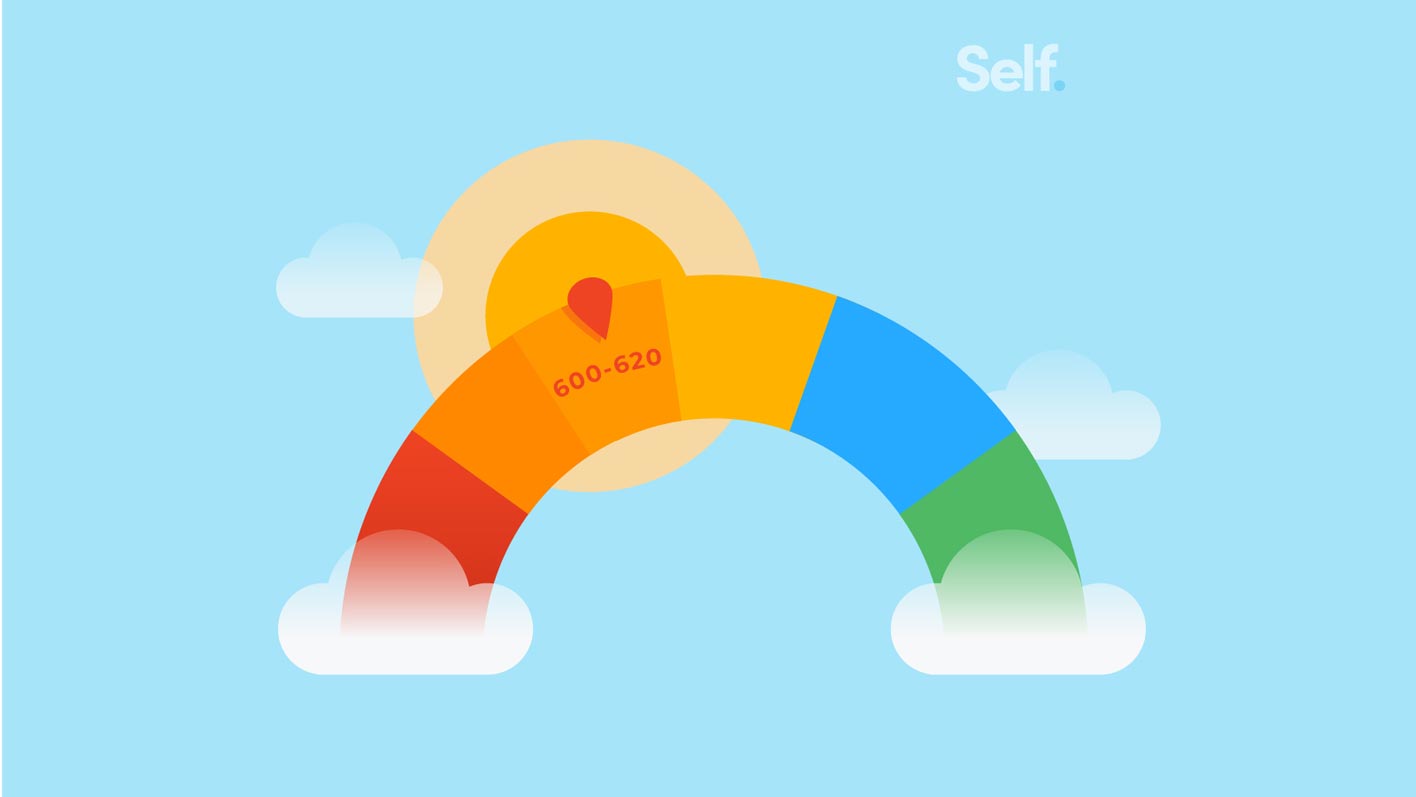

You’re applying for that loan and you get notified that your FICO score falls between 600 and 620. You might be wondering what that really means. Is it low? Is it high?

A 600-620 score is a ‘fair’ credit score and is considered subprime, which means your credit or loan application may have undesirable conditions that can prevent approval. It’s not ‘good’ but it’s certainly not bad either. The line is often blurry.

Will you be approved or rejected? Is your credit score the reason for either decision?

A score between 600 and 620 is in a grey area between the “Good” scores above, and the “Poor” scores below. Scores at the bottom of the range can limit your options while scores at the top can start opening up more credit options to you.

The ambiguity of having a “fair” credit score means it’s crucial to understand how that score will open or close your options. Understanding how lenders interpret your credit score will help you to gain more control over your financial life.

| FICO Score Range | Label | Percentage of Americans in that range |

|---|---|---|

| FICO Score Range 800-850 | Label Exceptional | Percentage of Amerians in that range 21% |

| FICO Score Range 740-799 | Label Very Good | Percentage of Amerians in that range 25% |

| FICO Score Range 670-739 | Label Good | Percentage of Amerians in that range 21% |

| FICO Score Range 580-669 | Label Fair | Percentage of Amerians in that range 17% |

| FICO Score Range 300-579 | Label Very Poor | Percentage of Amerians in that range 16% |

- 19 percent of Americans have a FICO score below 600

- 78 percent of Americans have a FICO score above 620. [2] FICO.com - Average U.S. FICO Score Ticks Up to 706 https://www.fico.com/blogs/average-us-fico-score-ticks-706

Source: Experian [1] Experian: 600 Credit Score: Is it Good or Bad? - Accessed April 22, 2021 https://www.experian.com/blogs/ask-experian/credit-education/score-basics/600-credit-score/

600 to 619 Credit Score

Credit scores can both frighten and confuse borrowers. They’re a little frightening because they are purely mathematical scores based on financial behavior that can either give you access to a range of benefits or lock you out of them—at least until your score improves.

And credit scores are often confusing because it’s easy to misinterpret the scores based on a range instead of by the underlying criteria that determine the score.

While a credit score in the low 600s is roughly the middle of the full possible range of scores, being in the middle doesn’t mean it’s the average. Most Americans (83%) have a FICO® score higher than 600. [1] Experian: 600 Credit Score: Is it Good or Bad? - Accessed April 22, 2021 https://www.experian.com/blogs/ask-experian/credit-education/score-basics/600-credit-score/

With a score between 600 and 619, you are locked out of many options that people with scores 50 to 70 points higher may enjoy, such as qualifying for credit cards with airline and hotel rewards, and zero percent interest rate auto loans. Even renting an apartment could be difficult with a credit score between 600 and 619. [3] Wallethub: 619 Credit Score - Accessed April 22, 2021 https://wallethub.com/credit-score-range/619-credit-score/

While there is no single and universally applicable qualifying score for an auto loan, the higher your score climbs, the better your loan terms will typically be. Auto lenders differentiate between “subprime” and the slightly more favorable “non-prime.” A credit score of 600 qualifies a borrower for a “non-prime” rate.

How to Build Credit When You Have None

Building credit from scratch can be a lot easier when you understand where to start and which mistakes to avoid.

Download our guide620 Credit Score

When you reach a score of 620, one major door opens: the possibility of home ownership. Most lenders require a minimum credit score between 620 and 640 to qualify for a mortgage. [10] My Mortgage Insider: Low Credit Score Home Buyers In 2021 Could Qualify Because of this new FHA Policy - Accessed April 22, 2021 https://mymortgageinsider.com/new-fha-policy-for-low-credit-home-buyers-7494/ That’s a big step; the only mortgages available to borrowers with a score below 620 are FHA loans.

Another option that becomes more accessible with a 620 or greater credit score is a credit card that carries significant perks, such as zero percent financing for the first year or no annual fee. [4] Wallethub: 620 Credit Score - Accessed April 22, 2021 https://wallethub.com/credit-score-range/620-credit-score/

A FICO score of 620 is right on the border of qualifying for products such as conventional loans. Installment loans and lines of credit may be more accessible if your score has improved to 620, but interest rates won’t become competitive until your score gets closer to the “Good” range. [5] Experian: What Auto Loan Rate Can You Get With Your Credit Score? - Accessed April 22, 2021 https://www.experian.com/blogs/ask-experian/auto-loan-rates-by-credit-score/

Living With a Credit Score of 600 to 620

Some individuals don’t learn about the importance of their FICO score until they apply for a loan. It’s far better to learn not only what your score is, but also how it might impact your finances and life choices.

Your FICO score has wide-ranging effects. While this may seem daunting, you have more control over your credit score than you might think.

A credit score between 600 and 620 doesn’t mean you can’t get a loan—far from it. It does mean that getting that loan could cost you more than it would cost someone with a better credit score.

Simply moving from one score range to another can mean a difference of several percentage points of interest, translating to thousands of dollars.

| Credit Score | Rating | % of People | Interest Rate(Personal Loan) | Impact |

|---|---|---|---|---|

| Credit Score 300-579 | Rating Very Poor | % of People 16% | Interest Rate(Personal Loan) 30.25% | Impact Applicants may be forced to pay a deposit or fee, or may not be approved for credit at all. |

| Credit Score 580-669 | Rating Fair | % of People 17% | Interest Rate(Personal Loan) 18.85% | Impact People in this number range are generally classified as subprime borrowers. That denotes a less-than-desirable credit standing. |

| Credit Score 670-739 | Rating Good | % of People 21% | Interest Rate(Personal Loan) 14.5% | Impact The percentage of borrowers likely to become seriously delinquent in the future is only 8 percent in this range. |

| Credit Score 740-799 | Rating Very Good | % of People 25% | Interest Rate(Personal Loan) 11.4% | Impact Applicants here tend to get better than average interest rates from lenders. |

| Credit Score 800-850 | Rating Exceptional | % of People 21% | Interest Rate(Personal Loan) 11.4% | Impact People in this number range gain eligibility to the most favorable interest rates. |

Source: Experian [12] Experian: What Is a Fair Credit Score? https://www.experian.com/blogs/ask-experian/what-is-a-fair-credit-score/

Auto Loans

| Category | Average New Car Rate (Q1 2020) | Average Used Car Rate(Q1 2020) |

|---|---|---|

| Deep subprime (579 or below) | 14.39% | 20.45% |

| Subprime (580 - 619) | 11.92% | 17.74% |

| Non Prime (620 - 659) | 7.65% | 11.26% |

| Prime (660 - 719) | 4.68% | 6.04% |

| Super prime (720 or above) | 3.65% | 4.29% |

Source: Experian [5] Experian: What Auto Loan Rate Can You Get With Your Credit Score? - Accessed April 22, 2021 https://www.experian.com/blogs/ask-experian/auto-loan-rates-by-credit-score/

When shopping for a car, the make-or-break moment usually happens in the finance office while you negotiate the terms of your auto loan.

The car dealership will typically ask further questions about your financial background if your credit score is below 700. [6] myFICO Loan Savings Calculator - Accessed April 22, 2021 https://www.myfico.com/credit-education/calculators/loan-savings-calculator/ So if you are one of the thousands of Americans with a credit score in the 600-620 range, expect additional scrutiny into your finances. It’s part of a lender’s normal due diligence for underwriting a loan.

If the car dealer does want more information about your finances, it doesn’t necessarily mean rejection of your application or a sky-high interest rate. Credit scores reflect numerous metrics, and rarely is a loan application completely rejected because of a single blemish.

One way to avoid exposing your entire financial life at a car dealership is to ensure your financing is in place before you get there.

Getting auto financing in advance can be difficult when you have a credit score in the “Fair” range, but it’s not impossible. Some credit unions offer prime financing to people with scores as low as 660. [7] Better Credit Blog: What Credit Score is Needed to Buy a Car? - Accessed April 22, 2021 https://bettercreditblog.org/credit-score-for-car-loan/

Mortgages

| Mortgage rates as of May 3, 2021 - 30 Year Fixed, $250k Principal Amount | ||

|---|---|---|

| FICO score | APR | Monthly payment |

| 760-850 | 2.668% | $1,010 |

| 700-759 | 2.89% | $1,039 |

| 680-699 | 3.067% | $1,063 |

| 660-679 | 3.281% | $1,092 |

| 640-659 | 3.711% | $1,152 |

| 620-639 | 4.257% | $1,231 |

Source: myFICO Loan Savings Calculator [6] myFICO Loan Savings Calculator - Accessed April 22, 2021 https://www.myfico.com/credit-education/calculators/loan-savings-calculator/

Unless you’re willing to pay a considerably higher interest rate, your options are likely to be limited. Statistically speaking, the lower the credit score, the greater the default risk. Lenders use higher interest rates to insure themselves against defaults.

Most negotiations for conventional mortgages begin with a credit score of 620 or more. You’re generally excluded from a conventional mortgage or VA loan with a lower credit score.

Below a 620 credit score, you’re usually limited to a Federal Housing Authority or FHA loan, which can be accessible for people with credit scores of 500, if they can also provide a large down payment.

Renting

While not all landlords run credit checks, it can be a challenge to get a rental if your credit score is below 620 and a credit check is part of the approval process. Many property management firms as well as landlords run credit checks to screen potential tenants.

While there are no official published guidelines on minimum scores for potential tenants, a higher score is always better since it suggests that you are more likely to pay your rent on time. A credit score below the “Good” range will be subject to additional scrutiny.

And more…

Not only can your landlord check your credit, but your property or rental insurance provider can as well when you apply for a policy to protect your investment. Customers with less-than-perfect credit may find themselves paying higher insurance premiums [11] Investopedia: The Side Effects of Bad Credit - Accessed April 22, 2021 https://www.investopedia.com/the-side-effects-of-bad-credit-4769783.

Improving a 600 to 620 Credit Score

Improve your payment history

Establishing a positive payment history is the most effective way to improve your credit score.

While a credit score is based on a number of criteria, your payment history is a key factor. In fact, around 35 percent of your credit score is based on the consistency and promptness of your payment history. [8] myfico.com - What’s in my FICO Scores? - Accessed May 4, 2021 https://www.myfico.com/credit-education/whats-in-your-credit-score

Paying off balances in full and as soon as possible will also help raise your score. If you have habitually paid late on any debts, get them current as soon as possible.

Improve your credit utilization rate

Your credit utilization rate is calculated as a percentage. Ideally, you should use no more than 30 percent of your available credit at any given time.

To lower your credit utilization rate, you can use three strategies.

- Pay down your balances, which will lower the amount of credit that you have in use.

- Increase your credit limit so that the ratio of used credit versus available credit leans more in your favor.

- Don’t close unused credit cards. Closing an unused card cuts off a line of credit with an available limit.

Use a secured credit card

When conventional credit cards are unavailable due to credit history blemishes, turn to secured credit cards.

With a secured credit card, you’ll put down a deposit that equals your spending limit. This can be as little as a few hundred dollars, and acts as the collateral for the credit you are being extended.

As you use the card and make on-time payments, the issuer reports your history to the credit bureaus and improves your credit score.

Dispute credit report errors

Make sure you regularly review your credit report to verify all the information contained in it is accurate. After all, the human beings who work at the credit reporting agencies can make mistakes just like anyone else.

Fixing errors on your credit report in a timely fashion can help you change a credit score from “Fair” to “Good.”

What Can You Do With a 600 to 620 Credit Score?

Can I get a mortgage?

You could qualify for a conventional mortgage with a credit score of 620.But your options may be limited.

With a 600 to 620 credit score, or even with a higher score in the “Fair” range, your mortgage will likely be backed by Fannie Mae or Freddie Mac, making it a federally-insured loan.

If you have a credit score in the “Fair” range, it might be a good idea to apply for that mortgage, given that interest rates right now are quite low (as of April 2021). With a positive payment history on an approved mortgage and with some equity built up over time, you could qualify to refinance later at an even lower rate.

If you have a credit score closer to 600, look into an FHA loan, which can have a down payment requirement from 3.5 percent to 10 percent, depending on your credit score. This type of loan also requires a mortgage insurance premium. (See more about FHA loan credit requirements.)

In addition to your credit score, lenders will consider the percentage of your income that goes toward paying down debt. This is your debt-to-income ratio.

For getting a loan, the lower your debt-to-income ratio the better. It will be more difficult to secure a loan if the income you will use to pay a mortgage exceeds 28 percent of your gross monthly income. [9] Experian: Why would a Mortgage Get Denied? - Accessed April 22, 2021 https://www.experian.com/blogs/ask-experian/why-would-a-mortgage-get-denied/ FHA loans are more flexible, allowing a maximum of 50 percent debt-to-income ratio and are accessible for those with credit scores from 500, provided they have a large down payment.

Can I get a car loan?

Lenders consider automobile loans “secured loans” because, much like mortgages, the item being purchased acts as the collateral for the loan. That’s the car in this case.

Auto lenders don’t use the same categories or ranges that the credit rating agencies do. While credit rating agencies consider a score of 580 to 669 to be in the “Fair” category, car lenders consider your credit score to be in the “subprime” category if it’s below 600. (See more about the credit scores car dealers use.)

This re-categorization of scores and the use of the car as collateral let auto lenders offer financing to folks who wouldn’t otherwise be able to obtain unsecured loans based on their FICO score. [9] Experian: Why would a Mortgage Get Denied? - Accessed April 22, 2021 https://www.experian.com/blogs/ask-experian/why-would-a-mortgage-get-denied/ But it also lets auto lenders charge higher interest rates based on the subprime ranking.

As with other types of loans, the higher the credit score, the better, but interest rates fluctuate widely on a car loan. The rates can be volatile and you can hear it in the excited tone that some dealers use to advertise their willingness to finance your purchase, no matter what your credit woes might be.

Auto loan interest rates can vary from 3.65 percent on a new car with a near perfect credit score to as high as 20 percent for a used car purchase with a credit score of 579 or lower. [5] Experian: What Auto Loan Rate Can You Get With Your Credit Score? - Accessed April 22, 2021 https://www.experian.com/blogs/ask-experian/auto-loan-rates-by-credit-score/

The important thing to remember with auto loans, especially when your credit score is in the lower end of the Fair range (600-620), is that your lender will demonstrate a greater tolerance for risk if they approve your loan, but a higher interest rate allows them that tolerance.

Will I be accepted for a credit card?

If your credit score is 660 or above (the upper end of the “Fair” range), you should be able to qualify for credit cards that do not require an initial deposit. You may even qualify for credit cards that offer perks such as cash back, airline and hotel points, zero percent interest, and no annual fee.

There is one important caveat with credit cards: Only apply for credit if you are reasonably certain you will be approved.

Every application for credit, regardless of approval status, causes a small (if temporary) drop in your credit score. Applying for credit too often and too frequently can cause a vicious cycle of a constantly declining score, from which it’ll take a longer amount of time to recover. Choose your cards carefully and learn more about getting a credit card when you have poor credit.

Article Sources

- [1] Experian: 600 Credit Score: Is it Good or Bad? - Accessed April 22, 2021 https://www.experian.com/blogs/ask-experian/credit-education/score-basics/600-credit-score/

- [2] FICO.com - Average U.S. FICO Score Ticks Up to 706 https://www.fico.com/blogs/average-us-fico-score-ticks-706

- [3] Wallethub: 619 Credit Score - Accessed April 22, 2021 https://wallethub.com/credit-score-range/619-credit-score/

- [4] Wallethub: 620 Credit Score - Accessed April 22, 2021 https://wallethub.com/credit-score-range/620-credit-score/

- [5] Experian: What Auto Loan Rate Can You Get With Your Credit Score? - Accessed April 22, 2021 https://www.experian.com/blogs/ask-experian/auto-loan-rates-by-credit-score/

- [6] myFICO Loan Savings Calculator - Accessed April 22, 2021 https://www.myfico.com/credit-education/calculators/loan-savings-calculator/

- [7] Better Credit Blog: What Credit Score is Needed to Buy a Car? - Accessed April 22, 2021 https://bettercreditblog.org/credit-score-for-car-loan/

- [8] myfico.com - What’s in my FICO Scores? - Accessed May 4, 2021 https://www.myfico.com/credit-education/whats-in-your-credit-score

- [9] Experian: Why would a Mortgage Get Denied? - Accessed April 22, 2021 https://www.experian.com/blogs/ask-experian/why-would-a-mortgage-get-denied/

- [10] My Mortgage Insider: Low Credit Score Home Buyers In 2021 Could Qualify Because of this new FHA Policy - Accessed April 22, 2021 https://mymortgageinsider.com/new-fha-policy-for-low-credit-home-buyers-7494/

- [11] Investopedia: The Side Effects of Bad Credit - Accessed April 22, 2021 https://www.investopedia.com/the-side-effects-of-bad-credit-4769783

- [12] Experian: What Is a Fair Credit Score? https://www.experian.com/blogs/ask-experian/what-is-a-fair-credit-score/