What Is the Minimum Credit Score to Rent an Apartment or House?

Published on: 06/25/2025

You may think you need a specific minimum credit score to rent an apartment or house, but in reality, the necessary score can vary by landlord, tenant, location and a variety of other factors.

This post covers what constitutes a good credit score, what goes into credit score calculations and what other information landlords may consider. We will also discuss what to do if a property owner denies your rental application and how to go about improving your credit for future applications.

Table of contents

- What is the minimum credit score to rent a house?

- What landlords may consider when screening applicants

- How to check your credit report before submitting a rental application

- What to do if your application was denied

- Alternative ways to rent with bad credit

- How does renting impact your credit score?

- Looking to build your credit?

What is the minimum credit score to rent a house?

The minimum credit score required to rent a house may vary depending on several factors, including the landlord, the current real estate and rental markets, your income and the city or neighborhood in which you plan to live.

If your credit score is 670 or below, property owners may take a closer look at your credit details. If you do receive approval, you might have to put down a higher security deposit when you sign the lease.[1]

To have a credit score calculated in the first place, you must meet a few minimum requirements. A valid FICO® Score requires the following information:

- At least one credit account opened for six months or more

- At least one account reported to the credit bureau within the past six months

- No mention of deceased person on the credit report, which may affect you if you share an account with a person reported as deceased[2]

Around 90% of top lenders use FICO® Scores, making it the most widely utilized credit scoring model. According to MyFICO®, a good credit score falls in the range of 670 to 739.[3]

| Rating | Credit score range | How the credit score is seen by lenders |

|---|---|---|

| Poor | 580 or lower | Because these scores are well below the U.S. average, they may reflect that the borrower is a higher risk. |

| Fair | 580–669 | Although slightly below the U.S. average, lenders may approve loans in this range. |

| Good | 670–729 | Being near or slightly above the U.S. average, the majority of lenders consider this a good score. |

| Very Good | 740–799 | Above the U.S. average, scores in this range demonstrate that the borrower is likely to pay back what is owed. |

| Exceptional | 800+ | Well above the U.S. average, lenders consider borrowers in this range to be very low risk. |

While many lenders use the FICO® scoring model to help make decisions, each landlord or property management company has its own way of determining the likelihood that potential renters will pay according to the terms of the lease. For that reason, no universal cutoff or average credit score exists to qualify for a rental unit.

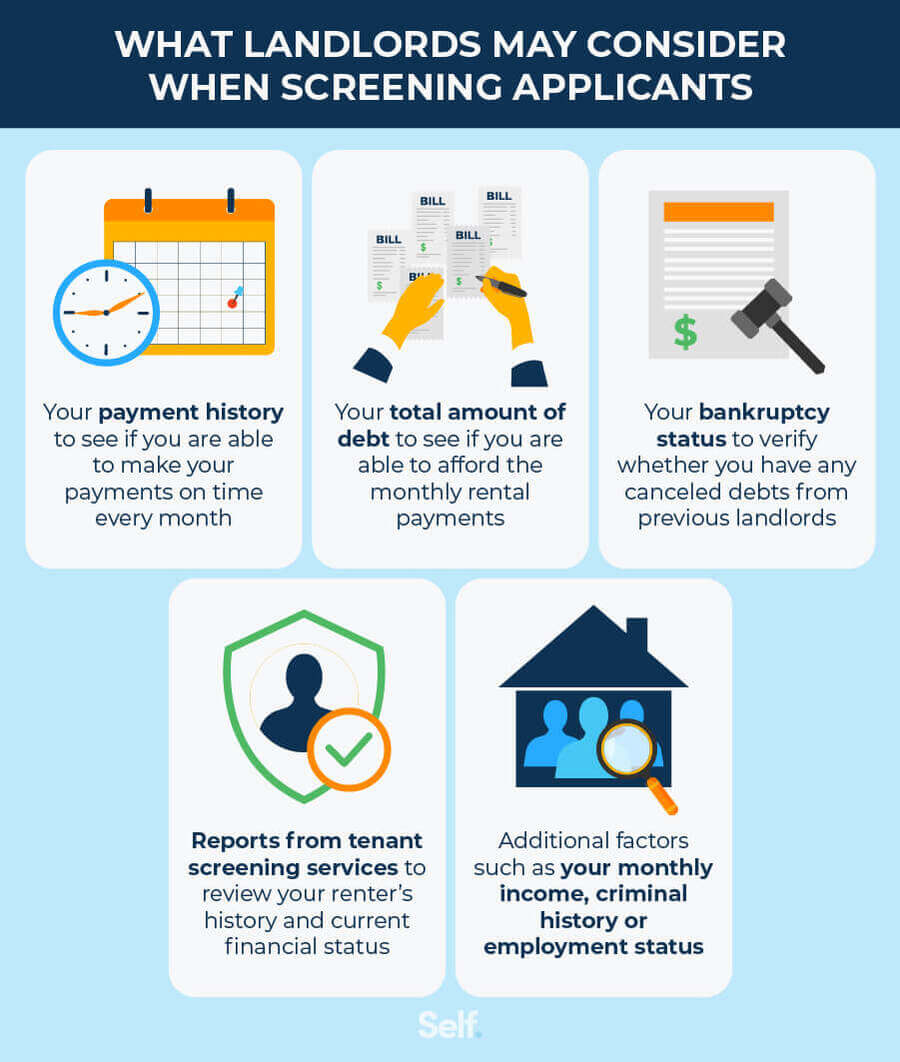

What landlords may consider when screening applicants

In addition to your credit score, landlords can look at a number of factors in determining whether to approve your rental application.

Landlords may review your payment history

Potential landlords want assurance that you will be a tenant who pays the monthly rent in full and on time. They will check your payment history for a solid record of on-time payments.[4] Payment history counts as the most important factor in your FICO® Score, making up 35% of your score.[5]

Landlords may review your total amount of debt

Landlords may review your overall debt amounts including credit card balances, loans, and minimum monthly payments.[4] You may want to evaluate how much total debt you carry since “amounts owed” makes up 30% of your FICO® score.[6]

Landlords may review your bankruptcy status

Landlords may check your credit report to assess how responsibly you manage debt, including whether you have any bankruptcies on your record.[4] Keep in mind that bankruptcies can stay on your credit report for 7 years for Chapter 13 and 10 years for Chapter 7. The impact of a bankruptcy lessens as time goes on.[7]

Landlords may use tenant screening services

Landlords and property management companies may use a tenant screening report to help them evaluate potential renters. Although the information used varies by service, it may include credit reports, rental history (including eviction lawsuits), and a risk score based on criteria selected by the landlord.[8]

Landlords may review additional risk factors

Landlords may consider the following factors in addition to your credit score:

- Income verification: Pay stubs, tax forms or employer verification of your income and employment can help landlords know whether you can afford the monthly rental payments. Landlords may sometimes make decisions based mostly on income, regardless of other factors.

- Criminal history: Landlords may run a criminal background check on future tenants. Past felonies and misdemeanors, pending criminal cases and any outstanding warrants can potentially affect your rental approval.[4]

How to check your credit report before submitting a rental application

By reviewing your credit report, you can check it for inaccuracies and see how you look on paper to potential landlords. Compare what’s listed on your credit report to the specific rental requirements before you fill out a rental application. That way, if a landlord has requirements, such as you needing to have no bankruptcies listed on your credit report, you can be sure your report meets the criteria before you apply and have them run your credit with a hard inquiry.

You can receive a free report every week from the major credit reporting agencies by visiting AnnualCreditReport.com. You can also check your credit report at any time for a fee by contacting any of the three major credit bureaus (Experian, Equifax and TransUnion). These companies cannot legally charge you more than $14.50 for each report.[9]

What to do if your application was denied

By law, landlords must provide an “adverse action” notification to the prospective tenant explaining why they rejected the application.[10] If you receive a denial, the following steps may help you get future applications on track.

Review your credit report for inaccuracies

If you didn’t look over a copy of your credit report before submitting your rental application — or even if you did — now would be a great time for you to check it out and catch any errors or review the negative information that the landlord may have seen. If you haven’t already received your free weekly report, you can do so at AnnualCreditReport.com or through Experian, Equifax and TransUnion directly for a fee. If you find a mistake on your credit report, you may want to contact the potential landlord to explain the situation and see if they will reconsider their decision.[11]

Review your tenant screening report for any inaccuracies

As a tenant or rental applicant, the Fair Credit Reporting Act (FCRA) gives you rights when your rental application is denied in what is called an “adverse action.” Among your rights, the landlord must supply you with the contact information (name, address and phone number) of the screening company and give you notice that you have 60 days to request a free copy of your tenant screening report. Review the report for any incorrect or outdated information. If it contains an error, you can dispute it.[11]

By law, you have the right to dispute any inaccurate information on your tenant screening report and have it corrected. The screening company generally has 30 days to investigate your dispute, though in some cases they may take up to 45 days, but it may vary by state. In some states, the deadline may be shorter.[11] The Consumer Financial Protection Bureau also provides dispute forms for you to use for credit report disputes.[12]

Apply for a different property that fits your budget

If a landlord rejected your rental application, you may decide to look for a different rental property that fits your budget and credit score range. Start by calculating your rent-to-income ratio to get an idea of what you can afford.[13] Generally, a good rule of thumb is to spend 30% of gross income on rent. You may also want to contact the prospective landlord before you apply to confirm their minimum requirements.

Work on improving your credit score

If the property owner denied your application due to poor credit, consider working to build a better credit score. Although you can’t obtain a higher credit score overnight, with some patience, the following steps may help you gradually lift your credit score:

- Pay your bills on time. As the most important factor in your credit score, payment history helps assure potential landlords that you’re more likely to avoid late payments and will pay in full.[5]

- Monitor your debts carefully. Amounts owed refers to how much debt you carry and may be considered as a factor by landlords. A high percentage of available credit being used could be a sign that you’re overextended and more likely to miss or make late payments.[6]

- Keep your credit utilization low. Your credit utilization ratio (CUR) refers to the amount of your revolving credit balances divided by your total credit limit. Experts suggest keeping your CUR under 30%, but ideally less than 10%.[14] Remember that your CUR can be combined across all cards, if you have multiple cards with no balance and only one with a higher utilization, it may not impact your score as much as having high utilization across all cards. A high CUR may impact your amounts owed, which accounts for 30% of your FICO® Score.[6]

Alternative ways to rent with bad credit

If you have a lower credit score, the following strategies may help improve your chances of renting a house or apartment.

- Gather letters of reference: Recommendations from credible sources (previous landlords, roommates or employers) may help bolster your case.[4]

- Gather proof of income: W-2 tax forms, bank statements or pay stubs going back several months can indicate that you have stable employment.[4]

- Find someone who is willing to be a cosigner or guarantor: If you can’t qualify to rent an apartment on your own, a friend or family member with a better credit history might improve your chances. Cosigners generally sign the lease and have the right to live in the rental unit with you and are responsible for paying rent. Guarantors, on the other hand, vouch to pay your rent in the event you default but have no rights to the house or apartment.[4]

- Offer a higher security deposit: Paying a larger security deposit or more months of rent upfront might reassure your landlord while you work to prove your creditworthiness.[4]

How does renting impact your credit score?

Rent payments generally do not appear on your credit report unless you use a third-party rent-reporting service such as Self. If you have several months of unpaid rental debt, however, your landlord may have sent it to collections, which means the collections account may end up on your credit report.[15]

Having outstanding debts — rental or other kinds — sent to collections can negatively impact your credit score and may remain on your credit report for up to seven years.[16] You generally won’t see evictions on credit reports, but they can stay on your public records for up to seven years.[16]

Looking to build your credit?

If you believe better credit will help you rent a home — you can take steps to rebuild your credit or start building a credit score. If you don’t know where to start, Self offers tools that can help you build credit, build savings and arm you with information that help you understand how to handle your credit decisions.

Disclaimer: FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Sources

- Capital One. “What Credit Score Do You Need to Rent an Apartment?” https://www.capitalone.com/learn-grow/money-management/what-credit-score-is-needed-to-rent-apartment.

- MyFICO. “What are the minimum requirements for a FICO® Score?” https://www.myfico.com/credit-education/faq/scores/fico-score-requirements.

- MyFICO. “What is a Credit Score?” https://www.myfico.com/credit-education/credit-scores.

- Experian. “What Do Landlords Look For in a Credit Check?” https://www.experian.com/blogs/ask-experian/what-landlords-look-for-credit-check/.

- MyFICO. “What is Payment History?” https://www.myfico.com/credit-education/credit-scores/payment-history.

- MyFICO. “What is Amounts Owed?” https://www.myfico.com/credit-education/credit-scores/amount-of-debt.

- MyFICO. “What Are the Different Types of Bankruptcy and How Is Each Considered by My FICO® Score?” https://www.myfico.com/credit-education/faq/negative-reasons/bankruptcy-types.

- Consumer Financial Protection Bureau. "What is a tenant screening report?" https://www.consumerfinance.gov/ask-cfpb/what-is-a-tenant-screening-report-en-2102/.

- Consumer Financial Protection Bureau. “How do I get a copy of my credit reports?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-a-copy-of-my-credit-reports-en-5.

- Federal Trade Commission. “Using Consumer Reports for Credit Decisions: What to Know About Adverse Action and Risk-Based Pricing Notices,” https://www.ftc.gov/business-guidance/resources/using-consumer-reports-credit-decisions-what-know-about-adverse-action-risk-based-pricing-notices#action.

- Consumer Financial Protection Bureau. “What should I do if my rental application is denied due to a tenant screening report?” https://www.consumerfinance.gov/ask-cfpb/what-should-i-do-if-my-rental-application-is-denied-due-to-a-tenant-screening-report-en-2105.

- Consumer Financial Protection Bureau. “How do I dispute an error on my credit report?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-an-error-on-my-credit-report-en-314.

- The Motley Fool. “What Is Rent-to-Income Ratio?” https://www.fool.com/investing/stock-market/market-sectors/real-estate-investing/basics/rent-to-income-ratio/.

- MyFICO. “What Is Credit Utilization and How Does It Affect Your Score?” https://www.myfico.com/credit-education/blog/credit-utilization-be.

- Experian. “Is My Rental History on My Credit Report?” https://www.experian.com/blogs/ask-experian/is-my-rental-history-on-my-credit-report.

- Experian. “How Long Does an Eviction Stay on Your Record?” https://www.experian.com/blogs/ask-experian/how-long-does-eviction-stay-on-report/.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).