Can You Get a Credit Card at 16 Years Old?

As a parent, it’s natural to want the best for your children’s future. And since you have some experience in the real world, you know that building good credit can be a big key to leading a more financially successful (or at least a less stressful) life.

When your child approaches their later teenage years, you might start wondering about the right time to help him or her open a credit card. If you haven’t done so already, you might soon find yourself asking the question, “Can a 16 year old get a credit card on their own?”

The short answer is no. Your 16-year-old son or daughter won’t be eligible to open a credit card in their name—at least not for a few more years.

Yet there are other strategies you can try to help your child start building credit at an early age. You can also find tools to help you teach your teenager how to manage a credit card the right way.

Table of contents

- Pros and Cons of Being an Authorized User on a Credit Card at 16

- Alternatives to Getting a Credit Card at 16

What Credit Cards Can a 16 Year Old Get?

At 16 years old, your child won’t be able to open a credit card account. This opportunity isn’t available for at least a few more years, after your son or daughter celebrates their eighteenth birthday and is old enough to enter into a credit card agreement.

Of course, turning 18 doesn’t seal the deal in terms of a credit card approval either. At 18 your child will need to find a credit card issuer that’s willing to work with them. The Credit Card Accountability Responsibility and Disclosure Act of 2009 also requires credit card applicants to meet the following criteria before they’re eligible to open a credit card account on their own.[1]

- Be at least 18 years old.

- Have an independent source of income.

Without independent income, an 18, 19, or 20 year old may still be able to open a credit card. But the young person would need a cosigner in this scenario—at least until they reach their twenty-first birthday—and finding one may be difficult. (Note: Cosigning can be dangerous. So consider the risks of cosigning carefully before you accept this responsibility for your child or anyone else.)

The Workaround

There’s a potential workaround to these obstacles. You can add your child to one of your own credit cards until they’re old enough to open an account on their own.

When you add your 16-year-old child as an authorized user to your existing credit card, there’s a good chance the account will show up on their credit report. (Tip: Ask your card issuer for details about its credit reporting policy for authorized users.)If the account is in good standing, it could help your child start building credit.

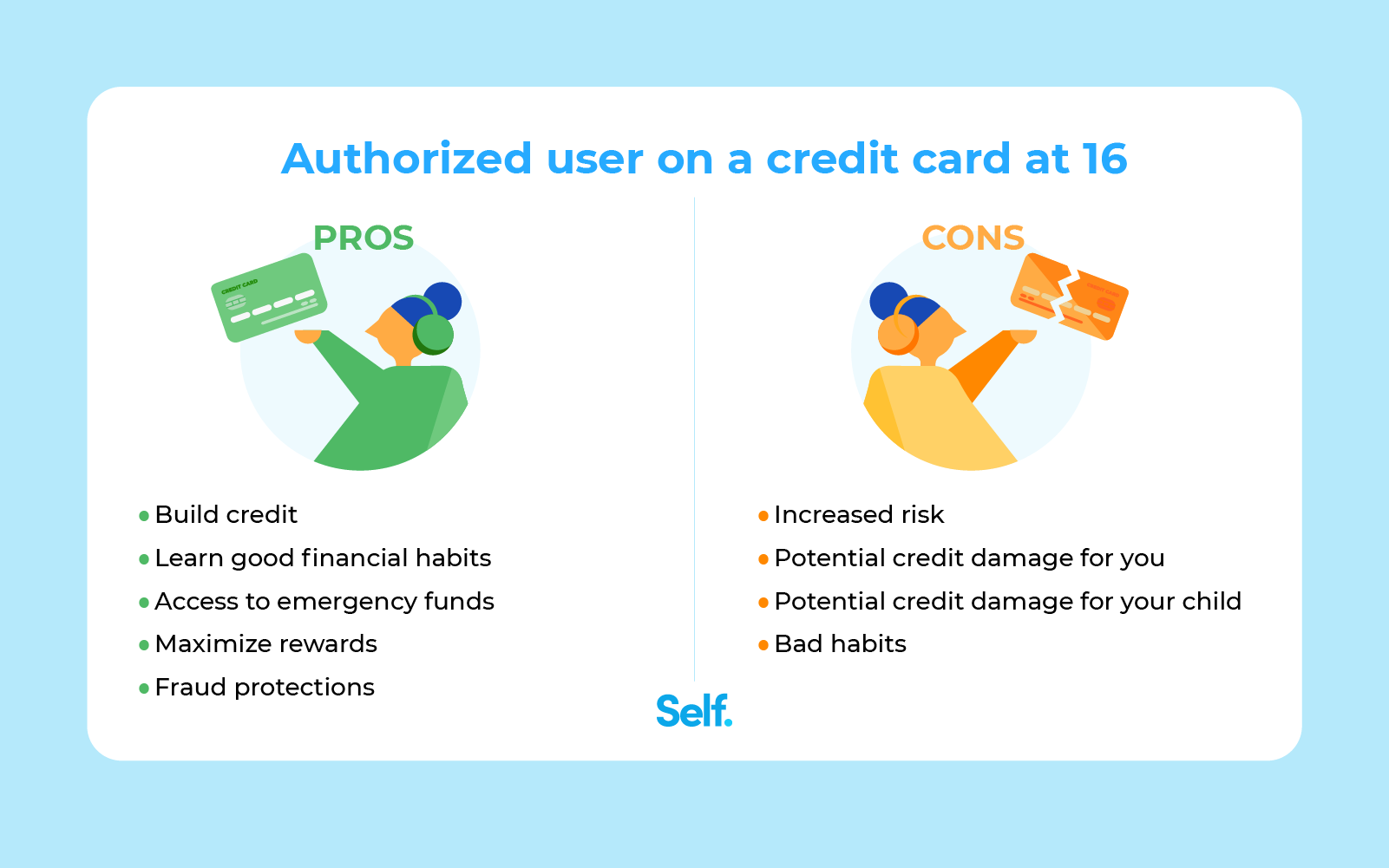

Pros and Cons of Being an Authorized User on a Credit Card at 16

Becoming an authorized user at the age of 16 could offer your child several possible benefits, but also potential drawbacks. Here’s a look at both sides of the equation.

Pros

- Build Credit. Adding your child as an authorized user to your credit card might help them build credit early—provided the card issuer reports account activity to the credit bureaus for both primary account holders and authorized users. It’s critical, however, for the account to be in good standing (i.e., no late payments and low credit utilization ratio). Otherwise, there could be potential credit score damage.

- Learn Good Financial Habits. Learning to manage a credit card responsibly could set your child up for future success. As you teach your child how to budget and the right way to use a credit card, your child can develop sound financial habits to carry with them into adulthood.

- Access to Emergency Funds. It’s impossible to know in advance when an emergency may strike. But knowing that your teen has access to a credit card if they need it can alleviate some parental stress—especially as your child may be getting their first small tastes of independence at this age.

- Maximize Rewards. Many rewards credit cards give you the ability to earn points, miles, or cash back on your everyday purchases. Those benefits usually apply to the purchases authorized users make on your account as well.

- Fraud Protections. Thanks to the protections available through the Fair Credit Billing Act (FCBA), credit cards may be a safer way to pay for purchases.[2] If someone steals and uses the credit card with your child’s name on it for unauthorized purchases, your credit card issuer can only hold you liable for up to $50. However, the major credit card networks will waive this amount as a courtesy. (Just make sure to report the theft or loss within 60 days.). Debit cards offer some protections as well, but they’re not as robust as those afforded under the FCBA.[3]

Cons

- Increased Risk. When you add an authorized user to your account, you’re responsible for any charges they make. So even if you have a verbal agreement in place with your child, you might want to see if your card issuer allows you to set spending limits on authorized user cards as an added safety measure.

- Potential Credit Damage for You. As an authorized user, your 16 year old could potentially damage your credit. For example, if your child charges more on your credit card than you can afford to pay in full, you could risk increasing the credit utilization ratio on your account or, worse, not being able to afford the minimum payment due.

- Potential Credit Damage for Your Child. When you add your child as an authorized user on your credit card, the account may show up on his or her credit report. And if the account has any negative credit history associated with it, like late payments or high credit utilization, you will likely hurt your child’s credit instead of helping it.

- Bad Habits. Credit cards can be powerful tools. But if you don’t teach your child how to use the account in a responsible way, they could develop a habit of overspending (and you might find yourself carrying extra credit card debt as a result). It’s essential to help your teen learn to charge only what they can afford to pay off each month.

Alternatives to Getting a Credit Card at 16

It’s true that your child won’t be able to open a credit card on their own before they turn 18 years old (at the earliest). But that doesn’t mean your son or daughter is without options. The alternative solutions below might help your teen prepare for a healthy financial future in other ways.

Become an Authorized User

As mentioned above, adding your child as an authorized user to your credit card might help them build credit. Plus, being an authorized user can provide your child real-world experience and you can teach them how to use credit in a responsible way.

Wait 2 Years and Get a Job

Once your child turns 18 years old and has a job (or another independent source of income), your teen may be able to open a credit card in his or her own name. Your son or daughter will still need to qualify for an account, of course. So a student credit card or a secured credit card might be a better fit in this situation.

At the age of 18, your child may be ready to open other types of credit-building accounts as well. A credit builder loan, for example, could be worth considering at this stage.

Get a Debit Card or Prepaid Card

Debit cards and prepaid debit cards look similar to traditional credit cards on the surface. Behind the scenes, however, these plastic payment methods have some big differences.

For starters, debit cards and prepaid debit cards won’t help your teen build credit. Yet they do have some potential to work as a tool to teach your child sound financial management habits. These payment methods might also make it easier to send your child funds electronically if they allow you to transfer funds from your bank account.

Payment Apps

Like debit cards and prepaid debit cards, payment apps such as Venmo, CashApp, PayPal, and Zelle may help your 16 year old manage personal finance while using their own bank account. These tools could also make it easier to send cash to your child. Yet again, none of these payment apps will help your 16 year old build a credit history.

Concluding Thoughts

It’s wise to teach your child about money and credit. And if your 16 year old is showing signs of wanting to learn how to budget, earn money, and save money for future goals, it may be a good time to introduce some of the financial tools mentioned above.

Just because your child is a little young to open a credit card account doesn’t mean they’re too young to learn credit and money management skills. And with the authorized user strategy in particular, you might even be able to give your child a head start when it comes to establishing credit for the future (e.g., credit cards, debit cards, etc.).

It is never too early to start teaching your child how to use credit responsibly and avoid credit card debt. In fact, taking the time to teach your son or daughter the basics of financial management and building healthy credit habits could be life changing.

Sources

- Federal Trade Commission. “Credit Card Accountability Responsibility and Disclosure Act of 2009.” https://www.ftc.gov/sites/default/files/documents/statutes/credit-card-accountability-responsibility-and-disclosure-act-2009-credit-card-act/credit-card-pub-l-111-24_0.pdf

- Federal Trade Commission Consumer Advice. “Disputing Credit Card Charges.” https://consumer.ftc.gov/articles/disputing-credit-card-charges

- Experian. “Are Credit Cards Safer Than Debit Cards?” https://www.experian.com/blogs/ask-experian/are-credit-cards-safer-than-debit-cards/

About the author

Michelle L. Black is a leading credit expert with over 17 years of experience in the credit industry. She’s an expert on credit reporting, credit scoring, identity theft, budgeting and debt eradication. See her on Linkedin and Twitter.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.