Line of Credit vs. Credit Card: The Key Differences

Published on: 12/02/2022

Both credit cards and lines of credit let you borrow money when you need it and pay it back at a later time. The two forms of credit operate in a similar way, allowing you to make purchases in any amount up to your borrowing limit and then make payments in variable amounts with monthly minimum payments required. This post covers many common questions about lines of credit and credit cards to help you decide which type of credit best suits your needs.

Table of contents

- What is a line of credit?

- What is a credit card?

- What’s the difference between lines of credit and credit cards?

- Pros and cons of lines of credit

- Pros and cons of credit cards

- How do they affect your credit score?

- Which is right for you?

What is a line of credit?

A line of credit is a type of revolving credit that gives you access to funds up to a certain preset amount. As you pay down your balance, more funds become available to you.

A line of credit works differently than a credit card. It has a draw period for using your credit and a repayment period for paying it back. The terms for the following periods are detailed in your agreement with your lender:

- Draw period: During this period, you can generally use checks or debit cards to make purchases and cash withdrawals from your account. You typically can take out variable amounts up to your limit and even pay it back during this time.

- Repayment period: You can no longer borrow against your credit line and must begin paying back your balance with fixed payments each month.

While most personal lines of credit are unsecured, you can also apply for a secured line of credit ― a type that requires collateral. Common types include home equity lines of credit (HELOCs), in which you borrow money against the equity in your home, and CD-secured lines of credit, which require you to put down money in a certificate of deposit. With secured lines of credit, lenders may seize the assets you put down as collateral if you fail to make payments.[1]

What is a credit card?

A credit card is a form of revolving credit that allows cardholders to make purchases as needed and pay the money back as they can, as long as they make their minimum monthly payment. If you pay back your previous statement balance by the due date, you will not have to pay interest. However, in the event that you carry a balance from one month to the next, credit card companies will charge interest and include it on your next statement.[2]

What’s the difference between lines of credit and credit cards?

Although lines of credit and credit cards share some similarities, they also have several key differences to consider when deciding which works best for your personal finances.[1]

| Personal Lines of Credit | Credit Cards | |

|---|---|---|

| Approval | Usually based on credit score, financial information and proof of income | Usually based on credit score and financial information, including income |

| Usage | Primarily used to make large purchases | Primarily used for making smaller, everyday purchases |

| Rewards | Usually don’t offer rewards | Some credit cards offer rewards like flight miles or cash back |

| Interest rates | Usually have lower interest rates | Usually have higher interest rates |

| Grace Period | No grace period for payment | Grace period between the end of your billing cycle and when payment is due (minimum 21 days) |

Application process

Banks and other lenders typically base approval for any type of credit, credit limits and credit terms on the borrower’s creditworthiness. Lenders check your credit score and other elements of your financial profile to make their decisions. To apply for a line of credit, you may need to submit financial documents, such as bank statements.[3] To apply for a credit card, you will need to provide financial data such as income and housing costs. Some credit card issuers offer preapproval letters, which simply indicate that you are likely (but not guaranteed) to qualify for their financial products.[4]

Interest Rates

Unlike installment loans, credit cards and credit lines only charge interest on the outstanding average balance on your account. (You should review your credit agreements to understand how the lender calculates the average balance on your account.) Lines of credit, however, tend to have one crucial advantage over credit cards: a lower interest rate. Although interest rates vary, according to CNBC, as of September 2022, credit lines have an APR range of 9.30% to 17.55%, while credit cards range from 8.99% all the way up to 29.99%. [1] [5]

Lines of credit

According to Forbes Advisor, as of November 2022, the average interest rates for home equity lines of credit are as follows*:

- HELOCs (10 year): 5.50%

- HELOCs (20 year): 7.31%

[6]

Interest rates on lines of credit vary significantly by financial institution and the creditworthiness of the borrower.

Unlike some other loan types with fixed interest rates, lines of credit have variable interest rates that may fluctuate over time. For example, U.S. Bank bases its APR on the Prime Rate plus a margin. So as the Prime Rate fluctuates, so does the APR.[7] Finally, rates may also vary based on the type of account you may have with the bank. Citbank’s variable-rate lines of credit range, as of November 2022, from 18.25% to 21.25%, depending on account type and package.[8]

Credit cards

The average interest rates for credit cards are as follows*:

- National average: 19.20%

- Low interest: 16.28%

- Bad credit: 28.12%

[9]

*This data was collected as of November 2022 from creditcards.com and is subject to change.

Fees and Repayment

Although credit cards are convenient, they often come with fees to consider. Besides interest charges, cardholders may have to pay late fees, annual fees, foreign transaction fees, balance transfer fees and cash advance fees.[2] Lines of credit generally don’t charge extra for making cash withdrawals, but you may want to ask your lender about annual fees, early repayment fees and any other fees that may be associated with your account.[10]

Note that if you do not carry a credit card balance and pay your statement balance by your due date, no interest charges will be added to your account. By contrast, lines of credit do not generally have grace periods.[1]

Credit limit

Lenders set borrowing limits on both unsecured credit cards and lines of credit based on the borrower’s credit score, credit history and other financial factors.[12] Limits on unsecured lines of credit range from $300 to $100,000 or up to 85% of home equity on a secured HELOC. High-limit credit cards may allow as much as $500,000 in spending, which is rare, but $10,000 or less is more common.[1] The limit on secured credit cards usually equals the amount of money put down in a certificate of deposit or savings account as a security deposit. Intended to help borrowers with poor credit or no credit, secured cards often make a good choice for those looking to get credit from scratch.

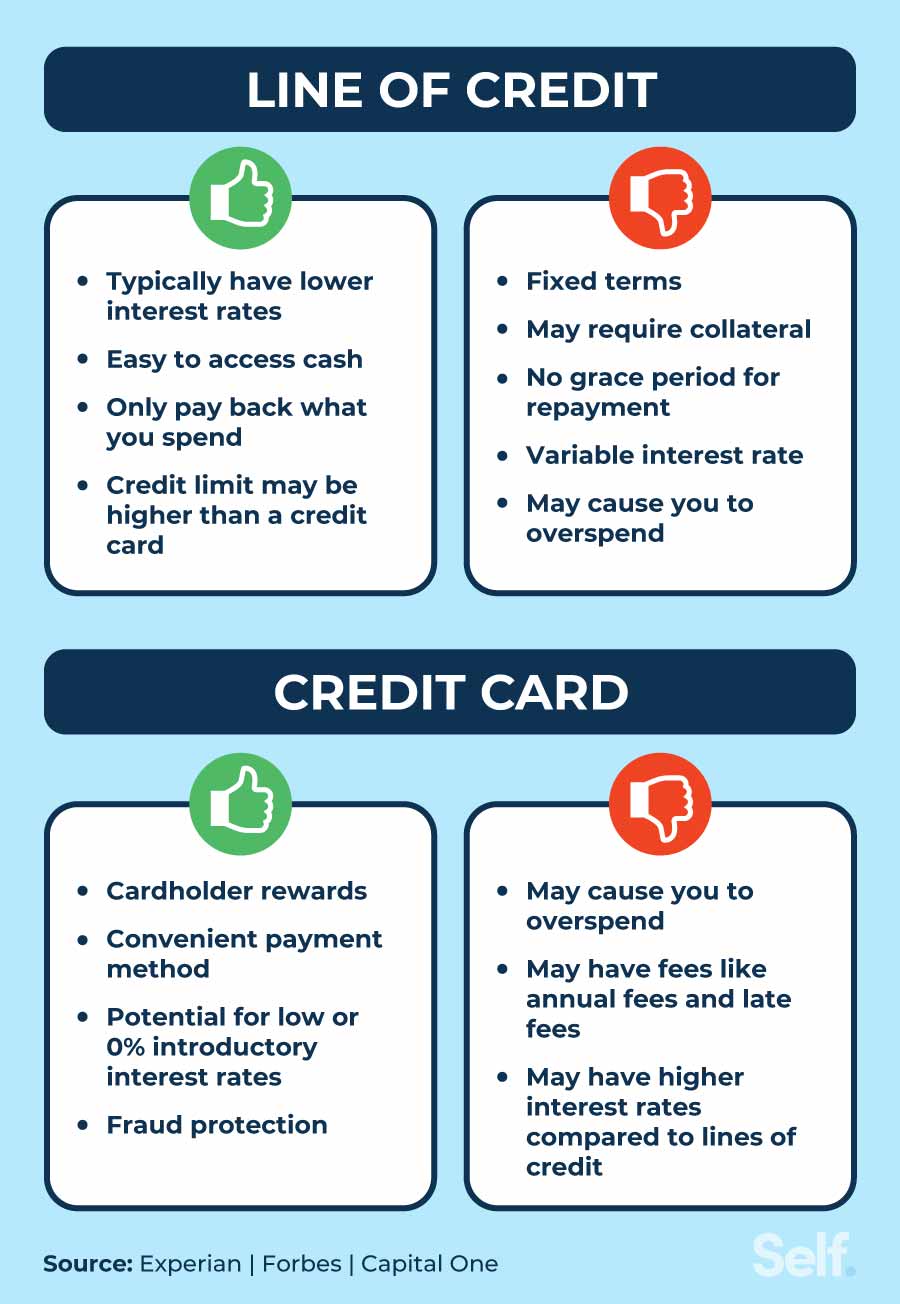

Pros and cons of lines of credit

To help you decide which type of credit is right for your financial situation, consider the following pros and cons of lines of credit.

Pros:

- Typically have lower interest rates: Between lines of credit and credit cards, lines of credit tend to charge lower interest rates.[1]

- Easy to access cash: Credit lines allow you to access your funds with checks, debit cards and fee-free cash withdrawals [1]

- Only pay back what you spend: Unlike a lump-sum loan, you only need to pay back the amount of money you actually use on your line of credit. [1]

- High credit limit to use as needed: Customers may qualify for a higher borrowing limit with lines of credit than compared to the credit limits they may be offered on credit cards.[3]

Cons:

- Fixed terms: Unlike open-ended credit cards, lines of credit may have a limited account duration of up to 15 years.[1]

- Can cause you to overspend: Because lines of credit give you access to money you may not have the resources to repay, you may overspend.

- May require collateral: Secured lines of credit may require that you pledge collateral, such as equity in your home or a certificate of deposit.[1]

- No grace period for repayment: Unlike credit cards, credit lines don’t permit a grace period. You will be charged interest as soon as you use any funds from your account. [1]

- Variable interest rate: Interest rates can vary depending on the lender and market conditions when the funds were borrowed.[3]

Pros and cons of credit cards

While not all types of credit cards are identical, you may consider the following advantages and disadvantages generally associated with credit cards.

Pros:

- Cardholder rewards: Many credit cards offer rewards programs with perks such as travel points, airline miles, cash back and more.

- Convenient payment method: Credit cards make it easy to pay bills online, buy items in person, make purchases with your phone and shop even when you don’t have cash on hand.

- Potential for low or 0% introductory interest rates: In order to attract new customers, credit cards may offer a special introductory APR on purchases and/or balance transfers for a certain period of time.

- Fraud protection: Credit cards may offer protection in the case of theft or fraud.

Cons:

- Credit card fees: When selecting a credit card, be sure to look into any annual fees, late payment fees, foreign transaction fees or any other account fees that may apply.

- Can cause you to overspend: Because they give you access to money you may not have, credit cards can tempt you to overspend.

- May have high interest rates: While interest rates vary, credit cards typically have higher interest rates than lines of credit. You may see higher interest rates or may not get approved particularly if you have a bad credit score.

[2]

How do they affect your credit score?

Both credit cards and credit lines can affect your credit score for better and for worse, depending on how you manage them.[1]

How credit cards can affect your credit score

When used responsibly, credit cards can play an important role in building credit. By paying your bills on time you may see your credit score increase. However, if you miss payments, make late payments, use a high percentage of your limit, or default on your credit card altogether, your credit score will likely decrease.[2]

How a line of credit can affect your credit score

Similar to credit cards, lines of credit can have a positive impact on your credit score if you manage them carefully. They can contribute to your payment history, total available credit and diverse mix of credit types – all important factors in your credit score. However, if you fail to make the minimum monthly payment or default altogether, you will likely see your score drop.[1]

Which is right for you?

In addition to weighing the pros and cons of credit cards and credit lines, you may want to think about your financial situation before you choose a line of credit or credit card.

Consider a line of credit when:

- You have unexpected expenses: When emergencies happen, a line of credit often proves a less expensive way to handle expenses than a credit card.

- You need to make a large cash payment: Since credit cards often charge higher interest for cash advances, credit lines can offer a better option for withdrawing large amounts of cash to pay medical bills, major car repairs and other unexpected large expenses.

- You have ongoing projects: You may find lines of credit useful in the case of ongoing projects such as home improvement. Unlike a typical loan, you can access just the amount of money you need as you need it.[1]

Consider a credit card when:

- You make smaller, regular purchases: For less expensive everyday bills — like groceries, gas, clothing and subscriptions — credit cards make a convenient purchasing option.

- You want to take advantage of specific rewards: If you are a frequent flyer, for example, you may select a credit card that offers airline miles. Foodies may opt for a card that offers enhanced points for restaurant purchases.(Some reward cards come with annual fees so be sure the airline miles and reward points benefits outweigh the annual fee.)

- You want revolving credit that stays open: Unlike loans and lines of credit with fixed durations, credit cards are open-ended accounts.(As long as you meet the credit cards terms and conditions.)[2]

Find a credit account that fits your financial needs

Both credit cards and lines of credit offer a convenient, flexible way to borrow money. While credit card options are available to individuals with a range of credit scores, credit lines are often more accessible to those with better credit. To build your credit prior to applying for a credit line or unsecured credit card, you may consider Self’s Credit Builder Account and secured credit card. Both options can help consumers build their credit — whether you have a bad credit history or no credit at all.

Sources

- Experian. “What Is Line Of Credit?” https://www.experian.com/blogs/ask-experian/what-is-a-line-of-credit. Accessed on July 7, 2022.

- Capital One. “How Do Credit Cards Work?” https://www.capitalone.com/learn-grow/money-management/how-credit-cards-work/. Accessed on July 20, 2022.

- Forbes. “What Is Line Of Credit And How To Get One?” https://www.forbes.com/advisor/in/loans/what-is-line-of-credit-and-how-to-get-one. Accessed on July 7, 2022.

- Forbes. “How To Apply For A Credit Card (And Receive Approval),” https://www.forbes.com/advisor/credit-cards/how-to-apply-for-a-credit-card. Accessed on July 7, 2022.

- CNBC. “Personal Loan vs. Personal Line of Credit: What’s the Difference?” https://www.cnbc.com/select/personal-loan-vs-personal-line-of-credit-difference/. Accessed on July 20, 2022.

- Forbes Advisor. “Average HELOC Rates: November 9, 2022—Rates Stay The Same,” https://www.forbes.com/advisor/home-equity/heloc-rates-november-09-2022/. Accessed on November 15, 2022.

- U.S. Bank. “Personal Line Of Credit Details And Benefits,” https://www.usbank.com/loans-credit-lines/personal-loans-and-lines-of-credit/personal-line-of-credit.html. Accessed on November 4, 2022.

- Citibank. “Personal Lines & Loans At A Glance,” https://online.citi.com/US/JRS/pands/detail.do?ID=CheckingPlus. Accessed on July 7, 2022.

- Creditcards.com. “Average Credit Card Interest Rates: Week of July 6, 2022,” https://www.creditcards.com/news/rate-report. Accessed on July 7, 2022.

- Experian. “Personal Line of Credit vs. Credit Card: Which Is Better?” https://www.experian.com/blogs/ask-experian/personal-line-of-credit-vs-credit-card. Accessed on July 7, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).