What Is a Flex Loan and Should You Consider One?

Published on: 02/22/2022

There may come a time when you’re looking to access money quickly to pay for unexpected expenses. A flex loan provides you with exactly that.

However, a flex loan is one of many lending options out there. Whether it’s one you want to consider will depend on your financial needs, creditworthiness, and other factors. Here are some FAQs and information to think about if you are in the process of making that decision.

What is a flex loan?

A flex loan, or flexible loan, is an unsecured line of credit that gives you easy access to cash. It works similarly to a credit card: You get a pre-set amount of money that you can borrow as needed, which is essentially like a credit limit, and you pay interest on the money you borrow.

You pay the charged interest for the loan amount you borrowed every month and make a monthly payment to the flex loan lender.

Loans come in two forms: secured and unsecured. Secured loans involve collateral, typically in the form of what you’re buying. For example, if you take out a car loan, the car itself acts as your collateral: If you stop making payments, the lender can repossess your car. A mortgage loan works similarly, with your house acting as collateral. You risk foreclosure if you cease making payments.

Secured loans are generally for a fixed amount of money and are repaid over a set period, such as five or seven years. At the end of that period, once you have paid the principal and interest you agreed to, you are free from any further obligation. The terms of the loan have been satisfied, and the lender will not lend you any more money — unless you apply for an entirely new loan.

Unsecured loans, on the other hand, are not guaranteed by collateral. Flex loans fall into this category.

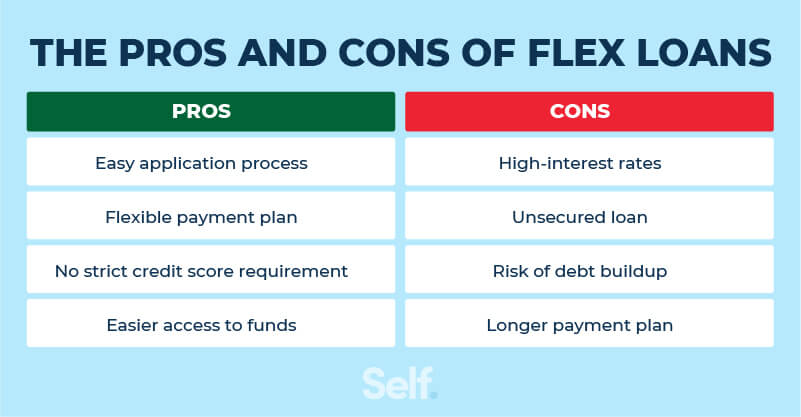

Pros of flex loans

Flex loans offer several upsides if you’re looking for cash. It is generally easy to apply. You can do so with less-than-perfect credit, and you can get cash quickly.

They can be an option if you find yourself in an emergency situation that you can’t put off and you don’t have the cash available to handle it.

Easy application process

You can apply in-store in minutes, but it can be even simpler than that. You can often get flex loans online, because lenders may offer you forms on their websites that make it easy to apply from the comfort of your home. You will often get a decision within 24 hours of submitting your application and sometimes even the same day.

Flexible payment plan

It is possible to choose the repayment schedule that works best for you. For example, some lenders offer loan payments “aligned with your payday.”[1] Others promise no prepayment penalty if you pay off your loan early, and options of paying the minimum payment each month or paying everything off at once.[2] You only pay interest on the money you borrow. You can choose to pay more to pay off the loan more quickly, or to have low minimum payments.

No strict credit score requirement

You don’t have to have perfect credit in order to get a flex loan. In fact, you likely can qualify if you have bad credit or fair credit. Sometimes you don’t need a credit check. And you don’t need a high credit score to qualify, but having a high credit score does help get you a lower interest rate.

Instant access to funds

Once you get approved, you may receive the money the same day or within the next business day depending on the lender. In most cases, you can continue to borrow as long as you don't go above your credit limit. Such loans are called revolving lines of credit and work like credit cards.

Cons of flex loans

Repayment terms on flex loans tend to be difficult. They typically carry high interest rates that can make it difficult to get out of debt and, if you fail to repay them, can lower your credit score. This can create a vicious circle for borrowers who sought out flex loans in the first place because they could obtain them with low or even no credit.

High interest rates

Flex loans generally have higher interest rates than almost any other type of loan.

You could be tempted to make minimum payments, but you’ll actually be paying more than what you expected in the long term. This could cost you hundreds or even thousands of dollars. In Tennessee, one borrower reported paying twice as much when his loan was converted to a flex loan without his permission. Another said she paid roughly $300 of interest along with $20 of principal.[3]

Interest rates aren’t always that high, but they’re still higher than most loans and even other unsecured lines of credit, such as credit cards. The Michigan State University Federal Credit Union, for instance, offers flex loans of $200 to $1,000 with interest rates “as low as 28.00% APR.”[4] By comparison, banks typically offer credit cards with APRs that range from 12% to 24%.[5]

Unsecured loan

Because they are not guaranteed by collateral, loan providers must find another reason to grant an unsecured loan. Typically, lenders will look for people with good credit so they have confidence the loan will be repaid without needing collateral to guarantee it. But those who don’t have good credit represent an untapped market, which lenders can access by offsetting their greater risk with higher interest rates.

According to the Consumer Financial Protection Bureau, unsecured loans with high interest rates such as flex loans often target “consumers who are living paycheck to paycheck, have little to no access to other credit products, and seek funds to meet recurring or one-time expenses.”[1]

Examples of similar short-term loans aimed at this group of consumers include payday loans and vehicle title loans. The latter, however, are high-interest secured loans that require you to put up your car as collateral for a loan of 25% to 50% of its value, with the promise to repay within 15 to 30 days, or else you forfeit the title to your car. These high-interest loans tend to carry an annual percentage rate of about 300%.

Risk of debt buildup

It sounds appealing to meet the minimum payment each month, but this is a habit that can lead you into deeper debt because you’ll be spending much of your money paying off the interest instead of the principal. The higher the interest rate, the more difficult it can be to pay off what you owe using minimum payments, and the more it will cost you. This is why paying only the minimum on high-interest loans (such as flex loans) can make paying off debt more difficult.

The ability to access high-interest loans with poor credit can further encourage bad spending habits and tempt you to make purchases you can’t afford. That will put you into deeper debt, but fortunately, there are strategies to prevent it from happening.

Longer payment plan

The option of a longer payment plan that is available with some flex loans can seem like a relief at first. But you can wind up having to pay more and feel discouraged as the plan continues and you keep making payments over an extended period.

How much can I get with a flex loan?

Depending on your financial situation, where you live, and the lender involved, you can typically borrow anywhere from $100 to $4,000. In 2016, the $4,000 figure applied in Tennessee, while Mississippi capped the amount at $2,500.[1]

What happens if you don’t pay a flex loan?

The lender will attempt to collect your payment. If you can’t pay, the lender will likely sell your debt to a debt collection agency and ask them to contact you instead. This is what is known as a charge-off.

Debt collectors will then attempt to contact you to collect the debt. It’s important to know, however, that debt collectors are prohibited by law from calling you repeatedly, threatening to hurt or arrest you, using obscenities, posing as attorneys or law officers, or misrepresenting what you owe.[6]

If their attempts to collect what you owe are unsuccessful, debt collection agencies may take you to court and, if they prevail, may be able to garnish your wages or bank account.

In the meantime, your credit score will be damaged, because each missed payment will appear as a negative mark on your credit history. Under the FICO® scoring system, your payment history counts for a larger percentage (35%) of your credit score than any other single factor. You also may be charged extra fees, and interest will continue to accrue.

Do I need a flex loan?

Before taking out a flex loan, or any loan, it’s a good idea to take a look at all the options available to you. Can you qualify for a lower-interest loan that will give you the money you need when you need it?

Factors to consider before taking on a new loan include the cost of the loan, your ability to repay it, what you plan to use the loan for, and how it might affect your credit. If you’ve recently applied for several other credit loans, another loan application can be a red flag that damages your credit. And if you miss or are late with payments, that will hurt your credit score, too.

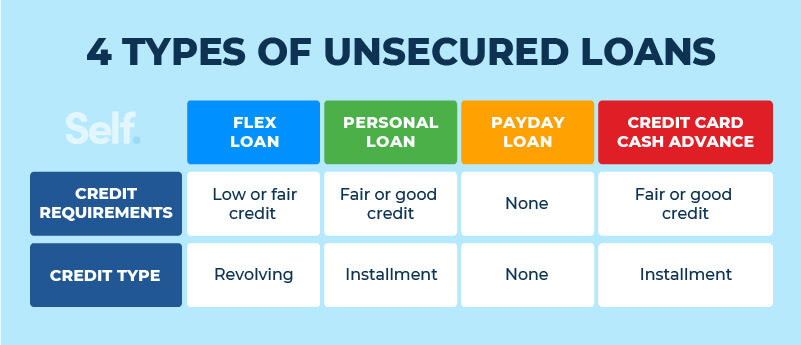

Flex loan vs. other options

Flex loans aren’t your only loan option. Here are other loan options that you may want to consider.

Personal loans

Personal loans typically come with lower interest rates than flex loans.

Borrowers who take out personal loans have fixed payments, as with a flex loan, along with a specific repayment or installment plan. Personal loans don't have to be spent in a specific way (as with a car loan or mortgage, for example). They can be used for a range of purposes, including to consolidate debt, and may be secured by collateral or unsecured.[7]

Unlike flex loans, personal loans don’t tend to offer revolving credit with a specific limit that frees up more available credit as you pay it down.

Payday loans

Payday loans are similar to flex loans in that they’re easy to access, carry lofty interest rates, and don’t tend to require credit checks. All that’s typically required is a government ID, such as a driver’s license, an active bank account, and proof of income.

Interest rates on payday loans can top 400%.[8] (This has led to concern among lawmakers who have introduced the Veterans and Consumers Fair Credit Act, a proposal in Congress to cap consumer loan interest rates at 36%.)[9]

The difference between a flex loan and a payday loan is that a payday loan is repaid in a single payment on your next payday. Flex loans, by contrast, allow you to choose a repayment plan and use a minimum monthly payment.

Another difference is the amount you can take out. Payday loans are usually about $100 to $500, while flex loans can range from $100 to a few thousand dollars. Flex loans also give you a line of credit, as opposed to payday loans, which give you the full amount in a short-term loan that you’re then expected to repay.

Credit card cash advance

Flex loans are similar to credit cards in terms of how they work, so you may be tempted to use the cash advance from your credit card instead if you think you can get a lower interest rate.

But getting a cash advance from your credit card isn’t the same as using the card to purchase something. Unlike with purchases, interest begins to accrue the moment you take out the advance, without any grace period. (The grace period on purchases allows you at least 21 days from the time of purchase to pay for it without incurring interest charges.)[10]

In addition, a cash advance can lower your credit score by increasing your credit utilization ratio, which is another important factor in determining your FICO score. Experts recommend a credit utilization rate of less than 30% and, ideally, less than 10%. This is calculated by dividing your overall credit card debt by the total credit limit on all your credit cards.

Weigh your options

Flex loans are an option if you are looking for easy access to fast cash and are confident you can deal with high interest rates. However, there are other options available that are worth looking into before you commit. Weighing the pros and cons of each is an important step before deciding how to proceed and will help you determine how the debt and credit implications will affect you, both in the short and long term.

Sources

- Consumer Financial Protection Bureau. “Payday, Vehicle Title, and Certain High-Cost Installment Loans,” https://www.federalregister.gov/documents/2017/11/17/2017-21808/payday-vehicle-title-and-certain-high-cost-installment-loans#footnote-261-p54497. Accessed October 17, 2021.

- Advance Financial 24/7. “FLEX Loan Benefits,” https://www.af247.com/flex-loan-benefits/. Accessed October 17, 2021.

- News Channel 5 Nashville. “Critics Call 279% Loan A ‘Debt Trap,’” https://www.newschannel5.com/news/newschannel-5-investigates/consumer-alert/critics-call-279-loan-a-debt-trap-for-poor. Accessed October 17, 2021.

- Michigan State University Federal Credit Union. “Flex Loan,” https://www.msufcu.org/product_flex_loan/. Accessed October 17, 2021.

- Forbes. “What Is A Good Credit Card APR?” https://www.forbes.com/advisor/credit-cards/what-is-a-good-apr-for-a-credit-card/. Accessed October 17, 2021.

- Federal Trade Commission. “Debt Collection FAQs,” https://www.consumer.ftc.gov/articles/debt-collection-faqs. Accessed October 17, 2021.

- Investopedia. “What is a personal loan?” https://www.investopedia.com/personal-loan-5076027. Accessed October 17, 2021.

- Washington Post. “Payday lenders that charge 400 percent interest want access to small-business loans,” https://www.washingtonpost.com/business/2020/05/08/payday-small-business-loan. Accessed October 17, 2021.

- SF Weekly. “What You Should Know About Predatory Lending,” https://www.sfweekly.com/sponsored/what-you-should-know-about-predatory-lending. Accessed October 17, 2021.

- Investopedia. “Grace Period,” https://www.investopedia.com/terms/g/grace_period.asp. Accessed October 17, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.