, worry, and anxiety with some people even being diagnosed with a mental health disorder as a result. In fact, our survey discovered that medical debt has caused or contributed to 41.9% developing a mental health disorder at some point; some of them were medically diagnosed (28.2%) and others were not (13.7%.)

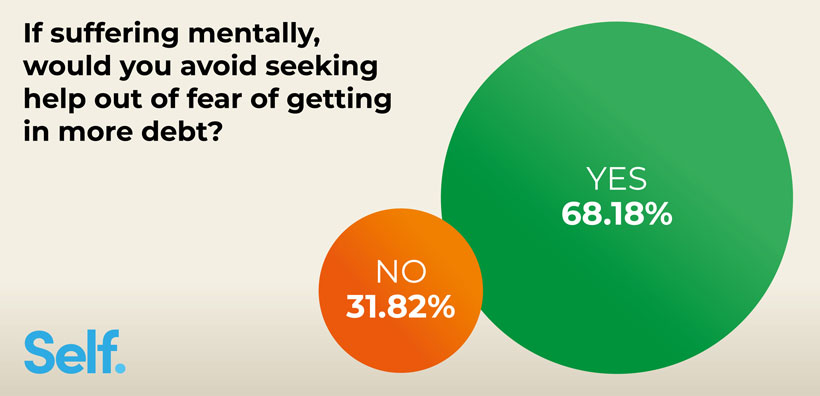

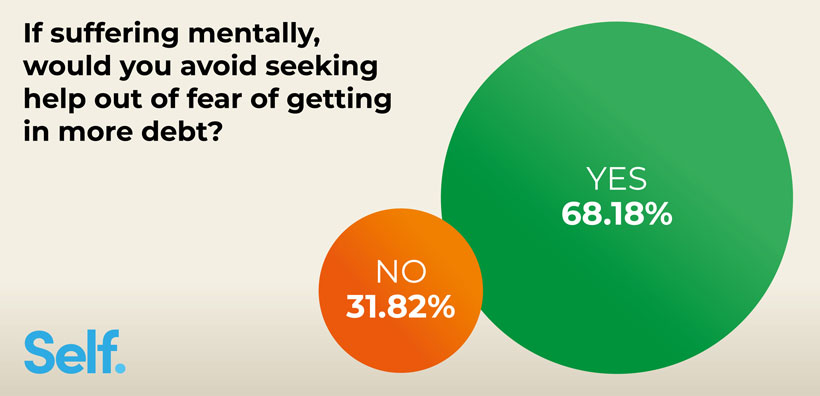

While health care debt in the U.S. contributes to the cause of mental illnesses for many, our survey also found that over two-thirds of people (68.2%) would avoid seeking help for their mental health out of fear of getting into more debt.

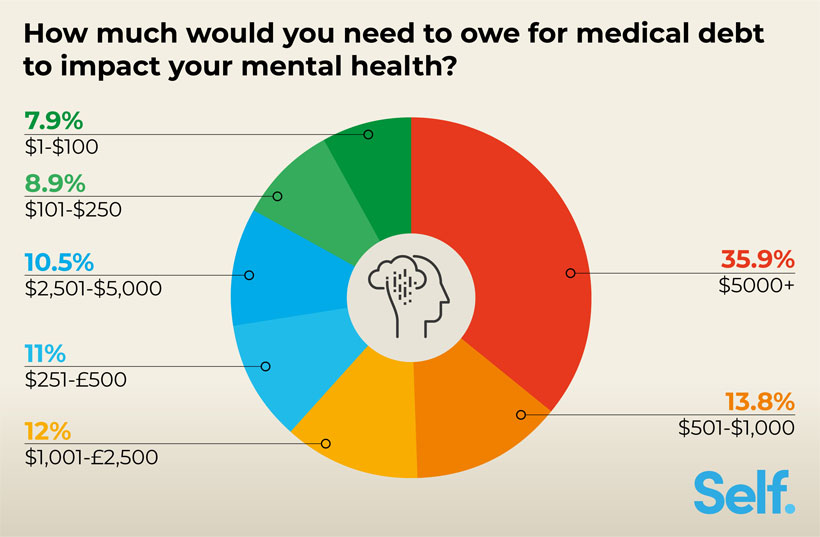

41.6% would suffer mentally with any medical debt under $1,000

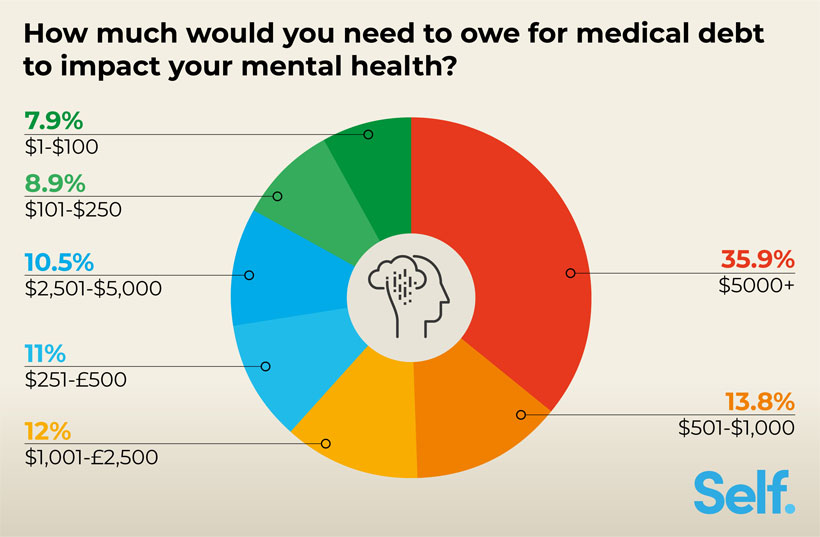

Whether you may be attending a routine appointment, having emergency treatment or a scheduled surgery, medical bills are hard to predict. The average amount of medical debt in America for 2020 was $2,424. However, our survey found that even a bill up to $1,000 would become a source of stress for 41.6% of people.

Participants were asked how large a medical bill would need to be in order for it to impact their mental health. A bill costing anything less than the current average medical bill ($2,500) was enough to have an impact for more than half (53.6%) of participants. Furthermore, a bill of under $100 would be enough to cause distress for 7.9%.

Over two-thirds (69.9%) have avoided seeking medical care due to financial worries

According to our survey, four in ten (40.5%) have medical debt with over one in four (26.7%) of those owing medical debt on behalf of a child. Fears surrounding large costs have resulted in two-thirds (69.9%) avoiding medical care.

While hospitals and doctors don’t typically report medical debt to credit bureaus, unpaid bills can be turned over by health providers to a debt collector and the collection agency can report any debts.

While over half (55.5%) have never had their credit impacted, the survey discovered that over four in ten (44.5%) Americans have had their credit negatively impacted due to being unable to keep up to date with repayments. Building credit is crucial in order to qualify for essential loans and credit cards. Fears of being unable to make expensive health cost repayments may just be enough to deter someone from receiving medical treatment.

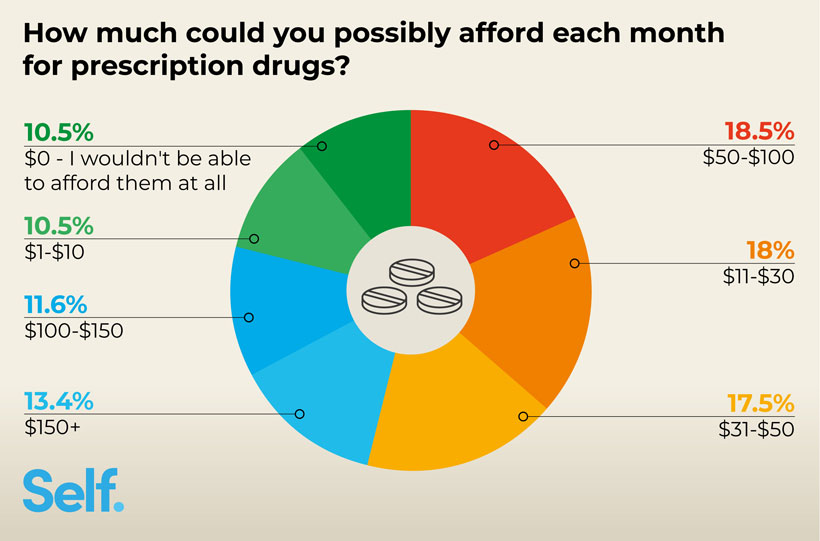

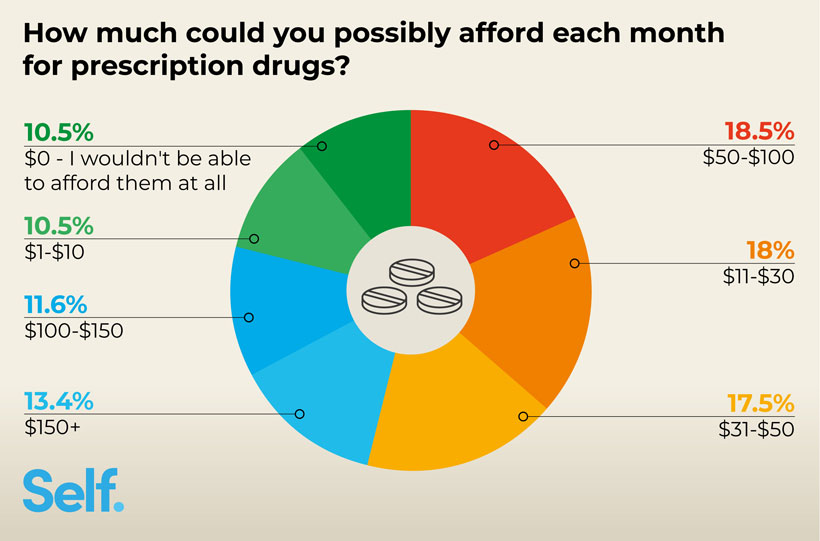

Monthly prescriptions are unaffordable for 21%

The cost of visiting a doctor may be a one-off fee; however, taking prescribed medication is a cost that someone may incur monthly in order to treat a medical condition or disease. On average, prescriptions cost $1,200 annually, a price that is simply unaffordable for many.

As part of our survey, we asked participants how much they would be able to spend on prescription drugs each month at the absolute most. Just over one in ten (10.5%) wouldn’t be able to afford monthly prescription fees of any value. This means that over 32.9 million Americans could be left with complications further down the line if they were diagnosed with a medical condition, or are currently struggling to treat an existing one.

Just over one in ten (10.5%) Americans would only be able to afford between $1 to $10 a month. The most common prescription drugs range in cost between $12.41-$97.57, suggesting that people who can only afford between $1 and $10 (10.5%) may not be able to afford the medication they are prescribed.

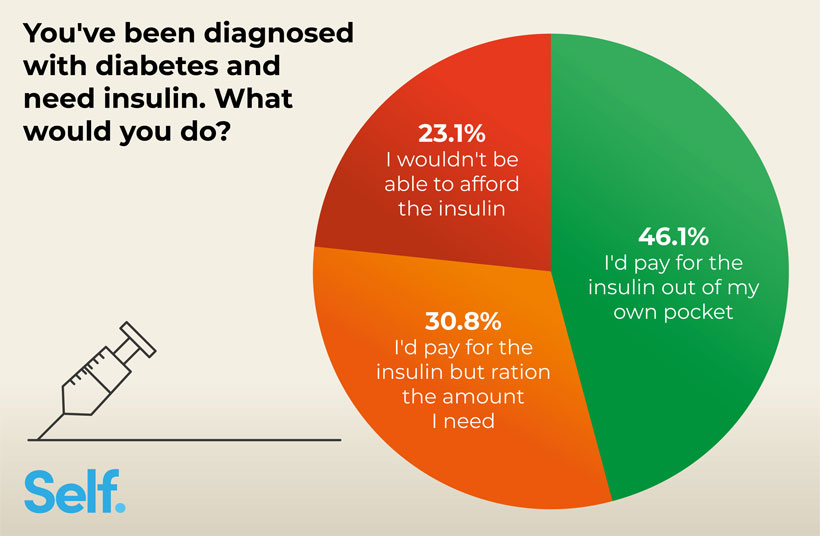

One in three (30.8%) would ration insulin dosage in order to manage costs

Currently, one in ten Americans suffer from type 1 or 2 diabetes, a disease that causes high blood sugar levels due to a poor functioning pancreas.

Since 1999, the price of insulin has increased by 1,000%. The main cause of this increase is due to the sheer demand for the product. Up to 34.2 million people suffer from diabetes causing many to rely on the drug which is used to regulate blood sugar levels.

We asked participants how they would afford insulin if it is or were ever needed. While not all answers were given by participants confirmed to have diabetes, almost one in four (23.1%) said they wouldn’t be able to afford insulin at all, and a further 30.8% of people would need to ration their insulin in order for it to be affordable.

Rationing insulin is a huge problem that involves taking smaller doses or skipping them altogether and can lead to both short-term and long-term health implications. It may mean that a patient could risk experiencing an increase in more severe hyperglycemia emergencies, heart disease, blindness, and potentially limb amputation. It can cause kidney failure and in some cases, even death.

Over one in five (22.3%) would hope heart attack symptoms pass

Around 475,000 people in the U.S. die from a cardiac arrest each year with survival rates reported to be as low as between 3-10%.

Although this rate is increasing due to more education and availability of defibrillators, it’s still crucial that any symptoms of a heart attack or cardiac arrest are assessed by a doctor.

Participants were asked what they would do if they had symptoms related to a heart attack. While the majority (61.2%) would call for an ambulance, others were still keen to manage any potential medical costs where possible, for example 22.3% said they would avoid seeking medical help in the hope symptoms pass.

Just over one in six (16.5%) said they would drive themselves to the hospital to avoid the cost of an ambulance. An ambulance in the U.S costs between $400 - $1,200, a cost that a lot of people simply cannot afford.

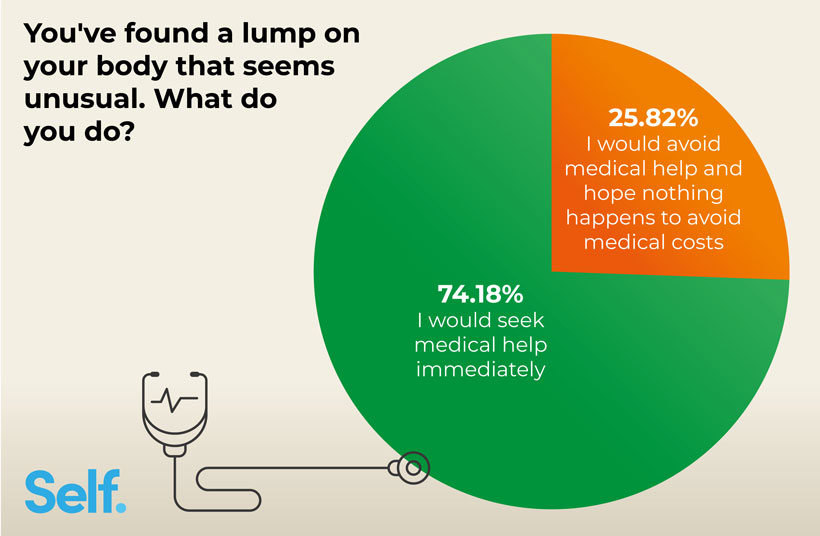

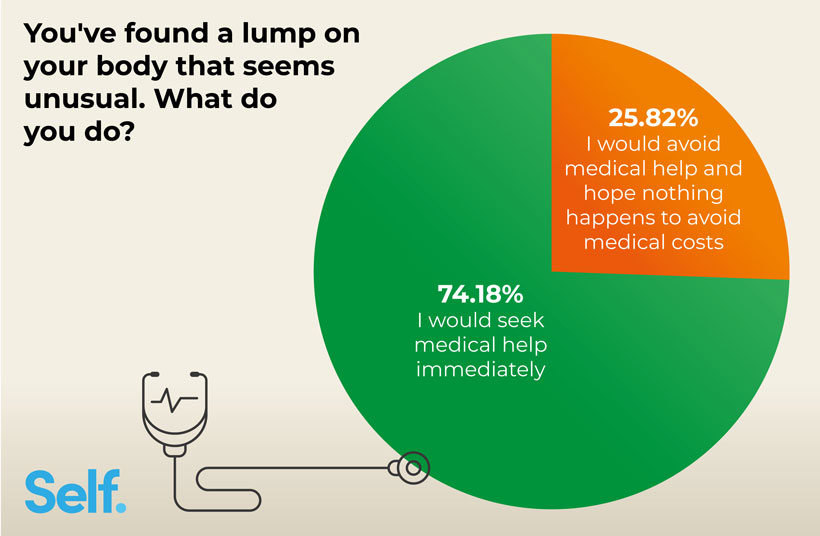

Over one in four (25.8%) would avoid medical help if they found a lump due to financial worries

It is estimated that nearly 2 million new cancer cases are expected to be diagnosed in 2022 which is equivalent to 5,250 new cases being detected every day. The rise in suspected cases is reportedly due to patients missing screenings and doctors appointments.

We asked participants hypothetically if they found a lump on their body that seemed unusual, what would they do? Although this may sound worrying, we wanted to discover just how dangerous a situation may be that people would still consider their financial well-being as a factor in their decision making.

While almost two-thirds (74.2%) said they would seek medical help, 25.8% answered that they would avoid seeking care due to medical costs, causing concern that large medical bills may force someone to make a tough decision that may impact their health drastically.

Methodology

The survey was conducted via Amazon’s Mechanical Turk platform collecting responses from 1,110 Americans from a range of backgrounds in January 2022. The demographic breakdown of our respondents is as follows:

Gender:

- Female (55.9%)

- Male (43.4%)

- Other (0.6%)

Age:

- 18-24 (7.3%)

- 25-34 (37.6%)

- 35-44 (27.6%)

- 45-54 (15.5%)

- 55-64 (8.3%)

- 65+ (3.8%)

/

Sources

- Centers for Medicare & Medicaid Services, ‘The National Health Expenditure Accounts (NHEA)’

(https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical)

Accessed January 2022

- Mental Health American, ‘The State Of Mental Health In America’

(https://www.mhanational.org/issues/state-mental-health-america)

Accessed January 2022

- KFF, ‘The Implications of Covid-19 for Mental Health and Substance Use’

(https://www.kff.org/coronavirus-covid-19/issue-brief/the-implications-of-covid-19-for-mental-health-and-substance-use/)

Accessed January 2022

- Stanford Institute for Economic Policy Research (SIEPR), ‘America’s Medical Debt Is Much Worse Than We Think’

(https://siepr.stanford.edu/news/americas-medical-debt-much-worse-we-think#:~:text=Nationally%2C%2017.8%20percent%20of%20people,amount%20was%20%242%2C424%20last%20year)

Accessed January 2022

- HealthCareInsider, ‘Can medical bills go on your credit report?’

(https://healthcareinsider.com/medical-bills-on-credit-report-46295)

Accessed January 2022

- OECD Library, OECD Health Statistics, ‘Health Expenditure Indicators’

(https://www.oecd-ilibrary.org/social-issues-migration-health/data/oecd-health-statistics/system-of-health-accounts-health-expenditure-by-function_data-00349-en)

Accessed January 2022

- NIDDK, ‘Diabetes Facts, and Statistics’

(https://www.niddk.nih.gov/health-information/health-statistics/diabetes-statistics#:~:text=Learn%20more%20from%20the%20Diabetes,percent%20of%20the%20U.S.%20population)

Accessed January 2022

- Mayo Clinic Proceedings, ‘The High Cost of Insulin in the United States: An Urgent Call to Action’

(https://www.mayoclinicproceedings.org/article/S0025-6196(19)31008-0/fulltext)

Accessed January 2022

- AJMC, ‘Gathering Evidence on Insulin Rationing: Answers and Future Questions’

(https://www.ajmc.com/view/gathering-evidence-on-insulin-rationing-answers-and-future-questions)

Accessed January 2022

- CPR & First Aid, Emergency Cardiovascular Care, ‘CPR Facts & Stats’

(https://cpr.heart.org/en/resources/cpr-facts-and-stats#:~:text=In%20one%20year%20alone%2C%20475%2C000,firearms%2C%20and%20house%20fires%20combined)

Accessed January 2022

- US National Library of Medicine Nation Institutes of Health, ‘Long-term survival after successful in-hospital cardiac arrest resuscitation’

(https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3156467/#)

Accessed January 2022

- Costhelper health,’ How Much Does An Ambulance Cost?’

(https://health.costhelper.com/ambulance.html#:~:text=The%20cost%20can%20be%20nothing,%241%2C200%20or%20more%20plus%20mileage)

Accessed January 2022

- American Cancer Society, Cancer Facts & Figures 2021

(https://www.cancer.org/research/cancer-facts-statistics/all-cancer-facts-figures/cancer-facts-figures-2021.html)

Accessed February 2022