How to Get Overdraft Fees Refunded

Published on: 09/24/2021

At one point or another, we’ve all seen our bank accounts come precariously close to that “$0” danger zone. Overdraft fees are an added sting, taking money that you may not have.

If a fee does hit your account, you have options. Sometimes, simply talking to your bank and explaining your situation can be enough to get those fees reversed and your account back in good standing. With that said, knowing the ins and outs of the overdraft system can help you avoid overdraft fees altogether.

What are overdraft fees?

An overdraft fee is a penalty charged to your bank account when certain transactions occur without sufficient funds in the account to cover them, leaving your account overdrawn. This can happen for several reasons, including automatic payments, funds coming out while a deposit is pending or ATM withdrawals.[1]

There are other reasons for fees to hit your account, in addition to insufficient funds. Other bank charges include out-of-network ATM fees and monthly maintenance charges. These are typically not associated with having sufficient funds in your account.

How much do overdraft fees cost?

There is no standard rate for overdraft fees across the financial world. Banks and credit unions set their fee schedules, both the costs and the reasons why they occur. On average, overdraft fees are roughly $35 for each occurrence, with online-only banks typically charging less per occurrence than traditional banks and credit unions.[2]

In 2020 alone, financial institutions such as Bank of America and Chase earned $12.4 billion in overdraft fees.[3] Though this number is down from years before, banks earn a massive amount of money from customers with insufficient funds.

It is important to note that overdraft fees can’t occur on credit cards. There are other fees associated with credit cards, including finance and interest. Most credit cards are governed by an existing limit. With these cards, transactions are automatically declined once that limit is reached. However, there are some credit cards that allow customers to spend beyond their limits without fees. Others allow customers to opt-in to allowing fees for charges that go over the credit limit.

How to waive overdraft fees

Some banks, such as Ally Bank, have done away with overdraft fees completely.[4] There are also apps, including Recoup and Cushion, that will negotiate with your bank on your behalf to get fees refunded.[5]

If your bank does charge overdraft fees, there is a good chance that you can get them waived. No matter what financial institution you use, the process to get your fees waived is roughly the same. Though getting an overdraft fee refund is never a guarantee, there are steps to take that can improve your chances.

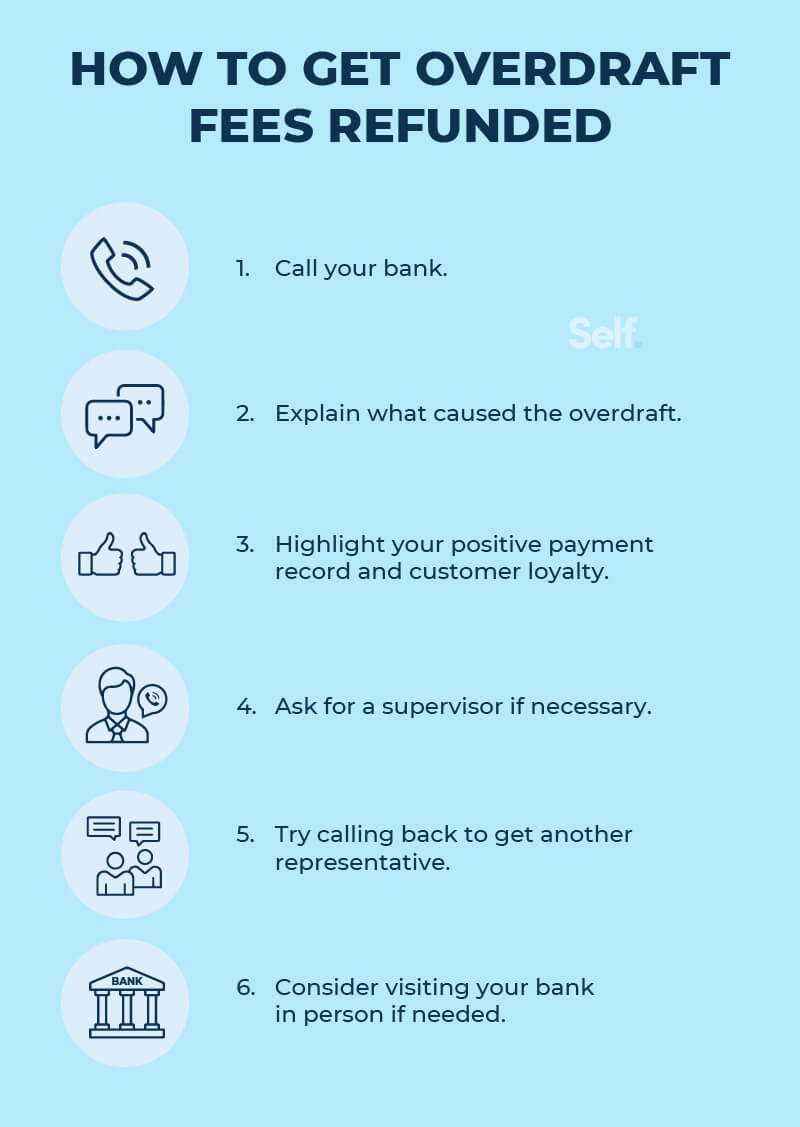

Steps you can take to have overdraft fees waived

1. Contact your financial institution: Start with a simple phone call. Call your bank as soon as you notice an overdraft fee on your account. Speaking to a real person should be the first step.

2. Explain your situation: People make mistakes. This is why talking to a live representative is so important. Be sure to explain why you had insufficient funds, such as financial troubles or an unexpected transaction. You don’t have to go into every detail, but explaining your situation allows the representative to understand essential information that led to the fee.

3. Advocate for yourself: While maintaining a respectful tone, indicate why you feel the fee should be reversed. As a loyal customer, be sure to highlight your longevity with the bank and list your other accounts there (such as CDs or investments). Conclude with your plan of action for not only ensuring the account gets back to a positive balance, but what you’re doing to make sure it doesn’t happen again.

4. If necessary, talk to a supervisor: Sometimes, the first representative you talk to may not be the best to handle your request. They might not be in a position to reverse fees, or they simply might not understand your appeal. If this is the case, ask for one of the managers on duty. They often have the final say on reversing fees and can weigh your presented points against the bank’s interest better than a customer service representative.

5. Try again later: If you’re still not getting the desired results, call back and try again in a day or so. The bank is staffed with people, and moods can change from day to day. Simply speaking with a different representative at another time could be all that’s needed to get the fee reversed.

6. Explain your situation in person: If all else fails, put down the phone and visit your bank. Putting a face to the voice often helps your case, as bank representatives will see your plight as a human, not just another voice on the phone. Be sure to remain respectful, but follow the above list while sitting down with someone.

Is it legal for banks to charge overdraft fees?

In short, yes. Overdraft fees are legal as long as the bank has provided you with their documented overdraft rules and allowed you to consent to such regulations.[6] Banks are required to ask you if you want transactions to occur that would result in a negative balance. If you allow this, it is called “opting-in to overdraft protection.”[7] In other words, you opt for the bank to enable ATM transactions and one-time debits to be withdrawn from your account, even if you don’t have the funds.

Banks must also disclose how much their item fees are, including maximum amounts and the number of times a fee can be assessed. Each bank determines these, so be sure to ask your institution to clarify their rules if you are unsure. This option will be presented to you, typically upon opening the account. At any time, you can also revoke consent, or “opt-out,” of the overdraft protection service. Doing so will decline any one-time debit or ATM transaction that would take your account negative, but it will save you an overdraft fee.

Note that opting in or out only affects ATM and debit card usage. If funds are taken directly from your account — such as through a check or ACH transaction — these charges do not fall under the same guidelines. This can result in multiple overdraft and nonsufficient fund fees, depending on how many of these transactions go through.

How to avoid overdraft fees

Now that you know how to get overdraft fees reversed, take the time to understand the various fee avoidance measures at your disposal.

Consider overdraft protection for your account

Financial institutions typically offer several options to protect your accounts from overdraft fees. Opting-in or out of protection starts when you open your account. Both of these can protect you, depending on your needs.

Suppose you’re willing to pay the overdraft fee so that a debit card transaction can occur. In that case, opting in will ensure the transactions proceed. In this case, the overdraft has protected your normal flow of transactions. But, it hasn’t protected you from fees.

However, it is important to note that opting in can lead to more fees than opting out. In fact, opting-in leads to seven times the fees when compared to opted-out accounts. Opting out will help avoid overdraft fees. But, it will also stop transactions from proceeding on your account. [7]

Some online banks, including Chime, allow up to $200 of overdrafts without a fee. Because they don’t have traditional branches, online banks can extend customers more protection than standard banks. This isn’t always the case, but it is often a selling point for online institutions. These banks often offer fee-free ATMs and other services, as well.[8]

Additionally, customers with additional accounts can link them to their main account as overdraft protection.[9] This allows your bank to transfer funds out of your other accounts, such as a savings account or a specific line of credit, into your main account to cover the shortage. Lines of credit may have a higher interest rate for transfers, so be sure you understand the details of your account.

Credit cards can help avoid overdraft fees, as well. In a process similar to an overdraft line of credit, funds can be transferred to your bank account from a credit card. Be sure to note the terms of your card, especially for transfer fees and specific APRs.

Normally, these transfers are treated as cash advances. Cash advances from a credit card carry fees and high interest rates. And, the penalty APR for a transfer begins immediately. This will often lead to greater fees than one overdraft. Plus, you have to be sure to pay the credit card off. If you don’t, the monthly interest charges and use fees will almost always amount to more than one overdraft fee. [10]

Not every card will have the availability to act as overdraft protection. And, some banks may only allow a credit card or line of credit from the bank itself. Using a credit card as overdraft protection shouldn’t be the first choice for many. But, it is a last-choice option for those that have the capability.

Keep a close eye on your bank balance

Getting into the habit of routinely checking your account balances can often be the best protection against overdraft fees. Many accounts can be set up through online banking to alert you when the balance drops below a threshold of your choosing.

Get a checking account from a bank without overdraft fees

If you find yourself having trouble avoiding overdraft fees, or if you are unsatisfied with the response of your bank when you’ve tried to get one refunded, you can always find banks that simply don’t have overdraft (and other) fees in the first place.[11]

Mobile banking options, like Acorns and Simple, offer accounts with no overdraft fees up to a certain amount. Some simply don’t allow transactions to occur if they would take your account negative. These options are typically quite user-friendly and could be precisely what you need.

Does overdraft protection help avoid NSF and other bank fees?

Slightly different from an overdraft fee, an NSF fee (nonsufficient funds) occurs when payments or checks are returned because of insufficient funds in your account.[12] If you have opted-in to your bank’s overdraft protection, debit purchases will be charged an overdraft fee when they are allowed to occur and take your account negative. An NSF fee would be assessed if a check or ACH transaction is rejected because you lack sufficient funds.

Apart from opting-in or out of your bank’s overdraft protection, linking supplemental accounts or lines of credit can help protect you from NSF fees. They can be set up to ensure enough money is transferred before a payment tries to leave your account. Other fees — such as account maintenance fees, out-of-network ATM fees and transfer fees — may not be protected by overdraft coverage. Be sure to double-check your bank’s terms to understand its specific policies.

Can overdraft fees affect your credit score?

If you’ve wondered how overdraft fees affect your credit score, there is good news. Being assessed an overdraft fee will typically not affect your credit score. There is no borrowing from a lender when using a checking account, so nothing is reported to a credit bureau.

However, checking accounts are actively monitored by another reporting agency known as ChexSystems. This agency monitors account usage, including account health and fee history, as well as hints of fraud. Failing to maintain a positive available balance, or routinely conducting financial transactions that lead to a negative account balance, will be reported to this agency.

This information is kept for up to five years and is available to any banks that use ChexSystems reports. This information can be used to deny the opening of a checking account.

Finally, allowing an account to remain negative without rectification can cause the account to be sent to collections. This will impact your credit score, as collection accounts are reported to credit agencies. Be sure to check your accounts daily.

If you do find yourself on ChexSystems or having less-than-ideal credit, there are options for you. Self offers many solutions to help build credit that can help you get back on track with your finances. Even if you have fallen on tough times, there’s always hope!

The bottom line

Some banks are more customer-friendly than others and offer ways to reduce or eliminate overdraft charges. If you get charged a fee, remember that you can and should contact your bank and negotiate its reversal. Remain polite, explain your situation and detail why it won’t happen again.

There are safety nets, such as overdraft-protecting lines of credit that will automatically transfer funds into your main account to prevent a negative or low balance. But, the first and most important step in preventing fees is to be on top of your finances. Monitoring your accounts daily can help you avoid fees altogether. We all go through difficulties, but knowing how to avoid overdraft fees can save you headaches (and money).

Sources

- Help With My Bank. “Can the bank charge an overdraft fee while there is a deposit pending?” https://www.helpwithmybank.gov/help-topics/bank-accounts/nsf-fees-overdraft-protection/nsf-fees/nsf-deposit-pending.html. Accessed August 9th, 2021.

- Experian. “What Are Overdraft Fees and How Much Do They Cost?” https://www.experian.com/blogs/ask-experian/what-are-overdraft-fees/. Accessed August 9th, 2021.

- Forbes. “Banks Charged Low-Income Americans Billions In Overdraft Fees In 2020,” https://www.forbes.com/advisor/personal-finance/how-to-prevent-overdraft-fees. Accessed August 9th, 2021.

- US News. “How to Get Overdraft Fees Waived,” https://money.usnews.com/banking/articles/how-to-get-overdraft-fees-waived. Accessed August 9th, 2021.

- Recoup. “What is Recoup?” https://www.recoup.ai/. Accessed August 9th, 2021.

- CFPB. “§ 1005.17 Requirements for overdraft services.” https://www.consumerfinance.gov/rules-policy/regulations/1005/17/. Accessed August 9th, 2021.

- CFPB. “Understanding the Overdraft ‘Opt-in’ Choice,” https://www.consumerfinance.gov/about-us/blog/understanding-overdraft-opt-choice. Accessed August 9th, 2021.

- Chime. “What is Chime?” https://www.chime.com. Accessed August 9th, 2021.

- Forbes. “Understanding Checking Account Overdraft Protection and Fees,” https://www.forbes.com/advisor/banking/understanding-checking-account-overdraft-protection-and-fees. Accessed August 9th, 2021.

- The Balance. “What Does Overdraft Protection Mean for Your Credit?” https://www.thebalance.com/what-does-overdraft-protection-mean-for-your-credit-960738. Accessed September 10th, 2021.

- Crediful. “Best Checking Accounts With No Overdraft Fees,” https://www.crediful.com/banks-with-no-overdraft-fees/. Accessed August 9th, 2021.

- Investopedia. “Non-Sufficient Funds (NSF) Definition,” https://www.investopedia.com/terms/n/nsf.asp. Accessed August 9th, 2021.

About the Author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).