What is a Business Credit Score?

Published on: 08/15/2019

You’ve probably heard of a personal credit score, but did you know that businesses have credit scores as well? In fact, if you have a business credit card, there’s a good chance you have a business credit profile and score.

Similar to personal credit scores, business credit scores are important because they can help you secure better financing terms for your company. But even though there are similarities between the two types of credit scores, there are also some differences. Here’s everything you need to know about business credit scores.

Why business credit matters

Business owners use business credit cards to help build credit and credit worthiness, which can help decide loan qualification and more. Plus, business credit scores are separate from personal credit scores (although your business credit can sometimes affect your personal credit).

In other words, your business credit rating is important for many of the same reasons that personal credit scores are important — to decide credit worthiness and secure better financing terms. Just like you need a good credit score to get a personal credit card, you need a good business credit score to gain access to some of the most competitive business financing and credit card issuers to manage your business expenses.

Mike Pearson, credit expert and founder of Credit Takeoff, explains:

“Business credit scores and personal credit scores are similar in that their purpose is for lenders to analyze the risk of your chances of paying back a loan on time, as well as to evaluate how much money they feel comfortable loaning you, and what kind of rates to offer you.”

The lower the credit risk, the more likely you are to gain access to the financial products you need as a business owner. In fact, the benefits of a high business credit score are directly related to your company’s bottom line.

“[A high score] allows you to borrow money from lenders, and at much more favorable rates than if you had poor credit. And those favorable rates can save you a lot of money in interest payments.”

For example, if you took out a $20,000 loan over five years with a 6% interest rate, you'd end up paying about $3,200 in interest over the lifetime of the loan.

If you took out that same $20,000 loan over five years but with a 9% interest rate, you'd end up paying about $4,900 in interest over the lifetime of the loan.

“So just by having a better business credit score and getting an interest rate that's 3% better, you'd end up saving $1,700,” Pearson explains.

How to get started with business credit

There are a few steps you need to take to set up a business credit profile. Even though there are multiple steps, the process is straightforward and you only need to do it once.

Step 1: The first thing you need to do is incorporate your business and form a Limited Liability Company (LLC). Unlike a sole proprietorship, where you provide a personal guarantee, this ensures that your business finances are separate from your personal finances, and not entangled with your personal credit history.

Step 2: After that, you need to get an employee identification number (EIN), which is for tax filing and reporting purposes. Instead of using your social security number when you file taxes or submit forms, you’ll use your EIN.

Step 3: Next, you’ll need to open a business bank account. You must open the account with your legal business name.

After you complete these steps, you can begin to build business credit.

The major business credit bureaus

When it comes to personal credit, there are three major credit reporting agencies that collect the information on your credit report and use it to generate credit scores. Credit reporting for business works in a similar way.

There are three major credit bureaus for business:

- Experian

- Equifax

- Dun & Bradstreet

While some of the information used at each of these credit bureaus is the same, some of the scoring models and ranges differ.

How your business credit score is calculated

Similar to your personal credit score, your business credit score is based on a variety of factors. But unlike your personal credit score, it’s not always clear exactly how your business score is calculated.

Pearson explains:

“Your company actually has several different business credit scores calculated by different reporting agencies — Experian, Equifax, FICO, and Dun & Bradstreet — who all have their own methods and algorithms for determining your score.”

For example, Dun and Bradstreet uses a Paydex score that ranges from zero to 100 to decide creditworthiness. This is different from personal credit scores which range from 300 to 850. But each reporting agency has a slightly different method.

“Your personal FICO score is calculated using five known factors — payment history, credit utilization, length of credit history, credit mix, and new credit — it's much less clear how your business score is calculated.

While we know that things like credit utilization and payment history play important factors, there are several other factors at play that the reporting agencies don't make public,” Pearson concludes.

Unfortunately, unlike with your personal credit report, there's no such thing as a free business credit report. However, you can gain access to certain business credit scores at no cost.

Below is a breakdown of how your scores are calculated at each of the three major business credit bureaus so you know what you're looking at. Each section also explains how to get copies of your business credit reports.

Dun & Bradstreet business credit score

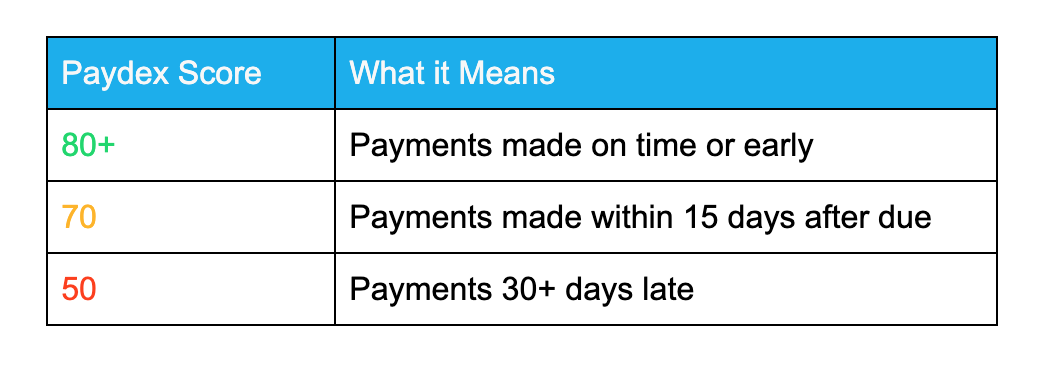

Dun & Bradstreet calculates a Paydex score for each business in their system. This score looks at trade references from vendors and suppliers and contains detailed payment information.

Basically, it looks at whether you make your payments on time, in full, before the due date, or if your debts are overdue or in collections. Here’s a basic breakdown of a Paydex score:

Paydex score range: 0-100

A score of 80 or higher reflects positive payment history, and may result in better payment terms, insurance rates, higher credit limits, and more cash flow.

To check your Dun & Bradstreet business credit score, the first step is to get a D-U-N-S number for your business. It’s a bit of a process, but you’ll have the number within 30 days.

After that, you’ll be able to watch changes to your score for free through Dun & Bradstreet’s CreditSignal. But if you want to view the report, you’ll need to pay for one of their business credit monitoring or credit building solutions.

Equifax business credit score

Equifax for business provides two different types of business risk scores:

- Business Credit Risk Score

- Business Failure Score

A Business Credit Risk Score ranges from 101-992. This score predicts the likelihood of a business becoming severely delinquent or getting a debt charged-off in the next 12 months. Essentially, it measures how high of a risk your business poses of not paying off a debt owed. The lower the score, the higher the risk.

A Business Failure Score ranges from 1,000-1,610. This score predicts how likely a business is to fail through either formal or informal bankruptcy over the next 12 months. Again, the lower the score, the higher the risk.

Equifax also offers a Payment Index. Similar to Dun & Bradstreet’s Paydex score, this score ranges from 0-100 and measures a business’ payment trends while comparing them to the industry norm.

In addition to these scores, an Equifax business credit report also shows:

- Your company profile and information

- A summary of your business credit accounts

- Public records concerning your business

- Any alternate business names, the names of owners and guarantors

- Business and credit granter comments

How to get a copy of your Equifax business credit report and credit score

You can buy one small business credit report from Equifax for $99.99 (or a multi-pack for $399.95). The process of buying a report is straightforward.

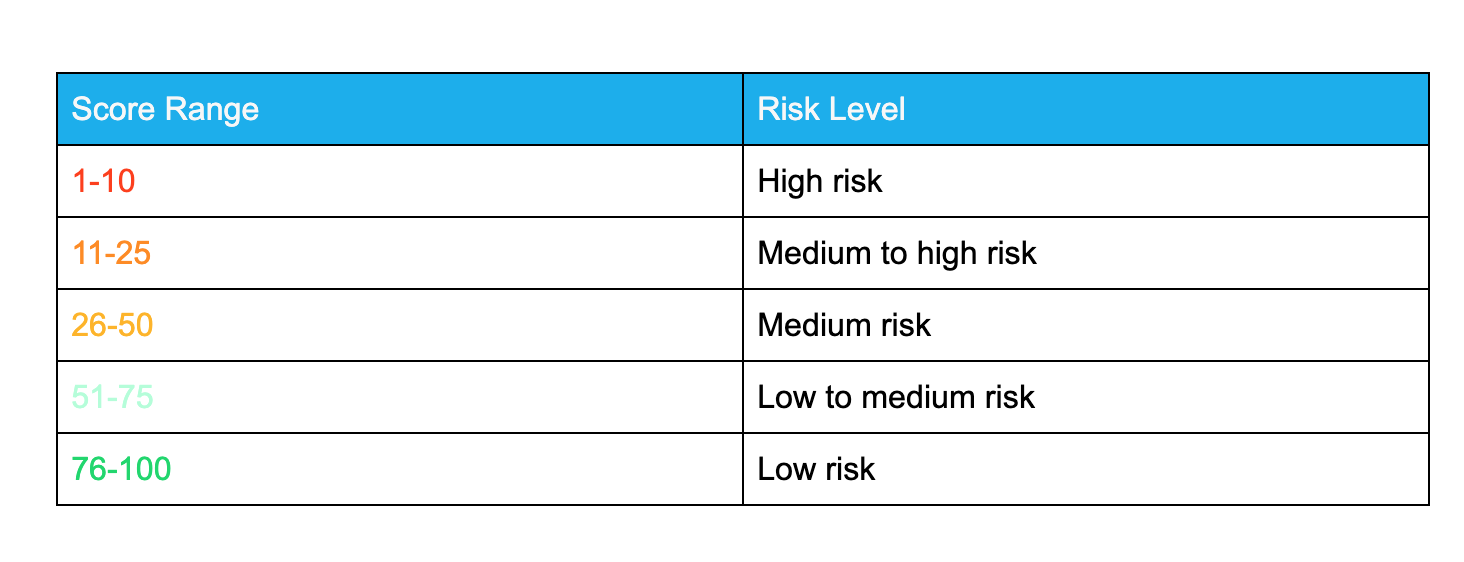

Experian business credit score

Score range: 0-100

Otherwise known as the Experian Intelliscore Plus, this score helps predict derogatory payment behavior and determines risk based on factors that include information on:

- Credit lines (tradelines)

- Outstanding balances, payment habits and trends over time

- Credit utilization ratio

- Public records, including liens, judgments or bankruptcies

- Business profile and information

You can buy a copy of your Experian business credit report for $39.95.

How to maintain your business credit

Even though the methods for determining scores might differ from one reporting agency to the next, Pearson explains a few things you can do to improve your business credit score:

1 - Avoid using too much of your available credit

Credit reporting agencies like to see that you're not maxing out all your available credit, which could be a sign of financial duress. You should try to keep this number at 30% or lower. For example, if you have a $50,000 line of credit, you shouldn't have a balance of greater than $15,000 at any given time.

2 - Avoid making any late payments

All of the business credit reporting agencies take your payment history into account when calculating your credit score, and it's one of the most important factors — so you want to make sure you're making payments on your credit cards every month, on time. Even one late (or missed) payment can significantly hurt your credit score.

3 - Work to establish lines of credit with different vendors and suppliers

By opening a line of credit with a vendor and keeping your account in good standing, you're establishing new business credit, and credit agencies use this data to help populate your business credit score.

Bottom line

“Your business credit score impacts your ability to get debt financing and a business loan. The higher your score, the better chance you have of obtaining financing, and at much more favorable interest rates,” says Pearson.

The truth is that monitoring your business credit score is like monitoring your personal credit score. Plus, as Pearson explains, the potential benefits of a high score are worth the extra effort.

About the author

Taylor Milam-Samuel is a personal finance writer who has also written for Credit Karma, Chime, Acorns and Policy Genius, among others.