Secured vs. Unsecured Credit Cards: The Key Differences

Published on: 08/18/2025

The main difference between secured and unsecured credit cards lies in the initial setup — secured credit cards require that you make a security deposit to qualify for the credit card while unsecured credit cards do not. Both types of cards have benefits and drawbacks, and choosing the right one depends on your unique financial situation and credit history. This post walks you through the difference between secured and unsecured credit cards as well as how secured credit cards work to help you make the right choice for your personal finances.

Table of Contents

- What is a secured credit card?

- What is an unsecured credit card?

- What’s the difference between secured and unsecured credit cards?

- How to apply for a secured credit card

- How to apply for an unsecured credit card

- How to build credit with credit cards

- What type of credit card is better for you?

What is a secured credit card?

Secured credit cards, like secured loans, require you to put up collateral when you open the account. With a secured credit card, you make a refundable security deposit with the issuing bank or financial institution. Your deposit often equals the credit limit on the account — for example, a $500 security deposit gets you a $500 credit limit. After a certain period of time, some card issuers may give you the option of increasing your credit limit by adding to your original deposit or when you make a specific number of on-time payments.[1]

Because the deposit reduces the financial institution’s risk, you may find it easier to qualify for a secured credit card even if you have bad credit or a limited credit history. For that reason, secured cards make a good option for people looking to establish credit.

Note that secured credit cards are different from prepaid cards. Although both require a deposit before you can use them, prepaid cards do not trigger a credit check and do not affect your credit score in any way. This means you cannot use a prepaid card to build credit. On the other hand, the issuer of your secured card will report the payments you make — whether they be on time, late or not all — which may impact your credit.[2]

Pros and cons of secured credit cards

Secured credit cards have both advantages and disadvantages when compared with other types of cards.

Pros:

- Good for starting to build credit: Users with no credit history or poor or average credit may find it easier to qualify for a secured credit card than a typical unsecured credit card. And unlike prepaid cards, secured credit card issuers generally report your payment activity to the three major credit bureaus Experian, TransUnion and Equifax, which can make them a great option to start building credit.

- May encourage on-time payments: Because you put up your own money as a deposit for a secured credit card, this may offer an incentive to make on-time payments so that you avoid forfeiting your deposit.

- Can be obtained with bad credit: Because secured credit cards are backed by a deposit, banks may see them as less risky, making them a possible option for borrowers with poor credit.

- May not trigger a hard credit inquiry: Some secured cards, such as the such as the secured Self credit card, don’t result in hard credit pulls. Customers must meet eligibility requirements to open a secured credit card account, so be sure to understand those requirements prior to applying.

[2]

Cons:

- Security deposit required to open: Unlike unsecured credit cards, secured credit cards require that you make a security deposit prior to using the card.

- Potential fees: Secured credit cards may charge annual fees, application fees and late fees if you don’t make payments on time.

- Higher APR: A secured credit card may charge you a higher APR than you might see on typical unsecured credit cards.

[1]

What is an unsecured credit card?

Unsecured credit cards do not require a deposit when you open the account. The card issuer sets a maximum credit limit to which you can borrow up to without asking you to put up any collateral on your end. Instead, the bank runs a credit check and uses data about your credit score, credit history, income and other financial factors to approve or deny your application, as well as to decide your credit limit and other terms.[1]

Pros and cons of unsecured credit cards

While considered the standard credit card, unsecured cards come with both pros and cons of their own.

Pros:

- Potential reward offers: Unsecured credit cards may offer a number of useful reward programs to cardholders, including airline miles, cash back and bonus points.[3]

- Can have higher credit limits: Unsecured cards don’t require you to make a security deposit and your creditworthiness determines your credit limit, so you may qualify for a higher credit limit than you would on a secured card.[1]

Cons:

- May be difficult to qualify for: Because approval for unsecured cards depends on your credit score, credit history and other financial information, individuals with poor or no credit history may not qualify.[1]

- May result in faster debt accumulation: With a higher credit limit and access to new funds, you can dig yourself into a financial hole unless you use your unsecured card responsibly.

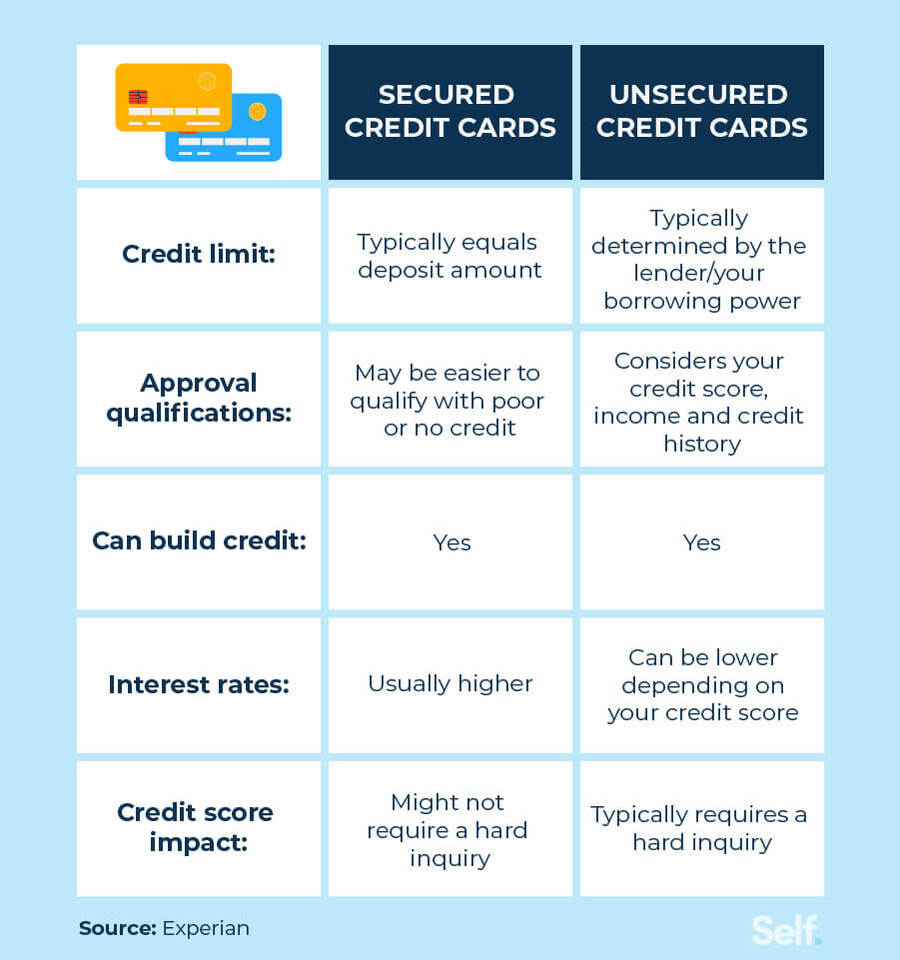

What’s the difference between secured and unsecured credit cards?

While secured and unsecured credit cards share similarities, several differences distinguish them:

- Security deposit requirements: The key feature of a secured credit card is that it requires a security deposit before use. Unsecured cards have no such requirement.

- Credit score requirements: For unsecured credit cards, your credit score helps determine approval, credit limits and other financial terms. Those with low credit scores may find it easier to qualify for secured credit cards.

- APR and interest: Traditional, unsecured credit cards tend to have a range of rates, offering the lower interest rates to those with excellent credit scores and those who qualify with lower scores tend to get the higher interest rates. On the other hand, secured cards generally have just one high rate. If your APR is high, you may find it useful to learn more about how to lower your credit card interest rate.

- Credit limit: Credit limits for unsecured credit cards depend on a number of financial factors including credit score, credit history and income. Secured credit cards generally have a credit limit equal to the initial security deposit, but some issuers may increase that limit if you add to your deposit or make a certain number of on-time payments.

[1]

How to apply for a secured credit card

Not all lenders have the same application requirements. So, you may want to check with a credit card company to learn its specific approval criteria before submitting an application for a new card. However, you usually need to satisfy three common requirements to qualify for a secured credit card:

- Provide proof of your identity: You typically must verify your name, address, Social Security number and date of birth.

- Have no bankruptcies listed on your credit report: If you have a long history of late or missing payments, delinquent accounts and/or bankruptcy, a prospective lender will have a harder time taking a chance that you’ll be a reliable borrower.

- Come up with the deposit: Because secured credit cards require an initial deposit, you need that deposit to begin using it.

[4]

If you’re concerned that your credit score or credit history may be a barrier to obtaining a secured card, then consider cards that don’t perform a hard inquiry.

Do I get my deposit back from a secured credit card?

When you provide a secured credit card with a security deposit, you generally get your money back when you close the account or convert to an unsecured credit card. However, if you default on the account by failing to make payments, the card issuer may keep your deposit and use it to satisfy your debt. Remember: The deposit serves as collateral, so don’t rely on it to pay your monthly payments if you fall behind. Otherwise, you may risk losing your deposit and having your credit card account closed.[1]

How to apply for an unsecured credit card

You can apply for many unsecured credit cards online. However, unsecured credit cards tend to have stricter approval criteria. Again, every lender sets its own terms and conditions, but many unsecured options require excellent credit or a good credit score. While you may qualify for some unsecured cards with fair credit or even no credit at all, these products may feature less attractive terms and APRs.[1]

How to build credit with credit cards

While secured and unsecured credit cards differ in important ways, both can help you build credit when used responsibly. If you have bad credit, a secured credit card can also help with rebuilding credit.

Make on time payments

If you want to use a secured card to build credit, making on-time monthly payments is essential. Late payments on any credit card can damage your credit score because it affects your payment history. In the case of secured cards, you may also lose your security deposit.[1]

Keep your credit utilization rate low

Credit utilization calculates how much of your credit limit you are using at any given time. For good credit health, you should look to keep that percentage below 30%. Because of the low limits characteristic of secured credit cards, you’ll need to pay careful attention not to go above that percentage. For example, if your credit limit is $300, spending more than $90 will cause you to go over the recommended credit utilization ratio.[1]

Pay your balance in full when possible

Whenever you carry a balance on a credit card — either secured or unsecured – you will likely have to pay an interest charge. It will also increase your credit utilization rate. For that reason, paying off your full balance every month makes good financial sense. Whether you're looking to build credit or get out of debt, budgets play an important role in financial health. Decide how much you can afford to pay off by the due date, and then limit yourself to spending that amount during the month.[1]

Keep close tabs on your credit score

No matter what kind of credit you have, staying on top of your credit score is always a good idea. Some credit cards offer free credit monitoring services. You can also check your credit score for free every week by going to annualcreditreport.com.

What type of credit card is better for you?

The ideal credit card depends on your specific financial situation, so you may want to consider the following factors when making your decision.

A secured credit card may be your best option if:

- You have no credit or bad credit. Since lenders tend to see secured credit cards as less risky, those with no credit or bad credit may find it easier to qualify.[1]

- You want to build credit. If you’re trying to qualify for your first credit card or rebounding from financial hardship, a secured card may be your best bet.[1]

- You need to keep spending low. If you don’t want to be tempted by a high credit limit, secured credit cards make it easier to keep your spending in check.

An unsecured credit card may be your best option if:

- You can’t afford to put down a cash deposit. If you simply don’t have the money to make the initial deposit but can still qualify for credit, you might look at an unsecured card. Just make sure you can afford to make monthly payments once you start using the card.[1]

- You want a higher credit limit. Unsecured credit cards often come with higher credit limits than secured cards.[1]

- You want specific reward perks. Unsecured credit cards tend to have more reward options, so you may opt for those if you want miles on a specific airline or points at a specific hotel.[3]

Choose a credit card that works for your financial needs

No single type of credit card is best for everyone, so make your choice by taking a look at your financial situation, credit history and overall creditworthiness. While unsecured credit cards tend to be the go-to option for people who qualify, secured credit cards can help people who need to rebuild or establish credit. You may also want to consider a credit builder account that both helps you better your credit as well as offers a path to potentially obtain a secured credit card in the future.

Sources

- CNBC. “Everything you need to know about getting a secured credit card.” https://www.cnbc.com/select/how-secured-cards-work/

- Experian. “What’s the Difference Between Secured and Prepaid Cards?” https://www.experian.com/blogs/ask-experian/secured-card-or-prepaid-card-which-credit-card-is-best-for-you/

- Bankrate. “What’s the difference between secured and unsecured credit cards?”

https://www.bankrate.com/credit-cards/building-credit/secured-vs-unsecured-credit-cards/#vs - CNBC. “What to do if you’re denied a secured credit card,” https://www.cnbc.com/select/denied-secured-credit-card/

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).