Secured Loans vs. Unsecured Loans: Key Differences & Benefits

Published on: 01/07/2026

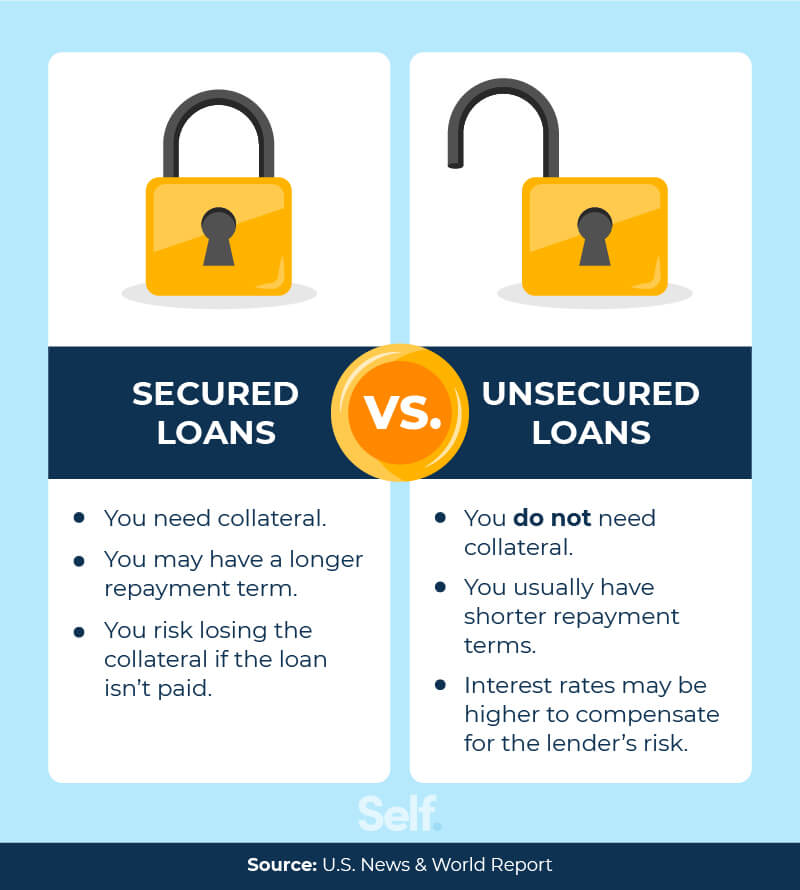

A secured loan uses an asset as collateral, while an unsecured loan does not. Choosing between the two types of loans means understanding the details and weighing the benefits of each to see which credit option works best for you.

This post takes you through the differences and benefits of both secured and unsecured loans so that you can choose the right credit option that meets your financial needs. We also help you understand how best to use these loans and provide tips for repayment.

Key points

- Secured loans require collateral, such as a home or a car, whereas unsecured loans do not.

- Examples of secured loans include mortgages, auto loans, and secured credit cards. Examples of unsecured loans include credit cards, student loans, and personal loans.

- Secured loans may offer lower interest rates and higher borrowing limits, but they put assets at risk if you default, whereas unsecured loans avoid collateral but often come with stricter approval requirements and higher costs.

Table of contents

- What is a secured loan?

- What is an unsecured loan?

- What’s the difference between secured and unsecured loans?

- What to know before taking out a loan

- Tips for faster loan repayment

What is a secured loan?

With a secured loan, you offer the lender an asset you own — such as a home or car — as collateral in case you cannot pay back the loan.[1]

Examples of secured loans

A number of financing options require collateral, including the following common secured loan examples:

- Mortgage loan: When you use a mortgage loan to buy a home, the home serves as collateral. If you fail to make your mortgage payments on time, the lender can begin the foreclosure process to take legal possession of your home.

- Home equity loan: Consumers typically take out home equity loans to pay for major expenses such as medical bills, education or home improvement. Another type of mortgage loan, a home equity line of credit also requires that you pledge your home as collateral.

- Installment loans: Installment loans — such as car loans — require you to pay back the amount you borrowed in a certain number of scheduled payments. In the case of an auto loan, the vehicle is the collateral.[2]

Advantages and disadvantages of secured loans

Because lenders often see borrowers of secured loans as less risky to lend to, secured loans may have less strict qualifications.

Here are the pros and cons of a secured loan:

Advantages:

- Easier approval: Lenders generally consider secured loans as less risky. You may also be approved with a lower credit score than you would for an unsecured loan.

- Higher borrowing limits: Because you’ve backed your loan with an asset, lenders may be willing to let you borrow more money.

- Lower interest rates: Interest rates on secured loans tend to be lower than on unsecured loans.

- Tax deductions: Some types of secured loans (such as mortgages) offer borrowers tax-deductible interest payments.[1] [3]

Disadvantages:

- Higher borrower risk: The principal risk of secured loans is a big one — if you default on the loan, you could lose your home, car or other collateral.

- Only for specific purposes: Typically, you can only use the amount borrowed to purchase a specific asset (such as a car or home), which is then used as collateral to secure the loan.[1] [3]

What is an unsecured loan?

An unsecured loan doesn’t require you to pledge any assets to borrow money. Instead of relying on collateral, unsecured loans depend on the creditworthiness of the borrower. Borrowers typically need to have good credit to receive approval for an unsecured loan.[4]

Examples of unsecured loans

Common types of unsecured loans not backed by collateral include the following:

- Credit cards: Credit cards allow you to spend money now, with the promise to pay it back later. Interest rates, fees, finance charges and benefits vary by credit card company and by cardholder.

- Student loans: Students and parents can finance education costs by borrowing money from the state and federal governments, universities and various agencies. Although these loans must be repaid with interest, they tend to have lower rates than typical consumer loans.

- Unsecured personal loans: People use unsecured personal loans to pay off credit card debt, pay for unexpected tax bills or afford big-ticket items like a wedding. Personal loan offers may come from a variety of sources, including credit unions, banks, online lenders or peer-to-peer (P2P) platforms.[2] [4] [5]

Advantages and disadvantages of unsecured loans

Because lenders see unsecured loans as riskier than secured loans, this type of loan can have several disadvantages. Consider the following pros and cons when evaluating an unsecured loan.

Advantages:

- Less risk for borrowers: Although defaulting on an unsecured loan can negatively impact your credit score, the loan isn’t tied to any specific collateral.

- No collateral required: You can qualify for an unsecured loan even if you don’t have any assets to back the loan.

- Quicker application process: Because you only need to provide basic financial information and credit history when applying, lenders can approve unsecured loans more quickly.[1] [5]

Disadvantages:

- Higher interest rates: Since lenders can’t seize your financial assets if you default on an unsecured loan, they may charge higher interest rates.

- Lower loan amounts: The higher risk of unsecured loans generally results in lower permitted loan amounts.

- Stricter qualifications: You may need a higher credit score and better financial stability to receive approval for an unsecured loan.[1] [5]

What’s the difference between secured and unsecured loans?

When considering financing options for that next big expense, you may notice both secured and unsecured loans. While these two loan types share similarities, they also differ in important ways. Knowing the key differences between unsecured and secured loans can help you choose the best credit options for your financial situation.

Similarities of secured and unsecured loans

- Allows borrowers to make larger purchases: Whether secured or unsecured, all loans help you to pay for something you can’t (or prefer not to) purchase in cash.

- Accumulates interest and fees: While the specific rates and terms may vary, just about any type of loan requires you to pay interest and other fees.

- Presents risks to borrowers: Anytime you borrow money — backed by collateral or not — you risk damaging your credit score if you make late payments or default on the loan.[1] [6]

Differences between secured and unsecured loans

- Different approval requirements: Borrowers taking out a secured loan may find the requirements more forgiving than for unsecured loans. For example, lenders might permit a higher debt-to-income ratio for a secured loan.

- Speed of application process: While a home equity line of credit may take weeks to process, an unsecured credit card approval could take minutes.

- Different loan amounts: Since you pledge collateral with a secured loan, lenders may feel more comfortable letting you borrow larger amounts.

- Interest rates and terms: Secured loans generally have lower rates and more favorable terms than unsecured loans because lenders may seize your assets if you fail to pay.

- Borrower risk differences: While making late payments on any type of loan can drop your credit score, defaulting on a secured loan could also cost you your house or car.

- Repayment times: Although the application process for an unsecured loan may be quicker, you typically have less time for repayment than with a secured loan.[1] [6]

What to know before taking out a loan

Loans can play an important role in successful financial plans. On the other hand, they can also negatively affect your credit score and financial health if not managed correctly. Before taking out a loan, consider the following steps to help decide if a loan makes sense for you:

- Evaluate your credit score: Before applying for loans, see if you have a high enough credit score to qualify. Many lenders look for applicants with good credit, but your bank or local credit union might work with you even if your credit report isn’t perfect. (If you have no credit history at all, check out our tips for how to get credit.)

- Research repayment terms: Find out when you have to start making payments and how long you have to pay back the loan.

- Check out interest rates and other fees: Interest rates often depend on your credit score and the length of the loan. Some personal loans may charge a percentage of the loan amount upfront, called an origination or sign-up fee, but most will only charge you interest.

- Know what your monthly payment will be: Since even one missed payment can damage your credit history, carefully consider how much you can afford each month.

- Consider other options: If you need less than $500, it may be better to save that amount on your own or borrow it from friends or family. If you’re trying to pay off debt, you may look into a 0% APR credit card that offers balance transfers rather than applying for a personal loan.[7]

Tips for faster loan repayment

If you’ve already taken out an unsecured or secured loan, you may be looking for ways to pay off your loans early. While the right moves for you depend on your specific financial situation, consider the following tips for faster loan repayment:

- Pay more than your minimum amount: The longer you make only the minimum payment each month, the longer you may be in debt. Consider paying a little extra when you can, or even rounding up your monthly payment to the nearest $10 or $50 (for example, paying $300 instead of $257).

- Make payments every two weeks (or one extra a year): If you split your monthly auto, mortgage or credit card payment into two biweekly payments, you’ll end up with an extra payment per year (26 biweekly payments make 13 monthly payments) as long as your two payments fall within your due date so that you’re not late. Or to avoid the hassle of pg twice a month, budget an extra monthly payment into your year. Tax refunds and work bonuses may provide opportunities to find that extra payment.

- Research loan forgiveness and repayment programs: If you have a federal student loan and meet certain criteria, you may qualify for loan forgiveness or special repayment plans. Ask around at work too: some employers offer assistance programs for employees carrying student loans.

- Refinance your loan: If your credit score or financial situation has improved since you took out your vehicle loan, you may get a lower interest rate if you refinance. Similarly, you could save money by refinancing your home loan when interest rates drop or by selecting a shorter term. But do keep your financial goals in mind when refinancing: a shorter mortgage term will likely result in higher monthly payments, whereas a lower monthly car payment could cause you to go upside-down (meaning you owe more than your car is worth).[8] [9] [10]

Raise your credit score before applying for loans

Borrowers with bad credit or a limited credit history may find it easier to take out a secured loan than an unsecured loan. However, building your credit and potentially raising your credit score may help you to obtain a loan of any type — especially one with lower interest rates and more favorable terms. You may also improve your credit by taking out a credit builder loan at a bank, credit union or through Self.

Sources

- Experian. “Secured vs. Unsecured Loans: What You Should Know” https://www.experian.com/blogs/ask-experian/secured-vs-unsecured-loans-what-you-should-know/. Accessed September 23, 2022.

- MyCreditUnion.gov. “Personal Loans: Secured vs. Unsecured,” https://www.mycreditunion.gov/life-events/consumer-loans/secured-unsecured. Accessed on May 30, 2022.

- Forbes. “Secured Loan: What It Is, How It Works, & How To Get One,” https://www.forbes.com/advisor/personal-loans/what-is-a-secured-loan/. Accessed on May 30, 2022.

- Investopedia. “Unsecured Loan,” https://www.investopedia.com/terms/u/unsecuredloan.asp. Accessed on May 30, 2022.

- SoFi. “A Guide to Unsecured Personal Loans,” https://www.sofi.com/learn/content/guide-unsecured-personal-loans/. Accessed on September 3, 2025.

- U.S. News & World Report. “Secured vs. Unsecured Loans: What's the Difference?” https://money.usnews.com/loans/articles/secured-vs-unsecured-loans-whats-the-difference. Accessed on May 30, 2022.

- CNBC.com. “10 questions to ask before you take out a personal loan,” https://www.cnbc.com/select/questions-before-taking-out-personal-loan/. Accessed on May 30, 2022.

- U.S. News & World Report. “How to Pay Off Your Mortgage Faster,” https://money.usnews.com/loans/mortgages/articles/how-to-pay-off-your-mortgage-faster. Accessed on May 30, 2022.

- Federal Student Aid. “5 Ways to Pay Off Your Student Loans Faster,” https://studentaid.gov/articles/pay-off-student-loans-faster/. Accessed on May 30, 2022.

- PNC. “What Does It Mean to Have an Upside Down Car Loan?” https://www.pnc.com/insights/personal-finance/borrow/upside-down-car-loan.html. Accessed on September 3, 2025.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).