17 Money Affirmations to Bring Financial Positivity to Your Life

Published on: 04/05/2024

You could unlock the secret to financial empowerment with 17 money affirmations, designed to reshape your relationship with wealth and success. As you focus on taking care of your financial self, try to picture a future where you have more than enough of what you need... more than enough money, more than enough savings, more than enough to buy your dream home, meet other financial goals, or whatever that might look like for you.

Sound impossible? This “more than enough” is exactly what abundance affirmations can help you focus on – setting a vision for your financial life you can then turn into actionable financial goals.

In this post with abundance affirmations in mind, I’ll walk you through:

- The Law of Attraction (and why you should know about it if you’re trying to turn your money situation around)

- Why your mindset towards money matters

- How you could transform your financial life from lack to abundance using wealth affirmations

- A real-life example of how abundance affirmations worked for me

- 17 money affirmations you can use to get out of your own way and change your relationship with your finances

But first...

What’s the Law of Attraction and why should you care?

The Law of Attraction is the idea that you attract into your life what you focus on, per Jack Canfield.

Yes, there are exceptions to this. There are certain terrible things that just happen. There are certain systemic challenges that make it harder.

But the idea at its core is to focus on what you want for your future. And that includes what you want for your finances.

In finance this law could translate to a concept that basically says you have to be able to envision the life you want your money situation to support before you can set goals to achieve it. Wealth affirmations play a crucial role in this process, serving as a powerful tool to help you clearly visualize and manifest the prosperous life you aspire to create through your financial goals.

For example:

In a world without any obstacles, what would your life look like, money-wise?

Once you ask yourself this life-free-from-your-own-limitations question, you can break that dream down into goals.

Then break those goals down into steps.

Then create an action plan, based on those steps, and follow along to try to obtain the life you want.

Why your mindset towards money and abundance affirmations matters

This is where I inevitably hit a snag with people. They struggle to even dream about a hopeful turnaround for their future financial situation because they’re so caught up in the bad things that are going on right now. And the belief that they don’t deserve any better.

They get so caught up on what their mind tells them about money, their belief that they aren’t capable prevents them from even trying. But as you’ll see in the next section, believing you can is a critical piece of the puzzle and this is where abundance affirmations play a crucial role.

I know from personal experience, which I’ll share in just a minute.

How you could turn your money situation around by using abundance affirmations

Here’s a basic outline of how you could turn your money situation around, based on what I’ve witnessed in my own life and my practice:

- Have hope that you can do it.

- Want to do it.

- Believe you can do it.

- Find money management resources and tools that can help you do it.

- Recruit people to hold you accountable and support you through it.

Of course, feel free to adjust it however you need to to fit your life.

For now, let’s focus on #3. Chances are, if you’re reading this, you’ve already taken care of numbers 1 and 2 (hoping and wanting to make a change) on your own – so congrats!

Now here’s an example of how this played out in my life.

How money affirmations worked for me

Just a few years ago, I was drowning in medical debt and side-hustling like nobody’s business to try and make ends meet.

I guess you could call me a typical millennial.

These affirmations gave me the motivation to overcome my money obstacles and discover new sources of income . Now I have a financial safety net, money to travel when and where I want, have purchased my own home, and have zero medical debt (I paid it off!). Through the affirmation of money coupled with hard work and consistent focus on my finances, I've been able to maintain this secure financial state, reinforcing my belief in abundance and my ability to achieve and sustain it.

I now get to turn my hard-earned battles with money into information to help you learn from my mistakes.

How did I do it? I started with changing my mindset.

Before, I thought I was destined to…

- Always be broke

- Never have enough

- Live paycheck-to-paycheck

- Never retire

Then one day I decided that wasn’t the life I wanted, so I was going to figure something else out.

I started by hoping it was possible because I’d seen others do it, then wanting it to be possible for me, then finally believing it was possible to the point where I could take a chance to make it so.

Then I started acting on that belief and finding the resources, information, and people who could help me achieve my financial goals and live the financial life I wanted.

I don’t say this to brag, but to share my life as proof about how shifting your attitude towards money, then taking the steps to follow through and change money habits, can completely change your financial life.

While it may sound deceptively simple, changing your decades-long, deeply ingrained attitudes and beliefs about money takes practice. Sometimes you really do have to “fake it ‘til you make it.”

That’s where wealth affirmations come into play. To experience a quick shift in your financial mindset, try these money affirmations that could work, paving the way for positive changes in your attitude towards wealth.

Here are 17 money affirmations you can use to shift your mindset and set your thoughts toward improving your financial health.

17 money affirmations that could attract financial abundance

Changing or breaking old habits takes daily practice. Affirmation to manifest money requires a consistent blend of positive thinking and proactive steps, steadily transforming your mindset and actions toward attracting financial abundance.

So if you’re truly committed to changing your money mindset, pick a few of your favorite wealth affirmations from this list and try to practice them daily.

17 money affirmations

- I experience wealth as a key part of my life.

- I am capable of overcoming any money-obstacles that stand in my way.

- I can conquer my money goals.

- Today I commit to living my financial dreams.

- I want more money. And that's okay.

- It's easy and natural for me to be prosperous and successful.

- My life is filled with health and wealth.

- Abundance is coming, I deserve and accept it.

- I accept and receive unexpected money.

- I accept and receive unexpected prosperity.

- I have more than enough money.

- I deserve to make more money.

- I am always discovering new sources of income.

- Money comes my way in both expected and unexpected ways.

- I am open to receiving all wealth life brings to me.

- I’m not poor, I'm just low wealth right now. That is changing.

- I’m getting out of my own way when it comes to money.

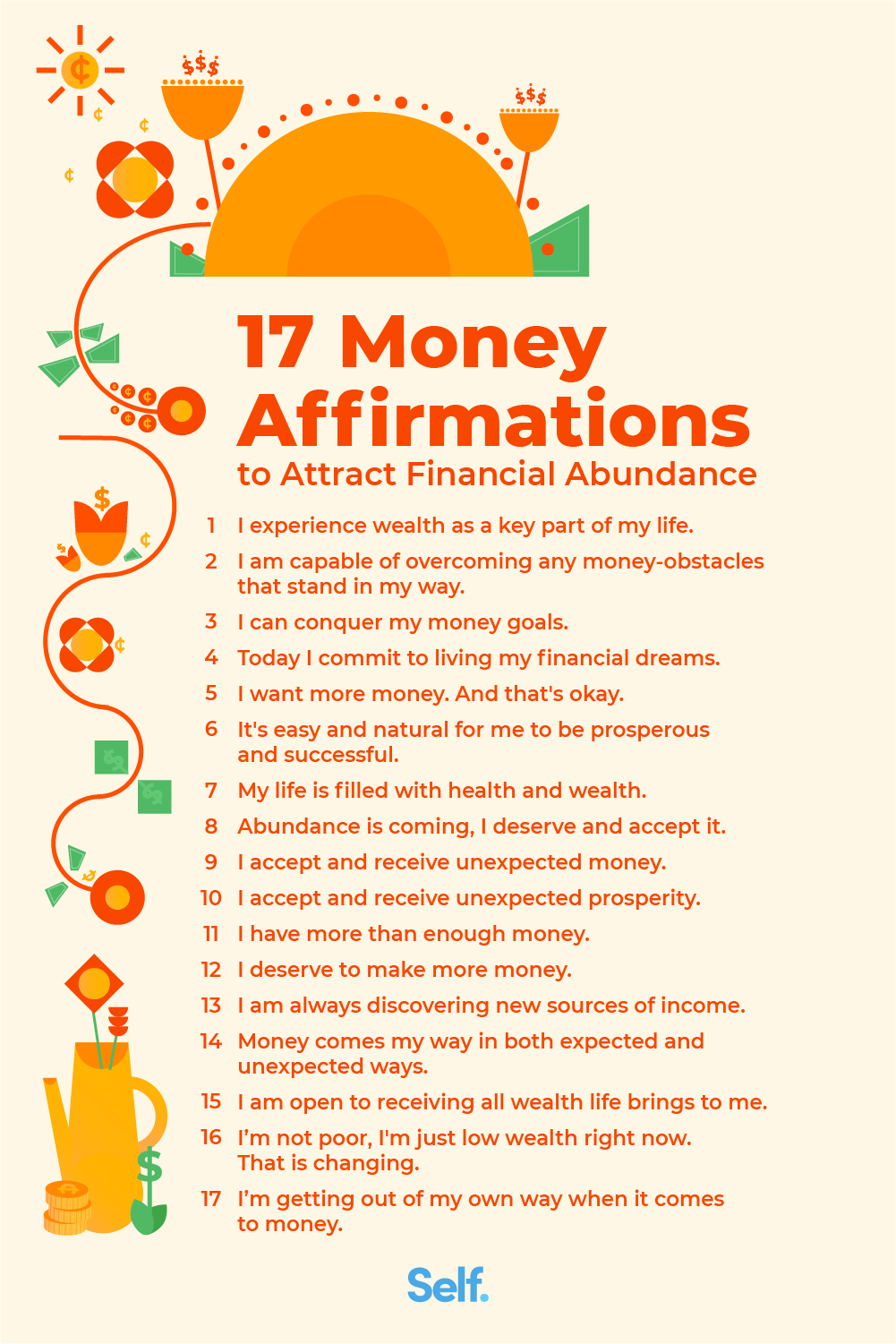

In case you want to put them on a Pinterest board, or print them off and keep them handy somewhere, here are those affirmations in visual form:

About the author

Lauren Bringle is an Accredited Financial Counselor®. Self is a financial technology company with a mission to help people build credit and savings.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).