What Is a Tradeline and How Does It Impact My Credit Score?

Published on: 06/02/2025

A tradeline is a term used by credit reporting agencies that describes any credit accounts that are listed on your credit report.[1] Credit reporting agencies use this term to describe your credit accounts and the information associated with them, including who the lender is and the amount of debt. Each credit account has its own separate tradeline on your credit report.

Creditors can use data from your tradelines to establish the bigger picture of your likelihood to pay back loans, or whether you seem like a reliable borrower. The data in tradelines is also used to help calculate your credit score.

Table of Contents

- What is a tradeline on a credit report?

- Types of tradelines

- What are tradelines used for?

- How tradelines can affect your credit score

- How long do tradelines stay on your credit report?

- What happens if a tradeline is removed from your credit report?

- Buying tradelines may be risky

What is a tradeline on a credit report?

A tradeline on your credit report is a record of activity for any one of your credit accounts. Tradelines show up on your credit report as a line that records the trade between you and your creditor. This credit activity gets compiled into your credit report by the major credit reporting agencies. A tradeline is meant to both identify the credit activity or debt and include information about the account.[1]

Tradelines include both installment tradelines, like auto loans, personal loans and student loans, and revolving tradelines, like credit card accounts and other lines of credit.

Looking through the tradelines on your credit report can help you get a better sense of your personal finances. Not only does it make you aware of the information in your credit file, but it also helps you ensure that the information being reported is accurate, so that your credit isn't harmed by incorrect negative information.

A tradeline isn’t just for a lender’s benefit — it can provide a wealth of information for you, too. Some details that are generally included in tradelines are:

- Reporter information

- Account number

- Equal Credit Opportunity Act (ECOA) codes (such as, A for authorized user, I for individual account, and so on)

- Type of account

- Loan amount or credit limit

- Outstanding balance

- Payment status

- Account open and close dates

- Minimum payment

- Recent activity on the account

- Recent balance on credit cards

- Remarks

- Delinquency details

Keep in mind that creditors decide what information is included on tradelines, so some of the above might be different or missing from your tradeline, depending on the creditor.[2] [3]

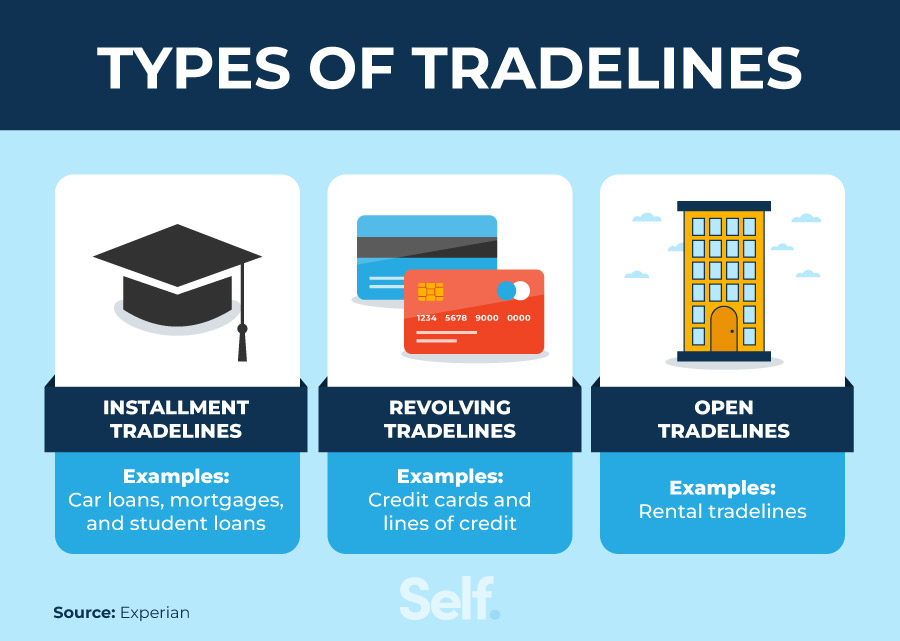

Types of tradelines

Just as you may obtain different types of accounts and credit, credit tradelines come in different types as well. These sections break down some of the most common types of tradelines.

Installment tradelines

An installment tradeline is a fixed loan that you have to pay back. It’s essentially when an installment loan of yours, like a student loan, auto loan, mortgage or other personal loan, is included on your credit report. If you take out a $10,000 auto loan, for example, your credit report will show an installment tradeline with the same opening balance. [1]

Revolving tradelines

A revolving tradeline is an open-ended account that creditors and consumers can use multiple times without a fixed timeline. Examples include credit cards or lines of credit, which involve fluctuating account balances within a set credit limit, available credit and monthly payments based on use.[1]

Open account tradelines

This category of tradelines can include things like charge cards and certain business credit cards. An open account doesn’t include specific credit limits, but you must repay what you have borrowed in full when each billing cycle ends.[13]

Another example is rental tradelines from third-party rent reporting services, like Self’s free rent reporting service.*

What are tradelines used for?

The information included in the tradelines on your credit report has a number of uses. These can include:

- Calculating your credit scores - FICO® and VantageScore® use data from your tradelines to calculate your credit scores.

- Assessing your own credit situation - Reviewing the tradelines on your credit report can help you get a better idea of where you stand on your credit profile to ensure it is accurate. You can also use it as a starting point to build credit where necessary.

- Lenders evaluating your creditworthiness - When you apply for credit accounts like loans, credit cards, or auto financing, lenders may review tradelines in your credit reports to understand whether or not they should approve you.[1]

How tradelines can affect your credit score

All of your reported credit activity can affect your credit score. Positive information on your credit report helps you achieve good credit; negative information, on the other hand, can hurt your creditworthiness.

Tradelines are part of what makes the information on your credit report. Positive tradelines generally help you build credit, while negative tradelines can lower your credit score. Tradeline information is factored into credit scoring models like FICO® [4] based on the following factors:

- Payment history (35%): A consistent on-time payment history helps establish that you’re a reliable borrower. Missing or late payments hurt your creditworthiness.

- Amounts owed (30%): Having large amounts of debt in relation to your credit limits on your credit report may make you seem like a riskier borrower.

- Length of credit history (15%): The longer your credit history, the more time you have to establish a consistent payment history. Maintaining tradelines in good standing over the course of months or years demonstrates that lenders can trust in you.

- Credit mix (10%): A mix of installment tradelines and revolving tradelines in good standing shows potential lenders that you can handle multiple responsibilities and manage different types of credit well.

- New credit (10%): While hard inquiries to open new tradelines can temporarily lower your credit score a bit, opening accounts is important for your credit mix and, ultimately, establishing the length of your credit history.

Accounts in good standing may have a positive impact

Accounts in good standing are what make up the positive information on your credit report. They’re credit accounts that you manage well through consistent, on-time payments over the length of your credit history. Generally, maintaining these accounts has a positive impact on your credit score.

For fixed accounts like installment loans, paying the amount of your monthly payment each month helps keep you in good standing. For revolving accounts, paying off your account balance, staying within your credit limit and keeping your credit utilization ratio (your balance on revolving credit divided by your credit limit) low are key strategies.

Some examples of accounts in good standing may include:

- Student loans you make regular payments on

- Credit cards that you pay the balance in full monthly

- A mortgage you’ve paid consistently for 10 years

[5]

Consider becoming an authorized user on a credit card account

If you’re struggling with your credit score or to open new tradelines, you may want to consider becoming an authorized user. An authorized user is someone who has permission to use another person's credit card account to make purchases but is not legally required to pay the debt. If the credit card company reports the authorized user’s account to the three major credit bureaus (Experian, Equifax, and Transunion) it could impact their credit score positively or negatively.

Authorized users should look for a trusted cardholder with a record of on-time payments on their card, a low credit utilization rate (CUR, the total balance divided by the credit limit) and a long account history.[6]

Accounts in bad standing may have a negative impact

Accounts in bad standing make up the negative information on your credit report, and generally hurt your credit score. These can include credit accounts that are unpaid, especially to the extent of being considered delinquency or going to collections, that have late or missing payments, and things like foreclosures or repossessions.

Some examples of accounts in bad standing may include:

- Accounts that are past due

- Charge-offs

- Collection accounts

- Repossessions

- Voluntary surrenders

- Foreclosure

- Settled accounts

- Bankruptcy discharged

[7]

Recent changes in the major credit reporting agencies and major credit scoring models may be more forgiving about some negative information. For example, FICO® 9 scores no longer factor in third-party collection accounts that have been paid off in full, and unpaid medical debt is given less negative weight. However, FICO® 9 isn’t as widely used as FICO® 8.[8]

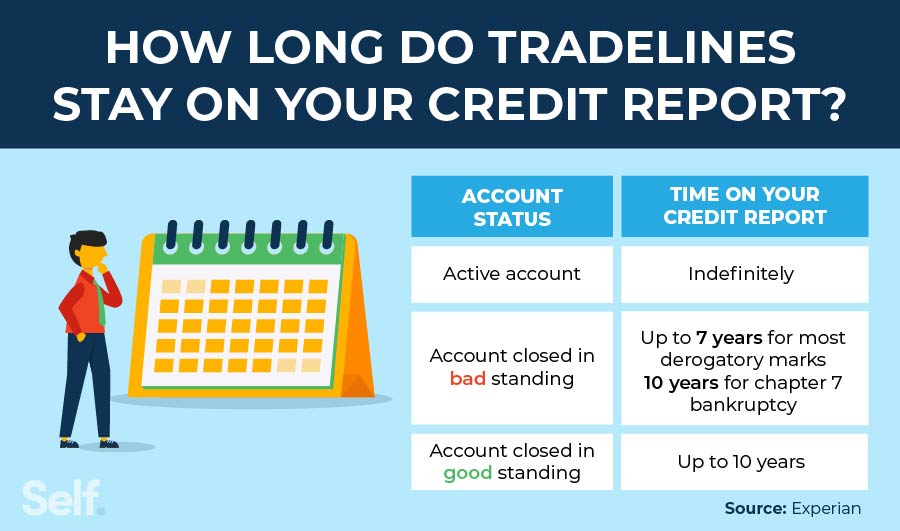

How long do tradelines stay on your credit report?

Typically, when a new tradeline has been opened, it’ll appear on your credit report. This may have a slight negative impact on your credit score due to a hard inquiry. Examples of activity that could lead to a hard inquiry can include applying for financing at a car dealership or requesting a credit line increase from your credit card company.[9]

The length of time a tradeline stays on your credit report will typically depend on whether the account is active or, if it is closed, whether it was closed in good or bad standing.

Once they’re on your credit report:

- Tradelines stay on your credit reports as long as accounts are active.

- Closed accounts in good standing remain on your report for up to 10 years.

- Tradelines with negative history that are closed remain on credit reports for seven years.

Just as tradelines themselves can be positive or negative, whether or not they stay on your credit report can have a positive or negative impact too.[10]

What happens if a tradeline is removed from your credit report?

Tradelines can be removed from your credit report, though the time it takes for them to be removed and the impact that it has on your credit score varies depending on the specific account that has been removed.

Closing an account of your own, for positive or negative reasons, generally takes 7 to 10 years.

The positive or negative impact of a tradeline's removal from your credit report depends on the information associated with the account. For example, an account in bad standing that falls off after seven years might cause a lift in your credit score because the negative information associated with it is gone as well.

If there’s a negative tradeline on your credit report due to fraud or identity theft, you can have it removed. Be sure to dispute it immediately — the longer fraudulent activity goes unchecked, the more time it takes to repair the credit impact.[1] [10]

Buying tradelines opens you to unnecessary risk

Buying a tradeline is sometimes presented as a credit repair strategy that can help you rebuild your credit score. It involves paying a third-party service to add you to another person’s tradeline, so that their tradeline information appears on your credit report, represented as your own. These are short-term agreements, so you’re removed from the tradeline after a designated amount of time.[11]

Purchasing tradelines might seem similar to becoming an authorized user on someone’s account, but there are two key differences:

- You don’t know the person whose account you’re being added to. When you become an authorized user, it’s usually on a line of credit held by a friend or family member, not a stranger.

- You’re paying to be added to the account. Becoming an authorized user on the account of someone you know and trust, on the other hand, is free.

Is buying tradelines illegal?

While it’s technically not illegal, buying a tradeline isn’t exactly ethical either. Many creditors consider it to be misrepresentative, and the practice poses some risks for borrowers, like identity theft. Your credit score is designed to demonstrate how creditworthy you are to lenders. If you pay to lift your credit score without doing any of the necessary work to build it legitimately, you could be falsely representing yourself and your credit to lenders.[11]

Alternative ways to build your credit score

If you’re looking for alternatives to buying tradelines to help you build your credit score, consider some of the following:

- Focus on paying down your existing debt and reducing your credit utilization ratio; the lower this is, the better.

- Dispute any inaccurate or fraudulent tradelines on your credit reports as they could be bringing your credit score down.

- Develop good credit habits like making on-time payments and paying balances in full each month.

- Consider becoming an authorized user on a trusted person’s account, but beware that this can negatively impact your credit score if their account is not in good standing.[11]

Understanding your credit report is key to financial health

Looking at your credit report can be overwhelming, but understanding how tradelines work can help. It makes you more aware of how to read your credit report, what to look for, how to spot inaccuracies and how to make better decisions that can help build or rebuild your credit going forward.

You can check your credit report once per week for free from each of the major credit bureaus, which you can access at AnnualCreditReport.com. You can also check your credit report for a fee any time you like with any of the three major credit bureaus (Experian, Equifax and TransUnion). They cannot charge you more than $14.50 for each report.[12]

Many companies and financial institutions provide free credit scores. For example, you can check your FICO score for free with an Experian account.

If you’re looking for ways to build credit, or want to repair credit and are struggling with where to start, Self’s credit-building tools can help get you oriented on the right path.

*Results vary. You may not receive an improved credit score. Not all lenders use scores impacted by rent/utility payments.

Sources

- Experian, “What Are Tradelines and How Do They Affect You?” https://www.experian.com/blogs/ask-experian/what-are-tradelines/.

- American Express, “What is a Credit Tradeline?” https://www.americanexpress.com/en-us/credit-cards/credit-intel/credit-tradelines/.

- Chase, “ECOA Codes on an Annual Credit Report” https://www.chase.com/personal/credit-cards/education/build-credit/ecoa-code-on-credit-report.

- MyFICO, “How Are FICO Scores Calculated?” https://www.myfico.com/credit-education/whats-in-your-credit-score.

- Consumer Financer, “How Do I Get and Keep a Good Credit Score?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-and-keep-a-good-credit-score-en-318/.

- Equifax, “What is an Authorized User on a Credit Card?” https://www.equifax.com/personal/education/credit-cards/articles/-/learn/authorized-user-on-a-credit-card/.

- Experian, “What Does Good Standing Mean on a Credit Report?” https://www.experian.com/blogs/ask-experian/good-standing-mean-credit-report/.

- MyFICO, “Understanding FICO Score Versions” https://www.myfico.com/credit-education/credit-scores/fico-score-versions.

- MyFICO, “How Do Credit Inquiries Affect Your FICO Scores?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries.

- Experian, “How Long Does It Take For Information to Come Off Your Report?” https://www.experian.com/blogs/ask-experian/how-long-does-it-take-information-to-come-off-your-report/.

- Experian, “Why You Should Avoid Buying Tradelines” https://www.experian.com/blogs/ask-experian/are-buying-tradelines-legal/.

- Consumer Financial Protection Bureau, “How Do I Get a Free Copy of My Credit Reports?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-a-free-copy-of-my-credit-reports-en-5/.

- Discover, “What are Credit Tradelines?” https://www.discover.com/credit-cards/card-smarts/what-are-credit-tradelines/.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).