What Is a Credit Reference and When Do You Need One?

Published on: 10/12/2022

A credit reference refers to a document that a borrower provides to a potential lender or service provider to prove their creditworthiness. Credit references typically take the form of documentation like a credit report or a utility payment record. Borrowers may increase the odds that they are approved for a loan or a line of credit by providing a credit reference, which serves as evidence to the lending institution that the borrower can responsibly manage their debt.

Table of contents

- What is a credit reference?

- When do I need a credit reference?

- Types of personal credit references

- What to include in a credit reference letter

- Sample credit reference letter

- How to build your credit

What is a credit reference?

A credit reference document can take on many forms, the most obvious being your credit report. Other types of credit references include bank statements or letters from reputable sources like previous landlords.

A credit reference helps potential lenders, landlords and utility companies evaluate your creditworthiness, and it typically includes information such as:

- The borrower's credit history

- Number of open credit accounts

- Number of applications a borrower has made for new credit

- Negative information, such as delinquencies or defaults

- A list of any assets the borrower owns

- A character reference from previous lenders, landlords or employers[1]

Credit references not only provide evidence of creditworthiness to these individuals and institutions but they also provide an opportunity for you to explain any problems or shortcomings on your credit report to help improve your odds of being approved despite blemishes on your record.[1]

When do I need a credit reference?

The most obvious time you might need a credit reference is when applying for a line of credit. Examples include car loans, personal loans or mortgages, but you may need one for other situations:

- Loans: Typically lenders pull a credit report and credit score to determine your creditworthiness. Lenders, financiers and loan providers want confidence you’ll pay back the money you intend to borrow, so they may also request a credit reference from you to determine how much of a risk you pose.

- Rentals: Landlords or property managers likely will request a credit reference from you to find out if you have a good history of repaying money that you borrowed. However, they may also run a credit check on you. Keep in mind that renting with bad credit is still possible. Steps you can take include getting a cosigner, putting down a bigger deposit, and of course, building your credit.

- Utility services: Yes, utility service providers sometimes want credit references as well. They want to know if you have a good or bad payment history for utility services bills. Applying for utility services is a form of applying for credit. If you have a poor payment history or a limited one, you may have to pay a deposit in order to get services started.[1]

Types of personal credit references

Personal credit references take on many forms, and what you have access to may depend on your credit history or other experiences. To understand what credit references might work best for you, we walk you through the details of each type.

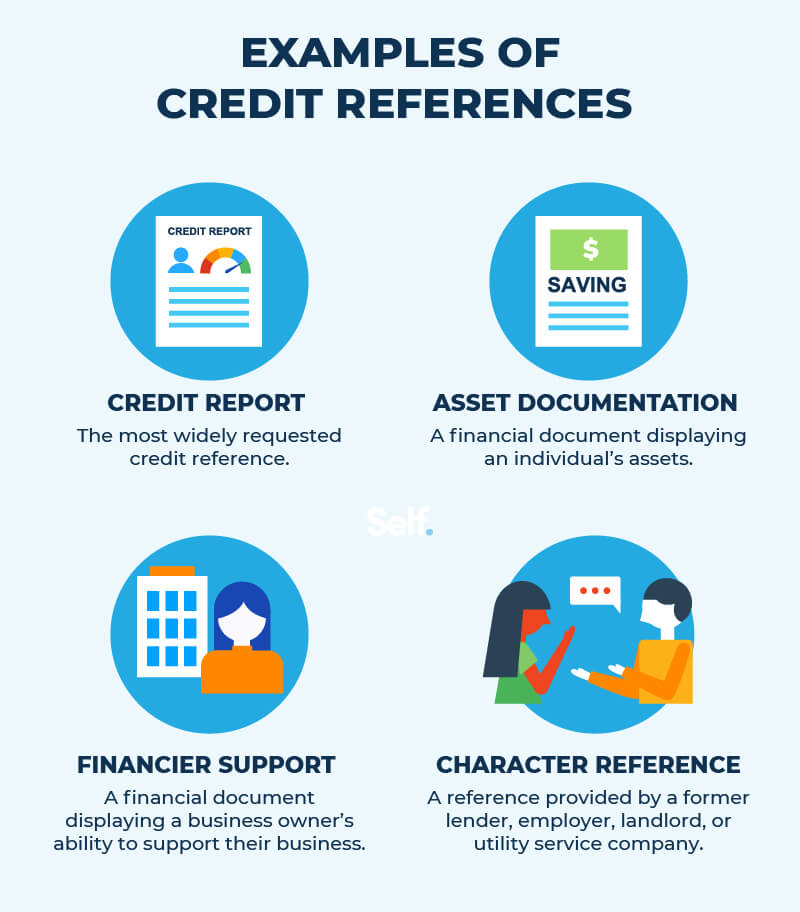

Credit reports

From lending institutions to potential employers and landlords, anyone wanting to assess the creditworthiness of a borrower, renter, or employee often pulls credit reports. Credit reports — the most basic and widely used credit reference tool — include a basic snapshot of your credit history.[1]

Your credit history reveals everything from credit cards to student loans and shows how you’ve dealt with these accounts. Listing items like a history of late payments, defaults, or high credit balances, your credit report offers a picture of your potential risk level for defaulting on loans and missing rent payments as well as how you manage your responsibilities.[1]

Take a close look at your credit report for anything that looks like it doesn’t belong there. You can always dispute any errors you may find to protect your score.

Asset documentation

Asset documentation basically refers to a list of any assets you own, including items like bank statements, savings, retirement funds, stocks, bonds and other investments. The more assets you have, the better you look to lenders because significant assets can demonstrate an ability to manage money effectively.[1]

Also, adding up your assets creates a picture of your net worth, which shows what you can draw upon to repay what you owe. If you have substantial assets, it can help a potential lender identify you as a good lending risk.[2]

As with your credit report, stay on top of your bank accounts to look for signs of suspicious activity. Any reduction in your assets not only affects your finances directly but your asset documentation.

Character references

A variety of sources can provide character references. Because they don’t quantify your financial situation the way a credit score or asset valuation does, they’re not quite as valuable. However, they still can be effective.[1]

You can get character references from:

- Former employers

- Former landlords

- Former utility service providers[1]

Types of business credit references

If you’re applying for business credit, your business credit references may look a little different. In this case, the lending institution is looking for documentation on investment in your business.

Financier support

A lending institution wants to see documentation of how much capital investors have put into your business. They want to see a level of financial commitment to your enterprise that indicates they should also invest in that business.[3]

If capital investors have put money into your business, this credit reference file may show potential lenders that you’re a good credit risk. You might use this venture capital loan to further grow and expand the business, qualifying for larger loans in the future.[3]

What to include in a credit reference letter

A credit reference letter provides a simple, formal letter that explains the basics of your arrangement with your credit reference. It includes how well you met your obligations and the level of confidence your credit reference has in you.[1]

Check with the lender to ask specifically what should be in the letter, and then ask the reference to include that information. Although some factors may vary based on the letter’s context and the individual or institution, here are some of the elements the letter may include:[1]

- Relationship with provider or landlord: Ask your reference to describe the details of your relationship — lender, landlord, and so on — as well as how good of a relationship and level of trust you had with that provider or landlord.

- Payment history information: Have the letter include information on your payment history, such as whether you made payments on time. Ask your reference to discuss your reliability for making payments.

- Account numbers: The letter may include numbers of accounts with the institution, which make tracing details easier.

- Payment amount details: Include details like how high the payments were to indicate that you’re used to making payments of a certain amount. Also ask your reference to include the total you’ve paid to date, which may reveal the weight and longevity of your relationship.

- Existing debt amount: The letter may also include any remaining debt that you owe the provider or landlord.

Sample credit reference letter

So what does a credit reference letter look like? We put different elements together to show you a few examples so that you have an even better idea of what to ask for.[1]

"This letter confirms that Jane Doe has been a customer at our bank since August 2015. Over that period, Ms. Doe has never defaulted on her loan or received any overdrafts or penalties on the bank account she has with us. She consistently paid $250 each month and currently owes nothing more on the loan. As a customer that we see in our branch regularly, we consider her to be a highly communicative, responsible and creditworthy individual and would happily do business with her again."

"I am John Doe's landlord. Over the past five years, Mr. Doe has been renting from me. He has always made payments on time and has shown extreme responsibility and care for the property he rents. I consider Mr. Doe to be reliable, trustworthy and highly creditworthy and should be considered for any loan or venture."

"This letter confirms that Jane Smith has had a utility account with us since October 2016 and never missed a payment even when the winter months required monthly payments of $400 or more. Please consider Ms. Smith for whatever loan or venture she is seeking as we consider her a reliable, creditworthy individual."

The full letter may include more detailed information, like account balances and numbers, but this is what the format generally should look like. The letter should also include contact information so the potential lender can contact the reference for more information or to confirm the letter.

How to build your credit

You can take several steps to provide good credit references, and understanding the different facets of how to build credit may help you further strengthen your credit history and creditworthiness in the eyes of potential lenders.

To keep tabs on your credit history, check your credit report often. Under federal law, you’re entitled to a free copy of your credit report once per year.[4] You can order a copy from any one of the three credit bureaus: Equifax, Experian, or TransUnion. Also, check your credit score from both FICO® and VantageScore®.

Knowing your credit score gives you a better idea of what to expect from financial institutions and other lenders when you apply for a loan. Armed with that information, you can assemble your credit references as needed. At the same time, you can begin to build credit by taking a variety of steps:

- Make timely payments and reduce debts: An important factor in most credit scores, your payment history reveals to lenders how risky it may be to extend credit to you. When it comes to the amount of debt you carry, paying down debt may show lenders you are responsible with your current debt and not overextended.[5]

- Pay off any overdue accounts and delinquencies: Negative information on your account may hurt your credit score. Because payment history impacts most credit scores so heavily, getting current on accounts may show potential lenders that you are being responsible with the debt you owe.[5]

- Don’t fill out too many credit applications in a short time: Applying for credit results in a hard inquiry into your credit history. Hard inquiries can impact your credit score negatively, and too many in a short period of time may signal to lenders that you’re having financial troubles.[6]

- Get a secured credit card: A secured credit card may help you build credit and improve your score.[7]

- Take out a credit builder loan: Like a secure credit card, this is another avenue to improve your credit or establish a credit history.

- Give clear details about your credit history: When you know certain negative items on your credit report may impact your potential lender’s decision, a credit reference may provide helpful context. Offering more details to your potential lender may help describe your full financial picture.[1]

Make credit references work for you

Credit references provide evidence to lending institutions that you are a good borrower who uses money responsibly and makes payments on time. They may also offer the necessary context for blemishes found in your credit history. As a result, you can use credit references to maximize your chances of success the next time you need credit.

Sources

- U.S. News and World Report. "What Is a Credit Reference?" https://money.usnews.com/credit-cards/articles/what-is-a-credit-reference. Accessed May 26, 2022.

- Experian. "What Factors Do Mortgage Lenders Consider?" https://www.experian.com/blogs/ask-experian/what-do-mortgage-lenders-look-for/. Accessed May 26, 2022.

- Harvard Business Review. "How Venture Capital Works," https://hbr.org/1998/11/how-venture-capital-works. Accessed May 26, 2022.

- AnnualCreditReport.com. "Home," https://www.annualcreditreport.com/index.action. Accessed May 26, 2022.

- myFICO. “What's in my FICO® Scores?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed May 31, 2022.

- Experian. “What Are Inquiries On Your Credit Report?” https://www.experian.com/blogs/ask-experian/credit-education/report-basics/hard-vs-soft-inquiries-on-your-credit-report/. Accessed May 26, 2022.

- CNBC. "Everything you need to know about getting a secured credit card," https://www.cnbc.com/select/how-secured-cards-work/. Accessed May 26, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).