Credit Lock vs. Credit Freeze: Differences and Uses Explained

Published on: 04/05/2022

Credit locks and credit freezes are both ways to protect your credit report and prevent lenders from accessing your personal information. However, while they are similar, there are some key differences between them. Credit locks and credit freezes are offered by all three major credit bureaus — Experian, Equifax and TransUnion.

While checking your credit score and keeping tabs on your credit report is a great general practice, it's not always possible to avoid negative actions. Credit freezes and credit locks can be a major advantage to secure your personal information and protect your credit.

Table of contents

- What is a credit lock?

- What is a credit freeze?

- When to use a credit lock

- When to use a credit freeze

- How do you lock your credit?

- How do you freeze your credit?

- How credit freezes and locks affect your credit score

- Protect yourself against identity theft

What is a credit lock?

A credit lock is a quick and convenient way for you to restrict access to your credit reports. It is a service offered by all three major credit reporting agencies that can be accessed immediately through a mobile application or website.

What is a credit freeze?

A credit freeze, also known as a security freeze, does much the same thing a credit lock does—it blocks most access to your credit history. A credit freeze isn’t implemented immediately. It takes up to 24 hours. It’s not as convenient, but it is free under federal law.[4]

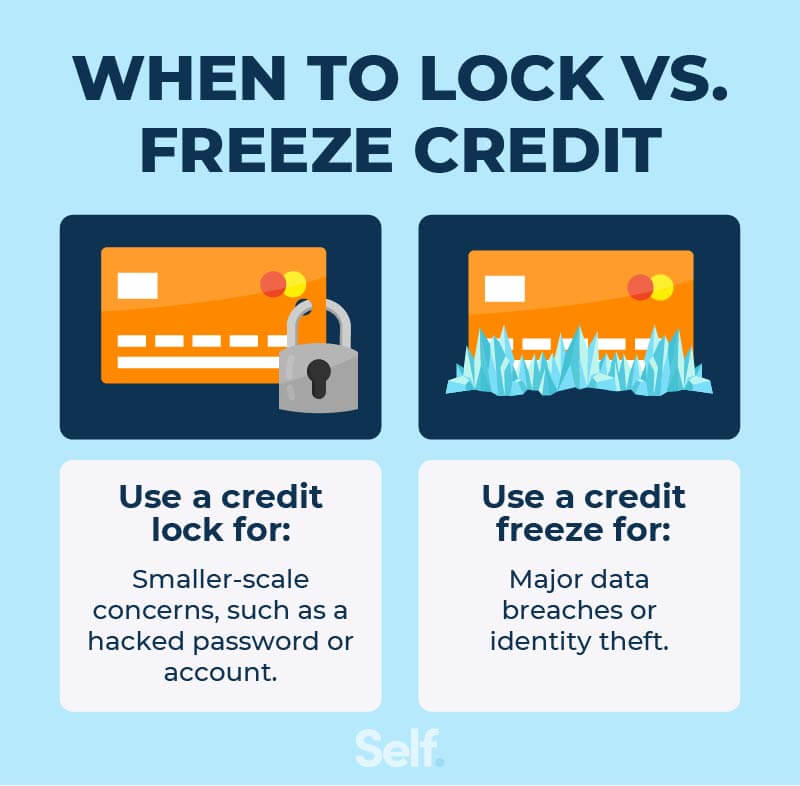

When to use a credit lock

It makes sense to use a credit lock if you are worried one of your bank accounts or credit cards has been hacked because you can do so quickly and easily. You can set a credit lock using an app on your phone, an option that is not available with a credit freeze, so you can address any threat immediately.

You might also want to use a credit lock as a precautionary measure if you’re worried about identity theft. But once you lock your credit, no one can look at it, so potential lenders won’t have access to it for credit checks that are used to verify your creditworthiness when you apply for a loan or credit card.

As a result, it’s best to lock your credit when you aren’t planning to apply for new credit. That said, it’s as easy to unlock your credit as it is to lock it.

Pros and cons of credit locks

Credit locks are appealing because they can be done quickly, bypassing the potential waiting period for a credit freeze.[1] You have control in the palm of your hand, through your phone. However, a credit lock is provided as an option through the three credit bureaus, rather than being regulated by law, as a freeze is.[2] Here are a few other key pros and cons of a credit lock.

Pros:

- Convenience. You can lock and unlock your credit report immediately from your phone using a mobile app.

- Effectiveness. A lock can block access to your credit history as effectively as a freeze can.[2]

- Credit score. Using a lock will not affect your credit score.[3]

- Independent protection: Experian’s CreditLock, for example, provides $1 million in identity theft insurance.[1]

Cons:

- Recourse. Unlike freezes, which are regulated by law, you may not have any legal recourse if a lock does not function properly.[2] Credit lock options are provided by the credit bureaus voluntarily, not because they are mandated to do so.

- Access. Even if you lock your report, it will still be visible to your existing creditors, as well as bill collectors, government agencies and some marketers.[2]

- Scope. You have to lock your credit at all three bureaus in order to provide full protection against identity theft.[3]

- Cost. Equifax and TransUnion offer free options, but Experian’s credit lock service will cost you a $24.99 monthly fee.

When to use a credit freeze

As with a credit lock, you can use a freeze to keep people from seeing your credit history. You might use a freeze to prevent identity theft, credit fraud, data breaches, or simply because you do not plan to apply for new credit accounts and wish to restrict access to your credit information.

Pros and cons of credit freezes

Credit freezes offer many of the same benefits you get with a credit lock, but there are some key differences.

Pros:

- Cost: A credit freeze is free under federal law.

- Credit score: Like a credit lock, a freeze will have no impact on your credit score.

- Recourse: A freeze offers legal protections you may not get with a credit lock. For example, you may have the option of pursuing court action if the freeze fails to protect you.[2] You can also submit a complaint online or by phone with the Federal Trade Commission.[4]

- Parenting: You can freeze credit for children younger than 16 for free, and you can do the same if you have a valid power of attorney for someone or serve as their guardian.[4]

- Lifting a freeze: An agency must lift a freeze within one hour at your request. It’s also possible to lift a freeze temporarily for free.[4]

- Flexibility: A so-called temporary lift gives creditors access to your file for a specified length of time before the freeze is restored. By contrast, a permanent freeze removal leaves your reports accessible until you ask for a new freeze.[5]

Cons:

- Convenience: Setting up a freeze (and lifting one with a “thaw”) is more complicated than setting up a credit lock. Instead of working through a mobile app, you have to use a PIN or password from the credit bureau. If you lose it, you can ask for a reset, but you may have to wait longer than an hour to lift a freeze.[1]

- Access. As with a lock, certain parties will still be able to view your credit report, such as collections agencies, creditors with whom you already have a relationship, government agencies and some marketers.[2]

- Scope: As with a lock, you must contact all three credit bureaus independently to get a freeze placed or lifted.

How do you lock your credit?

You can lock your credit through each of the three main credit bureaus by signing up for their service and downloading their app. Information is available online about how to do this at their websites. The cost of doing so varies from free to a monthly fee of $24.99, depending on the credit bureau.

- Equifax offers this service free of charge through its Lock & Alert program.[6]

- Experian’s credit-locking service is available for a subscription of $24.99 a month (after a seven-day trial period).[7]

- TransUnion offers a pair of options. One is a free credit locking through its TrueIdentity services.[8] The other is part of its credit score monitoring service, which is available for a subscription fee of $24.99 a month.[9]

How to unlock your credit

Unlocking your credit at each of the three credit bureaus is as easy as locking it, using your app. For instance, with Equifax’s Lock & Alert system, you simply slide a button to the left of your screen to unlock it.[6] You will want to unlock your credit history when you are preparing to apply for a new credit card, new lines of credit or any other new accounts.

How do you freeze your credit?

You can freeze your credit by contacting the three credit bureaus. You will need to contact all three to ensure that you freeze access to your credit history. It is free to place a freeze on your credit under a federal statute that took effect on September 21, 2018. You cannot be charged for doing so. Once a request is made, the freeze must be placed within one business day.[4]

How to thaw your credit

Thawing your credit is the opposite of freezing it: It entails removing a freeze you have placed on your credit history using a PIN or password. If you request a thaw, your freeze must be lifted within one hour, or within three business days if the request is made by mail. You may also ask to have your freeze lifted temporarily, for a set period, without incurring a fee.[4] As you would when placing a freeze, you will need to contact each of the three credit reporting agencies independently.

How credit freezes and locks affect your credit score

Credit freezes and locks have zero effect on your credit score. They also do not affect your ability to get a free copy of your credit report each year, as guaranteed under the Fair Credit Reporting Act. You can request yours by visiting annualcreditreport.com.

Protect yourself against identity theft

While credit locks and credit freezes are tools to use when your information is compromised, there are steps you can take to reduce the likelihood of identity theft and catch issues early.

If you are a victim of identity theft, close any card or account that has been compromised; then contact your issuer or bank and request a new card or open a new account. (Once you’ve done so, you will need to switch any automatic payments over.)[10]

Other steps you can take are contacting law enforcement and filing an identity theft report with the FTC. You also may want to sign up for a fraud alert, which lets potential creditors know they should confirm your identity whenever a credit request is made.

Credit monitoring services

Credit monitoring services are tools you can use to receive an early warning that your credit might have been hacked or you may be a victim of identity fraud. These services can alert you to problems with your credit report when they occur, so you don’t have to wait for the next time you order your own copy. (The best services offer “triple-bureau protection” by monitoring all three major credit bureaus.)

Some of them can even give you a head start on fraud by combing the dark web and identifying information that may have been hacked or stolen before it shows up on your credit report.[11]

Some credit monitoring services are free, while others charge a fee but offer more extensive protection. Companies providing free services include Capital One, Discover, American Express, Chase and Experian.[12] More comprehensive, paid services can cost up to $39.95 per month.[11]

Identity theft insurance

While credit card companies often provide some financial protection against fraudulent charges, they may not protect you against more far-reaching damage to your credit. If you wish to address additional fallout such as damage to your credit history or your reputation, you might consider identity theft insurance.

Policies can offer services that may help you reclaim your identity, restore your credit, go after hackers and identity thieves for civil penalties and criminal charges, and seek reimbursement for administrative and attorney’s fees.[13]

Fraud alerts

Unlike a credit lock or a credit freeze, a fraud alert doesn’t keep anyone from seeing your credit reports. In fact, it does the opposite by adding an important piece of information to your reports.

A fraud alert is a notice you can have placed on your credit reports that lets prospective lenders know you may have been the victim of identity theft or some other form of fraud. It gives them a heads up so they can take action to verify your identity before they approve any credit in your name.

Fraud alerts are generally free. You can ask to have a one-year fraud alert placed on your credit report, or you can ask for an extended fraud alert, which lasts seven years. An extended fraud alert is only available to individuals who have been victims of fraud or identity theft and requires a police report or Federal Trade Commission identity theft report.

Keep tabs on your credit score

In addition to getting a free credit report each year, you can also access a free credit score from each of the credit reporting bureaus. By monitoring your credit, you can be alerted to any red flags that might indicate fraud or identity theft, such as sudden drops in your credit score or suspicious activity on your credit report.

Keeping tabs on your credit can help you identify fraud, but it isn’t perfect because you will only see evidence of it once fraud has occurred. By then, your credit may have been damaged, and you may need to dispute negative marks on your credit report that occurred as a result of identity theft or fraud.

Choose the right option for yourself

Knowing the difference between a credit freeze and a credit lock can help you choose the right option if you need to restrict access to your credit report. It’s important to know the limitations of each, as well.

A credit lock and a credit freeze are two steps you can take to safeguard your information, but they aren’t the only ones. Other tools at your disposal include fraud alerts, credit monitoring services and identity theft insurance.

Protecting your credit can give you a solid foundation to build better credit in the future and secure your personal finances for years to come.

Sources

- Experian. “What’s the Difference Between a Credit Freeze and a Credit Lock?” https://www.experian.com/blogs/ask-experian/whats-the-difference-between-credit-freeze-and-a-credit-lock/. Accessed December 2, 2021.

- Consumer Reports. “Pros and Cons of Equifax's New Lock & Alert,” https://www.consumerreports.org/credit-scores-reports/pros-and-cons-of-equifax-lock-and-alert/. Accessed December 2, 2021.

- Federal Trade Commission. “What To Know About Credit Freezes and Fraud Alerts,” https://www.consumer.ftc.gov/articles/what-know-about-credit-freezes-and-fraud-alerts. Accessed December 8, 2021.

- Federal Trade Commission. “Free credit freezes are here,” https://www.consumer.ftc.gov/blog/2018/09/free-credit-freezes-are-here. Accessed December 2, 2021.

- Experian. “How to Unfreeze Your Credit Report,” https://www.experian.com/blogs/ask-experian/how-to-unfreeze-your-credit-report/. Accessed December 2, 2021.

- Equifax. “Lock & Alert,” https://www.equifax.com/personal/products/credit/credit-lock-alert. Accessed December 2, 2021.

- Experian. “Experian CreditLock,” https://www.experian.com/consumer-products/creditlock.html. Accessed December 2, 2021.

- TrueIdentity. “Completely free identity protection,” https://www.trueidentity.com/?_gl=1*14svo3m*_ga*OTY5ODAxMjMuMTYzNzA4OTgyNg..*_ga_6D2F5M2DQK*MTYzODQ1MjIxMi4yLjEuMTYzODQ1Mzc2MC4w&_ga=2.58353320.326763238.1638452213-96980123.1637089826. Accessed December 2, 2021.

- TransUnion. “Credit Score Monitoring Services,” https://www.transunion.com/credit-monitoring. Accessed December 2, 2021.

- Federal Trade Commission. “IdentityTheft.gov,” https://www.identitytheft.gov/assets/pdf/Data_Breach.pdf. Accessed December 2, 2021.

- CNBC. “The best credit monitoring services that can help you spot fraud early,” https://www.cnbc.com/select/best-credit-monitoring-services/. Accessed December 2, 2021.

- CNBC. “These services provide you with free credit monitoring alerts so you can spot fraud early,” https://www.cnbc.com/select/best-credit-monitoring-alerts/. Accessed December 2, 2021.

- Insurance Information Institute. “Identity theft insurance,” https://www.iii.org/article/identity-theft-insurance. Accessed December 2, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.