How Long Does It Take To Build Credit?

It can take 6 months to establish credit from scratch. How long it takes to improve an existing credit score depends on your personal situation, your credit information, and how much you're trying to raise it. If you are looking to achieve excellent credit when you have no credit history, expect the process to take longer.

Whether you’re starting from scratch or trying to rebuild after past credit mistakes, it’s unlikely you’ll see results overnight.

The varying amount of time it takes to establish credit can be frustrating, especially if you're trying to decide whether it's worth the effort in the first place.

Unfortunately, there’s no way to be certain how long it’s going to take you to establish or rebuild your credit score.

Fortunately, though, there are some guidelines you can use and habits to develop to help you reach your goal of achieving a strong credit score.

If you are wondering, “how long does it take to build credit?” you have come to the right place. In this article, we'll walk through the following (use the links to jump to that section):

- Why it's hard to say how long it will take

- Six months to establish credit

- Rebuilding credit can take longer

- How long to build credit for a mortgage

- How long to build good credit

- 3 habits for credit success

Let’s get started!

How long does it take to raise your credit score? Tough to say

Building a strong credit profile is like losing weight. You can't just flip a switch to make it better. Several factors go into your determining your credit score, and FICO® and the other credit scoring companies don’t share the details of their calculations with the general public.

Without knowing exactly how much your actions are going to affect your credit score and when, it's possible to go months without seeing much improvement in your score.

On the other hand, it's also possible to see your credit score jump quickly. Your personal credit situation has a lot to do with that variability.

While your credit score can serve as a guidepost on your journey toward financial health, your financial habits are what are going to help you achieve your goal - and improve your credit score along the way.

Guidelines for building credit

While it’s futile to try to determine exactly how long it will take you to improve your credit score, there are a few rules of thumb that can give you an idea.

Six months to establish credit

If you have no credit history or haven’t had any lines of credit in the past six months, it will take at least six months before FICO will calculate a credit score for you.

Once you have a credit score, though, you could still have what’s called a thin credit file. A thin credit file means that while you have some credit history, it's too limited for lenders to make decisions with confidence.

VantageScore doesn’t have the six-month rule, which means that you could have a VantageScore credit score as soon as your new credit account starts reporting. (See our related article about the difference between FICO Score and VantageScore.)

Unfortunately, though, lenders typically rely on the FICO credit score when underwriting credit applications. So, while it’s nice to see a score with VantageScore, lenders who only use FICO still won’t see a score for you when you apply for a loan or credit card until you’ve reached the six-month mark.

Rebuilding credit can take longer

Building credit from scratch likely won’t take as long as trying to rebuild your credit after a bankruptcy or foreclosure.

That’s because those major negative items can remain on your credit report for seven to 10 years. (Learn how to read your credit report.)

If you've been through bankruptcy or foreclosure, patience and consistent financial behavior are key. New positive information added to your credit report generally outweighs old negative information over time. In a nutshell, that means timely payments in full and not maxing out credit lines.

Remember, however, that rebuilding your credit is completely different from repairing your credit.

Credit rebuilding does not go back over your credit report to fix errors, or dispute any information with creditors. Instead, rebuilding your credit is all about adding new, positive information to your credit report, which you do through managing your credit accounts responsibly.

If you’ve made a small mistake, however, and have an otherwise spotless credit history, you will likely quickly restore your credit score to its former glory.

Credit utilization is usually a quick fix

If your credit utilization ratio gets too high, it could drop your credit score significantly.

The good news is that since credit card issuers report account activity once a month, paying down a credit card balance and keeping it low before the next reporting date could cause your credit score) to bounce back accordingly.

More debt may not always be the answer

Having multiple credit cards or a credit card and multiple loans — such as a car loan, student loan, and mortgage — could help you build credit faster. That’s simply because there’s more information for the credit scoring companies to use.

But going into debt just to build your credit probably isn't a great idea, especially if it’s high-interest debt. Taking on credit card debt that increases the risk of falling behind on payments could make things worse.

That said, using a secured credit card and paying off the balance in full each month, plus getting a credit builder loan with a reasonable interest rate could help you build credit more quickly because it shows you can responsibly manage different types of debt.

When lenders report affects when your score can change

In general, most lenders report your account activity to the credit bureaus once a month.

But it’s possible to get a lender that doesn’t report to a credit bureau as often. So then, how long does it take for your credit score to reflect your new improvements?

If building credit is your top priority in opening a credit account, check with the lender first to make sure that it reports at least once a month.

And you can ask them when they report. There will probably be some time elapsed between when they report and when the score updates, but you'll have a general idea of when it could happen.

How long to build enough credit for a mortgage?

To qualify for a conventional mortgage, you will probably need a credit score in the 600s or higher, a stable income and a debt-to-income ratio of 45% or less. Those thresholds will vary by lender, however, so you should ask the lenders at which you're considering applying for a mortgage.

According to Melinda Sineriz at Realtor.com[1]:

“You should know that while a ‘fair’ score may get you a mortgage, it won’t qualify you for the best mortgage – in terms of interest rates and other deals. To get better mortgage rates, you will need a good score (700-750) or an excellent score (760 or higher). Unfortunately, achieving those scores will take (you guessed it) more time.”

While some programs exist to help people buy a house with no credit or a poor credit history, in order to access the best interest rates and terms, you will need a much higher credit score.

With a mortgage loan, the rate difference may not seem wide between different credit score ranges. Your interest rate could be 6% instead of 4%, for example. But over the course of 30 years, bad credit could cost you tens of thousands of dollars if you can’t manage to refinance at a lower rate in the future.

While building credit fast to qualify to buy that dream home right now might sound appealing, sometimes it’s better to wait until you build the right amount of credit. That way, you can save the most money by getting a lower interest rate.

Improving your credit to get the best mortgage rates could take anywhere from six months to a few years, depending on your financial situation.

How long to build good credit

Building good credit takes time, usually takes anywhere from 3-6 months or more to build credit history with the major credit bureaus in the first place.

Unfortunately, damaging your credit is much easier, and can be done with just one missed or late payment. A missed payment could remain on your credit report for up to seven years.

While this might seem a little harsh, your payment history is the single most influential factor, counting for 35% of your FICO score. So paying your bills on time – whether they’re to a credit card company or on a loan payment – is incredibly important.

There are a few ways you can help yourself make timely payments. First, if it’s available, set up automatic payments. That way, you can set it and forget it — your payments will be made on time. If automatic payments are not an option for you, set a calendar reminder. Schedule it in your phone, write in on your bathroom mirror, whatever will work for you.

Just make sure you do not miss a payment!

To build a positive credit rating (and potentially raise your credit score), do what it takes to make sure you're paying your bills on time.

If you think you're at risk of being late or missing a payment altogether, ask your lender if they’re willing to work with you to move the payment due date.

Many lenders offer a grace period before a payment counts as late or missed, some as high as 15-30 days. Many lenders will assess late fees before they report a payment as late to the credit bureaus (yet another reason to pay your bills on time).

Check with your lender or credit card companies to see what options are available to you before late payments can damage your credit rating.

How late your payment is matters

Another thing to keep in mind, according to Equifax[2]:

“In general, though, the longer a bill goes unpaid, the more damaging the effect it has on your credit score. For example, all other things being equal, a payment that is 90 days late can have a more significant negative impact on your credit score than a payment that is 30 days late. In addition, the more recent the late payment, the more negative of an impact it could have.”

If you have a missed or late payment, don’t give up and let poor credit become bad credit. Making that payment sooner can prevent more damage to your good credit history.

If you have a history of missed payments, there is hope - your credit score can still recover. It just takes time, though perhaps more time than you'd like. The good news is you can take steps today that could help you achieve a good credit score moving forward.

3 Credit habits for success

Trying to establish a good credit history? In total, five factors go into your FICO credit score. But two of them — your length of credit history and the types of credit you have — tend to happen naturally over time. The other three are things you can start working on from the beginning.

1 - Pay on time every time

Your payment history is the most influential factor in your FICO credit score and makes up 35% of your score. As such, it’s crucial that you make your monthly payments on time every month.

If you happen to have late payments or an account in collections, get caught up as quickly as possible to avoid further damage.

Set up automatic payments for the future and make it a priority to pay your debts. Over time, this action will do more to boost your credit score than anything else.

2 - Keep credit card balances low

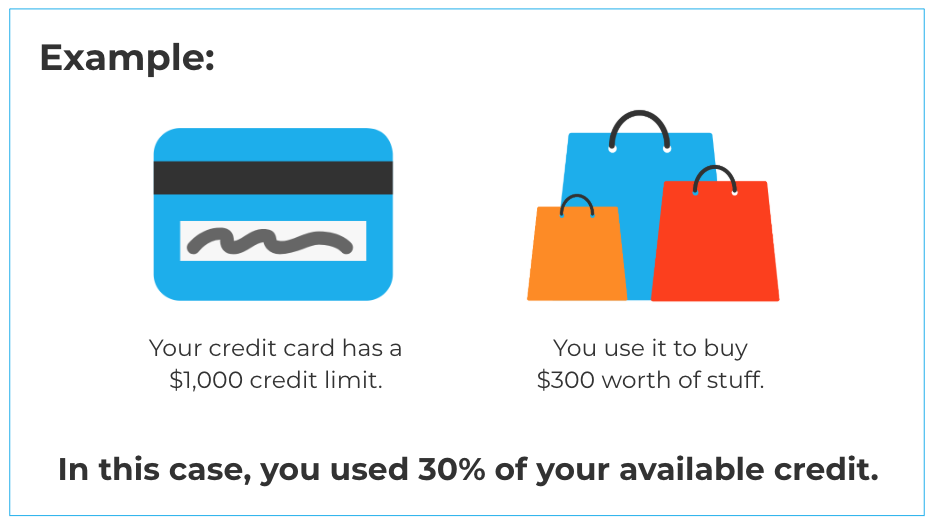

30% of your credit score is based on your credit utilization on your credit cards. Your credit utilization rate is calculated by dividing your balance by your credit limit. So, if you have a card with a $1,000 limit and a $750 balance, your utilization rate is 75%.

It’s best to keep your credit usage as low as possible. A few ways to do this include:

- Using your credit card sparingly, especially if it has a low limit.

- Making multiple payments each month to keep the balance low.

- Asking your credit card issuer when it reports your balance and making a large payment before that date.

3 - Borrow responsibly

Every time you apply for a credit card or loan, it can knock as much as five points off your credit score.

In some cases credit inquiries may not affect your score at all. But if you apply for multiple credit accounts in a short period, it could have a compounding effect on your credit score.

It’s wise to avoid opening up credit accounts unless you need them. Even then, try to keep your applications to a minimum as you’re working to get your credit on the right track.

Building credit takes time, but is worth doing

Establishing a good credit score can make a big difference in the type of interest rates and APRs you can get, as well as the types of credit you can qualify for. But it takes time to achieve that goal.

As you consider these tips, it’s important to stay focused on the actions you can take rather than the number.

With the right behavior, you’ll establish a solid foundation for building your credit to where you want it to be and keeping it there.

Take the first step towards building your credit. Download the Self app.

Article Sources

The Balance. "How Long Does It Take To Build Good Credit From Scratch?". https://www.thebalance.com/how-long-it-takes-to-build-good-credit-4767654

American Express. "How Long Does It Take to Establish Good Credit?". https://www.americanexpress.com/en-us/credit-cards/credit-intel/how-long-does-it-take-to-establish-credit/

Credit Karma. "Credit Karma Guide to Establishing Credit in the U.S.". https://www.creditkarma.com/advice/i/credit-karma-guide-establishing-credit

About the author

Ben Luthi is a personal finance writer who has a degree in finance and was previously a staff writer for NerdWallet and Student Loan Hero. See Ben on Linkedin and Twitter.

About the reviewer

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).