DIY Credit Repair: 11 Steps to Help Fix Your Credit

Published on: 06/21/2022

Fixing your credit yourself may be possible — and often the best solution. There are many credit building and credit repair techniques you can use to try to help your scores rise.

While some people think it may be useful to hire a credit repair company to fix their bad credit, there’s no reason to spend money on what you may be able to repair yourself with some targeted credit repair strategies. Here are 11 steps that may help repair your credit and raise your credit score.

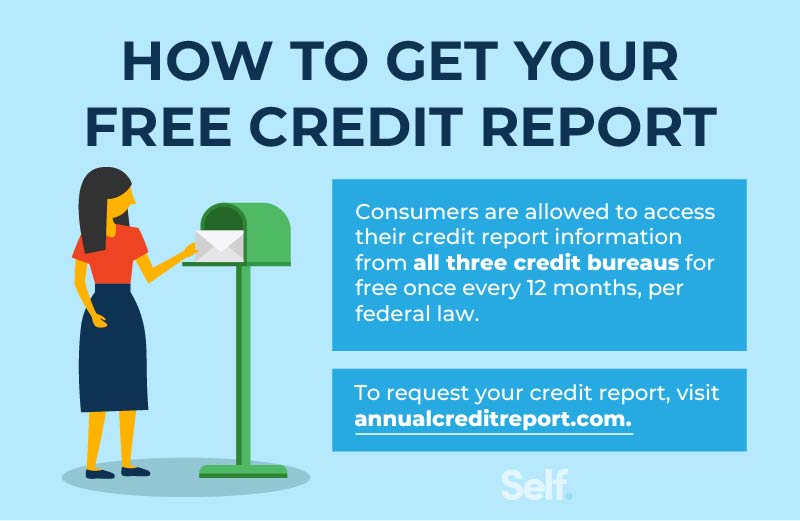

1. Get copies of your credit report from the credit bureaus

The first step to fixing poor credit can be examining your credit reports. Without knowing what is affecting your credit score, you may not be able to begin to fix the problems. Anyone can get a free credit report from each of the three major reporting companies every year.

To do so, head to annualcreditreport.com and enter your information. This is the only website authorized to generate free credit reports.[1] You can also reach out directly to each major credit reporting company: Experian, TransUnion and Equifax.

- Experian contact information: You can contact Experian by calling 1-866-617-1894. You can also visit their website and navigate to the “Contact Us” section, where you will be given multiple options for how to retrieve a copy of your credit report.[2]

- Transunion contact information: To reach TransUnion, call 1-833-395-6938, or visit their website to receive further instructions for obtaining a credit report.[3]

- Equifax contact information: Contact Equifax at 1-888-378-4329. Alternatively, their website will also give instructions for receiving a credit report.[4]

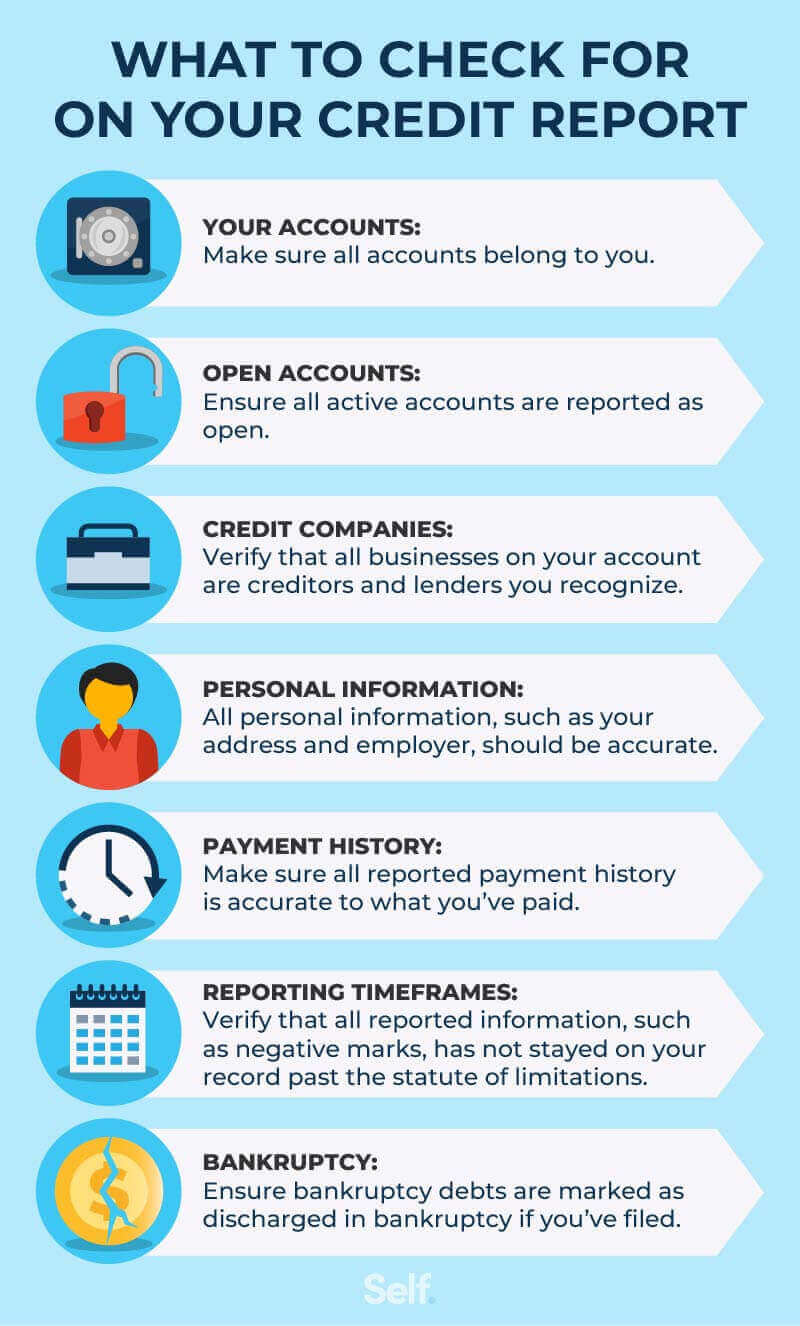

2. Review each report

Once you have your reports, you should review each one carefully. You should look out for any errors or incorrect information. This can include:

- Accounts that were never closed.

- Accounts that aren’t yours.

- Errors with personal information, such as name or address.

- Maxed, past-due or charged-off accounts.

Faulty items will need to be disputed with the three credit reporting agencies. Reach out to the original credit issuer (or the current account owner) for legitimate negative items to start a repair plan.

3. Address accurate negative marks

Once you’ve studied your reports, it is suggested that you highlight the legitimate negative marks. These items will likely be where your repair process will focus. These may include:

- Charge-off and collection accounts belonging to collection agencies.

- High-balance or maxed-out accounts.

- New credit cards.

- Accounts with late payments or outstanding balances.

You can’t dispute legitimate negative marks. However, you might be able to work with creditors and debt collectors to create payment plans or negotiate for a lower amount due.

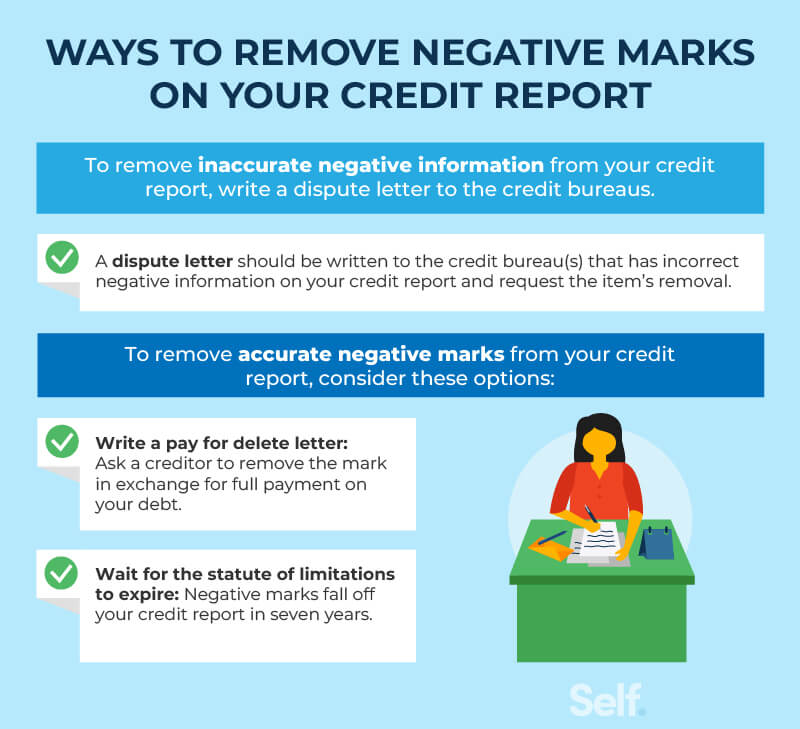

How to write a pay for delete letter

A pay for delete letter negotiates the removal of a negative mark from your record if you pay your debts. While this may be the best option for some, it’s not typically recommended overall. Pay for delete options hold minimal weight in courts and the success rate is usually low. Only inaccurate or incomplete information can be removed from your credit report, so credit repair companies that promise they can give you better results could be a scam.

When writing a pay for delete letter, you should include:

- Your name and contact information.

- Your account information.

- How much you owe and the amount you’re willing to pay.

- The deadline you’re willing to pay by.

This isn’t a surefire way to remove a negative mark, but the collection agency may be willing to negotiate if you offer them more than they paid for your debt.

4. Dispute false items to get them removed

Sometimes, errors can arise in a credit report. These include incorrect names, account numbers, or entire credit accounts in cases of identity theft. While not common, it does happen and can negatively impact your credit score.

Once you have verified the inaccurate marks, you can begin to dispute them. To do this, it’s suggested you:

- Contact the credit reporting company that provided the report with errors in writing.

- Highlight each mistake and explain why you want the errors removed.

- Provide details about the errors and include documentation that supports your claim.

- Include your contact information and a report confirmation number, if available.

You can also dispute incorrect information on the credit bureau's website. Be sure to have your information and digital copies of your documentation accessible when you do so.[5]

How to report identity theft

If you believe errors on your credit report are the result of identity theft, go to IdentityTheft.gov.[6] Since identity theft is a federal crime, this government site provides all the needed steps and information regarding reporting and fixing identity theft issues.[5]

How to write a dispute letter

When disputing items on your credit report, it may be a good idea to request a formal investigation and action via a dispute letter. This letter should include:

- The date.

- Your name.

- Your address and contact information.

- The name of the credit bureau showing the error(s).

- Descriptions of the error(s), with appropriate creditors’ names and amounts.

- Details describing the errors, such as proof of credit card balances or absence of an account.

- Specific change requests, including removal of incorrect items or changes to details.

- Copies of the credit report with highlighted information.

- Records and descriptions of payments, pay-offs, or other account information that proves the error(s).

To ensure a paper trail, it is recommended to send the letter via certified mail. We also recommend keeping all original items yourself and only sending in copies.[7]

5. Watch for responses from credit bureaus and take action

Because of the Fair Credit Reporting Act (FCRA), credit bureaus must complete an investigation within 30 days of receiving your request.[8] Investigations are sometimes finished quicker than this, but it may depend on how fast the original lenders or other companies provide the major credit bureaus with the necessary information.

If you have to submit any extra information, the FCRA allows 15 days of additional investigation time. Watch the mail for response letters within this time frame. If you disagree with the outcome, you can file another dispute with more information for further proof. You can also go to the original creditor and ask for a correction directly.

Finally, you can ask for a statement of dispute to be added to your report. This doesn’t change your credit score, but it will be visible to future creditors, indicating that you disagree with an item.

6. Avoid making late payments

While verifying your credit reports, it is essential to continue making your regular payments. Credit scores are generated from your credit reports by two main scoring companies: FICO©* and VantageScore, with FICO being the most widely used by creditors. Payment history is the most important and heavily weighted credit score factor in FICO’s score calculation formula.[9] As such, missing payments can lead to a bad credit score.

Creditors will typically report an account 30 days after you miss a payment. Some creditors wait 60 days to report late payments. Even if you miss the due date, it is recommended you pay the total amount due as soon as possible to reduce the late payment’s negative impact.

7. Don’t close any old credit accounts

Another way to help keep your credit score as high as possible may be to keep your credit accounts open. The age of your accounts makes up 15% of your FICO credit score, so closing old accounts will reduce the average age.[10]

Closing accounts can also affect your total credit utilization rate. Your credit utilization makes up 30% of your FICO Score. By closing an account, you reduce your total available credit amount, which increases your utilization rate.[10]

8. Avoid any hard inquiries

Any time you apply for a line of credit, it may count as a hard inquiry. This means that a creditor has looked at your credit report to determine your creditworthiness. These inquiries will have a short-term negative impact on your credit score, and too many inquiries in a short time can be a red flag to potential creditors.[11]

Hard inquiries may be necessary when opening a credit account, so they are, at times, a part of the process. However, you can be strategic with your inquiries, especially if you’re shopping around.

If you shop around for mortgage rates, for example, your credit won’t be impacted if your first hard inquiry occurs within 14-45 days of your last credit check. You can safely compare rates with as many lenders as you’d like within that period. You’ll only get one hard inquiry reported on your credit score if you do.[11]

Hard inquiry vs. soft inquiry

Hard inquiries are made whenever you apply for a credit account. These include loans, credit cards and credit line increases, and even new utility applications. These inquiries will slightly lower your credit score as new accounts are considered riskier than existing ones.[12]

Soft inquiries do not affect your credit score. Items such as pre-approved credit offers, personal credit checks and employment applications will generate a soft inquiry. These check your credit report, but they have no impact on your score.[12]

9. Request credit limit increases from creditors

Credit utilization is a large part of your credit score. To decrease your credit utilization, you can increase your total credit limit while maintaining the same level of spending. One way to do this is to request a credit line increase. Creditors may generally grant an increase if you’ve used your credit responsibly.[13]

If your credit score isn’t in the best shape, you may not be approved for a limit increase.

10. Pay off multiple types of credit

Another way to boost your credit score is to consider having an ideal mix of credit accounts. Different scoring models place different weights on your credit mix. Still, creditors look at your credit mix to determine your ability to manage various types of credit.[14]

A credit mix can include these four types of credit accounts:

- Installment loans (including student loans)

- Revolving credit card debt

- Mortgage loans

- Open accounts that require the entire balance to be paid each month, such as charge cards

11. Make a plan to pay down debts quickly

The quicker you can pay off debt, the faster your score may rise. Though it may not result in an immediate credit score raise, reducing your overall debt may save you money in interest charges and help position you for better loan terms in the future.

One strategy to consider is to focus on your revolving credit accounts first, as paying down installment credit accounts may not raise your credit score as quickly.[15] Start with accounts with the highest interest rates if you have many revolving accounts.

You can also look into debt consolidation loans to raise your credit. Debt consolidation loans provide funds to pay off your outstanding debts. By using the money from a debt consolidation loan to pay off outstanding debts, you can simplify your life by focusing on one payment over many.

Many consolidation loans feature extended periods of no or low interest to help keep costs down.[15]

With that said, installment accounts still do carry credit weight. By ensuring you make each payment, you may continue to improve your credit. Some loans, such as Self’s credit builder loans, are designed to raise your credit through 12-24 months of loan payment reporting.

Paying the loan may reflect positively on your credit score by improving your payment history, a major factor of credit score calculation. At the end of the loan’s life, you’ll receive the money back that you have paid (minus any interest, fees or associated costs).

Don't fall for credit repair scams

Repairing your credit is seldom a quick process. It may require patience, discipline, and a genuine commitment to improving your finances. With this in mind, you should thoughtfully consider any service advertising quick credit repair. These can be credit repair scams and can lead to disastrous financial results.

To try to identify a credit repair scam, look for the following:

- Services that demand an upfront payment (this is illegal under the Credit Repair Organizations Act).[16]

- Services that promise to remove negative information from your account. No information can be removed if it is legitimate.[16]

- Services that refuse to explain your rights as a creditor. Specifically, you can take the same actions advertised by a repair company yourself, and for free.

- Services that pressure you not to contact credit reporting companies. This can be deceptive, and scams may do this to ensure you aren’t aware of your rights.

If it seems too good to be true, it usually is. Avoid any services that try to avoid explaining their practices.[16]

Do you need a credit repair company?

In short, there generally isn’t a good reason to hire a credit repair company. Even legitimate companies can only do what you can already do for free. Credit counseling services do exist, but these are designed to help guide you through repairing credit while teaching better financial lessons.

To try to achieve a good credit score, take some time and work through this do-it-yourself credit repair process. If you need extra help, please visit Self’s blog for more information.

Disclaimer: FICO is a registered trademark of the Fair Isaac Corporation in the United States and other countries.

Sources

- Federal Trade Commission. “Get My Free Credit Report,” https://www.ftc.gov/faq/consumer-protection/get-my-free-credit-report. Accessed February 28, 2022.

- Experian. “Contact Us,” https://www.experian.com/contact/personal-services-contacts.html. Accessed February 28, 2022.

- TransUnion. “Contact Us,” https://www.transunion.com/about-us/contact-us. Accessed February 28, 2022.

- Equifax. “Equifax Contact Information and Helpful Links,” https://www.equifax.com/personal/help/help-contact-equifax/. Accessed February 28, 2022.

- Consumer Finance Protection Bureau. “How do I dispute an error on my credit report?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-an-error-on-my-credit-report-en-314/. Accessed February 28, 2022.

- Federal Trade Commission - Identity Theft. “Identity Theft.gov,” https://www.identitytheft.gov/. Accessed February 28, 2022.

- Federal Trade Commission. “Sample Letter Disputing Errors on Credit Reports to the Business that Supplied the Information,” https://www.consumer.ftc.gov/articles/sample-letter-disputing-errors-credit-reports-business-supplied-information. Accessed February 28, 2022.

- Experian. “How Long Do Credit Report Disputes Take?” https://www.experian.com/blogs/ask-experian/how-long-does-it-take-to-complete-the-dispute-process/. Accessed February 28, 2022.

- Experian. “What’s the Most Important Factor of Your Credit Score?” https://www.experian.com/blogs/ask-experian/what-factor-has-the-biggest-impact-on-credit-score. Accessed June 9, 2022.

- Experian. “Should You Cancel Unused Credit Cards or Keep Them?” https://www.experian.com/blogs/ask-experian/is-it-better-to-cancel-unused-credit-cards-or-keep-them/. Accessed February 28, 2022.

- Experian. “What Is a Hard Inquiry and How Does It Affect Credit?” https://www.experian.com/blogs/ask-experian/what-is-a-hard-inquiry/. Accessed February 28, 2022.

- Forbes. “What’s The Difference Between A Hard And Soft Credit Check? https://www.forbes.com/advisor/credit-score/soft-credit-check-vs-hard-credit-check/. Accessed February 28, 2022.

- Experian. “How to Increase Your Credit Limit,” https://www.experian.com/blogs/ask-experian/how-to-increase-your-credit-limit. Accessed February 28, 2022.

- Equifax. “What is a Credit Mix and How Can it Affect Credit Scores?” https://www.equifax.com/personal/education/credit/score/what-is-a-credit-mix/. Accessed February 28, 2022.

- Experian. “Which Debts Should I Pay Off First to Improve My Credit?” https://www.experian.com/blogs/ask-experian/what-debt-to-pay-off-first-to-raise-credit-score. Accessed February 28, 2022.

- Consumer Finance Protection Bureau. “How can I tell a credit repair scam from a reputable credit counselor?” https://www.consumerfinance.gov/ask-cfpb/how-can-i-tell-a-credit-repair-scam-from-a-reputable-credit-counselor-en-1343/. Accessed February 28, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).