What Is Buy Now Pay Later?

When shopping online or in stores, you have various payment options: cash, debit, and credit. In addition, a new option recently popped up at some registers and shopping carts: "buy now, pay later.”

Though new, the “buy now, pay later” (BNPL) payment option is growing in popularity. According to a 2021 survey by Credit Karma and Qualtrics, 42% of Americans have used some sort of BNPL or pay later service.[1]

The opportunity to buy something now and pay for it later is nothing new. After all, that's the appeal of credit cards. Like credit builder programs and getting a credit builder card, BNPL services can be more accessible to consumers with poor credit and low income. In the case of BNPL, however, it may not be good for some individuals’ debt load.

What is buy now pay later?

Buy now, pay later providers or BNPL service providers, partner with online shopping and brick-and-mortar retailers to offer customers a way to pay for their purchases in installments. Depending on the BPNL provider, the consumer may have anywhere from 30 days to 12 months to pay for their purchase.

In many cases, as long as the customer makes all payments on time and pays off the balance within the given timeframe, they won't pay any interest or fees. However, BPNL platforms charge hefty fees for missed payments.

How does buy now pay later work?

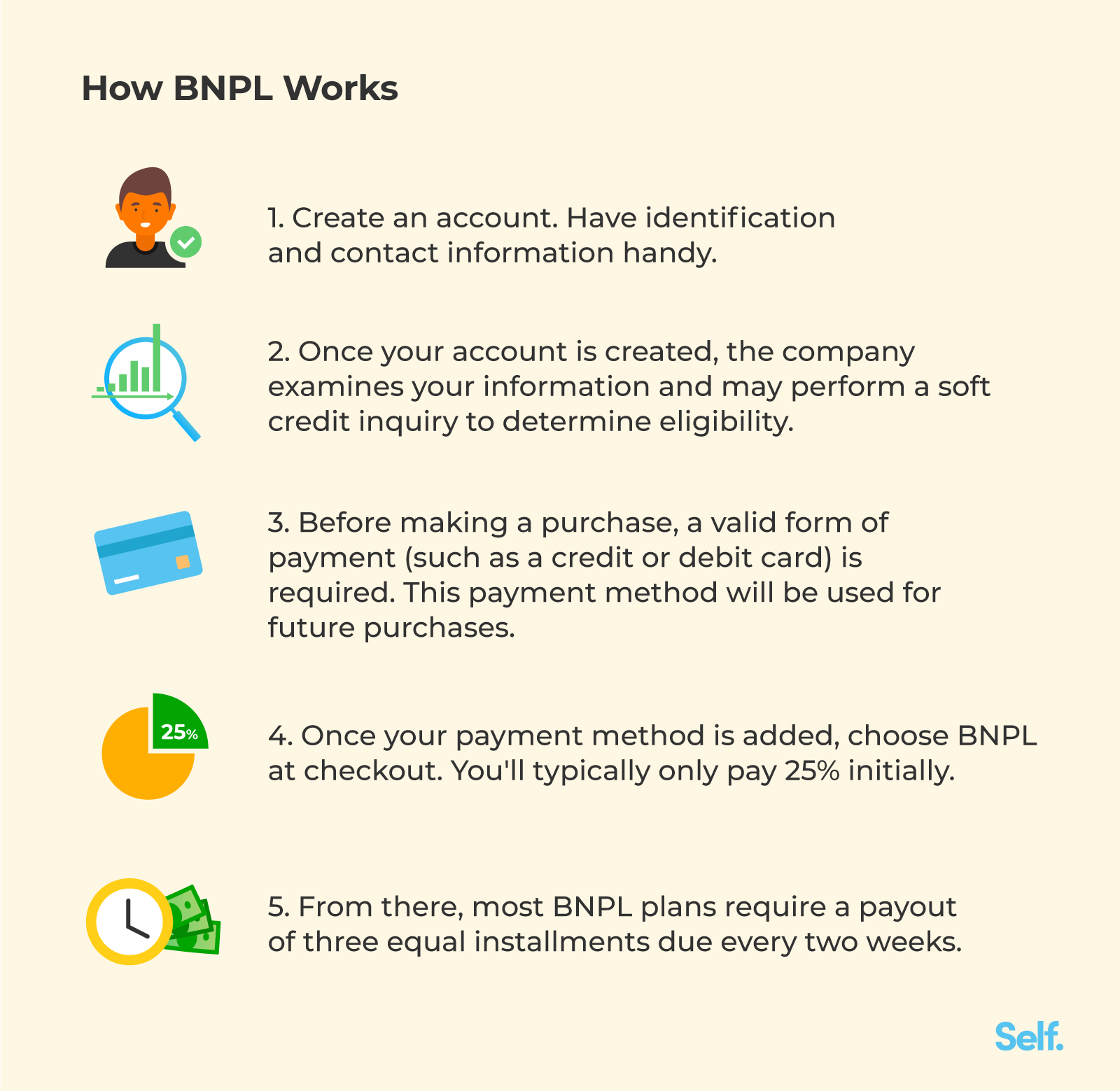

The sign-up process and steps to use BNPL services vary from company to company, but the process typically goes like this:

- You create an account by supplying some basic identification and contact information. For example, some companies may also ask for your Social Security number.

- Behind the scenes, the company runs your information through its risk algorithms and may perform a soft credit inquiry to determine your eligibility.

- Before making a purchase, you'll also need to provide a valid debit card, credit card, or checking account information. Then, you will use that card or account to make payments.

- When you're ready to check out at the store or website, choose the BNPL option. If your transaction is approved, you typically pay 25% of the transaction amount at checkout.

- The most popular BNPL plans require you to pay the remaining balance in three equal installments due every two weeks. You can sign up for automatic payments in the app or go into the app to approve each payment manually.

Are BNPL plans reputable?

There are many reputable BNPL providers and some big-name merchants, including Bed Bath & Beyond, Overstock, Sephora, and Target, offer buy now, pay later options. In addition, some banks and credit card issuers are now offering their version of BNPL deals.

Where would I find a buy now pay later plan?

Buy now, pay later may not be available everywhere you want to shop — the store or online merchant must partner with a BPNL provider. However, if you're at a brick-and-mortar store or shopping online, you may see offers to split your purchase into four payments with a BNPL company like Afterpay, Klarna, Zip, Splitit, Affirm, or Sezzle. These lenders’ websites also have a directory of stores that offer BNPL payment method options.

But, does Affirm affect your credit score, and does Klarna help build credit? Asking these questions will be important before trying one of these BNPL programs.

What are popular “buy now pay later” companies?

In addition to the BPNL providers listed above, many well-known banks and payment processing companies offer services that let customers pay for transactions in fixed installments, including:

- Citi Flex Pay. If you have a Citi credit card, you can use Citi Flex Pay when shopping on Amazon. Or log into your Citi account online to convert eligible purchases into installments. There's no fee to use it, but Citi does charge interest.

- JPMorgan Chase's My Chase Plan. The My Chase Plan allows Chase cardholders to pay off purchases over time in fixed monthly payments. To use My Chase Plan, log into your account online and select the "Pay with My Chase Plan" option next to an eligible purchase. Payment terms range from three to 18 months, depending on the purchase amount, your creditworthiness, and account history. Chase doesn't charge interest on purchases once placed in the plan, but they charge a fixed monthly fee, determined when selecting their BNPL plan.

- PayPal's Pay in 4. When you choose PayPal as your payment option at an online retailer, you can select "Pay Later" to use Pay in 4. If your transaction is eligible, you'll have to pay the down payment right away, then pay the rest in three payments due every two weeks. Payments are interest-free as long as you make them on time.

Is anyone eligible for buy now pay later plans?

Buy now pay later is a form of credit because you're being lent the item's price and paying back the amount you borrow over time. That's why some BNPL lenders run credit checks before deciding whether to approve your account. If you have bad credit, the lender may turn you down for a BNPL plan.

Do I need good credit to use a BNPL plan?

Some BNPL lenders check credit but not all do. According to the Consumer Financial Protection Bureau (CFPB), most BNPL providers only require you to:

- Be at least 18 years old

- Have a mobile phone number

- Have a debit card, credit card, or checking account

- Have a verifiable identity[2]

Does buy now pay later affect my credit?

Depending on the lender you use, using a buy now, pay later deal may or may not affect your credit. According to CNBC, some of the most popular BNPL lenders, including AfterPay, Affirm, and Klarna, report some loans to the credit bureaus, while others do not.[3]

If your BPNL lender reports to one or more of the credit bureaus and you make your payments on time, a BPNL deal can improve your credit. But, likewise, late payments can harm your credit score.

But you could see a drop in your credit score even if you make on-time payments. That's because each time you take advantage of BPNL payment terms, it's considered a new account on your credit report. This brings down the average age of your credit history considerably, especially if you use BPNL deals often.

BPNL lenders can also send your debt to a collection agency if you fail to repay the loan, which can seriously harm your credit score.

Buy now pay later pros

The advantages of buy now, pay later services are what attract most people. These are:

- Easier approvals. While some BNPL providers check credit, some do not. Instead, they use their algorithms to decide whether they should approve your purchases. This makes it easier for people with no credit history or bad credit to finance their purchases.

- Predictable installments. When you use a credit card, you have to pay at least the minimum payment each month. But with a BPNL loan, you may be able to choose a three-, five-, or 12-month payment plan. Some BPNL users feel this gives them more control over their payments.

- Automatic payments. BPNL companies give you the option of enrolling in automatic payments, so you don't have to remember when they're due and log into your bank or online account. Instead, they're automatically charged to your debit or credit card or bank account.

- No interest charges. With a credit card, you pay interest on purchases unless you pay your balance in full each month. Many BPNL lenders don't charge any interest on the amount you borrow – only fees for late payments.

Buy now pay later cons

BNPL services may be convenient for some shoppers, but there are a few downsides.

- Encourage overspending. By making large purchases seem affordable, you may spend more than you can afford, miss payments, and owe late fees.

- Fewer consumer protections. If you have a problem with your purchase, such as a defective product or one that never arrived, it can be tough to get a refund. Credit card issuers will typically remove disputed charges from your account. But according to Consumer Reports, BPNL lenders generally require consumers to contact the merchant first to get credit for a return or refund. Until the retailer notifies the lender that they've voided the transaction and issued a refund, you have to continue making payments."[4]

- High late payment fees. Some BPNL loans may not charge interest, but you will be charged a late fee if you don't pay on time. Late fees usually start at around $7 to $10 for one missed payment and are capped at 25% of your balance. According to the Credit Karma/Qualtrics survey, 38% of BNPL borrowers report missing at least one payment.

- Not all purchases are eligible. BPNL lenders place limits on the amount you can borrow. Those limits are determined by your credit history as well as the lender's and retailer's policies.

- Payments may be harder to track. According to Consumer Reports, two-thirds of people who've made a late payment on a BPNL loan said they fell behind because they lost track of the payments. Because BNPL flexible payment options are typically due bi-weekly, it can be easy to miss a payment even if you have money available to make the payment.

BPNL can make paying for purchases predictable, but it can also lead to overspending, racking up late fees, and harming your credit score. If you want to take advantage of buy now, pay later offers, consider signing up for automatic payments to make sure you don't miss one and get hit with a late fee. Then make sure you actually have the money available to "pay later."

Article Sources

Credit Karma. “72% of Americans Saw Their Credit Scores Drop After Missing a ‘Buy Now, Pay Later’

Payment, Survey Finds”. https://www.creditkarma.com/insights/i/buy-now-pay-later-missed-payments - Accessed August 25, 2021CFPB. “Should you buy now and pay later?”

https://www.consumerfinance.gov/about-us/blog/should-you-buy-now-and-pay-later/ - Accessed August 25, 2021CNBC. “Buy Now, Pay Later Loans Can Decrease Your Credit Score Even if You Pay On Time”.

https://www.cnbc.com/select/how-buy-now-pay-later-loans-can-decrease-your-credit-score/ - Accessed August 25, 2021Consumer Reports. “The Hidden Risks of Buy-Now, Pay-Later Plans”.

https://www.consumerreports.org/shopping-retail/hidden-risks-of-buy-now-pay-later-plans/ - Accessed August 25, 2021

About the author

Janet Berry-Johnson is a Certified Public Accountant and personal finance writer. Her work has appeared in numerous publications, including CreditKarma and Forbes. See Janet on Linkedin and Twitter.

About the reviewer

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).