Why is JPMCB Card Services on Your Credit Report?

Published on: 02/05/2023

Checking your credit report often is important because you never know what you’re going to find on it. Sometimes, a new account that doesn’t belong to you or inaccurate, negative information may get added, impacting your credit score and making it more difficult to build credit. Inaccurate, negative information may prevent you from getting the best credit score possible from the accurate information listed on your credit report.

If you’re not checking your report regularly, you may only find out about negative info after you’ve been declined. If you’ve recently checked and found a tradeline for JPMCB Card Services, you may be wondering what it is and how to remove it if the entry was reported in error. This guide helps you navigate this.

What is JPMCB?

JPMCB stands for JP Morgan Chase Bank, one of the largest banks offering financial services in the world. They were created in 2000 when J.P. Morgan & Co. Incorporated merged with The Chase Manhattan Corporation to form JPMorgan Chase & Co., and then in 2018 they merged with Chase Bank USA to form their present iteration.[1][2]

What cards are associated with JPCMB?

If you are seeing JPMCB on your credit report, this may be because you have applied for or obtained one of the following unsecured credit cards (as opposed to secured cards, which require a cash deposit upfront or debit cards, which draw directly from your checking account).

Chase credit cards

Chase credit cards come in many varieties, including Chase Freedom® and Chase Sapphire Reserve®. You can find many cards under the Chase banner and all with their own benefits and a wide range of APRs and annual fees.[3]

Airline rewards credit cards

Chase also offers credit cards with airline rewards, allowing you to rack up bonus miles and points that you can use to offset your travel costs.

A few types of Chase airline cards include the Southwest airline rewards cards, the United airline rewards cards, the Aeroplan Card, the British Airways airline rewards card, the Aer Lingus airline rewards card and the Iberia airline rewards card.[3]

Hotel rewards credit cards

Chase also offers hotel rewards credit cards, allowing you to collect points when you stay at certain hotel brands so you can earn free hotel stays in the future. These cards include Marriott Bonvoy hotel rewards cards and the World of Hyatt hotel rewards card.[3]

Company-specific rewards credit cards

Chase also offers credit cards that have rewards for specific companies, so you can get benefits from services you use frequently. Company-specific cards may include Disney rewards cards, Amazon rewards cards and the Instacart Mastercard.[3]

Business credit cards

Chase also has options for businesses looking to save money on typical expenditures including Ink business credit cards.[3]

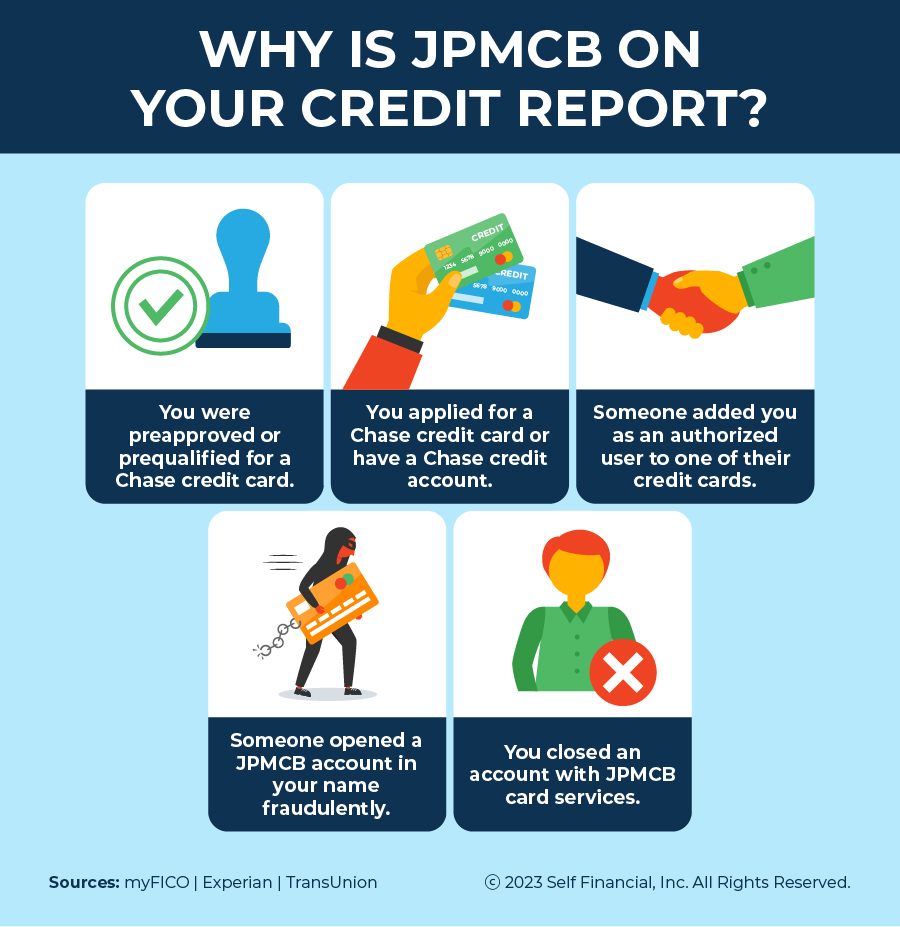

Why is JPMCB card services on my credit report?

When you check your credit report and see JPMCB card services, you may wonder why it is there. The following sections offer a few reasons why that might be the case.

1. You were preapproved or prequalified for a Chase credit card

Prequalification doesn’t necessarily happen because of a request from the consumer. When lenders and credit card issuers want to consider offering you preapproval for financial products, they perform a soft inquiry or soft credit check on your credit report. This soft pull gives them information to assess whether to offer you a preapproved or prequalified offer.

If Chase credit card runs a soft inquiry to offer you preapproval or prequalification for a credit card, that could cause it to show up on your credit report as a soft inquiry. Soft inquiries like this do not affect your credit score, but if you follow through and apply for the card, you’ll undergo a hard inquiry.[4]

2. You applied for a Chase credit card or have a Chase credit card account

If you applied for a Chase account, JP Morgan Chase Bank (JPMCB) would have made a hard inquiry on your report. This will still show up even if you were rejected after applying.[5]

A hard credit inquiry is when credit issuers and financial institutions ask the major credit bureaus to see a copy of your credit report when assessing your application for a new credit account. New hard inquiries affect your credit score for about 12 months, but they will remain on your credit report for two years.[5]

3. Someone added you as an authorized user on one of their credit cards

If someone adds you as an authorized user to their Chase credit card, that may show up on your credit report. An authorized user is not responsible for payments but can use the credit card. Then if the card issuer reports authorized users to the credit bureaus, credit information such as payment history and credit utilization rate for the primary cardholder may also show up in your credit history.[6]

4. Someone opened a JPMCB account in your name fraudulently

If you do not have a Chase credit card account, are not an authorized user on one, and have not even applied for one, then you may be a victim of identity theft or fraud. It could also potentially be a mistake. Either way, you can use the information in this post to get it off your report.

5. You closed an account with JPMCB card services

A final reason you may see JPMCB on your account is if you had a Chase card but later closed it. Closed accounts stay on your report for a long time — 7 years if it was closed in negative standing, and 10 years if closed in good standing. Because closed accounts can stay on your report for so long, it’s not uncommon for someone to check their report and forget about an account they closed many years ago.[7]

What to do if JPMCB is inaccurately listed on your credit report

If you’ve determined that JPMCB is inaccurately listed on your credit report, either due to fraud or a mistake, you can take action to remove it.

Contact JPMCB card services

The first step is to reach out to the company using the contact information below:[8][9]

- JPCMB Card Services Phone Number: 1-212-270-6000 (general information), 1-800-935-9935 (customer service)

- JPCMB Card Services Address: 1111 Polaris Parkway Columbus, OH 43240

Dispute the inquiry or account with credit bureaus

The next step is to dispute the inquiry, negative item or account with the credit bureaus and the business that reported it. They are required to fix the error for free. Take these steps to dispute the error on your report:[10]

- Write to the credit bureau(s) that are reporting the inaccuracy. You can find form letters online to help you do this. Be sure to write to each bureau that has the information listed on your report. You can find the dispute page for each bureau here: Equifax, Experian, and TransUnion.

- Wait for an official response: The credit bureaus must investigate a dispute within 30 days of receiving it.

- Dispute the inaccuracy with the business if unresolved: You can dispute the issue with the business that reported the error at the same time you’re disputing it with the credit bureaus. So reach out to the business directly to dispute the inaccuracy so that the business stops reporting it to the credit bureaus.

Consider reporting the fraud or signing up for fraud alerts

If you suspect fraud, you need to report it to the Federal Trade Commission (FTC). You can also sign up for fraud alerts on your credit report with credit monitoring services so you can be alerted immediately in case it happens again. The steps to report to the FTC can be found here.[11]

Should you remove JPMCB card services from your credit report?

You would only want to remove JPMCB card services from your credit report if it has inaccurate negative information like late payments — if the information is positive, you want it on your credit report. In any event, it may not be up to you. You can’t remove things from your credit report, negative or positive, if they are accurate. Only cases of error or fraud can be removed, and in that case, you definitely want it removed (you may also want to consider a temporary credit lock or freeze).

Be proactive with your finances and personal information

One step to establish a strong credit history is to protect yourself from inaccurate information on your report. You can do this by being vigilant and proactive with the information on your credit report. Negative marks from JPMCB or any other creditor can show up without you knowing it, and the only way to check is by pulling your credit report on a regular basis. And remember: You are legally entitled to one free credit report from each credit bureau every 12 months via www.AnnualCreditReport.com — so take advantage of it.

Sources

- JPMorgan Chase & Co. "JPMorgan Chase Bank, N.A. and Chase Bank USA, N.A. File Merger Application," https://www.jpmorganchase.com/ir/news/2018/file-merger-application. Accessed Sept. 23, 2022.

- JPMorgan Chase & Co. "History of Our Firm," https://www.jpmorganchase.com/about/our-history. Accessed Sept. 23, 2022.

- Chase. "All Credit Cards," https://creditcards.chase.com/all-credit-cards?jp_ltg=chsecate_allcards&CELL=6TT9. Accessed Sept. 23, 2022.

- Experian. "How to Prequalify for a Credit Card," https://www.experian.com/blogs/ask-experian/how-to-prequalify-for-a-credit-card. Accessed Sept. 23, 2022.

- MyFICO. "Credit Checks: What are credit inquiries and how do they affect your FICO® Score?" https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries. Accessed Sept. 23, 2022.

- Experian. "Credit Card Authorized User: What You Need to Know," https://www.experian.com/blogs/ask-experian/what-is-credit-card-authorized-user. Accessed Sept. 23, 2022.

- TransUnion. "How Long Do Closed Accounts Stay on My Credit Report?" https://www.transunion.com/blog/credit-advice/how-long-do-closed-accounts-stay-on-credit-report. Accessed Sept. 23, 2022.

- JPMorgan Chase & Co. "Contact Us," https://www.jpmorganchase.com/about/contact-us. Accessed Sept. 23, 2022.

- Bloomberg. "JPMorgan Chase Bank NA," https://www.bloomberg.com/profile/company/8147Z:US. Accessed Sept. 23, 2022.

- Federal Trade Commission. "Disputing Errors on Your Credit Reports," https://consumer.ftc.gov/articles/disputing-errors-your-credit-reports. Accessed Sept. 23, 2022.

- Federal Trade Commission. "What To Know About Credit Freezes and Fraud Alerts," https://consumer.ftc.gov/articles/what-know-about-credit-freezes-fraud-alerts. Accessed Sept. 23, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).