15 Easy Money Saving Challenges To Try Right Now

Published on: 12/28/2021

Saving money for a long-term goal or a sudden expense can seem like a daunting task, but with these 15 easy money-saving challenges, you’ll be on the right track to pad your savings account or emergency fund in no time.

15 easy money-saving challenges

From free apps or low-cost money apps to online printables, there are many methods to help you save money. Choose the money-saving challenge that fits your lifestyle to put a little extra in the bank.

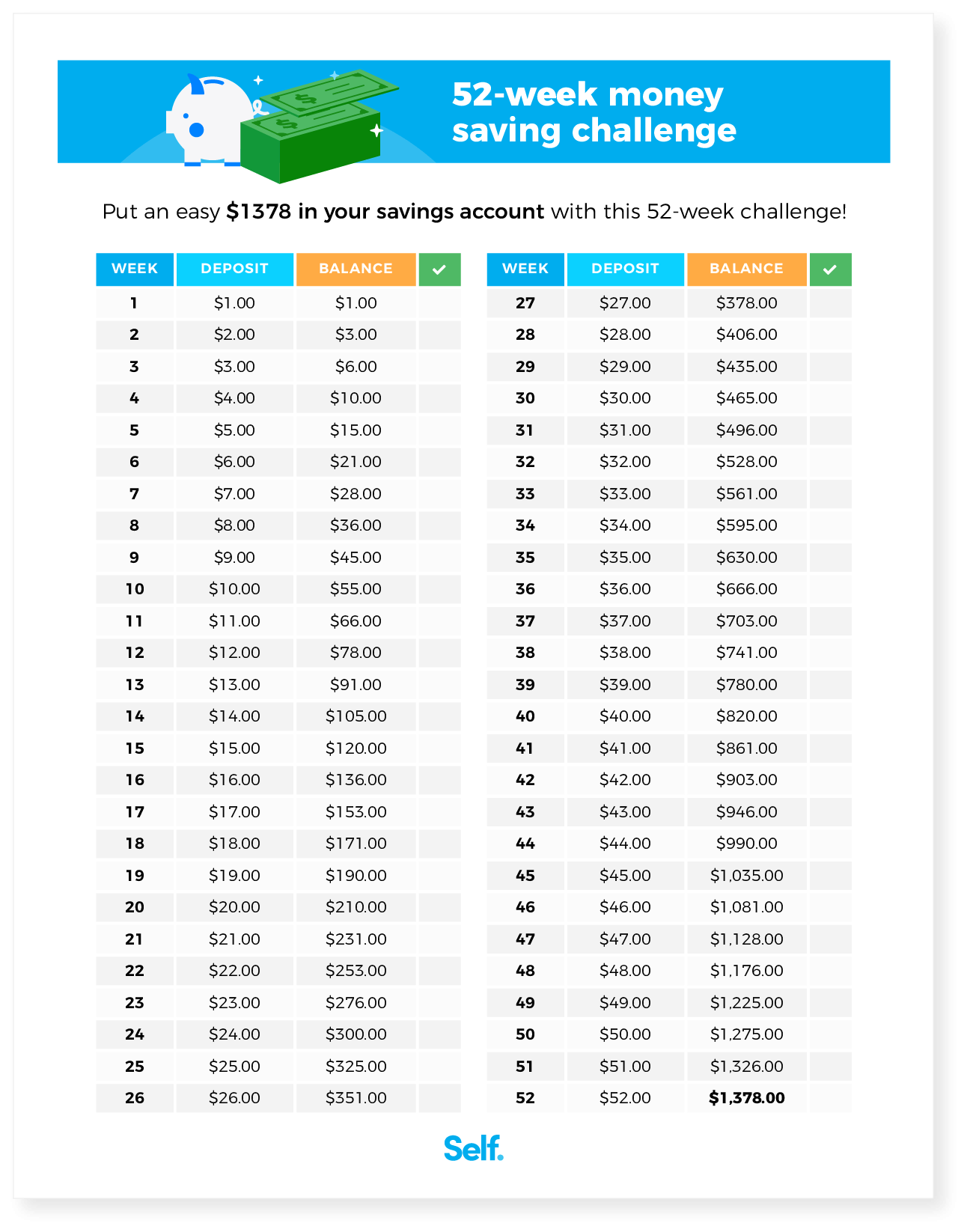

1. 52-week savings challenge

People love the 52-Week Money Saving Challenge for its ease and simplicity. Start with $1 on day one. Every week after, add another $1 to the amount you deposit. On week 52, you’ll deposit $52, for a yearly savings total of $1,378! There are numerous ways to complete this particular challenge.

2. $5 savings challenge

The $5-a-week savings challenge starts with a $5 savings deposit in the first week. Every week after, add another $5 to your deposit amount. At the start of the new year, you’ll have saved $6,890! And if you have the extra money to save, increase your weekly savings by $10 or $20 instead.

3. 100 envelope challenge

The 100 envelope challenge is a favorite among people looking to save money fast. Take 100 envelopes, label them $1 through $100, and place them in a container. Every day for 100 days, pull out a random envelope and fill it with the amount of money that corresponds with the number on the envelope. For example, if you drew an envelope with the number 3, you’d deposit $3. By day 100, you’ll have saved $5,050, which is the sum of all natural numbers 1-100. If you don’t carry much cash, you can label pieces of paper instead and deposit money into your savings account each day.

4. 7-day money saving challenge

The 7-day money savings challenge is useful if you’re trying to set up an annual financial plan. You’ll devote each day of the week to a different financial goal, such as figuring out your spending habits and creating an investment plan.[1] After one week, you’ll have your entire year of savings planned. For example, on day one you might choose to create a budget spreadsheet with all your monthly investments. On day two, you could do a deep-dive into your savings accounts, investment accounts, and allocate funds for emergencies. There are many ways to do this challenge, but most importantly, it’s useful to set aside time for planning finances.

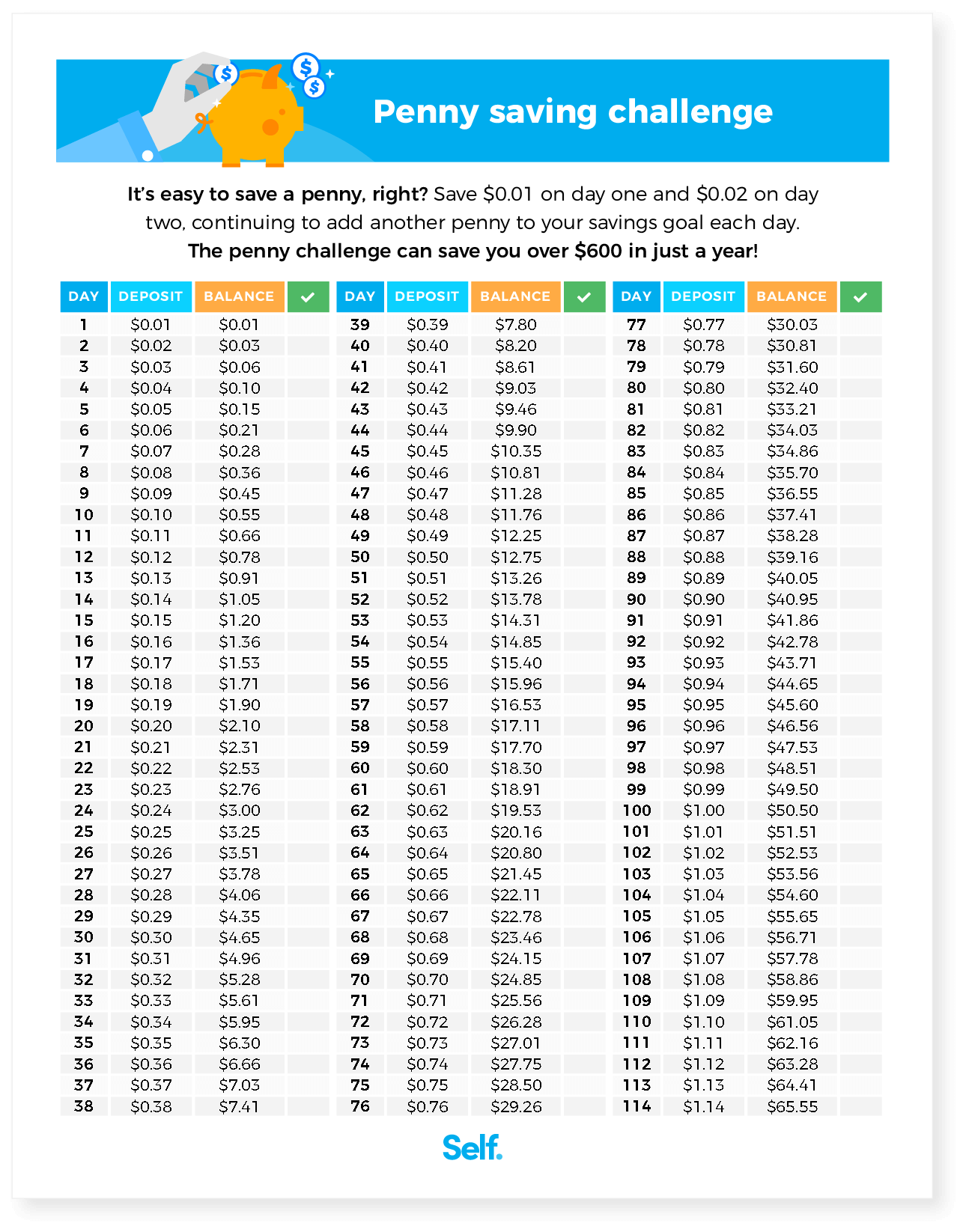

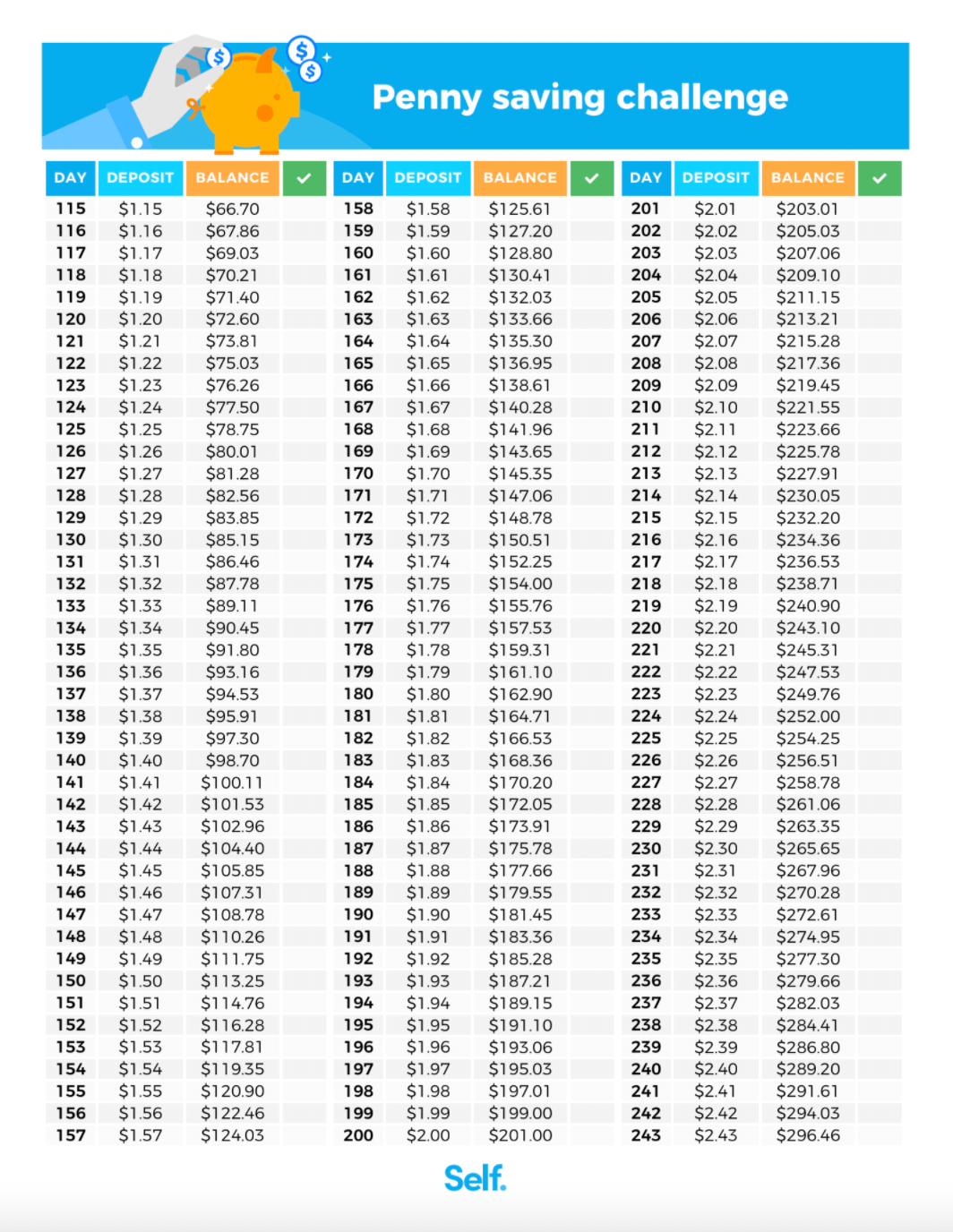

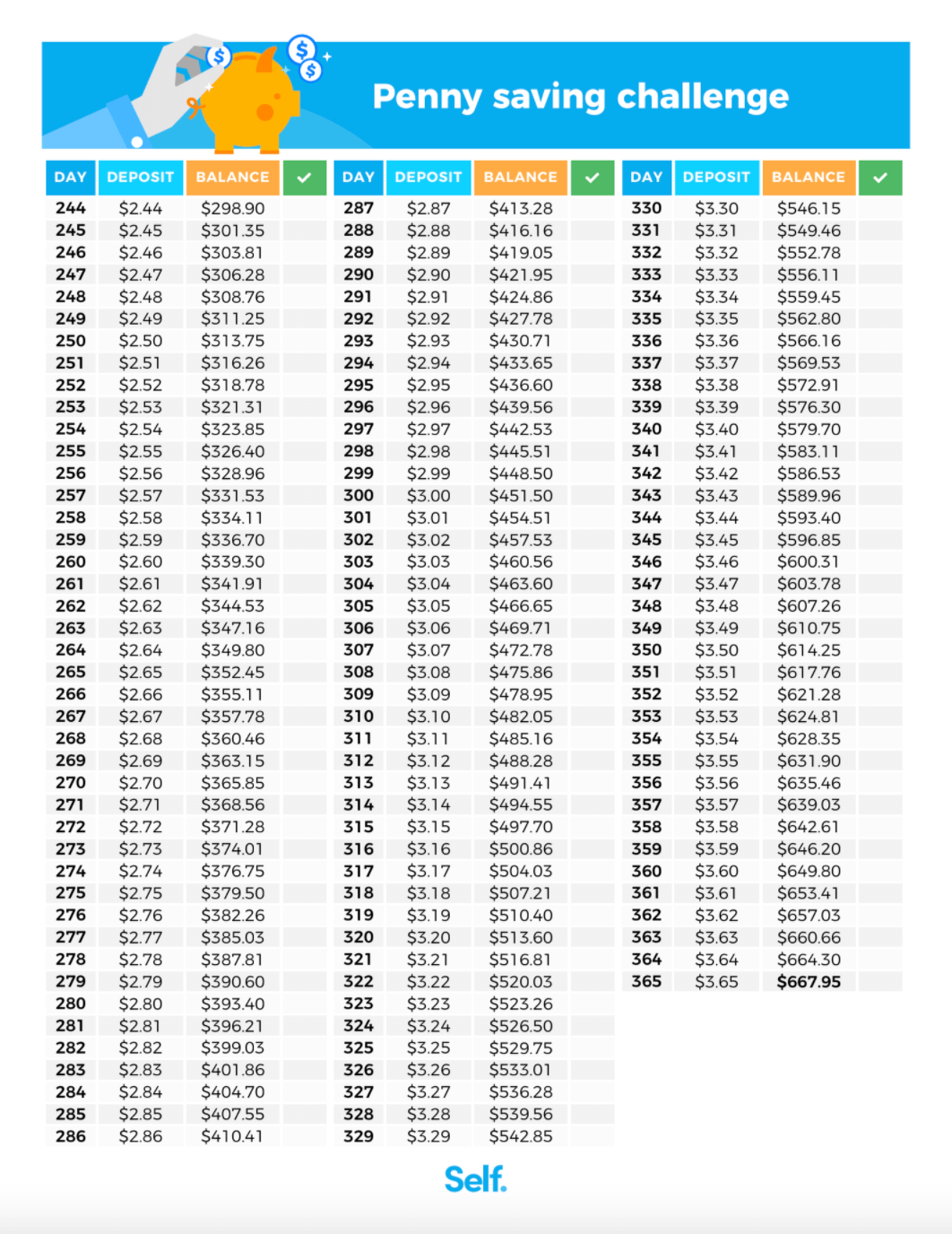

5. Penny challenge

The penny challenge is perfect for people without much extra cash lying around. On the first day, save one penny, on the second day, save two pennies, increasing your daily contribution by another cent each day. $3.65 will be your final contribution at the end of the year given it’s not a leap year. By the end of the year, you will have saved $667.95.

6. No-spend challenge

The no-spend challenge is a growing trend for those wanting to curb their spending habits. For one month, cut your spending to the bare minimum. Pay all necessary expenses, but keep other spending as restricted as possible. By the end of the month, you’ll have detoxed from chronic overspending.

7. Spare change challenge

The spare change challenge is a no-brainer for people who regularly spend cash. Simply put your loose change in a jar every time you pass by, and cash in when it’s full. You can also save with every purchase you make by rounding up to the nearest dollar and saving that extra change. You can do this yourself or use a roundup app like Acorns.

8. Vacation savings challenge

The average vacation costs $1,979.[2] A year before your vacation, create a savings goal covering all vacation expenses, including airfare, lodging, and spending money. Divide that total by 12, and save that amount each month.

9. Coffee break challenge

If you frequent coffee shops, this challenge is for you. The coffee break challenge tasks you with cutting back coffee shop visits. If you typically go three times a week, go once a week instead. On those days, make coffee at home. You’ll save hundreds just by sipping homemade brew once in a while.

10. “Swear jar” money challenge

The swear jar challenge is simple. Every time you swear (or engage in another habit you want to quit), put money in a jar. You can assign the worst transgressions higher dollar amounts. You’ll lose out on short-term cash, but you’ll kick a bad habit and have some savings at the end. Just be sure to hold yourself accountable.

11. Shopping receipt challenge

If you routinely purchase items on sale or love to coupon, this challenge is for you. Every month, collect all your receipts that list your purchase savings. At the end of the month, add up the savings amount and put that much money into a savings account. It’s that simple.

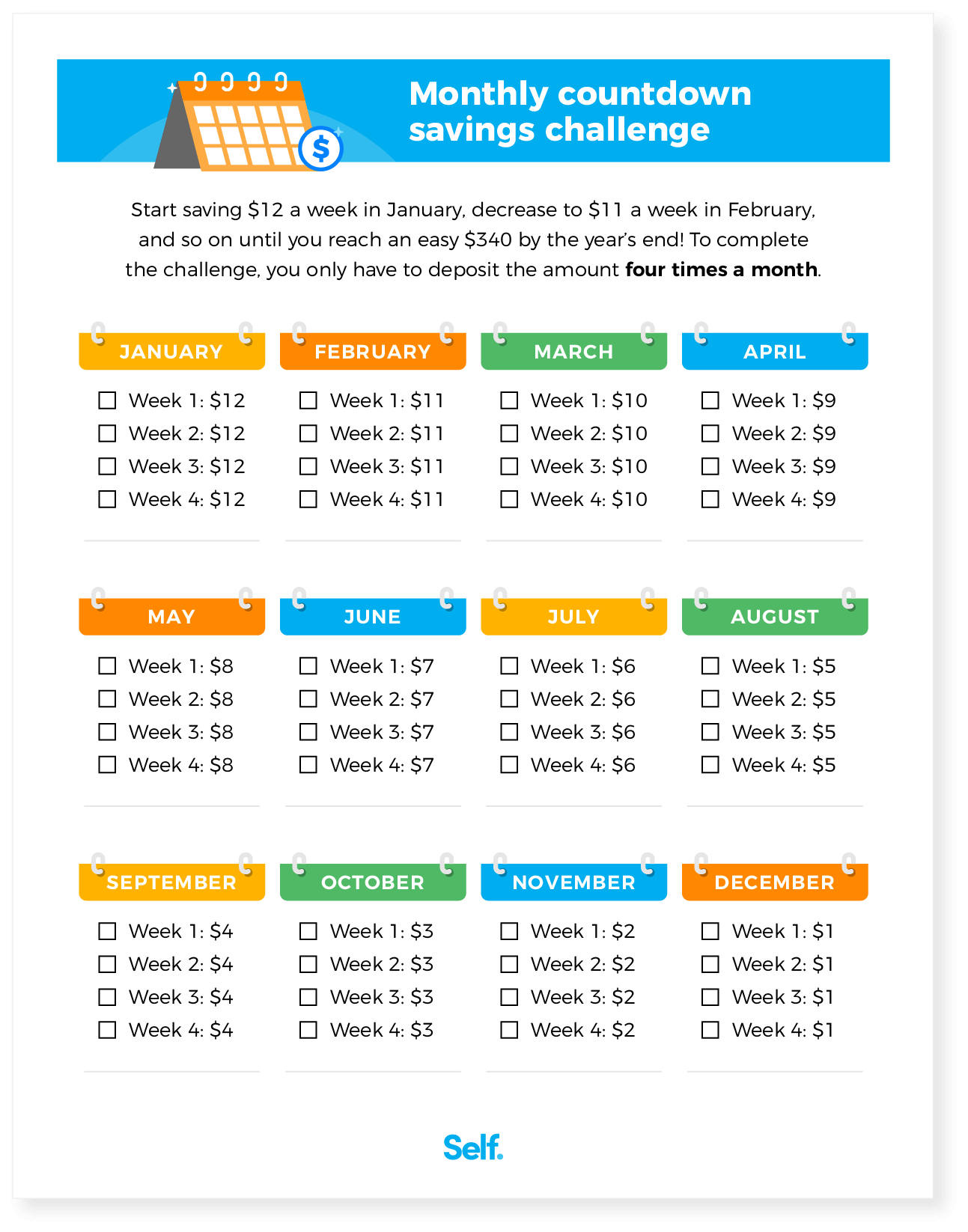

12. Monthly countdown savings challenge

The monthly countdown challenge is a great option to involve kids in saving. Every week in January, save $12. Every week in February, save $11. By December, you’ll be saving $1 a week, for a total of $340. This is a simple way to save and a fun way to get your kids to use math.

13. Holiday savings challenge

If you love Black Friday deals, the holiday savings challenge is for you. Starting in the first week of June, set aside $26. The second week, add $27. Add a dollar to your contribution each week. On Black Friday, your final contribution amount will be around $51, and you’ll have approximately saved $1,001 for Christmas shopping. The amount of money you’ll save ultimately depends on the number of weeks between June and Black Friday, but it’s never a bad idea to get an early jump start on your holiday savings!

14. Sell your stuff challenge

If you’re moving soon or just need to downsize a bit, the sell your stuff challenge is for you. Pick five things you don’t use often, and sell them on Facebook Marketplace, Letgo or even at a garage sale. Drop the proceeds in a savings account and repeat until you’re satisfied.

15. No car challenge

The no car challenge is made for people in cities who have reliable alternative transportation nearby. The goal is to cut down on car usage. Ride a bike, take the bus, or even carpool as often as you can. Combine shopping outings into one trip. Or head to the grocery store just one day a week. You’ll soon notice the extra money you’re not spending on gas.

Budgeting basics

No matter how you save, having a sound budget in place is crucial for financial health. Basic budgeting strategies help you track your daily spending and save more money. The key is to determine your goals, find a budget that works for you, and stick with it.

Start with a realistic goal

Every budget begins with a goal, be it saving for a trip or building your credit. Be sure to keep your goal realistic. Never cut out needed expenses, and leave yourself a little bit of wiggle room in your budget. Don’t let an overly restrictive budget crash you out too early.

Create a budget plan

A budget plan creates a money management structure that is easy to follow and helps you determine how to use your money. This makes it perfect for people just starting out with budgeting.

Do you want to put the money into an emergency fund to help your family deal with unexpected expenses? Are you working to pay down credit card debt and boost your credit rating?

Two popular budget plans involve breaking down your monthly income into different allotment categories. The 50/30/20 strategy calls for setting aside 50% of your income for essential costs, like food, bills, and housing. 20% goes directly to savings and investment accounts. The remaining 30% is for you to use however you’d like, such as subscriptions, eating out, or even luxury upgrades like a new car.[3]

The 70/20/10 budget is similar to the 50/30/20 budget, but with an altruistic twist. This budget calls for assigning 70% of your income for all spending. The next 20% goes toward saving and investing. The final 10% is donated however you see fit. This budget works best when you break down your expenditures so that you know exactly where your 70% is going.[4]

Cut out unnecessary spending

One of the easiest ways to save money quickly and improve your financial health is to cut any unnecessary spending habits and expenses. With this strategy, you’ll immediately start saving, but you may have to make some lifestyle and habit changes.

Start by looking at your budget and your spending habits. If you have time, track all of your spending during a month to determine just where your money is going. Or, use an app that does that tracking for you.

Tracking your monthly spending can be revealing. That cup of coffee at the drive-through on your way to work, the trip to the movies on Friday night, and the dinner out with friends can all add up to be surprisingly expensive. Eliminating some of these expenses could add up to hundreds of dollars.

Reduce high bill costs

While you might not have much bargaining power to bring down your mortgage or rent payments, some service providers will negotiate with you and may offer you lower monthly rates.

By eliminating subscriptions that you don’t use and by cutting down your phone, internet and cable bills, you can spend less this month and in future months, too.

Make a list of all of the bills you pay each month (or refer to the budget you created earlier), and start calling service providers to see what you can save. Take a hard look at your current subscriptions — like Netflix, cable, Amazon Prime or your gym membership — and consider canceling any that you don’t use often enough to justify the expense.

Create a special savings account

As you save money, continuously put it into a special savings account, rather than a checking account, so you don’t accidentally spend it. Investing your money in a high-yield savings account will put that saved money to work for you.

High-yield savings accounts function the same as regular savings accounts, but with interest rates and APYs 10-25 times higher than a standard account. High-yield accounts can be found at most financial institutions, but they shine at online banks. These banks save money by eliminating physical locations and are therefore able to offer high interest rates with low or no fees. There might be a minimum deposit amount, but these accounts are great for maximizing your monthly savings.[5]

How saving money can help your personal finances

Even if you don’t have a savings goal, being smart with your money and eliminating unneeded spending will free up the money to start an emergency fund, start investing or even pay your way to becoming debt-free. And eliminating debt is an excellent way to boost your credit score. Try to get into the habit of saving money wherever you can. Your future self will thank you.

The bottom line

No matter your financial situation, you can find a money challenge that fits your lifestyle and your wallet. Customize these plans to what you can afford to save. Don’t be too restrictive, and always make sure you have covered your essential expenses. Most importantly, keep your savings goals in mind.

Sources

- CNBC. “Looking to get your finances together in 2021? Check out the CNBC Select 7-day money challenge”. https://www.cnbc.com/select/guide/7-day-money-challenge/. Accessed 11/30/2021.

- Business Insider. “How Much the Average Person Spends on Vacations and How to Save,” https://www.businessinsider.com/average-american-spending-on-vacations-2019-8. Accessed 9/9/21.

- CNBC. “How to follow the 50-30-20 budgeting strategy,” https://www.cnbc.com/2021/05/11/how-to-follow-the-50-30-20-budgeting-strategy.html. Accessed 9/9/21.

- Education Credit Union. “Should I Use the 70-20-10 Rule for My Budget?” https://www.educationcu.com/should-i-use-the-70-20-10-rule-for-my-budget. Accessed 9/9/21.

- Forbes. “What Is A High-Yield Savings Account?” https://www.forbes.com/advisor/banking/what-is-a-high-yield-savings-account/. Accessed 9/9/21.

About the author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.