When you have bad credit, you may worry that purchasing a house is an impossible feat. Yet, just because you’re struggling with credit problems doesn’t mean you’re automatically doomed to receive a mortgage denial.

Some mortgage lenders may be willing to work with you despite a poor credit rating. The same is true if you’re trying to buy a house with no credit, although the obstacles you face may differ from trying to buy a home with low credit scores.

In this guide, we’ll take a deeper look at what buying a house with bad credit looks like and how much it might cost you. We’ll also show you some practical ways to improve your credit score quickly so you can put yourself into a better position as a borrower.

In this guide, we’ll explore:

Is it possible to buy a house with a bad credit score?

Bad credit can make buying a house challenging and expensive. However, in certain situations, it is possible to purchase a home with a bad credit score. In addition to your credit rating, there are other vital factors that mortgage lenders take into account, such as:

- Overall credit history

- Any major derogatory items on your credit reports (i.e., foreclosure, bankruptcy, charge-off, etc.)

- Recent credit applications (aka hard credit inquiries)

- Income

- Assets

- Existing Debts

- Employment history

- Down payment size

- And more

When you have bad credit, some of the factors above may be even more influential on your loan than usual. Furthermore, your credit and other loan factors determine whether you can qualify for a mortgage and the overall cost of your loan.

How to Rent with Bad Credit

Leasing an apartment or home with bad credit can be a challenge, but if you follow the right steps some landlords may be willing to work with you.

Download our guideWhat is considered a bad credit score when buying a house?

To remain profitable, lenders need to avoid making loans to people who won’t repay as promised. So, lenders rely on tools like credit scores to help them predict the risk of loaning money to applicants. The lower an applicant’s credit score falls, the more likely that individual will default on a credit obligation in the upcoming 24 months.

In the mortgage industry, lenders use FICO® Scores to evaluate applicants and assess risk. FICO credit scores range from 300 to 850. Within this broad range, there are five credit score categories:

- Exceptional

- Very Good

- Good

- Fair

- Very Poor

Each lender sets its own approval criteria. Some lenders may assign different minimum credit scores and may also rank specific credit scores differently. But FICO provides some general guidance about how lenders might interpret your credit score.

| How Lenders May View Your Credit Score | |

|---|---|

| FICO Score Range | Category |

| 300-499 | Very Poor |

| 500-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Exceptional |

What is the lowest possible credit score you can have when buying a house?

As you may note in the chart above, two categories of credit scores fit into the “very poor” category. However, they’re separated for an important reason. If you have a FICO score of at least 500, you might be able to qualify for a home loan.

Of course, buying a house with a 500 credit score won’t be easy. Any loan options you have are likely limited and costly. Many lenders require mortgage applicants to have a much higher score to receive loan approval.

You might be able to qualify for non-traditional financing (i.e. a hard money loan) with a credit score under 500. But you should be wary of these types of financing options since they can be both costly and risky. Additionally, you might be able to qualify for a number of different mortgage options if you have no credit established.

Steps to buying a house with bad credit

The home buying process can be a bit different when you’re dealing with credit problems. Here’s a look at the steps to purchasing a house with bad credit.

1. Pull your credit reports.

When you apply for a mortgage, the lender will review your credit reports from Equifax, TransUnion, and Experian, along with a FICO score based on each report. Therefore, it’s wise to review all three of your credit reports before you apply for a home loan.

Credit tip: Checking your own credit report will never harm your credit score.

Thanks to the Fair Credit Reporting Act (FCRA), you can claim a free credit report from each bureau once every 12 months from AnnualCreditReport.com. In addition, during the COVID-19 pandemic, the credit bureaus are voluntarily offering free weekly access [1] Forbes. “How to get your free credit report each week.” - Accessed September 2, 2021 https://www.forbes.com/advisor/credit-score/free-credit-report-weekly/ to your credit reports through the same website.

Checking your credit reports can show you where your credit stands now. It’s not a bad idea to check your credit scores [2] Forbes. “How to check your credit scores.” - Accessed September 2, 2021 https://www.forbes.com/advisor/credit-score/how-to-check-your-credit-score/, too, even though they might be different than the FICO Scores [3] Forbes. “What makes up your credit score.” - Accessed September 2, 2021 https://www.forbes.com/advisor/credit-score/what-makes-up-your-credit-score/ your lender checks when you apply for the mortgage. Your lender will review three of your credit scores, but it’s the score that falls in the middle (aka the middle score) that matters most.

Be sure to look over your credit reports for errors, too. Some credit reporting errors can hold your credit score back and even stop a lender from approving your loan application.

2. Try to increase the size of your down payment.

It’s common to need a down payment to secure financing for your home purchase. According to the National Association of Realtors (NAR), the average home buyer puts up a 12% down payment to purchase a home [4] National Association of Realtors. “2021 Home buyers and sellers generational report.” - Accessed September 2, 2021 https://www.nar.realtor/sites/default/files/documents/2021-home-buyers-and-sellers-generational-trends-03-16-2021.pdf.

If you have bad credit, having a down payment may be even more critical. Your lender may require a larger down payment than usual when your credit score falls below a certain threshold. Furthermore, putting more money down might make a lender more comfortable loaning you money despite a low credit score.

0% Down Payment

Finding a mortgage when you have bad credit and no money down can be tricky—sometimes downright impossible. Certain types of mortgages, like VA loans and USDA loans, feature 0% down payment requirements. But lenders may be hesitant to approve you for a no-money-down mortgage when you have bad credit.

Neither the Department of Veterans Affairs nor the Department of Agriculture mandates a minimum credit score for these government-backed loans. But the lenders themselves may impose minimum credit score requirements for their borrowers.

- 640 is the minimum credit score many lenders require for USDA loans.

- 620 is the minimum credit score many lenders require for VA loans.

Due to these factors, securing a bad credit mortgage with no money down is typically a long shot.

10% Down Payment

Saving for a bigger down payment may open doors when you have bad credit scores. For example, you can technically get approved for an FHA loan with a middle credit score of 500 if you find a lender that’s willing to work with you. But you’ll need to provide a down payment of at least 10% [5] Rocket Mortgage. “FHA Loans: Requirements, Loan Limits And Rates.” - Accessed September 2, 2021 https://www.rocketmortgage.com/learn/fha-loans.

20% Down Payment

A 20% down payment can be a considerable dollar amount when you’re buying a home. For example, on a $363,000 loan (the median purchase price in June of 2021 according to NAR), a 20% down payment is a sizable $72,600.

However, if supplying such a large down payment is within your reach, it might help your case. As mentioned, a significant down payment may make lenders feel more comfortable issuing you a mortgage when you have credit issues. Additionally, a 20% down payment could strengthen your offer to purchase, especially if you find yourself in a position where you’re competing against multiple offers.

50% Down Payment

For most people, a 50% down payment on a mortgage isn’t a realistic option. But if you’re selling a previous home with equity or have another large source of cash, putting down half of a home’s purchase price might be doable.

Suppose you’re willing and able to make such a substantial down payment. In that case, you might overcome a lender’s reluctance to issue you a loan with bad credit. From a lender’s point of view, chipping in with a large down payment makes you more likely to pay back the mortgage.

If you’re considering a hard money lender to finance your house purchase, a payment of 50% down might even be a requirement. However, you should proceed with extreme caution in this scenario. Hard money loans often feature escalated repayment terms, high interest rates, and other terms that make them more expensive and harder to repay.

3. Reduce your debt-to-income ratio.

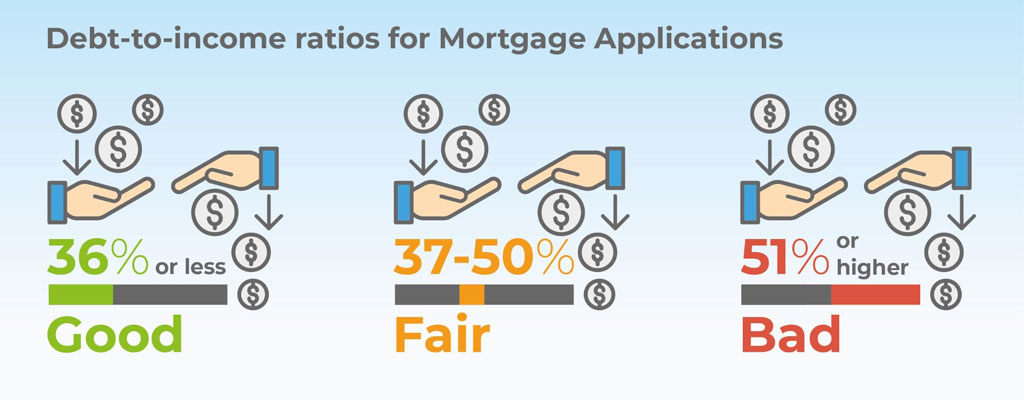

Another factor that impacts your ability to qualify for a mortgage is the relationship between your existing debts and your income—or your debt-to-income (DTI) ratio. Your DTI ratio tells the lender how much you spend compared to the amount you earn.

In general, the lower your DTI ratio, the better in the eyes of a lender. For example, you’ll typically need a DTI of 50% or less if you want to take out a new home loan. However, the maximum DTI ratio a lender will accept can vary based on the loan type and other factors.

The Consumer Financial Protection Bureau (CFPB) recommends keeping your DTI ratio at 43% or less. When your DTI is higher than 43%, there’s a risk you won’t be able to afford the loan, and you could lose your home to foreclosure in the future.

4. Consider getting a co-signer.

Adding a second name to a loan is a strategy that people with bad credit can use to increase approval odds when applying for financing. On a mortgage, there are two ways to add another party to the loan application. You can add a co-borrower or a co-signer.

- A co-borrower on a mortgage, also called a joint borrower, shares ownership of the property and financial liability to repay the mortgage.

- A co-signer on a mortgage is a non-occupant whose name doesn’t appear on the deed. They don’t personally benefit from the loan, but they share financial liability for the debt.

Adding a co-borrower or co-signer with good credit to your mortgage might help the lender feel more comfortable issuing the loan. In addition, having a second borrower with good credit scores can reduce the lender’s risk since they have a more creditworthy party to pursue in the event of a default.

On the other hand, you’re asking a lot from your loved ones, especially if they will not live in the house and potentially benefit from the investment. In addition, Co-borrowers and co-signers are just as liable for the debt as the primary borrower.

The mortgage will most likely appear on your co-signer or co-borrower’s credit reports too. So, any late payments on the loan could damage their credit scores. Furthermore, even if you consistently pay on time, the extra debt increases the DTI ratio for your co-signer. That could make it difficult for them to borrow money again if they want to in the future.

5. Rate shop.

It’s always wise to compare offers from multiple lenders before you take out a new loan. But rate shopping benefits are most apparent when it comes to mortgages. When you’re considering taking out a high-rate mortgage due to credit challenges, the need to compare multiple offers is even more imperative.

Rate shopping could save you thousands of dollars or more throughout a 30-year mortgage. Research by Freddie Mac [6] Freddie Mac. “Why are consumers leaving money on the table?” - Accessed September 2, 2021 http://www.freddiemac.com/research/insight/20180417_consumers_leaving_money.page shows that getting just one additional rate quote can save home buyers an average of $1,500 throughout their loan term. Homebuyers who are willing to do a little extra legwork to get five mortgage quotes save an average of $3,000.

You might feel the urge to take whatever loan you can get if you’re searching for a mortgage with bad credit. Yet, it’s still in your best interest to shop around. Having made an effort, you can at least feel confident you’re getting the best deal available for your current credit situation.

How much can a bad credit score cost you on a mortgage?

Before you decide to try to buy a home with a bad credit score, it’s essential to understand the cost of that decision. Higher interest rates and low credit scores go hand in hand. Yet sometimes, the ramifications of those higher rates can be unclear at first glance.

A mortgage APR that’s 1-1.5% higher may not seem very significant. Yet if you take the time to do the math, you might be surprised to learn that even a slight interest rate increase could add up to tens of thousands of dollars for a 30-year mortgage.

Here’s a comparison showing how much it could cost you to buy a home with a bad credit score. (Tip: You can run your own loan cost comparison using the myFICO Loan Savings Calculator [7] myFICO. “Loan Savings Calculator.” - Accessed September 2, 2021 https://www.myfico.com/credit-education/calculators/loan-savings-calculator/.)

| The Cost of Bad Credit | ||

|---|---|---|

| •30-Year Mortgage •Fixed Interest Rate •$360,000 Loan Amount | ||

| FICO Score | 620 | 720 |

| Average APR | 4.105% | 2.738% |

| Monthly Payment | $1,741 | $1,467 |

| Total Interest | $266,601 | $168,257 |

| Difference: •$274 Per Month •$98,344 Overall Interest | ||

If you decide to move forward with a bad credit mortgage, remember that it doesn’t have to be the end of the story. You can work to improve your credit and possibly refinance your home loan in the future. There’s a chance you might be able to qualify for a better APR later and put yourself in a better position.

Ways to improve your credit score quickly before a mortgage application

The details above underscore the importance of improving a poor credit score before you apply for a mortgage. But if you’re already looking for a home or you need to move ASAP, you may feel like you’re out of time to do anything about your credit. Thankfully, that’s not always true.

A complete credit overhaul typically requires time. But there are actions you can take now that might quickly improve your credit score. When you’re applying for financing—especially a large loan like a mortgage—even a small credit score increase has the potential to add up to big savings over the life of your loan.

Here are six ways you might be able to improve your credit score fast before starting your mortgage application.

1. Check for credit errors.

According to a Federal Trade Commission (FTC) study, one in four consumers has an error on their credit reports that could impact their credit scores. Credit scoring models, like FICO and VantageScore, base your credit score on the information found on your credit report. So, credit reporting errors have the potential to damage your credit score unfairly. Suppose you find mistakes in your credit reports. In that case, you may want to consider disputing them with the appropriate credit reporting agencies before you apply for a mortgage. Fixing harmful credit errors could drive credit scores up quickly in certain situations.

2. Lower your credit utilization ratio.

Aside from payment history, your credit utilization ratio is one of the most FICO Score factors. Ideally, you should keep your credit utilization rate, or your credit card balance-to-limit ratio, at the lowest percentage possible. Let’s say your credit report shows you have a $1,000 balance on a credit card with a $1,000 credit limit. Your credit scores may suffer when your account is maxed out or at a 100% utilization rate. Pay that same account down to $250, and your utilization rate drops to 25%—a move that might help your credit scores. Your best bet is to pay the balance down to $0 (preferably by the statement closing date) to both avoid interest and achieve 0% credit utilization. Paying down your credit card balance may be the best way to lower your credit utilization rate, but it’s not your only option. For example, suppose you can’t afford to pay off your credit cards. In that case, you might consider asking for a credit limit increase as an out-of-the-box approach to reduce your credit utilization.

3. Consider the authorized user method.

If you have a loved one with a good credit card account, a simple favor has the potential to improve your credit score. First, your family member or friend can call their credit card company and ask to add you as an authorized user on their existing credit card.

Many card issuers report account details to the three major credit bureaus for primary cardholders and authorized users. If you become an authorized user on a well-managed credit card, and if the account shows up on your credit reports, your score might benefit from the positive history. The approach doesn’t always work, but it might be worth trying.

4. Try to negotiate a pay-for-deletion arrangement.

Negative accounts, like collections and charge-offs, have the potential to harm your credit score. Therefore, if your financial situation allows, paying or settling negative accounts may be a good idea.

However, before you pay off an old collection, it’s helpful to understand what to expect from a credit score standpoint. There are two reasons why resolving an outstanding negative balance might not do much for your credit score.

- Paying a negative account doesn’t remove it from your credit report. The FCRA permits the credit reporting agencies to leave most negative accounts on your credit report for up to seven years. (Note: Some bankruptcies can stay on your credit report for as long as 10 years.) Settling or paying off an account won’t make the credit reporting agencies delete it sooner.

- Credit scoring models may still count paid collections (and other negative accounts) against you. Lenders use older versions of the FICO Score when you apply for a mortgage. With older FICO Scores, the presence of the collection account on your report is what hurts your credit score, not the account balance.

Of course, suppose a negative account is incorrect. In that case, you can dispute it and try to get it deleted from your credit report (see above). Otherwise, there’s another approach you can attempt called the pay-for-deletion strategy.

The goal of a collection agency is to—you guessed it—collect unpaid debts. So, you may be able to convince a debt collector to ask the credit bureaus to remove a negative account from your credit reports in exchange for payment. Suppose you’re successful and the account comes off your credit report. In that case, it will no longer have any negative impact on your credit score.

Note that the payment-for-deletion approach tends to be a long shot. A debt collector may turn down your request. If you find a debt collector that’s willing to agree to such an arrangement, be sure to get the offer in writing before you pay.

5. Mix up your credit accounts.

Credit scoring models may reward you for having a healthy mixture of account types on your credit report. With FICO Scores, for example, your credit mix makes up 10% of your credit score.

Ideally, you want to have both revolving and installment accounts on your credit reports. Common examples of revolving accounts include credit cards, home equity lines of credit, and retail store cards. Installment accounts, meanwhile, can be personal loans, mortgages, auto loans, student loans, etc.

If you know that you’re missing one of the types of credit above, opening a new account might benefit you. For example, you might consider applying for a credit builder account if your credit report doesn’t show any installment credit. And if your credit report has no revolving credit, getting a credit card might be helpful. Just be sure you pick the right type of credit card for your situation.

However, before you open any new accounts, be sure that you can commit to paying them on time so they can help, not hurt, your credit. In the case of a new credit card, it’s also essential to keep your balance-to-limit ratio low for the same reason.

6. Give your Experian credit score a boost.

The last credit improvement method we’ll explore is Experian Boost. Like the other strategies above, Experian Boost has the potential to help you see some type of credit score change in a relatively short time. However, with this particular tool, only credit scores based on your Experian credit report may change.

Experian Boost is a free program that’s available from the credit reporting agency Experian. When you opt in to the service, you allow Experian to scan your bank account or credit card history for the following types of monthly bills:

- Utility

- Phone Bills

- Select Streaming Services

If the system finds eligible bills (with on-time payment history), it will add them to your Experian credit report. The added accounts can be especially beneficial if you have a thin credit file that doesn’t feature many other tradelines. According to Experian, around 60% of consumers who use the free service see a credit score increase—13 points on average [8] Experian. “Experian Boost helped raise American credit scores by 50 million points.” - Accessed September 2, 2021 https://www.experian.com/blogs/ask-experian/experian-boost-study/.

Popular programs for buying a home with bad credit

When buying a home with bad credit, your mortgage options will fit into one of three categories: government-backed, conventional, and private.

- Conventional Loans: You generally need a minimum credit score of 620 or higher to qualify for a conventional mortgage loan. A 620 FICO Score is considered “fair” and falls between the good and bad credit score ranges. So, depending on the condition of your credit, a conventional loan may not serve you well with bad credit.

- Government-Backed Loans: Loans that are insured by the federal government are typically your best option when trying to buy a home with bad credit. Because the government backs these loans, lenders may offer more lenient approval criteria—opening the door to homeownership to people who might otherwise be excluded. FHA loans, VA loans, and USDA loans are the most popular types of government-backed mortgages. If your credit score falls below the 620 threshold, an FHA might be your best option.

- Private Loans: A private mortgage, or a non-qualified mortgage, comes from a lender who doesn’t plan to resell the loan to an investor on the secondary mortgage market. When a lender intends to keep the bank on its own books, it gets to set its own approval criteria. Often the focus is more on the value of the property you wish to purchase rather than your creditworthiness.

It’s important to be cautious if you’re considering a non-qualified mortgage to purchase a home. Because the lender is taking on a lot more risk, private loans can be expensive. You might also face large down payment requirements and short repayment terms—making them a poor choice for many home buyers.

Bottom Line

Just because you can find a way to buy a house with bad credit doesn’t mean you should. If you have the option to wait, working to improve your credit could save you money and make the home buying process much more manageable. Plus, the time it takes to improve your credit score might be a chance to pay down your debts or save a larger down payment. Both of those things potentially set you up to qualify for a better (and perhaps larger) home loan down the road.