6 Apps That Help You Save Money

World events and shifting economic conditions have everyone thinking about saving money. For many, however, the idea of being frugal has stayed just that - an idea - because they don't know where to begin in terms of money management.

Innovative startup entrepreneurs and financial institutions are working to solve these problems with practical, digital money-saving tools and personal finance apps to help you save money.

Below are some of our favorite apps to help save money and prepare for your financial future.

1 - Wikibuy: Best coupon app to help you save

Source: Wikibuy

With so many coupon sites to choose from, finding the deals that matter to you could become a full-time job. Wikibuy (now known as Capital One Shopping since it was bought by Capital One) aims to simplify the process, letting you compare prices and curate the deals that matter to you. If you are looking for apps that help you save money, Wikibuy is a great place to start.

How It works

Sign up for a free account, then install the browser extension on your computer. Once installed, the browser tool will help you save money by comparing prices while you shop online.

As you add items to the shopping cart on a site, Wikibuy begins scouring the internet to ensure you got the best deal and look for applicable coupon codes.

You can also use Wikibuy to search for products and featured offers. The tool will also alert you when prices drop on items of interest. With Wikibuy, you can also earn credits while shopping and then redeem those credits for a variety of gift cards.

Pros and cons

Wikibuy is easy to install and use, works in the background, and is a proven way to save extra money and time. It is also a trustworthy site, backed by Capital One and verified by TrustPilot.

However, Wikibuy tends to favor specific retailers. It may sells your data to third parties.

Application

This free money-saving app works for online shoppers who want to save money on all their purchases.

Access

The browser extension works for all PC and Mac computers that use browsers, including Chrome, Edge, Firefox, and Safari. There is also a Wikibuy app for Android and iOS devices for shoppers in physical stores.

Comparable tools

Similar tools that offer coupon savings include Honey and Piggy.

2 - Joy: Best savings app for changing spending and savings habits

Source: Joy

Having a healthy savings account means you always have some cash flow. However, many people live paycheck to paycheck, so finding extra dollars to put in a savings account can be challenging.

Joy is a personal finance app that was created by a team of psychologists, data scientists, neuroscientists, tech experts and financial professionals. Based on considerable research and understanding of money behaviors, the app is designed to help users change spending habits around everyday purchases.

Learning to find happiness through investing in others, paying in advance, and distinguishing between needs and wants as opposed to wasting money, helps improve your spending and savings habits.

It’s certainly a unique approach compared to other budgeting apps, which rely more on traditional, numerically or statistically based recommendations. Instead, Joy tries to get you to change financial behavior by focusing more on emotional elements.

Here’s a little more on how Joy differentiates itself.

How it works

After downloading the budgeting app to your smartphone or tablet, connect your bank accounts and credit cards. From there, the app rates each transaction with a happy or sad face in relation to its true source of happiness.

Additionally, the app encourages you to save money with a reminder each time you open the budgeting app based on an algorithm that calculates an amount you can safely move to your savings account.

This money saving app works to retrain your financial behavior to eliminate those everyday purchases that don't contribute to your happiness and improve spending decisions in the process. That way, you find more ways to save when you track your spending based on the Joy each purchase brings you (or doesn't).

Joy believes the financial security you build with healthier behaviors will then further your overall happiness and contribute more to your long-term financial goals.

Pros and cons

Joy gently moves you to be more mindful of how you spend money and shows you how the changes you make over time impact your savings and your mood. Also, the ability to set reminders to check spending and saving is helpful.

The app also presents an interesting personality quiz, which doesn’t necessarily give you a sense of what to do with the results.

Application

This personal finance tool helps anyone that needs to shift their perspective and behaviors related to spending and saving money.

Access

Joy is a mobile app available for iPhone and Android devices.

Comparable tools

Similar tools include Digit, but you have to buy this personal finance app to enjoy all of its features. The app helps determine what you should save depending on your income and transfers that amount into a secure account. To access the app's money-saving features, you can pay $5/month or sign up for a 30-day free trial.

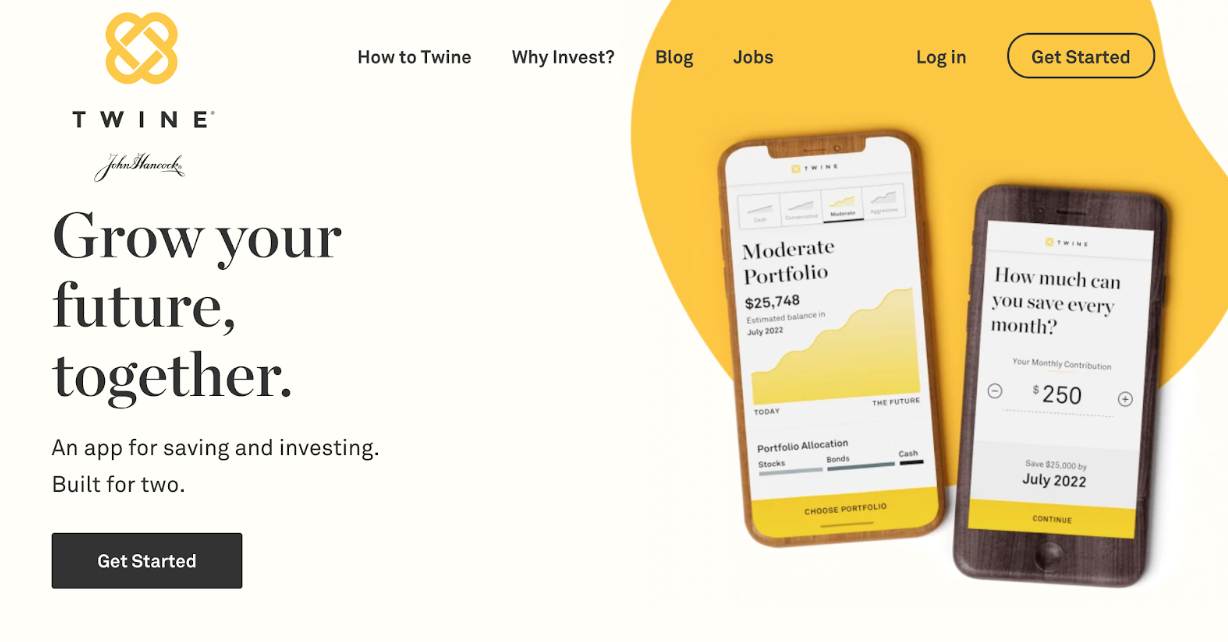

3 - Twine: Best money savings app for couples

Source: Twine

Saving money as a couple presents a complex dynamic. In fact, if saving money as a couple was a relationship status, it would be “It’s complicated.”

However, Twine wants to unravel the complexities of saving money as a couple and help you both come to an agreement on financial decision-making, including how to save money and make the best investments.

This is a free savings and investing app for couples that focuses on helping them develop and manage shared financial goals related to saving, payments, credit cards, and investments.

They also offer a premium add-on service that helps you invest your savings. Even then, it’s a low-cost transaction fee.

This app was created by John Hancock, a well-known financial services brand best known for its insurance solutions.

How it works

The Twine automatic savings app is easy to use. You create an account and connect a bank account to it.

From there, you establish savings goals, which you can revise at any point. When you add a partner, they can connect an additional account to further contribute to the shared Twine account.

Next, set up an automatic recurring savings transfer from your bank account to your Twine account. As you transfer money, Twine will provide updates on how long you have before you reach your stated savings goal.

Start with as little as $5. The money earns interest and is FDIC-insured up to $250,000. You can also transfer part or all of your Twine-account savings to an investment account. During this process, Twine will encourage couples to discuss and reach shared goals about finances, risk tolerance, and investment preferences.

Pros and cons

Twine charges no fees for the interest-earning savings account, empowering you to work with your partner on savings goals, and offers a choice of cash savings or investment options.

However, there are few customer support options if you need assistance. Also, you may be able to secure higher interest rates with other financial institutions.

Application

This money-saving app is made for couples who share decisions about how to spend, save, and invest their income.

Access

You can use a web-based version of Twine, or the iOS version for mobile devices.

Comparable tools

Alternatives to Twine include robo-advisor services like Wealthfront, which offer more investing options with lower fees. However, these services don’t emphasize the value of couples learning to work together on achieving their savings goals like Twine does.

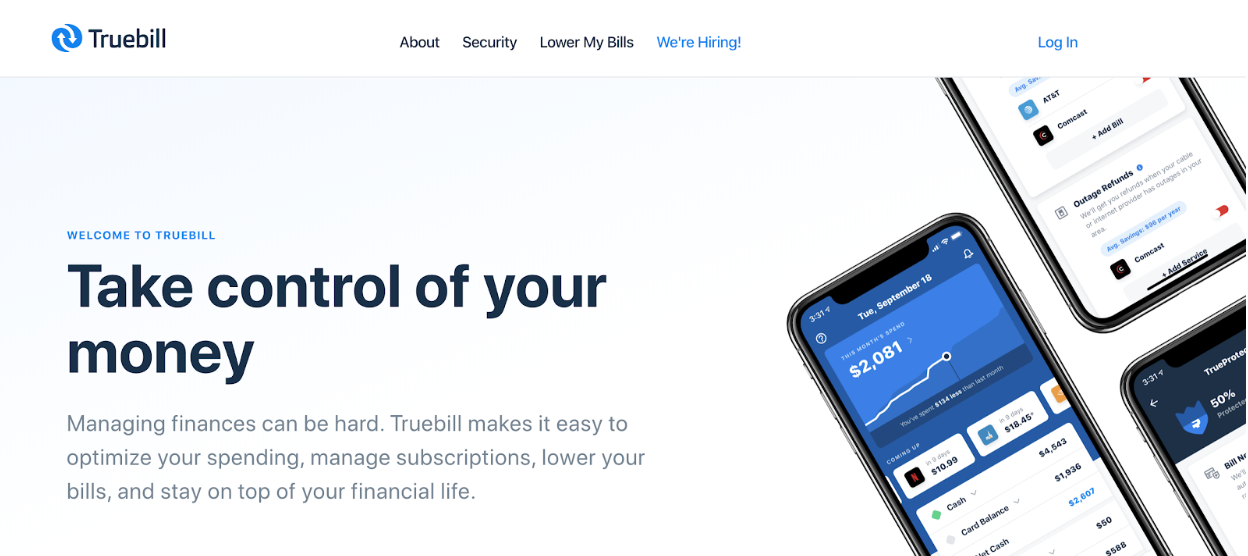

4 - Truebill: Best Savings App For Trimming Wasteful Spending

Source: Truebill

Automating payments saves time, but it doesn’t always save money, especially when it comes to things like subscriptions, memberships, and other monthly services.

You may not be using all of your subscriptions. If that’s true, you’re essentially wasting money that could go into a savings account to better position yourself now and in the future. Sometimes, you even forget you are paying for these things.

Or perhaps you are simply strapped for time to cancel all of them.

Enter Truebill, this budget app helps you get rid of these wasteful bills, payments, and automatic withdrawals.

How it works

Truebill helps you lower your bills by monitoring subscriptions and outages and offering its electric saver program, which can help you find better rates for your electricity bill in certain areas. You’ll need to upload copies of statements for any account you want Truebill to monitor so it can negotiate lower rates on your behalf.

For subscription monitoring, you'll need to connect your checking and credit accounts so that Truebill can assess those charges. From there, you can use the data to cancel subscriptions. You can also upgrade to Truebill's Premium budget app service so they will cancel these for you.

For outage monitoring, Truebill will monitor cable and internet providers so they can request credit when there is an outage.

Pros and cons

Truebill has a great track record of saving customers significant amounts of money. This financial app is also easy to use and it simply does more compared to other money saving apps.

However, while Truebill is free to download, it does take 40 percent of the annual savings it negotiates.

To tap into all of the app’s features, you’ll also need to pay for the Premium service, which is $4.99 per month or $35.99 per year.

Application

Anyone with unused memberships and subscriptions like the gym, streaming services, curated boxes and more can use Truebill to trim expenses.

Access

Truebill is available as a smartphone app for iOS and Android devices.

Comparable tools

While Truebill is the only available money savings app that also includes overdraft and late fees as well as the electric saver program as part of its functionality to help save you money, you can find comparable apps that help reduce your bills, like Trim and Billshark.

If you want to pay to save money...

There are also some tools and apps that may charge you to use them, but they deliver a significant return in terms of the money saved.

Here are just two examples...

5 - YNAB: Best budgeting tool to save more

Source: YNAB

A budget is a must-have tool for understanding how you spend money. That’s how you find the money to put in savings, an emergency fund, and retirement accounts.

YNAB (You Need a Budget) is a low-cost budgeting tool that shows you how to improve your money habits. It was started by a Certified Public Accountant (CPA) who had years of experience looking at people’s finances.

YNAB offers a 34-day free trial. After that, YNAB costs $6.99 per month.

How it works

YNAB is one of the best places to save money because it helps you establish a budget and automates the process.

The newest version of this budgeting tools adds more features including account syncing and live online courses, a blog, and forum to help you improve your money-saving habits.

Pros and cons

YNAB pros include the budgeting tool’s in-depth functionality, ongoing addition of new features, and value-added pricing.

Cons are minimal customer service support with only live chat offered. Also, you’ll find no additional personal finance features outside of budgeting.

Application

This financial app is for anyone that needs to create a budget.

Access

YNAB is web-based and also offers an app for iOS and Android devices.

Comparable tools

Personal Capital is one of the few comparable budgeting tools with similar functionality. However YNAB offers bill management and manual entries, whereas Personal Capital does not.

6 - Cleo: Best app for money management advice

Source: Cleo

Managing money and finances is a lot easier when you have access to a personal financial advisor offering practical advice on spending habits and financial decisions.

Cleo is an AI-powered chatbot that does just that at an affordable price. It’s available 24/7/365 as a text-based app that’s accessible through Facebook Messenger, iMessage, or text services.

There are both free and paid service plans (Cleo Plus is available at $5.99 per month).

How it works

The free version of Cleo allows you to ask the chatbot questions about financial transactions, such as “Am I overpaying for my cable service?”

You can also type commands like “Show me upcoming bills.”

The premium version (Cleo Plus) includes Cleo Cover, which provides you with an overdraft service whereby qualified candidates can borrow up to $100 for overdrafts as a no-interest loan to be paid back between three and 28 days.

Cleo Plus also offers Daily Cash, which features discounted products and services suggested by Cleo based on what it learns about you through interactions.

Some Daily Cash announcements are for cash-back opportunities while Challenges pay small amounts for your participation.

Pros and cons

One of the best features of Cleo is the chatbot, which helps make learning financial management more fun, convenient, and personalized to your needs. The chatbot serves as the voice of reason about certain purchases, telling you whether you can afford that item or not.

On the other hand, any money left in the Cleo Wallet from cash-back or challenge earnings does not earn interest.

Moreover, you cannot set different budgets for individual spending categories, and it can take up to four days to transfer funds between your bank and the Cleo Wallet.

Application

This financial advisory tool to save money is for anyone who needs help with setting financial goals and creating a financially secure future.

Access

The chatbot app is available for both iOS and Android devices.

Comparable tools

Similar tools include Mint and Digit, which both cost money to use but have varying functionality. It’s important to compare these to Cleo to see which features are most important to your money-saving goals.

The bottom line

At Self Financial, we care about your financial future. Whether you’re looking to get a credit builder loan or want to improve your credit score, you’ll be able to find all the information you need through our informative blogs. Check out our latest articles today to stay educated and informed on important financial matters.

About the author

John Boitnott is a longtime digital media consultant and journalist who covers technology trends, startups, entrepreneurship and personal finance for Inc, Entrepreneur, Business Insider, USA Today and other major publications.

About the reviewer

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.