How to Write a Debt Settlement Letter + [Template]

Published on: 07/20/2021

Debt settlement is a negotiation tactic you can use with creditors to obtain forgiveness on some or all of the debt you owe.

If you can reach a settlement on a debt, not only can you stop worrying about how to pay it off, but you also may be able to get it removed from your credit report. At the very least, a settled debt can be listed as “closed" or “settled,” which is better than “open.”

You’re at an advantage if you can write a debt settlement letter yourself, rather than hiring a debt settlement company, which can end up costing you more than you owed in the first place. There’s no guarantee a company will persuade your creditor to settle the debt, and you could end up owing even more money in late fees and interest.[1]

So, what are your chances of success with the debt settlement approach?

According to the Federal Trade Commission, completion rates on debt settlement negotiations range between 35% and 60%, depending on several factors. The average success rate is about 45-50%, so you’ll have about an even chance of reaching a debt settlement agreement on repaying all or part of what you owe.[2]

What is debt settlement?

Debt settlement is the process of negotiating terms with your creditor or a debt buyer to be forgiven on a portion, or the full amount, of your debt.

Debts 90 days or more past due are considered “seriously delinquent,” which makes them eligible for debt settlement. A sizable percentage of credit card and medical debt falls into this category, making these two types ideal for the settlement process.[3]

Federal student loans operate under different rules that make them virtually impossible to settle, but personal loans issued by banks are better candidates for debt settlement.[3]

Debt settlement letter template

Here is a sample letter showing how to request a settlement of your debt. You can download a template by clicking the button below.

[Date]

[Your full name]

[Your address]

[Your contact information]

Re: [Account number you’re trying to settle]

[Creditor’s or debt collector’s name]

[Creditor’s or debt collector’s address]

Dear [insert creditor’s or debt collector’s name]:

I’m writing this letter regarding the debt I owe [include the debt amount] on the account number provided above. I am unable to pay back the debt in full due to financial hardship. [Include more details about your situation].

I am proposing an offer to settle this debt for [include the maximum amount you’re able to pay to settle the debt], in exchange for [include what you expect in return: having a late payment removed from your credit report, etc.].

If you agree to the terms listed above, I request freedom from any liability associated with the debt of this account. I will expect my credit reports to state that the account has been paid off in full.

If you agree to this offer, please send a written and signed agreement to me at the address listed above. Once I receive the written and signed agreement, I will pay the agreed-upon amount listed in this document within [number of days the creditor can expect to see your payment].

Please let me know your decision by [your specified deadline for the offer].

Sincerely,

[Your signature]

[Your printed name]

Four steps to reaching a debt settlement

There are four steps you should take in attempting to reach a debt settlement agreement on what you owe, whether it’s with the original creditor or a debt collector.

- Save up money for the proposed settlement.

- Write a letter proposing your debt settlement offer.

- Ask for written confirmation of the agreement.

- Receive the confirmation and send the payment.

These steps are detailed below.

Save up the money for the proposed settlement

Before making a settlement offer, be sure you have enough money saved up to meet the settlement terms if the creditor agrees to your terms.

Create a budget and a proposed payment plan, and choose a settlement amount you can afford. Then, consider opening a separate bank account into which you can deposit money each month to save up.

Meanwhile, if you’re settling a credit card debt, it’s a good idea to stop charging anything on that card for three to six months before proposing a settlement. If you’re claiming hardship but still using the card to buy expensive clothes or eat at fancy restaurants, it won’t look like there's any hardship at all. You’ll lose credibility, and the company will be less likely to consider your proposal.[4]

You may propose monthly payments of a specific amount in a repayment plan. Or your creditor or collection agency may be open to accepting a lump sum payment that’s less than the total you owe to settle your account.[1]

A credit counseling agency can help you set up a debt management plan, which entails negotiating a repayment plan with your creditors. Under such plans, you make a monthly payment to the credit counselor, which in turn pays the creditors.[1]

An arrangement with a reputable nonprofit debt management counselor likely will require your participation in educational programs and counseling before you’re accepted for a debt management plan.[5]

Keep in mind that not all debt relief, credit repair and debt settlement services are legitimate. Credit repair scams are common, so be certain you’re getting help from a respectable and trustworthy organization.[1]

You can connect with a nonprofit counselor through the National Foundation for Credit Counseling, which offers help for people with debt to lower their interest rates, stop creditor calls and gain “financial education for long-term success” with improved credit and one monthly payment.[6]

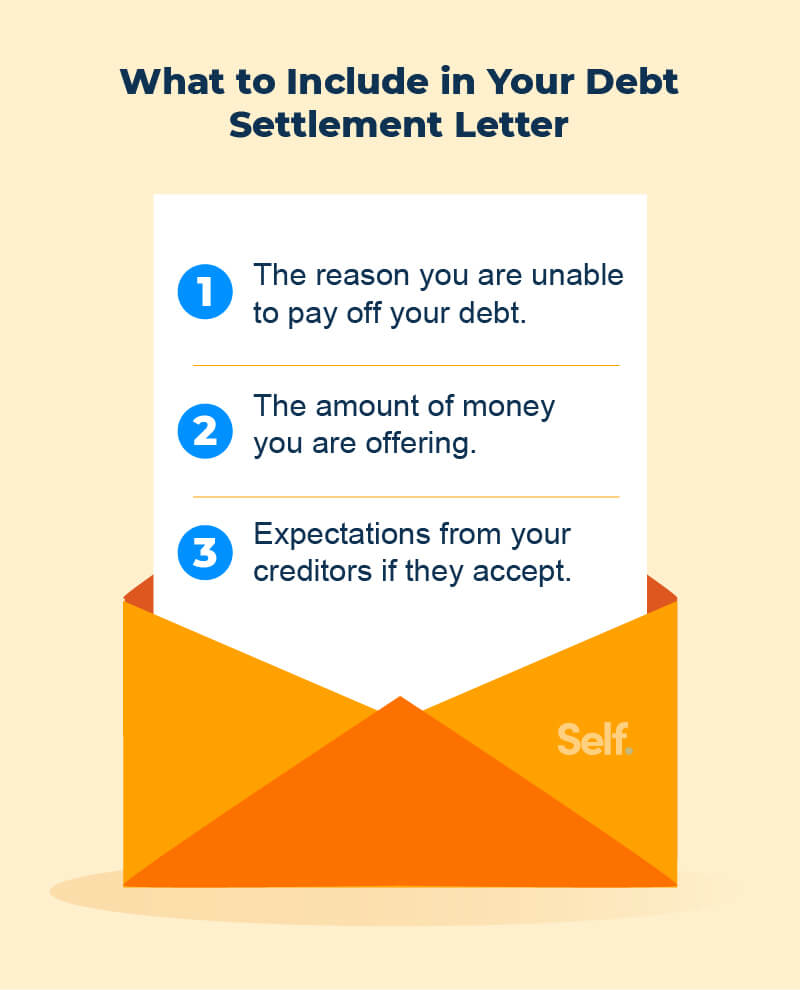

Write a debt settlement letter

Once you’ve saved up a reasonable amount, write a debt settlement letter to your creditor. Explain your financial situation and specify how much you’re offering to pay to close the account.

In your settlement offer letter, be sure to provide details of any financial hardship you may be facing, such as unforeseen medical bills or the loss of your job. If a creditor sees that you have a legitimate reason for possibly defaulting, they may be more willing to negotiate for at least something rather than nothing at all.

Don’t start by offering your final amount, or the most you can afford to pay. The creditor may reject it, and then you'll have no negotiating room.

Instead, consider beginning around 30% of the entire balance. Expect them to respond with a higher number. This is a negotiation, after all, so be prepared for a few counteroffers until you can agree.[4]

Ask for written confirmation

In your debt settlement letter, make sure to explicitly state that you need to receive a written confirmation from the creditor. You want them to agree in writing to the terms and conditions you offered in the letter, so you’ll have proof in the event of future disputes.

It’s a good idea to make this request before you send the actual payment. If the creditor already has your payment in hand, they might be less likely to continue negotiating.[7]

Send the settlement payment

Once you’ve sent the settlement payment, stay in contact with the creditors to ensure all of the terms and conditions are fulfilled.

Keep in mind that debt settlement of a loan — whether it's a car loan, student loan, credit card debt, or other personal loan — can cause a drop in your credit score. It’s better to stay current on your payments in the first place than to structure a repayment plan after you’ve missed payments and fallen behind.

And if you reach an agreement to pay less than the amount you originally owed, this also will reflect negatively on your credit.[8] The information will be sent to the three major credit bureaus (Equifax, Experian and TransUnion).

A settled item’s account status will appear on your credit reports as “settled” or “paid settled.” Of course, this is better than a status of "unpaid," but any payment status that’s less glowing than “paid as agreed” or “paid in full” can damage your credit.[9]

Even if your account was never late before it was settled, the notice will remain on your credit report for seven years, starting at the date of the settlement.[5]

A settled debt on your credit report can lead to higher interest rates and greater difficulty in obtaining future loans. Potential lenders won’t want to risk getting only part of their money back, or getting it late.

If you’re dealing with a debt buyer, this means your account has already been charged off by the original lender. This means the original creditor has given up trying to collect and sold your debt to a company that will try to collect it.

Collections will further negatively impact your credit, so it’s wise to pursue a debt settlement agreement with the original lender early rather than waiting for it to go to debt collection.

Sources

- Federal Trade Commission. “Getting Out of Debt,” https://www.consumer.ftc.gov/articles/getting-out-debt. Accessed May 29, 2021.

- Federal Trade Commission. “The Association of Settlement Companies (TASC) Study on the Debt Settlement Industry,” https://www.ftc.gov/sites/default/files/documents/public_comments/debt-settlement-industry-public-workshop-536796-00014/536796-00014.pdf. Accessed May 29, 2021.

- Debt.org. “Debt Settlement,” https://www.debt.org/settlement/. Accessed June 29, 2021.

- Investopedia. “Debt Settlement: A Guide for Negotiation,” https://www.investopedia.com/articles/pf/09/debt-settlement.asp. Accessed May 29, 2021.

- Experian. “What Is the Difference Between Credit Counseling and Debt Settlement?” https://www.experian.com/blogs/ask-experian/the-difference-between-credit-counseling-and-debt-settlement-2/. Accessed May 29, 2021.

- National Foundation for Credit Counseling. “Nonprofit debt management is the smart choice for paying off your debt!” https://www.nfcc.org. Accessed May 29, 2021.

- Intuit Mint Life. “Understanding Debt Settlement Letters,” https://mint.intuit.com/blog/credit/debt-settlement-letter/. Accessed May 29, 2021.

- Investopedia. “How Will Debt Settlement Affect My Credit Score?” https://www.investopedia.com/ask/answers/110614/how-will-debt-settlement-affect-my-credit-score.asp#citation-5. Accessed May 29, 2021.

- The Balance. “How Will Debt Settlement Affect My Credit Score?” https://www.thebalance.com/how-will-debt-settlement-affect-my-credit-score-960540. Accessed June 29, 2021.

About the Author

Lauren Bringle is an Accredited Financial Counselor® for Self Financial - a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).