Do Medical Bills Affect Your Credit?

Published on: 06/03/2022

The negative impact of unpaid medical expenses can create difficult financial obstacles, but after a recent joint reporting decision by the three major credit bureaus, many of those obstacles may soon disappear. The three major credit reporting bureaus — Equifax, Experian, and Transunion — announced major changes to the reporting guidelines to ease the burden of medical debt.[1]

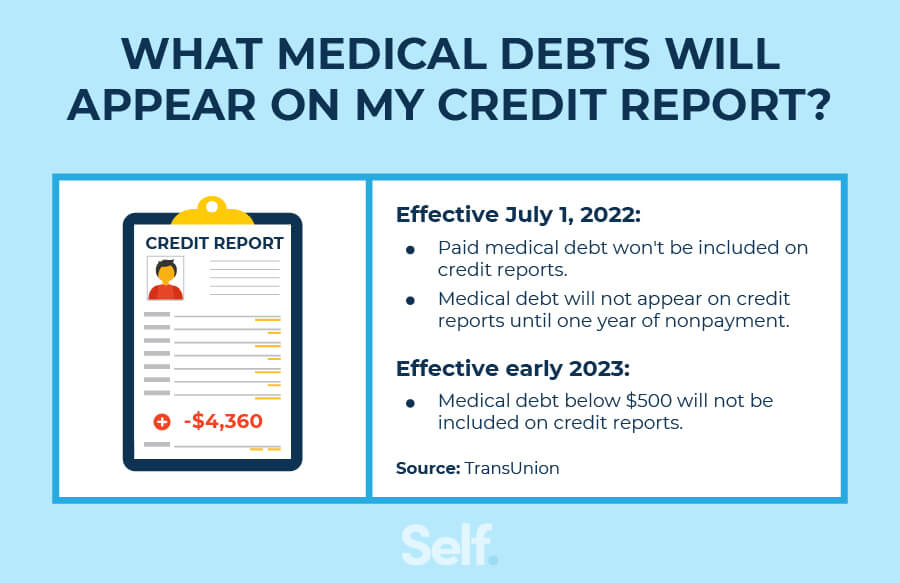

Effective July 1, 2022, unpaid medical debts have a collections waiting period of one year. Specifically, medical debt collection will show on one’s credit report after one year of nonpayment, up from six months. Additionally, starting in the first half of 2023, no medical debt below $500 will appear on credit reports.[1]

To better help consumers focus on personal health, paid medical debts will no longer appear on credit reports starting July 1. This article helps you better understand the changes and how medical debt impacts your credit report.

Table of contents

- What medical debt appears on your credit report?

- How medical debts can impact your credit

- When is medical debt reported?

- How long will medical debt remain on your credit report?

- How to dispute medical debts

- Prevent medical debt from impacting your credit

What medical debt appears on your credit report?

With these changes, medical debt once in collections but now paid in full will disappear from consumer credit reports. It will also now take twelve months in collections (up from six months) for an unpaid medical bill to appear on a credit report, but these debts must be more than $500 to even appear on the report.[2]

How medical debts can impact your credit

Until the new changes go into effect on July 1, unpaid and paid medical bills can impact one’s credit. Unpaid or past-due bills act like any other outstanding types of debt or debt in collections. Under the existing guidelines, accounts in collections but eventually paid could remain on a credit report for up to seven years.[3]

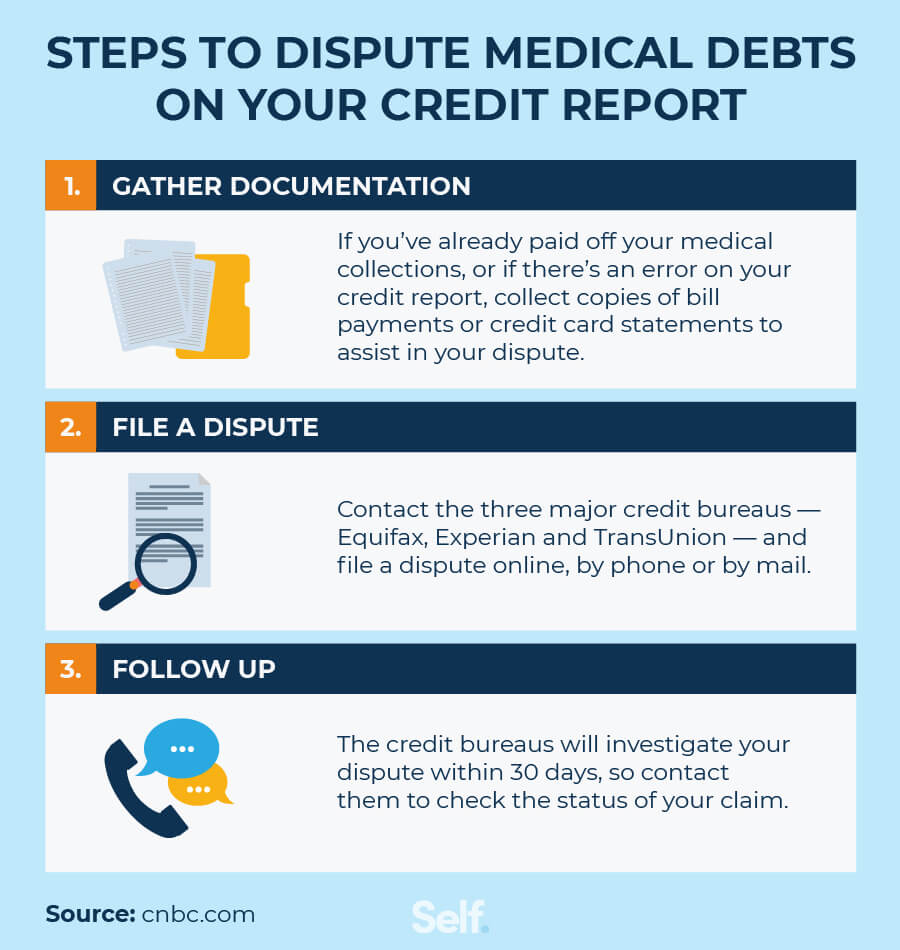

Currently, the process to remove already-paid medical debt involves multiple steps. The customer must file a dispute with the three major credit reporting agencies and the debt collector.[4]

After July 1st, the three major credit bureaus will eliminate those paid debts from credit reports. By the first half of 2023, credit reporting agencies will no longer report medical debt in collections that are under $500.[5]

Paid medical debt does not impact your credit score

With the new changes coming in July 2022, the three major credit bureaus will no longer include paid medical collection accounts on credit reports. This step will eliminate almost 70% of all medical collection debt accounts.[5]

When is medical debt reported?

Presently, unpaid medical debts report to the credit bureaus six months after a debt collector purchases the account.[6] However, with the new rules, medical debts in collection below $500 won’t be reported on your credit report, and people will have a full year grace period to pay off medical debts before the account goes to a debt collector.

These new rules can help ease the burden of medical bills, giving you more time to pay so that such debts avoid collections and won’t negatively impact your credit score.

How long will medical debt remain on your credit report?

Unpaid accounts will remain on your credit report for for seven years, but the time won't start until a year after the account goes to collections.[6]

If paid medical debt is currently hindering your credit, contact the three major credit bureaus. Send a letter through certified mail to dispute the inaccurate medical debts. Before the new rule guidelines begin in July, this process requires proper documentation and execution.[3]

How to dispute medical debts

You should dispute already-paid accounts and other inaccurate medical debts. Do so using the following steps[7]:

Gather documentation: Collect copies of proof of bill payments from your medical provider or credit card statements that backup your request. Circle or highlight the items in question to assist the investigation.

File a dispute: Equifax, Experian, and TransUnion allow dispute filing online, by phone or by mail. Explain your situation and request that the offending items be fixed or removed.

Follow up: As long as the dispute request isn’t deemed frivolous, the credit bureaus must investigate your claims within 30 days.[5] Following up can help determine what stage the investigation is at and allow you to provide additional information that can help your case.

Prevent medical debt from impacting your credit

Accurate medical debts must be paid, even after the upcoming rule changes, but you can find many ways to get out of debt. From paying your debt down to negotiating with your health insurance company, you can try one of the following options to help prevent medical debt from impacting your credit.[8]

Pay down your debt: Beginning in the first half of 2023, medical debt under $500 will no longer appear on your credit reports.

Negotiate your bills: Discuss your situation with your healthcare provider. Nonprofit hospitals must have financial assistance policies in place. These policies help those unable to pay their medical bills, such as payment plans, bill reduction or even forgiveness.

Follow up with insurance: After receiving a medical bill, you can follow up with your health insurance company. Verify the bill amount, and ask for an itemized bill to ensure an accurate bill amount.

For many, the new changes announced by the credit bureaus bring welcome news. Many individuals suffering from medical debt burdens can finally find relief. With those burdens removed, people can begin building their credit to achieve their goals.

Sources

- TransUnion. “Equifax, Experian, and TransUnion Support U.S. Consumers With Changes to Medical Collection Debt Reporting,” https://newsroom.transunion.com/equifax-experian-and-transunion-support-us-consumers-with-changes-to-medical-collection-debt-reporting/. Accessed on April 20, 2022.

- CNBC. “Your medical debt may no longer hurt your credit score — here's why,” https://www.cnbc.com/select/medical-debt-credit-report/. Accessed on April 20, 2022.

- CNBC. “Most medical debt will be wiped from consumer credit reports,” https://www.cnbc.com/2022/03/19/most-medical-debt-will-be-wiped-from-consumer-credit-reports.html. Accessed on April 20, 2022.

- Experian. “How Does Medical Debt Affect Your Credit Score?” https://www.experian.com/blogs/ask-experian/medical-debt-and-your-credit-score/. Accessed on April 20, 2022.

- CNBC. “Most medical debt is coming off credit reports. Here's what to do if yours doesn't,” https://www.cnbc.com/2022/03/28/most-medical-debt-to-come-off-credit-reports-what-to-do-if-it-doesnt.html. Accessed on April 20, 2022.

- Equifax. “Can Medical Collection Debt Impact Credit Scores?“ https://www.equifax.com/personal/education/debt-management/unpaid-medical-debt-credit-reports/. Accessed on April 20, 2022.

- Consumer Financial Protection Bureau. “How do I dispute an error on my credit report?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-an-error-on-my-credit-report-en-314/. Accessed on April 20, 2022.

- NPR. “Getting Out Of Medical Debt Can Feel Impossible. Here's How To Do It,” https://www.npr.org/2019/02/14/694670747/rx-for-medical-debt. Accessed on April 20, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).