Does Paying Phone Bills Help Build Your Credit?

Published on: 12/19/2022

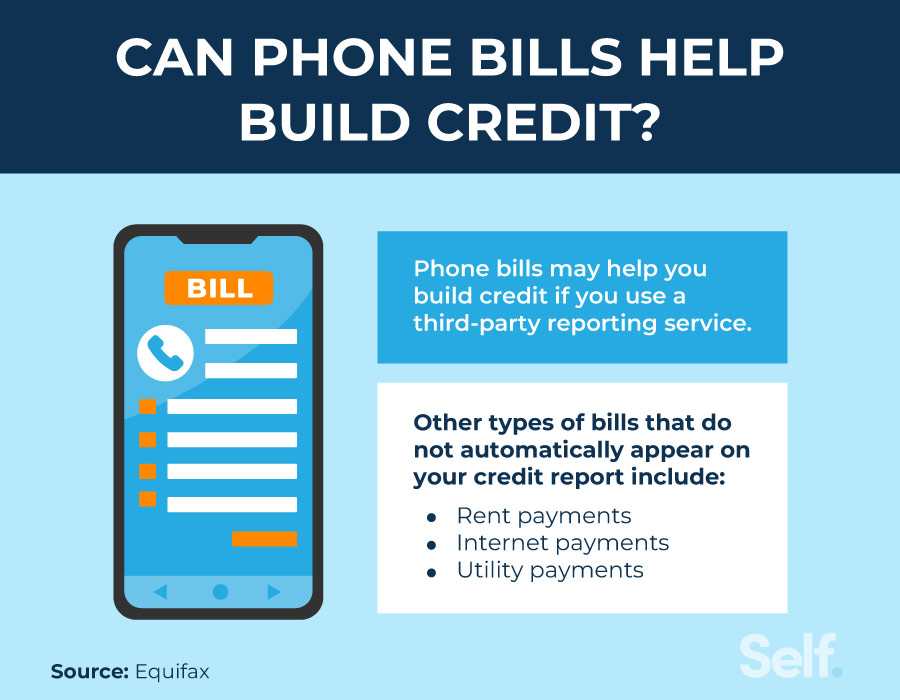

Making your credit card and mortgage payments on time can help build your credit, but even bills that don’t involve paying off debt may impact your credit, too, including on-time bill payments for your phone service. If you use a third-party reporting service, your positive history of phone payments could influence your credit for the better. On the flip side, missing your phone bill could negatively affect your credit score.

This article explains how you may be able to build credit by paying your phone bills, how doing so can affect your credit score and other options for elevating your credit.

Can phone bills help build credit?

Making phone payments can elevate your credit score when you use a third-party reporting service, but it may not happen automatically. Cell phone bills, utility and rent payments don’t automatically appear on credit reports. However, you can use a third-party reporting service, which can report your payments to at least one of the three main credit reporting agencies. The costs for using such a service will vary.[1]

You can also use your phone payments to elevate your credit indirectly. You can do this by using a credit card to pay your phone bill. Because credit card payments are reported to the credit bureaus, making on-time credit card payments will be reflected in your credit history. However, if you don’t pay off your balances in full when your credit card statement arrives, you may wind up increasing your credit utilization ratio, which may negatively affect your credit.[2]

How to report your phone plan payments

Third-party reporting services can help elevate your credit by sending records of your on-time payments to the credit bureaus. If you have a lesser known provider and you decide to use a service like this, you may want to be sure it accepts payment information from providers other than Verizon, AT&T, or T-Mobile.

- Self: Self's Free rent reporting service reports positive rental payments to all three major bureaus (Equifax, Experian and TransUnion). In addition, it reports utility and cell phone payments for $6.95 per month.[3]

- GrowCredit: GrowCredit lets you work to build credit using a free MasterCard. You use the interest-free card to pay for subscriptions and cell phone services, and this service reports on-time monthly payments to all three credit bureaus. There are four different plans: Build Free, Build Secured, Grow and Accelerate. Build Free is free, Build Secure starts as low as $2.99/month, Grow start as low as $4.99/month and Accelerate costs as little as $9.99/month. Choose your plan based on how much you want reported each year and what level of service you need.[4]

With any of these products, individual results will vary as each person’s credit history is unique. Your results will also vary depending on which product you use.

How phone plans can hurt your credit score

If you don’t pay your phone bill or utility bills on time, your credit score may suffer — even if the payments themselves aren’t reported to the major credit bureaus. These next sections detail how.[5]

Accounts sent to collections may be reported

Missed payments or late payments on cell phone or utility bills may not hurt you, but if you continue to miss payments and your account is sent to a collection agency, you may endanger your credit. One factor in your FICO® score is your payment history. This makes up the biggest factor in your FICO® score, counting for 35%.[6]

Applying for a new service may trigger a hard inquiry

If you apply for new credit to finance your phone contract, you may see a dip in your credit score. Credit card companies and other lenders may run a credit check, known as a hard inquiry, which may temporarily lower your credit score by a few points.[7]

Hard inquiries take place when you authorize a lender, service provider, or other entity to look at your credit file. They typically fall off your credit report after two years.

Does financing a phone help build credit?

You can build credit by financing your cell phone if the creditor reports your payment activity to the three major credit bureaus. If you are considering financing a phone, phone companies such as Samsung or Apple may work with a bank to open a line of credit for you that is reported to the credit bureaus.

For instance, Samsung offers financing with a $0 down and payment periods of up to 48 months. This offer is only available on purchases of select products charged to a Samsung Financing account.[8] If you use an Apple Card account to finance an iPhone, the credit bureaus will receive information on bill payments, credit utilization and the age of your account.[9]

Other ways to build credit

Paying your phone bills on time can help you build credit, but it isn’t the only option you have available to you.

Consider a secured credit card

A secured credit card can help you upgrade your credit by building a history of on-time payments. Unlike traditional cards, these accounts are secured by a deposit, usually a savings account or certificate of deposit. Because of this, you may qualify for them more easily.

The security deposit typically acts as your credit limit, which protects the card issuer against nonpayment. However, you can’t use it to make monthly payments to pay off your balance. First-time applicants often use secured credit cards to establish credit.[10]

Become an authorized user

You can ask a family member or trusted friend with established credit whether you could become an authorized user on their account. This way, you will be able to piggyback on their credit. An authorized user can benefit from the primary user’s credit history on that account as long as the primary user pays as agreed, has had the account open for some time and maintains a low credit utilization ratio (CUR) on the account. The CUR is the total balance divided by the total credit limit on the account.

However, poor habits can affect the credit of both users. In addition, you aren’t likely to get as much of a bump in your FICO® score from being an authorized user as you would from building your own credit.[10]

Try credit builder loans

A credit builder loan can help you establish or build credit as well as build savings. It works differently than a traditional loan process. With a credit builder loan, you don’t receive your lump sum upfront and pay it back in installments. Instead, you make monthly payments to the lender who secures your money in a certificate of deposit (CD) or savings account until you’ve made all of the payments for the loan.

Once you’re done paying for the loan, that money is returned to you (minus interest and fees). Not only do you have a lump sum of money to use at the end, but you may also elevate your credit score if you make on-time payments, which the lender reports to the credit bureaus. Lenders may also report late payments and nonpayments, which could negatively impact your credit score, so make sure you’re able to make on-time payments if you take out a credit builder loan.

Get started with a credit builder loan today

If you have poor credit or no credit, consider opening a Self Credit Builder Account (CBA). Choose a plan that fits your budget, and as you make monthly payments, Self reports your payments to all three credit bureaus. You get your money, minus interest and fees, once you’re done paying the loan. The Self CBA gives you a great way to build savings and credit at the same time.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- Equifax. “Establishing Credit When You Don't Have Credit,” https://www.equifax.com/personal/education/credit-cards/establishing-credit-when-you-don-t-have-credit/. Accessed on August 3, 2022.

- MyFICO. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed on August 3, 2022.

- Self. “Grow Your Credit With Your Rent Payments,” https://learn.self.inc/lpg/mpa/rent-bills-landing/?_gl=1*12al5a8*_gcl_au*MTAxNDUzODg5Ni4xNzA1MzYxOTMw. Accessed on January 23 2023.

- GrowCredit. “Build credit. For free.” https://www.growcredit.com/. Accessed on August 3, 2022.

- CapitalOne. “Can Paying Bills Help Build Credit?” https://www.capitalone.com/learn-grow/money-management/does-paying-bills-build-credit/. Accessed on August 3, 2022.

- MyFICO. “What is Payment History?” https://www.myfico.com/credit-education/credit-scores/payment-history. Accessed on August 3, 2022.

- MyFICO. “4 Surprising Things That Cause A Hard Inquiry,” https://www.myfico.com/credit-education/blog/4-surprising-things-that-cause-a-hard-inquiry. Accessed on August 3, 2022.

- Samsung. “Power up with Samsung Financing,” https://www.samsung.com/us/financing/. Accessed on August 3, 2022.

- Apple. “How Apple Card and Apple Card Family is credit reported,” https://support.apple.com/en-us/HT212288. Accessed on August 3, 2022.

- MyFICO. “How to Build Credit,” https://www.myfico.com/credit-education/credit-scores/how-to-build-credit. Accessed on August 3, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).