Do Tax Liens Impact Your Credit & How to Fix A Public Record

Published on: 12/01/2025

When you fail to pay off federal or state tax debts, you may incur a tax lien from either the IRS or state government. A tax lien gives the government a legal claim to your assets.

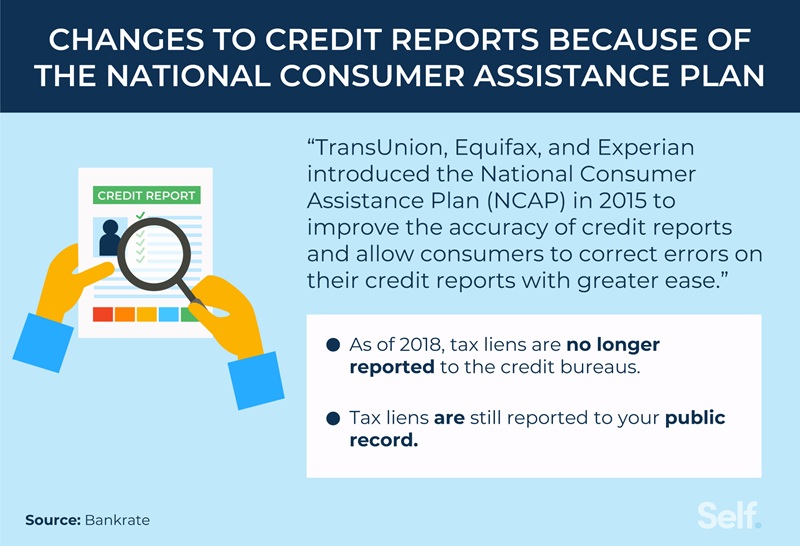

While the major credit bureaus stopped including tax liens and other civil judgments on credit reports in 2018, the government files a tax lien as a matter of public record.[1][2] Because tax liens don’t appear on credit reports, they also do not impact your credit score. This post guides you through how to clear the public record and explains how tax liens impact you.

Key points

- Tax liens no longer appear on credit reports. Since April 2018, the three major credit bureaus have stopped including tax liens on credit reports as part of the National Consumer Assistance Plan, meaning they don't directly impact your credit score.

- Tax liens remain public records and can still affect you. While not on credit reports, tax liens are filed publicly and can be found by lenders, which may hurt your chances of getting loans, credit cards, or refinancing your mortgage. They can attach to all your assets and don't discharge in bankruptcy.

- The IRS has 10 years to collect tax debt. The collection statute expires 10 years after assessment, but you can resolve a tax lien by paying in full or setting up a payment plan.

What is a tax lien?

If you have an unpaid tax bill or owe back taxes to the government, you could have a tax lien against your property, including financial and real estate assets.[2]

When you don’t pay your taxes, the IRS or state government sends you a bill demanding payment for your tax debt. If you don’t submit payment, interest may begin to accrue on your debt. [2]

If you don’t pay the debt in time, the IRS files a Notice of Federal Tax Lien. Although not part of your credit history, this public document alerts creditors that you have a lien against your property, which can serve as a red flag against them lending you money.[2]

Tax liens no longer appear on credit reports

In 2015, the three major credit bureaus (also known as credit reporting agencies) — Experian, Equifax and TransUnion — introduced the National Consumer Assistance Plan (NCAP).

As part of the NCAP, the credit bureaus decided to stop reporting tax liens and to begin removing tax liens from credit reports beginning in April 2018.[1]

Tax liens don’t impact your credit score

While tax liens don’t impact your credit score, they are a matter of public record, meaning employers, landlords, and lenders can still choose to review them. A lender may search for tax liens as part of its due diligence when evaluating your credit or loan application. So while your tax lien won’t impact your score, it may be a factor in whether you get offered a job, apartment, or loan. Someone with unpaid taxes on their record might be viewed less favorably than someone who is up to date on their taxes. [1]

How tax liens negatively impact you

Tax liens can have a number of adverse consequences, including affecting your assets and your ability to get credit:[3]

- Attaches to all assets: A federal tax lien covers your financial assets and everything you own, including anything you might acquire while the lien remains in effect.

- Limits your ability to apply for credit and/or loans: Because an IRS lien is a matter of public record, potential lenders can see it, and could consider it when deciding whether to lend to you. [1]

- Affects business property: An IRS lien doesn’t just affect a taxpayer’s personal property, but business property, too, including accounts receivable.

- Doesn’t discharge in bankruptcy: If you file for bankruptcy, your tax debt, lien, and Notice of Federal Tax Lien might still continue afterwards.

How do I find out if I have a tax lien against me?

If you want to know whether you have a tax lien against you, you can contact the IRS or your state or county’s local recorder’s office. Some states have centralized tax lien registries, but others are recorded at the county level, so this process might vary depending on where you live and where the lien is recorded. [4]

Statutes of limitations on tax liens

A federal tax lien begins as soon as the IRS makes the assessment, which is triggered by the IRS sending a first notice. This notice demands payment for outstanding tax debts and will result in a tax lien if the debts are not paid in full in response.

The IRS generally gets 10 years after the assessment to collect the tax liability. After the CSED has been reached, the lien becomes unenforceable, with a couple of exceptions.[5]

Federal tax lien vs. state tax lien

In addition to a federal tax lien, you may face a state tax lien against your property. Both federal and state governments can put a lien on your property over failure to pay back taxes. Liens can apply to income taxes. Local governments can also place a lien on your property if you’ve failed to pay your property taxes.

Important features of federal tax liens compared to state tax liens include:

- Federal tax liens take priority over state tax liens to collect tax debt unless the federal tax lien was filed later.

- Federal tax liens follow the same laws, established by federal statute.

- State tax liens differ based on specific state laws.

Because state tax liens depend on each state’s laws, important rules, such as the length of the statute of limitations and what property the tax lien can attach to, varies depending on the state. So understanding your state tax lien means knowing the law of the state in which the lien is attached. [6]

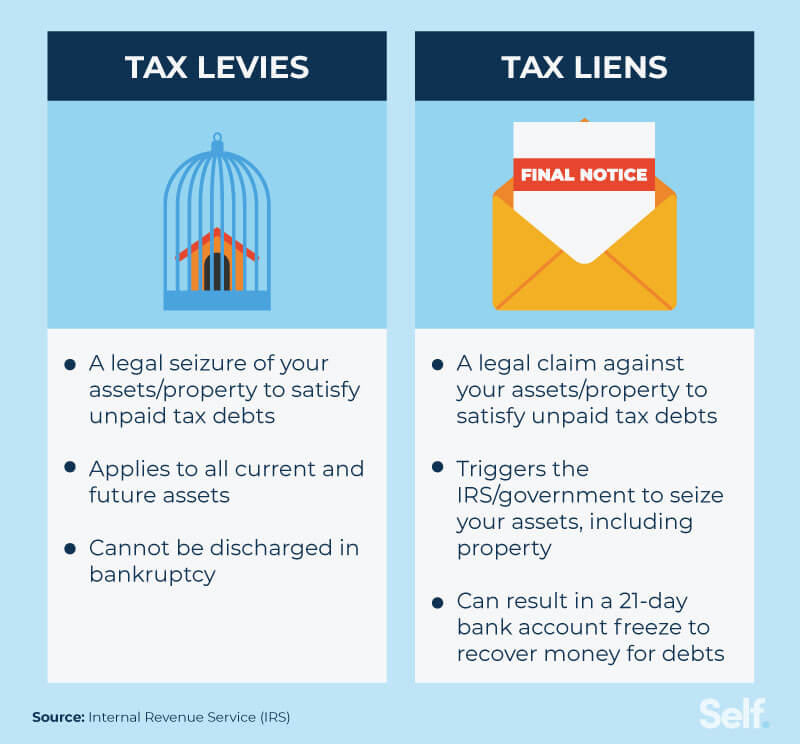

Tax lien vs. tax levy

A lien and a levy refer to two different things: A lien establishes that the federal government has an interest in your property when you haven’t paid a debt, but a levy actually seizes your property as a way to settle the debt.[7] In short, unpaid tax liens can lead to levies.

Before the IRS levies property, these requirements typically need to be met: [7]

- The IRS has sent you a Notice and Demand for Payment (tax bill).

- You have failed to pay the tax.

- The IRS has sent you a Final Notice of Intent to Levy and Notice of Your Right to a Hearing. Also known as a levy notice, the IRS delivers this at least 30 days before the levy takes place. It may be delivered in person, left at your home or workplace or sent via certified mail to your last known address, with return receipt requested.

- The IRS has sent you a notice informing you that the IRS may contact designated third parties (mentioned in the notice) about determining or collecting your tax liability.

Avoiding a tax lien by paying your debt

The easiest way to avoid a tax lien is to pay your tax debt in full. If you can’t pay it in a lump sum, there are short-term and long-term payment plan options.

A short-term payment plan requires you to pay the amount owed within 180 days and does not have a setup fee. A long-term plan requires monthly payments. You can either agree to a Direct Debit Installment Agreement (DDIA) for automatic monthly withdrawal from your checking account, or make payments manually each month. Both of these options come with fees, which you should make yourself aware of. Penalties and interest can still accrue until the balance has been paid in full. The fee may be waived for low-income taxpayers.[8]

There are more complex ways to get rid of a lien; consult the IRS’s website for more details.[3]

Keep tabs on all your records

The IRS recommends that you keep your tax returns for three years from the date you filed your original return, or longer in other situations. For more information about situations that may require you to keep tax records for longer, visit the IRS’s page. [9] These records may help you navigate a tax lien or other tax issues.

Tax liens can feel stressful and challenging. If you’re struggling to navigate a tax lien, consult with a licensed Tax Accountant or Tax Attorney.

Disclosure: Self does not provide tax advice. Speak with a professional Tax Accountant or Tax Attorney for advice on your specific situation.

Bottom line

While tax liens no longer appear on your credit report, they are available in public records which can be seen by lenders. This means a tax lien could still impact your ability to be approved for a loan, job, or apartment. [1] It’s important to keep records of any tax returns and ensure that you have paid all of the tax you owe to avoid tax liens.

Sources

- Bankrate. “How Tax Liens Affect Your Credit Score” https://www.bankrate.com/personal-finance/credit/how-tax-liens-affect-your-credit-score/ Accessed November 20, 2025

- IRS. “Topic no. 201, the collection process” https://www.irs.gov/taxtopics/tc201 Accessed November 20, 2025

- IRS. “Understanding a Federal Tax Lien” https://www.irs.gov/businesses/small-businesses-self-employed/understanding-a-federal-tax-lien Accessed November 20, 2025

- Middesk. “How to Do a UCC and Federal or State Tax Lien Search” https://www.middesk.com/blog/ucc-lien-search Accessed October 8, 2025

- IRS. “Legal Reference Guide for Revenue Officers,” https://www.irs.gov/irm/part5/irm_05-017-002. Accessed April 8, 2022.

- Optima Tax Relief. “State Tax Liens Vs IRS Tax Liens” https://optimataxrelief.com/blog/state-tax-liens-vs-irs-tax-liens/ Accessed October 8, 2025

- IRS. “What is a levy?” https://www.irs.gov/businesses/small-businesses-self-employed/what-is-a-levy. Accessed April 8, 2022.

- IRS. “Additional Information on Payment Plans,” https://www.irs.gov/payments/payment-plans-installment-agreements. Accessed April 8, 2022.

- IRS. “Topic no 305, Recordkeeping” https://www.irs.gov/taxtopics/tc305 Accessed November 20, 2025.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).