How to Cash a Cashier's Check and Where to Do It

Published on: 02/10/2026

If you need to cash a cashier’s check, you can do so at the issuing bank or financial institution, but there may be fees associated if you’re not a customer. Fortunately, there are other ways to cash a cashier’s check — even if you don’t have a bank account.

Key points

- A cashier’s check is a bank-issued payment drawn from the bank’s own funds, offering secure and verified money for larger transactions.

- Cashing a cashier’s check can be done at banks, credit unions, check-cashing stores, or some retailers, though fees and identification requirements vary.

- Banks generally release funds quickly, but Regulation CC allows extended holds on deposits above the federal threshold or when a check requires verification.

What is a cashier’s check?

When a bank issues you a cashier’s check, it’s acting as a middleman in your transaction.

First, the bank transfers the amount you’ve requested from your account into its account. Then the bank issues a check drawn from its funds to the person you want to pay. Because the bank’s funds are secure, the money may be available to the payee faster, especially on large deposits that may normally take several business days to clear if they’re made via personal check.

You will have to pay a little for that security and convenience, though. Some banks may offer a certain number of free cashier’s checks to account holders, but those that charge typically set fees between $5 and $20 per check. [1]

How to get a cashier’s check

You’ll need to have enough money in your account to cover the transfer. You’ll also need to provide your bank with the payee’s name, and you’ll have to have a driver’s license or other valid form of identification.

You can get a cashier’s check at your local bank branch: just ask your bank teller. You may be able to get one online if your bank offers that service.

Types of checks

Cashier’s check vs. personal check

A cashier’s check and a personal check are two different types of checks.

A personal check is drawn from your bank account, whereas a cashier’s check is drawn from the bank’s account. You can stop payment on a personal check because it’s drawn from your account, but you don’t have that option with a cashier’s check.[1]

There’s always a risk you won’t have enough funds in your account to cover a check you’ve written, but there’s no such risk with a cashier’s check. That’s because the bank determines whether you have enough funds to cover a cashier’s check before it issues one, so availability of funds isn’t a factor.

Cashier’s checks generally allow for the funds to be released quickly. [1] In general, deposits such as checks of $225 or less deposited in person, electronic payments (wire transfers and ACH), and government, cashier’s, and certified checks deposited in person or at the bank’s ATM must be made available by the next business day.[2]

Cashier’s check vs. certified check

A certified check, like a regular check, is a form of payment drawn from the bank customer’s account.

However, with a certified check, the bank checks to confirm there’s enough money in that account to cover the amount of the check. Once that’s verified, the bank will print the word “certified” or “accepted” on the check. This assures the payee that the check won’t bounce.

Some people or companies may ask for a certified check as payment, particularly on large payments, such as a down payment on a house. However, not all banks issue them, and you can’t get them online because you need the issuer to stamp the physical check you’ve written as certified.

Cashier’s check vs. money order

A money order is used, like a cashier’s check, to guarantee the funds you’re paying are available. Money orders are generally used for smaller purchases, and they’re a helpful option for people who don’t have bank accounts.

You might balk at spending $15 in fees to pay a $100 repair bill with a cashier’s check, but paying $1 for a money order at Walmart or a dollar or two at the post office is a lot more reasonable for a small purchase or payment.[3]

That’s right: You don’t have to go to a bank to get a money order, and that convenience can be a big advantage.

You can purchase a money order worth up to $500 at any post office for $2.55, or $3.60 for amounts from $500.01 to $1,000. Postal money orders issued by military facilities are $0.84 each.[4]

Where can you cash a cashier’s check?

Banks and credit unions

You can cash a cashier’s check at banks and credit unions. If you’re not a customer of the financial institution, you’ll likely have to pay a fee.

Other requirements may be in play, too. [5]

Check cashing services

You can also cash a cashier’s check at many check cashing stores such as Ace Cash Express, Check ’n Go, Check Into Cash, Pay-O-Matic, PLS Check Cashing, Money Mart, and Moneytree.

Check-cashing stores make money by charging a fee to cash your checks, and the fees can be significant because they’re sometimes charged as a percentage of the check’s face value.

The fees vary from store to store, and some locations may require a minimum fee or a small sign-up fee. For example, PLS cashes checks for ‘as low as 1% + $1,’ although the exact rate depends on the type and amount of the check. Always do your research, as fees can vary.[6]

Big box stores

Walmart and other big box stores can cash a cashier’s check for you, too. So can major grocers like Kroger and H-E-B. [5]

How to cash a cashier’s check online

Some banks offer the ability to cash a cashier’s check online with mobile apps and other methods of mobile deposit.

You may need to take a photo of the check and go through the verification process before the funds are available in your account.

Who can cash a cashier’s check?

In order to cash a cashier’s check, you’ll be asked to provide a government-issued photo ID. Fees and other requirements will vary depending on the location you choose. Some companies will require two forms of identification.

Can you get a cashier’s check without a bank account?

Most institutions will provide cashier’s checks to customers, but some smaller banks and credit unions also offer the service to non-customers for a fee. You’ll need to look around in your area to find one.

If you need to cash a cashier’s check but don’t have an account, you may be able to find a bank or credit union that will provide checks for non-customers. Be prepared to pay a fee in such instances. Another option is a check-cashing service, although such services frequently charge high fees. [8]

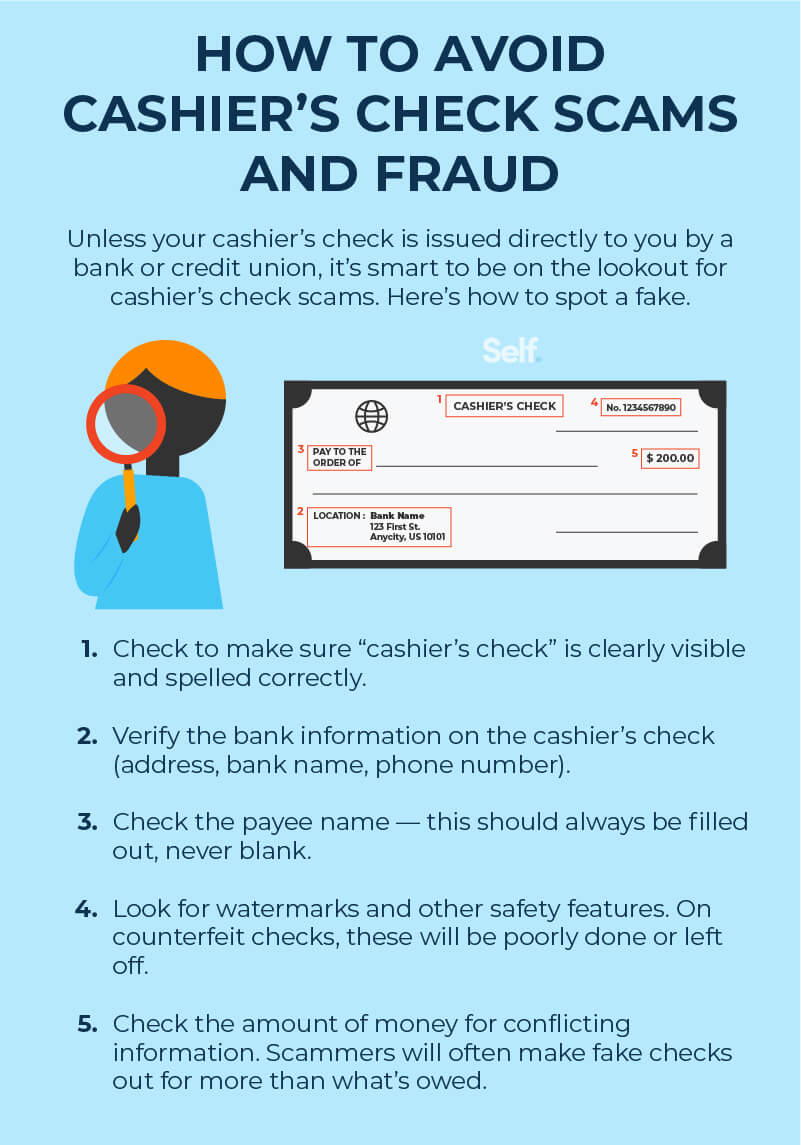

Cashier’s check fraud and scams

Cashier’s checks are more secure than personal checks because they’re backed by a financial institution, but that doesn’t mean they’re immune to fraud.

To ensure a check you’ve received is legitimate, contact the issuing bank using the contact information on its website. If there’s a phone number on the check, don’t call that: If the check is fake, the number will be, too. And most check scams involve fake checks.

Banks must make deposited funds available quickly, but that doesn’t guarantee the check has cleared. The Federal Trade Commission warns that if a check turns out to be fake, the bank will reverse the deposit and you’ll be responsible for paying the money back. If you’ve already sent funds to a scammer, you’re unlikely to recover them.

Don’t rely on money from a check unless you know and trust the person you’re dealing with.[9]

Sending and receiving money via recognized, trusted apps such as PayPal or Google Pay, or through your own bank’s website, is a good way to avoid scams.

How to spot check fraud and scams

Since most scams involve fake checks, verify that the checks have been issued by the institution whose name is on the front.

Common scams include:

- Someone using a cashier's check to purchase goods from you, only to find that the check is fraudulent.

- Being told you’ve been chosen as a mystery shopper and can use part of a (fake) cashier’s check you receive to purchase goods at a specified location.

- Being employed in a work-at-home scam in which you deposit money from a phony cashier’s check into your own account, then forward it to someone else. This is, in many cases, simply a form of money laundering.

- Receiving the news that you have won a bogus foreign lottery and been sent a cashier’s check, but you’re asked to deposit it into your account and then pay associated fees and taxes with your own money.[10]

Good rules of thumb:

- Don’t accept checks that pay you more than the selling price.

- Don’t send money back to someone who sent you a check.

- Discard any offer that says you’ve won a prize — then requires that you pay to claim it.[9]

How to report a fake cashier's check

Victims of fake check scams can report them to their state attorney general, the Federal Trade Commission, or the U.S. Postal Inspection Service.[9]

Be careful with a cashier's check

Cashier’s checks can be useful tools to send and receive large sums of money quickly and securely.

They aren’t the only option, though, and you need to be on the lookout for possible scams. Certified checks and credit cards are other possibilities.

Credit cards are secure against fraud, and you can use them to build credit as you pay off debt. (If you’re just establishing your credit or looking to bolster your credit score, consider a secured credit card.

Sources

- Experian. “What Is a Cashier’s Check?” https://www.experian.com/blogs/ask-experian/what-is-cashiers-check/. Accessed January 2nd, 2026.

- Consumer Financial Protection Bureau. “How Long Can a Bank or Credit Union Hold Funds I Deposited?” https://www.consumerfinance.gov/ask-cfpb/how-long-can-a-bank-or-credit-union-hold-funds-i-deposited-en-1023/. Accessed January 2nd, 2026.

- U.S. News. “Cashier's Check vs. Money Order: When to Use Which?” https://money.usnews.com/banking/articles/cashiers-check-vs-money-order-when-to-use-which. Accessed January 2nd, 2026.

- USPS. “Sending Money Orders,” https://www.usps.com/shop/money-orders.htm. Accessed January 2nd, 2026.

- First Quarter Finance. “Where Can I Cash a Cashier’s Check? 25 Places (& How to Cash Online),” https://firstquarterfinance.com/where-can-i-cash-a-cashiers-check. Accessed January 2nd, 2026.

- PLS. “Cash Checks for as low as 1% + $1*” https://pls247.com/tx/money/check-cashing.html. Accessed January 2nd, 2026.

- Techwalla. “How to Use a Check to Purchase a Cash Card Online ,” https://www.techwalla.com/articles/how-to-use-a-check-to-purchase-a-cash-card-online. Accessed January 2nd, 2026.

- Investopedia. "Where Can You Cash Checks?" https://www.investopedia.com/where-can-you-cash-checks-5176474. Accessed January 2nd, 2026.

- Federal Trade Commission. “How To Spot, Avoid, and Report Fake Check Scams,” https://www.consumer.ftc.gov/articles/how-spot-avoid-and-report-fake-check-scams. Accessed January 2nd, 2026.

- Washington State Department of Financial Institutions. “Cashier’s Check Scams,” https://dfi.wa.gov/financial-education/information/cashiers-check-scams. Accessed January 2nd, 2026.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.