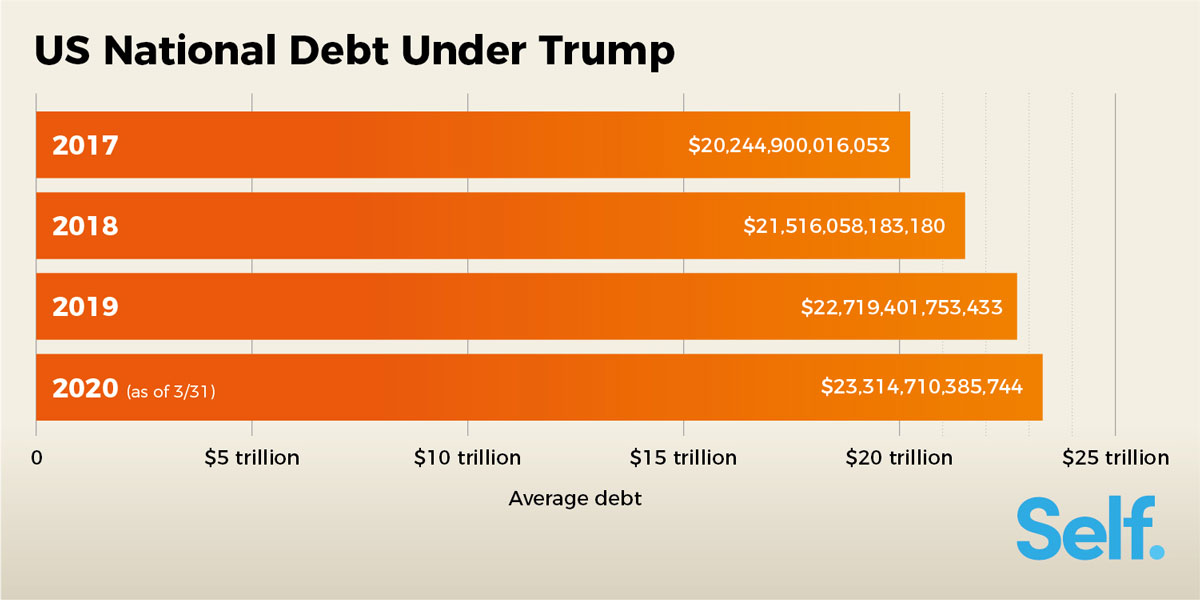

The national debt under President Trump increased from $20,244,900,016,053 to $27,751,896,236,415 (20th January 2021). [13] Treasury Direct: Debt to the Penny https://www.treasurydirect.gov/govt/reports/pd/pd_debttothepenny.htm That's $5.138 billion a day.

In less than one term, the debt under Trump’s presidency increased more than $7.5 trillion. In comparison, only Barack Obama had increased national debt more, totaling $8.3 trillion throughout his 8 years as President.

Key statistics

- During his presidency, national debt increased 37.1% under Trump

- Outside of the COVID-19 Relief Bills passed, Trump increased spending on agriculture more than any other area, jumping 194% between 2017 and 2019, from $14.2b to $41.7b

- Of the $1 trillion federal budget in 2020, $893 billion is a deficit and half of that will be owed to China

- Trump cut corporate tax rates from 35% in 2017 to 21% in 2018

- The highest federal Income tax rate was reduced from 39.6% to 37% at the start of 2018

It is projected that the president who campaigned on eliminating the national debt will add $8 trillion to it before leaving office. [1] US Debt by President by Dollar and Percentage https://www.thebalance.com/us-debt-by-president-by-dollar-and-percent-3306296 This is likely a conservative estimate given the originally unexpected $2 trillion stimulus just passed by Congress due to the COVID-19 pandemic.

The National Debt Under Trump

How the National Debt Has Changed Under Trump

The national debt over the nation’s history has grown from a modest $83.7 million under George Washington (even in the 1700’s wars cost staggering sums) to a whopping $23.3 trillion today.

But the debt has had some significant spikes for some very important reasons, and there was a brief period of time, one year to be exact, where the debt was entirely paid off.

In 1835, Andrew Jackson paid off the national debt through severe cost-cutting and land sell-offs. Jackson’s distrust of banks led him to redistribute funds to the states, which in turn caused an economic bubble, which led to recession. Restarting the national debt to reinvigorate the economy was inevitable.

World War I led to the debt increasing by more than $21 billion to a total of $24 billion. Two decades later, Franklin Delano Roosevelt would see the national debt rise from $22 billion to over $205 billion dollars, largely due to World War II. The Wars in Iraq and Afghanistan added $2.1 trillion to the debt just in George W. Bush’s administration alone. [8] US Debt by President: By Dollar and Percentage https://www.thebalance.com/us-debt-by-president-by-dollar-and-percent-3306296 Both Bush and Obama had massive stimulus packages to fight the 2008 recession that each added hundreds of billions to the national debt.

Coronavirus Lockdown & Unemployment

But by far, one of the most significant impacts on the national debt occurred very recently during Donald Trump’s administration. President Trump inherited a rising economy which continued to rise through the last two and a half years. The Dow reached 20,000, more than 140,000 jobs were added to the economy, and low unemployment persisted.

Then in February 2020, the COVID-19 pandemic, which had already caused economic havoc in China and Europe, reached the United States.

A highly contagious disease, COVID-19 could not only kill the very old, very young, and very sick, it could also be spread by carriers not displaying any symptoms who were completely unaware that they had it. And, it could live for hours in the air and up to days on surfaces. Faced with what was deemed an “invisible enemy,” governors across the US ordered schools and non-essential businesses closed, and citizens to self-isolate, telling them to leave their homes only for essential supplies and only when absolutely necessary.

Needless to say, the economic impacts of these decisions were staggering. The eight largest drops in the Dow Jones Industrial Average were recorded during this period. 26 million people had filed for unemployment benefits by late March (it took 10 years to add 22 million jobs to the economy, and those gains were wiped out in 5 weeks). And, Congress passed multiple large stimulus bills to assist individuals, families, and businesses.

CARES Act

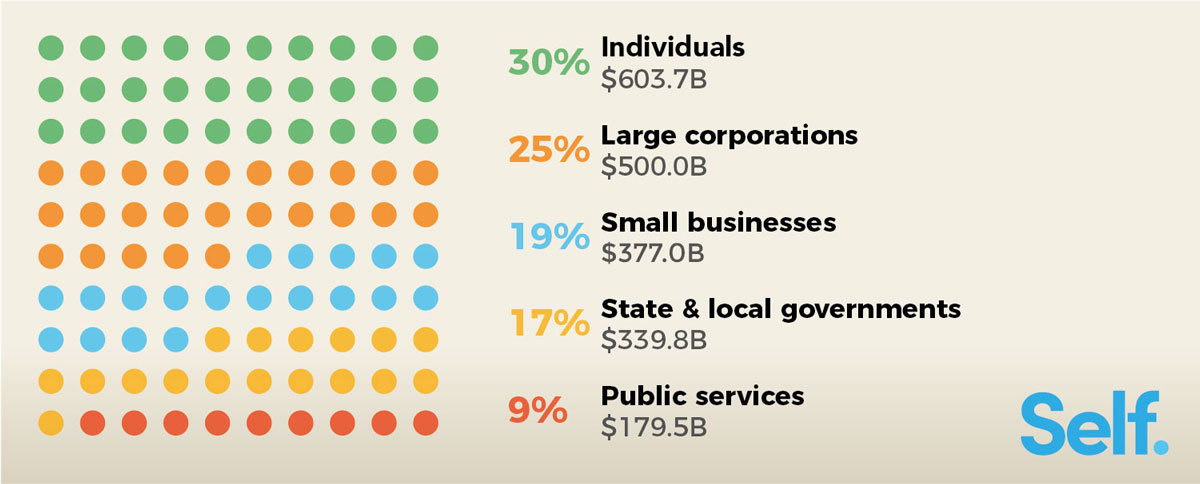

The Coronavirus Aid, Relief, and Economic Security Act — also known as the CARES Act — was passed by U.S. lawmakers in late March 2020. With the stroke of a pen, the CARES Act became the largest economic stimulus bill in modern history, more than doubling the stimulus act passed to stave off the effects of the 2009 Financial Crisis.

The various parts of the CARES act total $2.2 trillion. The parts are broken up based on what part of the economy each part is designed to help… individuals ($603 billion), big business ($500 billion), small business ($377 billion), state and local governments ($340 billion), and public services ($180 billion). A combination of loans, grants, and direct payments funds each of these areas. The most obvious direct payment is the $1,200 per individual, $500 per child payment given to every American taxpayer, depending on adjusted gross income.

Economists are still unsure of the total impact on the national debt as the COVID-19 pandemic is, to date, not even considered half over.

Trump’s Biggest Decision Areas

Often, the promises made by a candidate tend to differ from what they actually execute while in office, and Trump’s presidency is no exception. One of the promises made by Trump during his campaign was to eliminate the national debt, a feat achieved by only one other president in history, Andrew Jackson.

Trump had two strategies to reduce the debt. First, he promised to increase tax revenues. [4] Trump and the National Debt https://www.thebalance.com/trump-plans-to-reduce-national-debt-4114401 While originally promising to grow the economy by 6 percent, Trump immediately cut that estimate to 2-3 percent once he assumed office.

This was a wise move in that, while rapid growth sounds appealing, growing too rapidly can lead to boom-bust cycles and bubbles based on irrationality that usually end in recession.

The Tax Cuts and Jobs Act

Trump decided to spur the growth rate by announcing a strategy used by many other presidents, particularly Republican administrations. The outline for what would become the Tax Cuts and Jobs Act was released within his first 100 days in office, and was signed into law on December 22, 2017.

This cut the corporate tax rate from 35 to 21 percent beginning in 2018. The top individual income tax rate dropped to 37 percent. It doubled the standard deduction but eliminated personal exemptions.

Unfortunately for President Trump, his tax cuts won't stimulate the economy enough to make up for lost tax revenue. The Laffer curve indicates that tax cuts only stimulate economic growth when tax rates are above 50 percent.

By contrast, Ronald Reagan had success using tax cuts as an economic stimulus because the highest tax rate during his time in office was 70 percent.

Trump’s second promise was to eliminate waste in federal spending. [4] Trump and the National Debt https://www.thebalance.com/trump-plans-to-reduce-national-debt-4114401 He certainly lent credibility to this argument in the way he ran his campaign. By using social media and his numerous campaign rallies, he achieved as much exposure, if not more, than other candidates who had to gain visibility using expensive ad buys.

Trump wasn’t wrong in wanting to attack waste in federal spending. Both Presidents George W. Bush and Barack Obama had similar goals.

The problem is the consequences that come with cuts. Each government spending program has a constituency that lobbies Congress to remind legislators of their importance. Eliminating these benefits loses votes and contributors. Congresspeople love to agree to cut spending for any district except their own.

Domestic Social Programs and the Military

In order to make an impact on a huge and ever-increasing amount of money like the national debt, you have to cut into the largest spending programs. The largest of these programs are mandatory obligations made by previous acts of Congress.

One of the biggest, Social Security, is on that list.

For fiscal year 2021, Social Security benefits cost $1 trillion a year, Medicare, $722 billion, and Medicaid costs $448 billion. The interest alone on the national debt is $378 billion. These together total $3.3 trillion. Eliminating that entire sum will only have the tiniest of impacts on the national debt.

Outside of domestic social programs, the spending on the military makes the spending on any individual social program look tiny by comparison. If you want to have any impact on the debt, military spending must also be cut.

Trump increased military spending in fiscal year 2021 to $934 billion. [7] US Military Budget, Its Components, Challenges, and Growth https://www.thebalance.com/u-s-military-budget-components-challenges-growth-3306320 This figure includes the $636 billion base budget for the Department of Defense, $69 billion in overseas contingency operations for the fight against the Islamic State, and $228 billion to fund the other agencies that protect the U.S. and service the military.

This includes some expenditures you probably had no idea were part of the Defense Department budget.

They include:

- The Departments of Veterans Affairs ($105 billion)

- Homeland Security ($50 billion)

- The State Department ($44 billion)

- The National Nuclear Security Administration in the Department of Energy ($20 billion)

- The FBI and Cybersecurity in the Department of Justice ($9.8 billion)

The total budget for fiscal year 2021 is $4.8 trillion dollars. [5] Trump signs $738 Billion Defense Bill https://www.cnbc.com/2019/12/21/trump-signs-738-billion-defense-bill.html About $4.2 trillion is everything we just discussed in the last few paragraphs.

Once you deduct that from your overall budget, you have about $595 billion left to run the rest of the government. This is everything from the IRS to the rest of the Justice Department to the other government agencies not covered under defense or social programs.

For Trump to make any impact on the national debt that was either substantive or noticeable, he would basically have to eliminate it all. To even have an impact on the deficit, he would have to eliminate $966 billion.

Trump’s Impact on the Trade Deficit

The federal deficit, the gap between the amount of money the federal government spends and how much revenue it brings in, will exceed $1 trillion this year under the Trump Administration. This was the Congressional Budget Office fiscal outlook back in January. [11] Congressional Budget Office: The Budget and Economic Outlook 2020 to 2030 https://www.cbo.gov/publication/56073#:~:text=CBO%20currently%20projects%20a%20federal,see%20Table%201%2D1)

Of this $1 trillion, $893 billion of it is the trade deficit, which is the difference between how much the US imports versus how much it exports. Of the $893 billion, about half of it is with China, our largest trading partner.

Long before he was even a candidate for president, Trump advocated for tariffs to reduce the U.S. trade deficit and promote domestic manufacturing. His contention was the country was being "ripped off" by its trading partners, a sentiment he has echoed since the 1980s all the way up to his candidacy for president and throughout his administration.

Many economists argue that the trade deficit’s problems are overblown and most agree that tariffs are not a solution. [12] Economists united: Trump tariffs won't help the economy https://www.reuters.com/article/us-usa-economy-poll/economists-united-trump-tariffs-wont-help-the-economy-idUSKCN1GQ02G Tariffs are problematic because their cost is often borne by manufacturers and consumers in the form of higher prices [6] The Trouble with Tariffs is Unintended Consequences https://www.barrons.com/articles/trump-tariffs-against-china-unintended-consequences-51564748943 , which can achieve the effect of ultimately widening a trade deficit rather than reducing it. A “tit-for-tat” approach to tariffs can lead to deterioration of trade relations between opposing nations, which can prolong a trade war.

In 2001, China achieved two major accomplishments in its push to modernize its trade relations with the west. The first was joining the World Trade Organization, and the second was achieving Most Favored Nation trading status thanks to the United States–China Relations Act passed in late 2000. [3] Wikipedia - China-United States Trade War https://en.wikipedia.org/wiki/China%E2%80%93United_States_trade_war

One of the conditions of attaining this status was addressing a long list of trade grievances with the United States. Among these were protecting intellectual property. China was a major source of pirated music and movies, as well as other IP such as computer software. There was no enforcement of intellectual property rights in China's written law, and as a result, piracy and theft was costing American companies $1 billion a year by 1994.

By the time Trump took office, these complaints persisted, with American officials maintaining that China had done little to nothing to protect American IP. Trump also pointed out China’s manipulation of its currency, which made it difficult for American-made goods to compete in a global marketplace.

China’s counter was that advances in technology in China were not due to stolen IP but to research and development initiatives undertaken by the Chinese government. On January 22, 2018, the first volley of Trump’s trade war with China was fired.

Key Dates in Trump’s Trade War with China [6] The Trouble with Tariffs is Unintended Consequences https://www.barrons.com/articles/trump-tariffs-against-china-unintended-consequences-51564748943

- 2017

-

Trade Deficit with China: $375 billion

- 2018

-

January 22

Trump announces tariffs on solar panels and washing machines. Imports of residential washing machines from China totaled about $1.1 billion in 2015.

-

March 1

Trump announces steel and aluminum tariffs on imports from all countries. The US imports 3% of its steel from China.

-

April 2

China responds by imposing tariffs on 128 products it imports from America, including aluminum, airplanes, cars, pork, and soybeans (which have a 25% tariff), as well as fruit, nuts, and steel piping (15%)

-

May 20

Chinese officials agree to substantially reduce America's trade deficit with China by committing to increase its purchases of American goods. Treasury Secretary Mnuchin announces "We are putting the trade war on hold."

-

May 21

Trump tweets that "China has agreed to buy massive amounts of ADDITIONAL Farm/Agricultural Products," although he later clarified the purchases were contingent upon the closure of a potential deal.

-

May 29

White House announces that it would impose a 25% tariff on $50 billion of Chinese goods with "industrially significant technology. China announces it would discontinue trade talks with Washington if it imposes trade sanctions.

-

June 15

Trump declares that the US would impose a 25% tariff on $50 billion of Chinese exports. $34 billion would start July 6, 2018, with a further $16 billion to begin at a later date.

-

June 19

China retaliates, threatening its own tariffs on $50 billion of U.S. goods, and stating that the United States had launched a trade war. “Tit-for-tat” tariffs continue through July, August, and September, 2018

-

November 30

President Trump signs the revised U.S.–Mexico–Canada Agreement (USMCA) in Buenos Aires, Argentina. The USMCA contains a "rules of origin" provision for automobiles that was "touted by the Trump administration as a tool to keep out Chinese inputs and encourage production and investment in the US and North America."

-

December 1

Planned increases in tariffs are postponed. The White House announces that both parties will "immediately begin negotiations on structural changes with respect to forced technology transfer, intellectual property protection, non-tariff barriers, cyber intrusions and cyber theft."

-

December 11

Trade Deficit with China: $419.2 billion. Trump announced China was buying a "tremendous amount" of U.S. soybeans. Commodities traders see no evidence of such purchases, and over the next six months soybean exports to China were about one fourth of what they were in 2017, before the trade conflict began.

- 2019

-

May 5

Trump states that the previous tariffs of 10% levied in $200 billion worth of Chinese goods would be raised to 25% on May 10.

-

June 1

China raises tariffs on $60 billion worth of US goods

-

June 29

During the G20 Osaka summit, Trump announces he and Xi Jinping agreed to a "truce" in the trade war after extensive talks. After meeting with Chinese leader Xi Jinping, Trump announces "China is going to be buying a tremendous amount of food and agricultural products, and they're going to start that very soon, almost immediately." China denies making the commitment and one month later no such purchases occur.

-

July 11

Trump tweeted "China is letting us down in that they have not been buying the agricultural products from our great Farmers that they said they would."

-

August 1

Trump announces on Twitter that an additional 10% tariff will be levied on the remaining $300 billion of goods.

-

August 5

China ordered state-owned enterprises to stop buying US agricultural products.

-

August 25

At the G7 summit, Trump states, "China called last night our top trade people and said ‘let’s get back to the table’ so we will be getting back to the table and I think they want to do something. They have been hurt very badly but they understand this is the right thing to do and I have great respect for it." Chinese Foreign Ministry spokesman Geng Shuang says he was unaware of such a call and Trump aides later concede the call never took place but the president was “trying to project optimism.”

-

September 11

After China announces it was exempting 16 American product types from tariffs for one year, Trump announces he would delay until October 15 a tariff increase on Chinese goods previously scheduled for October 1.

-

September 12

Trump advisors are increasingly concerned that the trade war is weakening the American economy going into the 2020 election campaign and discuss ways to reach a limited interim deal.

-

September 26

The Wall Street Journal reports that Chinese retaliatory tariffs on lumber and wood products had caused hardwood lumber exports to China to fall 40% during 2019, resulting in American lumber mills laying off workers.

-

October 11

Trump announces that China and the US have reached a tentative agreement for the "first phase" of a trade deal, with China agreeing to buy up to $50 billion in American farm products, and to accept more American financial services in their market, with the United States agreeing to suspend new tariffs scheduled for October 15.

-

December 13

Trade Deficit with China: $345.6 billion Both countries announce an initial deal where new tariffs to be mutually imposed on December 15 would not be implemented. China says it "will buy more high quality of American agricultural products", while the United States says it will halve the existing 15% tariffs.

- 2020

-

January 3

Reuters reports that in December 2019 the American manufacturing sector fell into its deepest slump in over a decade, attributing the decline to the US-China trade war.

-

January 15

China's Vice Premier Liu He and President Trump sign the US–China Phase One trade deal in Washington DC. The agreement between the US and China is set to take effect in February, 2020.

Trump’s trade war with China produced several new trade agreements both with China and other nations, but at what cost?

In August of 2019, the Congressional Budget Office reported their estimates of the U.S. economic impact of tariffs (tariffs overall, but US tariffs were disproportionately applied against China). [10] Congressional Budget Office: The Effects of Tariffs and Trade Barriers in CBO’s Projections https://www.cbo.gov/publication/55576#:~:text=In%20CBO's%20projections%2C%20the%20tariffs,economic%20activity%20in%20several%20ways.&text=By%202020%2C%20they%20reduce%20the,businesses%20adjust%20their%20supply%20chains

In this estimate, the CBO projected that by 2020, tariffs would:

- Reduce the U.S. GDP by 0.3 percent

- Reduce real consumption by 0.3 percent

- Reduce real private investment by 1.3 percent

- Reduce real income by $580 per household.

- U.S. exports would be 1.7 percent lower and imports would be 2.6 percent lower

This is economists’ arguments against tariffs coming to fruition. Tariffs affect economic activity in three ways:

- Consumer goods become more expensive

- Business (especially small business) uncertainty increases, which slows investment

- Other countries follow by imposing retaliatory tariffs, which makes US exports more expensive.

Sources

- [1] US Debt by President by Dollar and Percentage https://www.thebalance.com/us-debt-by-president-by-dollar-and-percent-3306296

- [2] US Debt Clock https://www.worldometers.info/us-debt-clock/

- [3] Wikipedia - China-United States Trade War https://en.wikipedia.org/wiki/China%E2%80%93United_States_trade_war

- [4] Trump and the National Debt https://www.thebalance.com/trump-plans-to-reduce-national-debt-4114401

- [5] Trump signs $738 Billion Defense Bill https://www.cnbc.com/2019/12/21/trump-signs-738-billion-defense-bill.html

- [6] The Trouble with Tariffs is Unintended Consequences https://www.barrons.com/articles/trump-tariffs-against-china-unintended-consequences-51564748943

- [7] US Military Budget, Its Components, Challenges, and Growth https://www.thebalance.com/u-s-military-budget-components-challenges-growth-3306320

- [8] US Debt by President: By Dollar and Percentage https://www.thebalance.com/us-debt-by-president-by-dollar-and-percent-3306296

- [9] National Debt Increased by $3 Trillion During Donald Trump's Three Years as President https://www.newsweek.com/donald-trump-national-debt-increase-3-trillion-first-three-years-presidency-1483660

- [10] Congressional Budget Office: The Effects of Tariffs and Trade Barriers in CBO’s Projections https://www.cbo.gov/publication/55576#:~:text=In%20CBO's%20projections%2C%20the%20tariffs,economic%20activity%20in%20several%20ways.&text=By%202020%2C%20they%20reduce%20the,businesses%20adjust%20their%20supply%20chains

- [11] Congressional Budget Office: The Budget and Economic Outlook 2020 to 2030 https://www.cbo.gov/publication/56073#:~:text=CBO%20currently%20projects%20a%20federal,see%20Table%201%2D1)

- [12] Economists united: Trump tariffs won't help the economyhttps://www.reuters.com/article/us-usa-economy-poll/economists-united-trump-tariffs-wont-help-the-economy-idUSKCN1GQ02G

- [13] Treasury Direct: Debt to the Penny https://www.treasurydirect.gov/govt/reports/pd/pd_debttothepenny.htm