10 Easy Credit Score Hacks to Lift Your Score

Published on: 05/14/2024

Building better credit is a marathon, not a sprint. However, these 10 credit score hacks can help you build credit and make your way to a score you’ll be proud to show off.

- Become an authorized user.

- Pay off high-balance credit cards

- Keep old credit accounts active

- Get a secured line of credit

- Reduce overall credit utilization

- Stay on top of revolving credit accounts

- Avoid making late payments

- Have a good credit mix

- Check your credit report for inaccurate information

- Pay off old collection accounts

1. Become an authorized user.

An authorized user is just what it sounds like: someone who is authorized to access another person’s card, usually a family member or close friend, by obtaining an additional credit card under the friend or family member’s credit account and credit limit. If the credit card is in good standing — with monthly payments being made on time and low credit utilization rates— it may help better the authorized user’s credit. Exploring credit score hacks like becoming an authorized user can provide you with possible credit score benefits.

But unlike a joint account holder, the authorized user does not share any responsibility for making payments. That debt obligation falls solely to the primary cardholder. Therefore, it is important that you trust someone before allowing them to become an authorized user of your account.

On the plus side, an authorized user can help you keep a card you rarely use active, so the lender doesn’t close the account. It can also make it easier for someone else, such as a partner, spouse, or young adult child to make purchases using your card — which might not be accepted if their name isn’t on the account.

Understanding the risks of adding an authorized user

Be sure to only make someone an authorized user if you trust them. This is because you are responsible for the account and they could charge a number of high price items on your account which you would be responsible to pay. An authorized user’s purchases might also hurt your overall credit utilization ratio, one of the key factors in determining your FICO® score.

A credit card company is not obligated to report an authorized user’s activity to the three main credit bureaus (Equifax, Experian, and TransUnion). Nevertheless, some credit card companies may report to their bureaus as well. If you are trying to help them establish a credit score or better their score, you should check with your credit card company to make sure they do.

If you want to become an authorized user on someone else’s card, you’ll need to get approval from the cardholder and the card issuer. The account owner can often make an application over the phone or via the credit card issuer’s website. The card issuer may send the card to the primary cardholder’s address. However, some companies may allow an option to send it to a different address upon request. [1]

2. Pay off high-balance credit cards

According to Experian, the average American has 3.9 credit cards as of 2023. [2] You may benefit from four credit cards with different reward programs and four distinct credit limits, you could also be tempted to overspend. Maintaining a high credit card balance on one or all of the cards can hurt you. This is because the more debt you carry, the more interest accrues — which can make it harder to pay down your balance and cost you more money in the long run.

This many cards may also increase your credit utilization ratio (CUR), which can potentially hurt your credit score. Your credit utilization ratio is the amount you owe on multiple credit cards added up and divided by your total credit limit across all of the cards. Financial experts recommend keeping your CUR under 30% and ideally under 10%. The higher it is, the more it can negatively affect your personal credit score, and it is a factor under amounts you owe that counts for 30% of your total credit score under the FICO system.

You should be aware that credit card issuers generally report your balance after your due date, and the balance amount that is reported to the credit bureaus is typically from your statement closing date. A lower reported balance means a lower credit utilization ratio. So making an additional payment prior to your statement closing date, could lower your credit utilization rate. Keep in mind you could be giving up your credit card grace period. It's most important that you’re making your payments on-time by your due date and ideally the statement balance.

If that's not an option, you may want to explore repayment plans offered by your credit card issuer like the one outlined below.

Repayment by purchase credit card payment strategy

Some card issuers offer creative ways to pay, such as the Pay It Plan It option from American Express. Under this system, you split up larger purchases over time without interest and instead pay a monthly fee. You can choose as many as 10 purchases of $100 or more that you can combine into a plan you access via your online account.[3]

You need to carefully evaluate the fee and determine what the equivalent interest rate may be, if you use this option. Some programs have costly fees that could exceed the interest rate on the card. If you can’t pay off your entire credit card bill, the “repayment by purchase” strategy suggests that you make payments toward specific purchases you’ve made. This allows you to better understand how you are spending your money and feel more empowered because you are paying off specific purchases over a set period rather than feeling overwhelmed by a large total balance.[4]

3. Keep old credit accounts active

Credit score hacks such as keeping old accounts open can help your credit score in part because the length of your credit history accounts for 15% of your FICO score. This includes factors such as the age of your oldest account, how long your newest account has been open, and the average age of all your credit accounts.

4. Get a secured line of credit

If you have yet to build credit or need to rebuild it after a financial setback, a secured credit card can help you do that.

Credit comes in two forms: secured and unsecured. Unsecured lines of credit do not require any collateral. Secured lines of credit do. A car loan is a secured loan because the lender can repossess your car if you fail to make your payments. A mortgage works in a similar way.

Credit cards typically offer unsecured lines of credit. A lender approves your card application based on your credit score and other factors, rather than based on any collateral.

A secured credit card is a credit card that is linked to a savings account or a certificate of deposit (CD). You deposit a few hundred dollars as collateral, which is not touched unless you fail to make a payment. Your credit limit is usually set based on the deposit made into your secured savings account or CD. One of the effective credit score hacks is making on-time payments on a secured credit card to build a solid payment history. The idea is that by making on-time payments you build credit. Your credit limit is usually set based on the depositied into your secure savings account or CD.

Making on-time payments on your secured card is a good way to build credit because your payment history makes up 35% of your FICO score — more than any other single factor.

5. Reduce overall credit utilization

Your credit utilization is a key component of your credit score. It is obtained by a simple formula: adding up the balance on all your credit cards and dividing that figure by the sum of all your credit card limits.

Because it counts for nearly one-third (30%) of your FICO score, lowering your credit utilization is one of our recommended credit score hacks that can be a powerful tool in raising your personal credit score. If you want to maintain good credit, experts recommend that you keep your credit utilization rate below 30%. In order to achieve great credit, however, experts suggest an ideal credit utilization ratio at or below 10%.[5]

In addition to keeping your balance significantly lower than your credit limit, you can boost your CUR by requesting a credit limit increase or opening a new credit card account (and thereby increasing your total credit limit if using the card responsibly).

It is helpful to remember that applying for too much new credit in a short period of time can reduce your credit score. Each new account application, known as a hard credit inquiry or simply, hard inquiry, can have a small temporary negative effect on your credit score. Recent activity counts for 10% of your FICO credit score.

6. Stay on top of revolving credit accounts

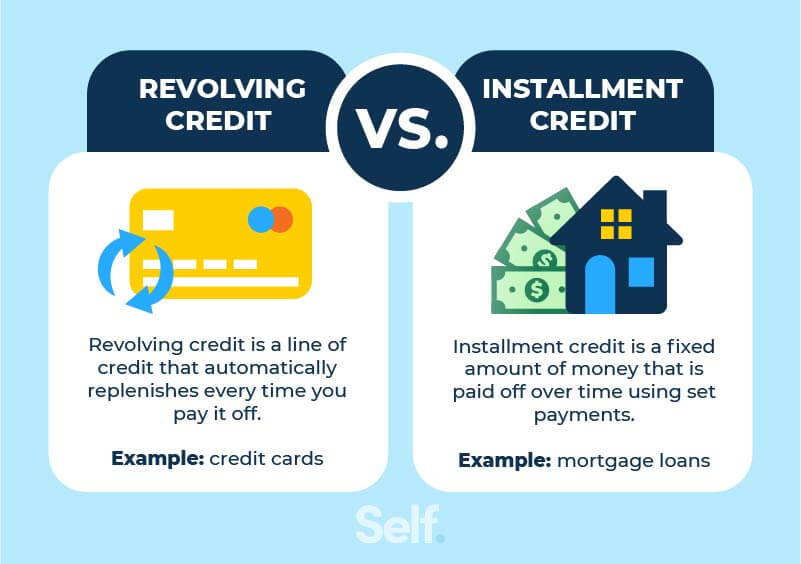

A revolving credit account allows you to use as much credit as you want, for whatever you want, up to a set credit limit. You can increase your available credit by making payments to lower your balance. The higher your balance, the higher your minimum credit card bill payment, which is calculated based on a percentage of the total you owe.

This contrasts with an installment loan, in which you borrow a specific amount and then pay it off over a set period of agreed upon time. Payments are typically the same from month to month, and once you make the final payment, you don’t owe any more money. If you want more credit, you will need to apply for a separate loan.

A revolving balance is the unpaid portion of your credit card account that carries over from one month to the next if you don’t pay your balance in full.

With revolving credit, the higher your balance goes, the more interest you incur, which means you will have to make larger payments to reduce that balance. This is one reason it’s a good idea to make more than the minimum payment, especially if you are continuing to use your card for purchases.

Setting up automatic payments, checking your statements online regularly, knowing your interest rate and other terms of use, are key ways you can stay on top of your revolving credit accounts.

Monitoring these accounts may help ensure you have the funds to make on-time payments and keep your credit utilization ratio in check. Among one of the smartest credit score hacks is the practice of setting up automatic payments to avoid late fees and additional interest on both revolving and installment credit.

7. Avoid making late payments

Because your payment history counts for the largest share of your FICO score, making your payments on time is key. You need to make your payments consistently by the due date or you will be considered late. While you may not be automatically reported late to the credit bureaus your lender may charge you a late fee and potentially increase your APR on a credit card. Typically, lenders will not report you late on your credit report until you are over 30 days late. If it remains delinquent for 60 or 90 days, it will have an even greater negative impact to your credit score.

A late payment can stay on your credit report for up to seven years. Although its impact will diminish over time, it is better to avoid damaging your credit score by staying on top of your payments. Scheduling automatic payments, which many creditors and lenders facilitate, is a good way of ensuring you stay current on your payments. Using automatic payments can be one of the most effective credit score hacks to maintain a payment history of on-time payments.

8. Have a good credit mix

Having a good mix of different kinds of credit may have a positive impact on your credit score by showing lenders that you can be responsible with several different types of accounts. In fact, your credit mix counts for 10% of your FICO score.

A good mix of credit includes both revolving credit — such as credit cards and home equity lines of credit (HELOC) — and installment loans like car loans, mortgages, and student loans. Payday and title loans do not factor into your credit mix, but failure to pay them can hurt your credit score if collections agencies take over your unpaid debt. Diversifying your credit portfolio is a possible credit score hack that can enhance your credit profile.

9. Check your credit report for inaccurate information

Credit reports aren’t perfect. In fact, they often contain inaccurate information that can damage your credit score. In a Consumer Reports study, 34% of volunteers found at least one error on their credit reports, and 29% found errors relating to their personal information.[6]

If someone else with bad credit has a similar name or Social Security number and negative marks from their credit are accidentally included in your credit history, your credit score can suffer.

The first step to determining whether you may have inaccurate information on your credit history is ordering a free credit report.[6]

There are three major credit reporting companies – Equifax , Experian , and TransUnion. You can get a free copy of your credit report once per week from all three companies at annualcreditreport.com. Although under federal law, credit reporting agencies are only required to provide it annually.

Look for any inaccurate information, including accounts you don’t recognize that may be the result of identity theft or fraud.

10. Pay off old collection accounts

If one of your accounts has gone to collections, it means your original lender has given up trying to collect a debt from you (called a “charge-off”) and sold it to a collections agency. That agency then takes over attempting to collect the debt (like credit card debt), which can be from a credit card, installment loan or past due utility bill. This usually happens after repeated missed payments, often adding up to a period of 120 to 180 days in delinquency.

You can try and ask the collection agency to remove a charge-off from your credit report in several ways. If it’s inaccurate, you can dispute it with the credit bureaus.

If it is accurate and you now have the funds to pay it off, you may want to send a pay for delete letter to the collection agency. The agency may or may not be willing to remove the charge-off for payment on the account. They also may take the money and still report your delinquency so be sure to get something in writing. You may also be able to negotiate a payment plan (you might be able to get a lower settlement by paying a lump sum).

Other options include asking them to change the status to “paid” or “closed,” or “settled” — the least attractive option since it indicates only partial payment.

Can a credit repair company fix your credit?

There are no quick-fix solutions, and that includes hiring a credit repair company. A credit repair company can only remove items from your credit report if they’re inaccurate, or unverified. You can do this yourself for free.

Under the Credit Repair Organizations Act, credit repair companies aren’t allowed to make false statements to credit bureaus, charge fees for services that they haven’t yet provided, guarantee removal of negative items, or ask you to change your tax identification number.[7]

Using a credit repair company isn’t technically a credit hack or a magic pill. Remember credit repair companies can only facilitate removing inaccurate marks from your credit report, not accurate. If the credit repair company promises easy fixes, you may want to consider alternative options.

What is a good credit score range?

FICO credit scores are divided into five categories defined by numerical ranges:

- 800-850: Exceptional, likely to qualify you for the best interest rates.

- 740-799: Very Good, likely to mean approved applications and competitive rates.

- 670-739: Good, more apt to mean less competitive rates.

- 580-669: Fair, which means you may or may not get approved and aren’t likely to receive the best interest rates.

- 300-579: Very Poor, which makes you more likely to be turned down for a loan and, if approved, to face a higher interest rate.

More generally, good credit is anything 670 or above. You will not get there overnight; building credit is a process, not something you can instantly hack to achieve.

A good place to start is knowing where you stand. You can check your credit score in several ways. FICO does provide plans to allow you to monitor your score. Some free options also exist. You can call your credit card company and see if they offer free credit scores, contact a non-profit credit counseling service that may offer free credit report counseling, or sign up with Self’s free credit monitoring tool, which gives you access to Experian’s VantageScore 3.0 model. While your FICO and Vantagescore may differ slightly they are a good gauge of where you stand generally and a good way to monitor where you stand.

What are the different types of credit scores?

Although the FICO system is the one lenders use most frequently, it’s not the only one. VantageScore, mentioned above, is another system that is often used. Credit bureaus provide their own models, too.

FICO score

Created by the Fair Isaac Corporation in 1956, according to FICO it is used by 90% of top lenders.[8] It gives payment history the most weight in determining its credit score, followed by credit utilization, length of credit history, new credit, and your credit mix. FICO has multiple credit scoring versions that they update periodically for different types of loans like mortgages, auto lending, and credit cards.

VantageScore

VantageScore® is an alternative system to FICO created in 2006 that uses the same 300-850 range as FICO but calculates its score differently and uses slightly different rating categories. They weigh total credit usage, balance, and available credit along with credit mix and experience, payment history, age of credit history, and new accounts.

Credit score hacks aren't quick fixes - building credit is a marathon

Each credit hack discussed here is not an easy or quick fix. Building credit takes time and vigilance. It’s important to stay on top of your credit reports and understand your credit score if you want to improve your financial health and improve your credit score to qualify for better interest rates that save you money over the long term.

Building good financial habits like making your payments on time, paying down high balances, and keeping your credit utilization low are some of the best ways to keep your credit in good shape.

Sources

- CNBC. “What you need to know about being an authorized user on a credit card,” https://www.cnbc.com/select/becoming-an-authorized-credit-card-user-what-you-should-know

- Experian, ‘Average number of credit cards a person has’, https://www.experian.com/blogs/ask-experian/average-number-of-credit-cards-a-person-has/

- American Express. “Pay your way with Pay It Plan It®,” https://www.americanexpress.com/us/credit-cards/features-benefits/plan-it/

- Harvard Business School. “‘Repayment-by-Purchase’ Helps Consumers to Reduce Credit Card Debt, “https://www.hbs.edu/ris/Publication%20Files/21-060_77e85b9a-f320-407d-9dad-ed5da9ae1972.pdf

- CNBC. “Does a $0 balance on your credit card make your score go up?” https://www.cnbc.com/select/what-is-a-good-credit-utilization-ratio

- Consumer Reports. “More Than a Third of Volunteers in a Consumer Reports Study Found Errors in Their Credit Reports,” https://www.consumerreports.org/credit-scores-reports/consumers-found-errors-in-their-credit-reports-a6996937910

- Experian. “How Do Credit Repair Companies Work?” https://www.experian.com/blogs/ask-experian/how-do-credit-repair-companies-work

- MyFICO. “FICO® Advanced,” https://www.myfico.com/products/ultimate-three-bureau-credit-report

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).