Can You Pay Rent With a Credit Card?

Published on: 04/03/2023

If your landlord or property manager uses a third-party payment service, you will be able to put your rent payments on a credit card. But should you pay rent with a credit card? Well, like any payment method, it has its advantages and disadvantages.

In this guide, we explain if you can pay rent with a credit card, the pros and cons of paying rent with a credit card, and other ways to pay your rent.

Table of contents

- Can you pay rent using your credit card?

- Should you pay your rent with a credit card?

- Disadvantages of paying rent with a credit card

- Advantages of paying rent with a credit card

- Can paying rent with a credit card affect your credit score?

- Other ways to pay rent without a credit card

- Use your credit card responsibly

Can you pay rent using your credit card?

Yes, if your landlord or property management company accepts credit card payments or uses a third-party payment service, you can pay rent using your credit card.[1] Because not all property managers may accept this payment method, be sure to contact them directly to see if you can make your monthly rent payments this way.

Should you pay your rent with a credit card?

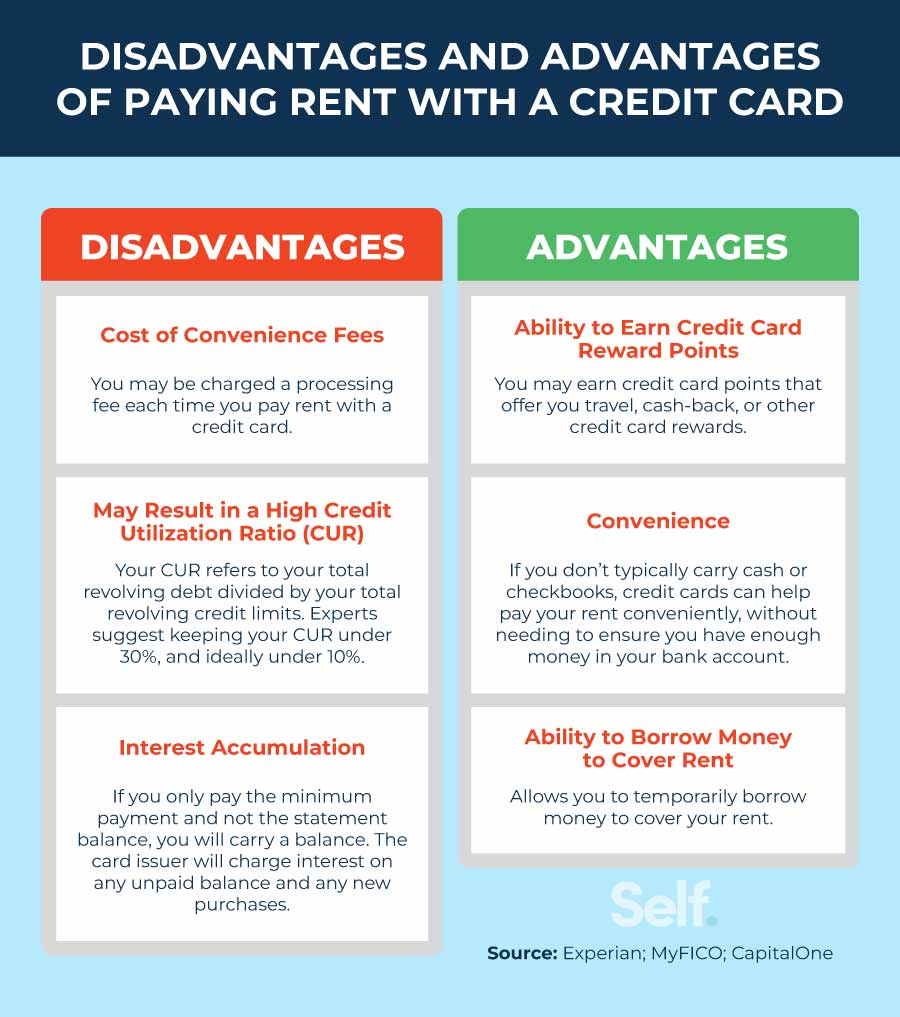

While it may vary depending on a renter’s individual financial situation, paying rent with a credit card typically has more disadvantages than advantages. Some disadvantages include additional fees and being charged interest if you don’t pay your credit card balance. So using a credit card may seem like an easy way to get your rent paid, but you need to weigh the costs and potential disadvantages before you do.

Disadvantages of paying rent with a credit card

Here are some of the biggest disadvantages of paying rent with a credit card.

Cost of convenience fees

When you pay rent with a credit card, your landlord might charge you an additional processing fee (also called a convenience fee) each time you pay with your credit card. A typical processing fee is 2.5% to 2.9% of your rent.[1]

For example, if your monthly rent is $1,100, and your landlord charges a 2.5% processing fee, it’ll cost you an additional $27.50 each month, or $330 annually, to pay your rent with a credit card.

May result in a high credit utilization ratio

Putting your rent on your credit card raises your credit utilization. Your credit utilization ratio, or CUR, is the total debt you have on your revolving credit accounts (like credit cards) divided by your total revolving credit limit. Try to maintain a CUR under 30%, but know that experts suggesting keeping it below10% for the best chance to build and maintain your credit score.[2]

Increasing your credit utilization also means decreasing your available credit. That means you’ll have less credit to spend on other things you need.

Interest accumulation

If you can’t afford to pay your credit card balance in full each month, and it carries over to the next billing period, your credit card issuer may charge you interest. Interest charges build up until the balance is paid off in full, so putting rent payments on your card continually without paying your balance in full could cause you to end up with a large amount of debt, especially if your interest rate is high.[3]

Advantages of paying rent with a credit card

Though the disadvantages of paying rent with a credit card generally outweigh the benefits, there are still some advantages to using a credit card to pay your rent, especially for a one-off payment.

Ability to earn credit card reward points

If you have a rewards credit card with special card offers, you could earn rewards points and other benefits, like cash back, by putting your rent payment on your credit card. However, you should weigh the total cost of extra fees, like convenience fees and interest charges you wouldn’t otherwise have, to see if the perks alone are worth it.[1]

Convenience

Using a credit card to pay your rent might be very convenient. It helps give you an option if you don’t typically use or carry cash and checkbooks, and if you don’t have time to get to the bank to get the money, you can just use your card. If you’re using a third-party service, you may even be able to pay online, which makes paying your rent easy and convenient.

Make sure, however, that you’re able to pay off the balance in full and on time. If you end up not being able to pay the statement balance on your next credit card bill, you’ll be charged interest.[4] If you don’t pay at least the minimum payment on time, you’ll end up with a late fee as well.

Ability to borrow money to cover rent

If you’re having a difficult month and run into some emergency expenses, a credit card can help you cover your rent even when you don’t have the money in your bank account.[5] While that can be a lifesaver, keep in mind that it can end up costing you if you aren’t able to pay off the balance in full.

If you’re charged interest and aren’t able to pay down the balance in addition to other expenses you have, you might end up owing a lot more money than you did to start with.[4] If your management company doesn’t allow credit card payments, as a last resort, you may consider using a cash advance from your credit card to pay. However, taking out cash at the ATM with your credit card may come with even higher interest rates and fees, and you typically get charged interest immediately when you take out a cash advance.

Can paying rent with a credit card affect your credit score?

Whether paying rent with your credit card affects your credit score depends on your financial situation and how you manage your debt. Here’s how paying rent with your credit card might affect your credit score:

Paying rent with your credit card can affect your payment history

Your payment history has the most influence on your credit score, making up 35% of your FICO® score.[6]

If you can’t make your minimum credit card payment, or make a late payment, this could hurt your payment history, which might negatively impact your credit score. On the flip side, if you’re able to make your monthly payments on time, this might positively impact your credit score.

If you carry a credit card balance over to the next billing period because you weren’t able to pay it off, you’ll be charged interest, which may make it more difficult to meet your monthly payment obligations.[4]

Paying rent with your credit card can affect your credit utilization ratio

Putting your rent payments on your credit card increases your credit utilization ratio (CUR). If your CUR gets too high, it may have a negative impact on your credit score. It’s best to maintain a credit utilization ratio below 30%. Experts suggest staying below 10% to build and maintain your credit score.[2]

Other ways to pay rent without a credit card

There are many ways to pay rent without using a credit card. Many landlords might even prefer these other payment methods, since they aren’t as likely to involve processing or transaction fees.

Here are some payment methods you can use to pay your rent:

- Send a paper check, like a personal or cashier’s check, directly to your landlord.[7]

- Send a money order.[7]

- Use direct deposit or automated clearing house transfer (ACH transfer).[8]

- Use a debit card.[9]

- Use a third-party service, such as PayYourRent, ClearNow or Flex. These require your landlord to sign up for the service. If your landlord doesn’t use a third-party service, you can always request them to sign up.

Aside from third-party rent payment services, these methods don’t affect your credit history because these activities aren’t reported to the major credit bureaus. So if you want to use your rent to build credit, you have options other than using a credit card. Using one of the third-party rent reporting services on our list can help add your rent payments to your credit report without the added risks of interest charges and late fees.

Use your credit card responsibly

While it may seem convenient to use your credit card for large monthly payments like rent, it’s important to manage your payments to avoid harming your credit and straining your finances. Make on-time payments and do your best to pay down balances to avoid interest charges.

If you’re looking for more secure ways to build your credit, Self’s credit products are here to help.

Disclaimer: FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Sources

- Experian. “Can You Pay Rent With a Credit Card?” https://www.experian.com/blogs/ask-experian/can-i-pay-my-rent-with-a-credit-card/. Accessed December 2, 2022.

- myFICO®. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed December 2, 2022.

- myFICO®. “How to Avoid Paying Credit Card Interest,” https://www.myfico.com/credit-education/blog/how-to-avoid-paying-credit-card-interest. Accessed December 2, 2022.

- Capital One. “How Does Credit Card Interest Work?” https://www.capitalone.com/learn-grow/money-management/calculate-credit-card-interest/. Accessed December 2, 2022.

- Experian. “Pros and Cons of Credit Cards,” https://www.experian.com/blogs/ask-experian/pros-cons-credit-cards/. Accessed December 2, 2022.

- myFICO®. “How Payment History Impacts Your Credit Score,” https://www.myfico.com/credit-education/credit-scores/payment-history. Accessed December 2, 2022.

- Consumer Financial Protection Bureau. “Ways to pay your bills,” https://files.consumerfinance.gov/f/201507_cfpb_ways-to-pay-your-bills.pdf. Accessed December 2, 2022.

- Experian. “What Is the Difference Between ACH and Wire Transfer?” https://www.experian.com/blogs/ask-experian/what-is-the-difference-between-ach-and-wire-transfer/. Accessed December 2, 2022.

- Consumer.gov. “Using Debit Cards,” https://consumer.gov/managing-your-money/using-debit-cards. Accessed December 2, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).