Black Friday Shopping Regrets

On Black Friday many of our favorite retailers offer amazing deals and discounts on popular and sought-after products. However, while some might wait all year to buy their “dream” products, as others look to impulse buy, the “event” has the potential to lead to shopping regret.

To reveal the Black Friday regrets and habits of consumers in the U.S., we surveyed 1,293 shoppers about their Black Friday spending, purchases, and how they felt after the deals had ended.

Quick takeaways from the Black Friday survey:

- 2 in 5 (42%) consumers have regretted their Black Friday purchases

- The average consumer expects to save $213 from discounts and deals

- Shoppers estimate they’ll spend an average of $399.69 on Black Friday offers this year

- 1 in 6 shoppers that received stimulus checks say they’ll spend more on Black Friday this year

- 71% of consumers say they’ll wait until Black Friday before purchasing electronics

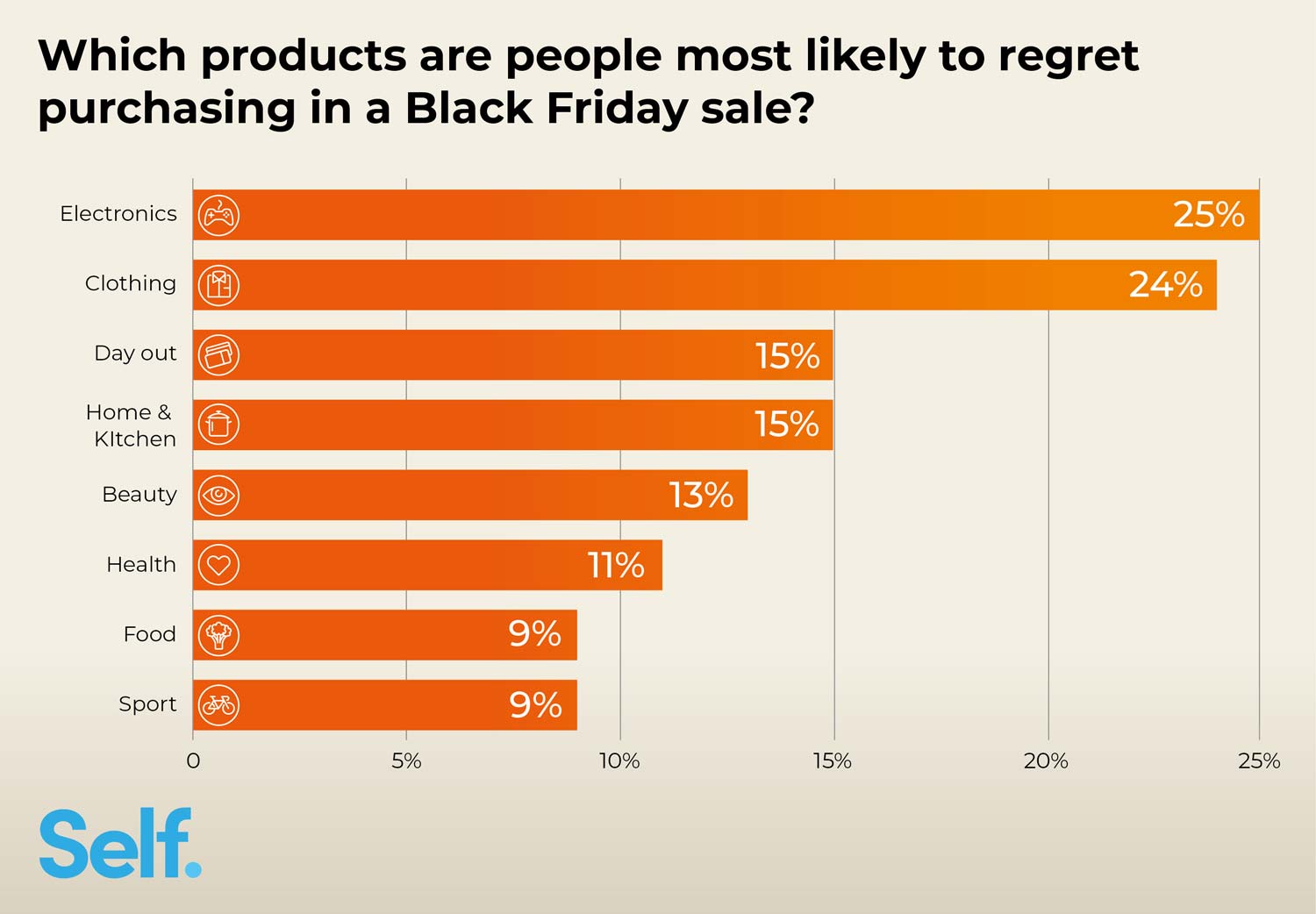

- Electronics (25%) and new clothes (24%) are the most regretted Black Friday buys

Black Friday - Consumer Regret

According to the findings of our survey, 91% of consumers in the U.S. have participated and purchased something during a Black Friday sales event, with 94% of consumers under 35 shopping during the annual sales at least once in recent years.

However, while the vast majority of shoppers might have bought from a Black Friday sale at some point, the overall trend of people participating in Black Friday has fallen from 59% annual participation in 2015 to just 36% annual participation in 2020 and 2019.

One potential cause of the drop-off could be the regret people face soon after buying during the Black Friday sales, with the survey revealing that 42% of consumers have regretted at least one of their Black Friday purchases.

The results of our survey found that more than half (51%) of consumers under 25 have regretted their purchases, while just 1 in 5 consumers over 65 have regretted their purchases (22%). Men (44%) are also more likely to regret their Black Friday purchases than women (41%).

When it comes to what people have regretted buying, a quarter (25%) of consumers have regretted the electronics they’ve bought, with 24% regretting the clothes they’ve bought during Black Friday.

Products people regretted purchasing during a Black Friday sale

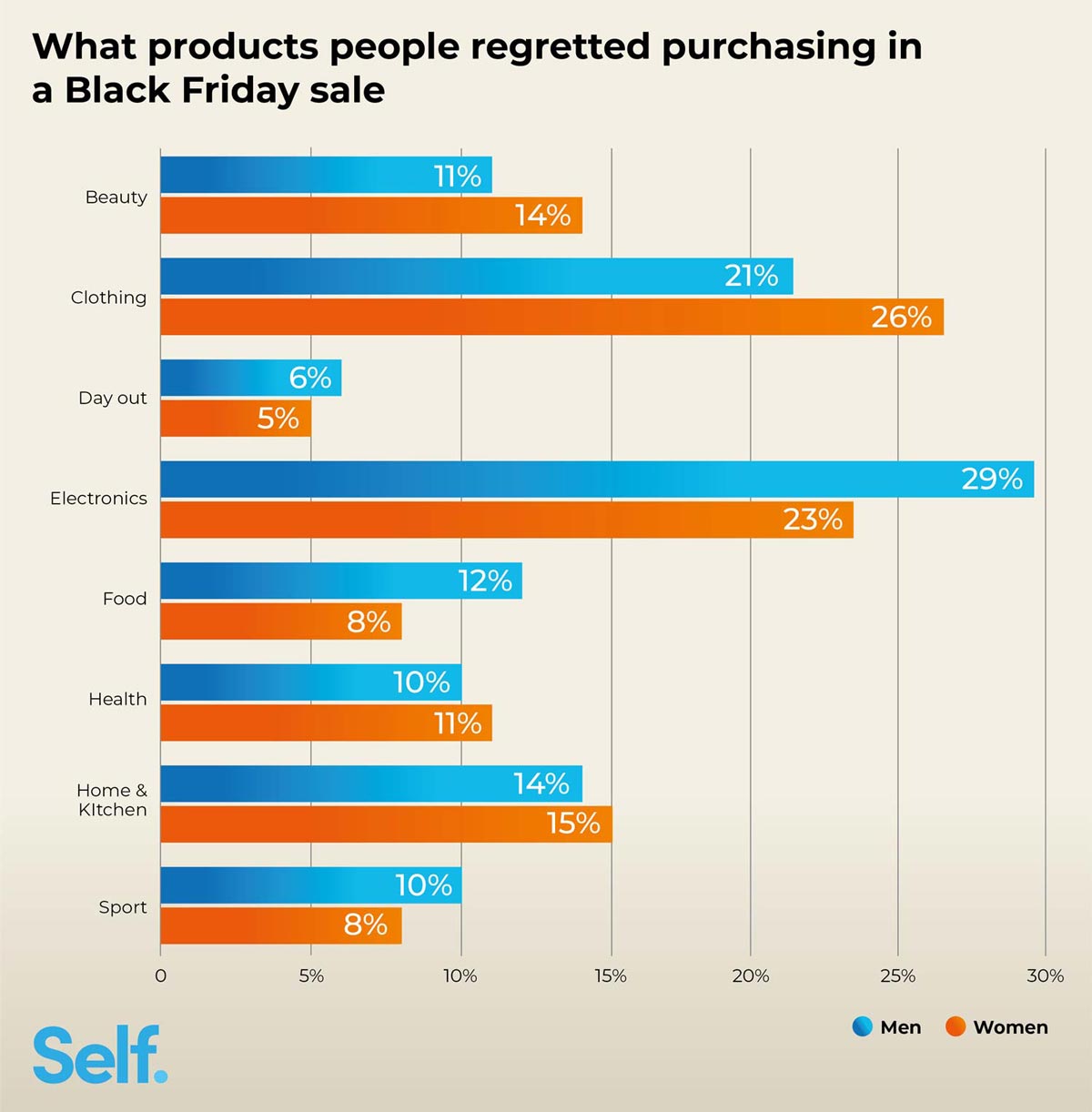

Our data showed that between men and women, men (29%) are more likely to regret their electronics purchases on Black Friday than women (23%), while women (26%) are more likely to regret their clothing purchases during Black Friday than men (21%).

Who regrets which products most?

Fewer than two-thirds (63%) of consumers still use all of their Black Friday purchases from last year, with 18% indicating they use some but not all of the products they bought in 2020. Overall though, 6% of consumers have used up, abandoned, or thrown away the products they bought last year.

Consumers under the age of 25 are 48% less likely to use the products they bought last year than the national average (6%), with nearly 1 in 10 (9%) no longer using what they bought 12 months ago.

Are They Planned Or Impulse Purchases?

All these regrets pose the question, are people planning to buy these products or are they impulse buys?

Prior to the annual sales event, 35% of consumers say they have pre-planned what they would buy, with 15% saying they have never planned their purchases ahead of time, and 43% indicating they plan some of their purchases, while others are impulse buys.

Men (40%) are 8% more likely to plan their Black Friday purchases than women (32%), with consumers under the age of 35 the least likely to plan ahead; 1 in 5 (19%) of those under the age of 25 say they haven’t planned previous Black Friday purchases.

That might sound like consumers are planning their Black Friday purchases all year round. But, as our survey found, nearly three-quarters (71%) of consumers say they make their plans within the month before Black Friday.

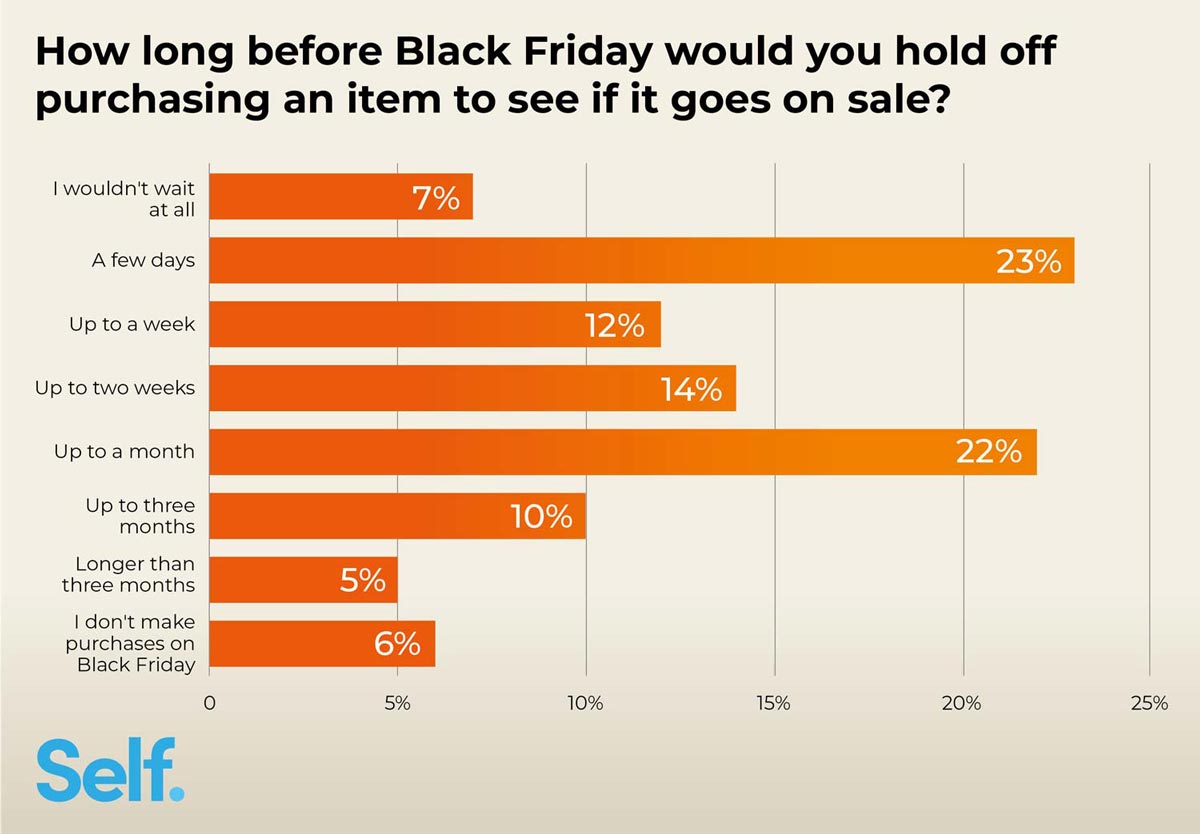

22% of consumers say they would hold off purchasing an item to see if it goes on sale for up to a month, 14% would wait up to two weeks, 12% up to a week, and 23% would wait just a few days. This data indicates that in the month before Black Friday many consumers already have an idea of what they’re looking to buy.

When asked about the purchases they would most likely wait to buy, 71% of consumers said they would wait until Black Friday to buy electronic goods, with home & kitchen goods ranking as the second most likely planned purchases (47%).

Which products are people willing to wait until Black Friday to buy?

Even after purchasing planned products, 27% of consumers revealed they will intentionally buy multiple “similar” versions of products to test and compare, then return those they don’t wish to keep. Taking advantage of the “reduced” prices to afford multiple versions.

A third (33%) of consumers under 35 take part in this practice of buying, testing, and returning products, with fewer than 1 in 5 (17%) of consumers aged 65 or higher doing the same.

Between men and women, it was also revealed that men are more likely to test and return their purchases, with 34% of men saying they will test products, compared to 23% of women.

How much are people spending during Black Friday?

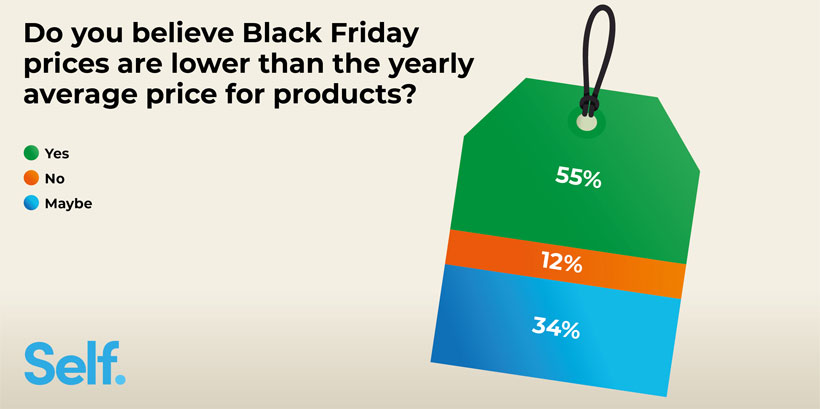

One key reason people are likely to wait to buy (often costly) electronic and home & kitchen goods on Black Friday is because 55% of people believe the prices are cheaper than any other time of year. However, while just over half of consumers believe prices are cheaper on Black Friday, 45% are unsure if retailers do make the prices any cheaper.

Despite this, the average consumer estimates they saved $213 buying products during the annual sales event, with the average consumer spending an average of $340 on products during Black Friday.

Male consumers estimate they spent an average of $409 during Black Friday 2020, while believing they saved an average of $270 on their purchase(s). In comparison, women say they estimate they spent $294 last year, with the average female consumer believing they saved $176 in the Black Friday sales events.

Data showed that consumers between the ages of 45 and 54 were the highest average spenders in 2020 ($488), with those over the age of 65 the lowest average spenders ($202). However, in terms of what people think they saved, those between the ages of 35 and 44 estimate they saved an average of $257 on purchases made on Black Friday.

How much do people estimate they’ll spend this year?

On average, U.S. consumers estimate they will spend about $400 on Black Friday, with men saying they estimate spending $479, while women estimate they will spend $349.

Respondents that indicated they received stimulus checks over the course of the pandemic estimate they will spend $419, 5% more than the national average. You can view more about how people have spent their stimulus checks by visiting our report on ‘Stimulus Checks and How They’re Being Spent’.

How will people take part in Black Friday this year?

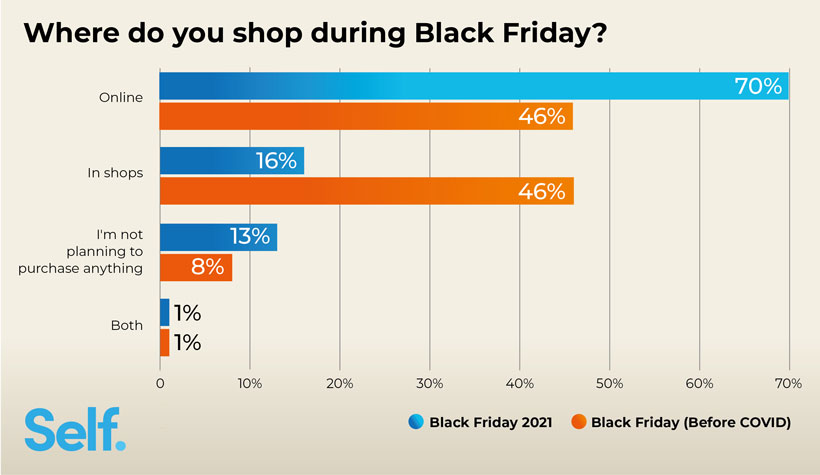

Fewer than 1 in 5 (16%) of respondents to our survey said they would be shopping in stores exclusively, with 70% saying they will be shopping online, and just 1% saying they would shop both online and in-store.

Our data showed that 1 in 5 (20%) consumers under the age of 35 intend on shopping in-store, while those aged over 65 are the least likely to be shopping in-store (10%).

In comparison to how people shopped on Black Friday before COVID, 46% said they would visit a store in person to purchase sales event products. The fall to just 16% this year indicates we could see a 65% drop in expected foot traffic at retail stores compared to pre-COVID Black Fridays.

In terms of online buying, pre-COVID, 46% of our respondents said they would take part in Black Friday shopping online. However, since the pandemic, this figure is now 70%, a 52% increase in those expected to shop online this year.

Methodology

To evaluate Black Friday shopping regrets and spending behaviors, 1,293 U.S. consumers were asked a series of questions related to their Black Friday shopping habits, shopping regrets, and plans for this year. All answers were provided anonymously using the Amazon Mechanical Turk survey platform.

The breakdown of respondents were:

| Gender | |

|---|---|

| Female | 59% |

| Male | 40% |

| Prefer not to say | 1% |

| Age | |

|---|---|

| 18 - 24 | 10% |

| 25 - 34 | 42% |

| 35 - 44 | 26% |

| 45 - 54 | 12% |

| 55 - 64 | 8% |

| 65+ | 3% |