How Long Does an Eviction Stay on Your Record and Affect Your Credit?

Published on: 09/17/2021

No one wants to go through an eviction. Not the landlord, and especially not the tenant. As a tenant, being removed from a rental property can have serious consequences. Evictions negatively impact public records and rental history and can affect your credit.

When a tenant fails to pay rent or meet the requirements of the rental agreement, the landlord gives notice, which provides the tenant a chance to make things right. However, if the tenant still doesn’t follow the contract, the landlord will file suit in court, and an eviction judgment is likely to be handed down.

Evictions can stay on your public record for up to seven years. And your credit reports will show the financial effects of eviction for the same period. The eviction will fall off of your public record — and eviction-related financial debts will drop off your credit reports — after those seven years. Still, during that time, the failure to pay can affect credit scores. The eviction will make it difficult for another landlord to offer you a rental agreement.

So, it makes sense to do all you can to avoid an eviction. Another thing to consider is filing for a complete rental history background check and receiving a free credit report to see if eviction-related debts are listed.

How long does an eviction stay on my record?

An eviction can remain on your record for up to seven years, depending on the state where it happened.[1] Eviction isn’t just removing someone from premises; it’s a process involving legal notices and court proceedings that can take several weeks.

But it’s not inevitable. If you’re worried about possible eviction, there are financial resources to help you stay in your home and pay your bills. For example, Self customers have access to SpringFour, which can provide access to housing, utility, food, job search, and other assistance resources you can use to avoid eviction and get back on your feet.

The eviction process

Eviction, in general, takes multiple steps:

- Filing a pay or vacate notice (an eviction notice)

- Providing time for the tenant to fulfill the terms of the lease

- A court proceeding and judgment leading to eviction from the premises

The amount of time it takes to move through the eviction process varies depending on where you live and if the eviction is with cause or without cause. If tenants comply with the written notice, eviction can take 30 days or less. However, if the landlord has to file a lawsuit, the process may take six weeks or more.[2]

Pay or vacate notice

The formal warning from the landlord or property manager to the tenant is known as a "pay or vacate notice" or "quit notice." The quit notice informs the tenant that the tenant violated the lease by missing rent payments (usually more than one month's rent) or violating another rule in the rental contract.

This notice gives the tenant a chance to comply with their lease before any court proceedings take place.[3]

Tenant must pay within a specific timeframe

Through the pay or vacate notice provided by certified mail, the landlord details the date of notice and how many days the tenant has to comply, pay back rent, and abide by the rental agreement.

Suppose the tenant fails to pay or comply within the specified timeframe. In that case, the landlord will usually take the eviction case to court.[3]

Judgment

Judgment is the final step in the eviction process. This typically involves a landlord filing a civil case against the tenant. Suppose the tenant is found by a judge or jury to have violated the lease agreement. In that case, a judgment will be issued against the tenant, after which the eviction will appear on the tenant's rental history report and in a court record.

The eviction itself should NOT show up on a credit report[1]; however, civil judgments resulting from an eviction (such as missed payments, collections, etc.) will show up on a credit report.

How can I remove an eviction from my record?

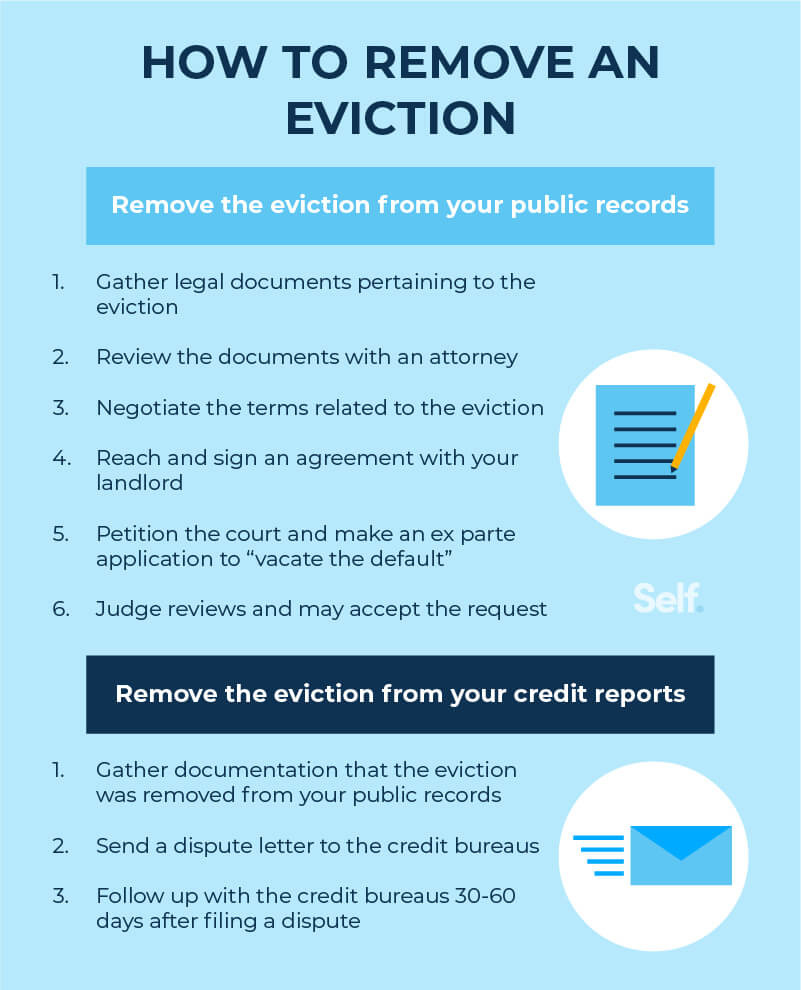

Removing an eviction from your public record is relatively simple for a tenant to pursue after having been evicted and having gone through the civil judgment process. First, however, you need to take steps to remove the eviction from public records and then from your credit reports.

Removing an eviction from the public record

Removing an eviction from the public record takes several steps, but it can be done.

- Gather all documents that pertain to the eviction. These include filed legal documents and personal records, such as emails and notices.

- Review the documents and eviction with an attorney (a local legal aid can help) to ensure the record can be removed and cleared.

- Negotiate. If the eviction is related to nonpayment of rent, back rent and interest will need to be paid. If the eviction was for something else, there would likely be fees and other costs to pay. The purpose of the negotiation is to reach an acceptable agreement for both parties.

- At this point, the lawyer will draft a stipulation that details the terms agreed on by the landlord and tenant. The stipulation should address the amount to be paid, the due date, who will be paid, the method of payment, and who pays for and files the stipulation.

- Once the stipulation is signed, it’s time to petition the court and make an ex parte application to “vacate the default.”

- Finally, the landlord and tenant attend an ex parte hearing where a judge reviews the documents and stipulation. If all is in order, the judge will issue an order granting the requests made in the ex parte application. Soon after that, the eviction will be removed from the public record.[4]

Removing an eviction from your credit report

Once you’ve taken the necessary steps — and paid back rent, fees, and the like — to remove an eviction from the public record, it’s time to clean up your credit reports.

- Again, gather documentation that the eviction was removed from the public record and that you paid all related debts.

- Send a dispute to the credit bureaus. You'll need to send separate disputes and documentation for each bureau — Experian, Equifax, and TransUnion.

- Once the disputes are filed, follow up with the bureaus. It takes time to remove items from a credit report, but after 30-60 days, it’s a good idea to follow up on the progress.[5]

How can I rent with an eviction on my record?

Even with an eviction judgment on your record, it is still possible to enter into a rental agreement with another landlord — if handled the proper way.

- The best course of action? Be up front with the potential new landlord about the eviction and the circumstances surrounding it. Be honest and admit it if you made mistakes that resulted in the eviction.

- Making amends with your previous landlord is a step that might help, and they might be willing to vouch for you in the future with other potential landlords.

- Another way to get a new rental agreement with an eviction on your record is to agree to a higher security deposit or higher rent with the new landlord. The landlord may perceive that you learned from the eviction and that you are now more trustworthy.[5]

How does a civil judgment affect my credit?

Besides being a negative factor for future landlords to consider, an eviction with a financial civil judgment on your record has other repercussions.

These repercussions can include a lack of employment opportunities, declined rental applications, a negative credit record and lower credit scores, and lenders refusing to loan money to you.[6]

Rental issues that may appear on your credit report

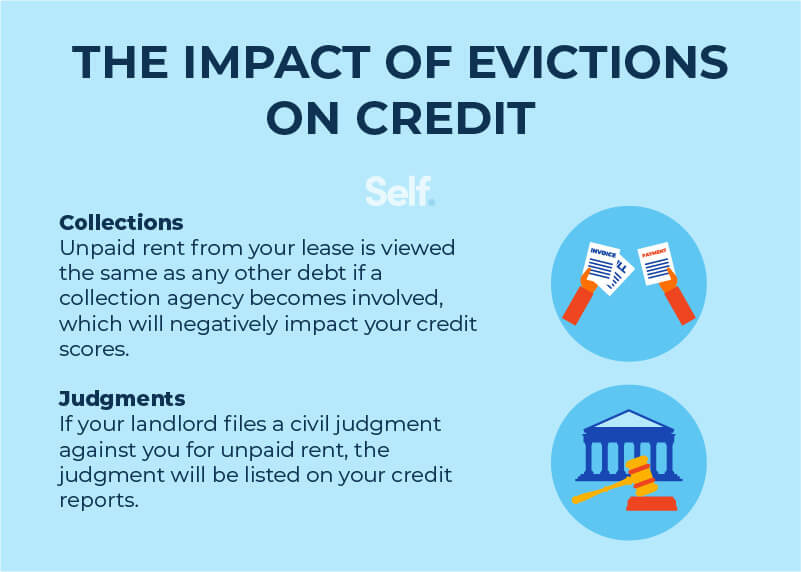

It may not seem like an eviction would affect your credit scores and show up on a credit report from reporting agencies. Still, there are credit-related effects from rental issues, just like if you had misused credit cards.

Collections

Unpaid rent from a lease agreement can be viewed as any other debt if a collection agency becomes involved. Unpaid debt can remain on a credit record, negatively impacting credit scores from the three major credit bureaus.[7]

Judgments

After an eviction, a landlord might try to recoup unpaid rent by filing a lawsuit in small claims court. If this happens and the judgment goes against you, the judgment stays on the public record for seven years and will be listed in your credit report.

The bottom line

No one wants to go through an eviction. But sometimes, life circumstances change, and your ability to pay rent to a landlord is restricted.

Do all you can to avoid eviction by working with your landlord, even before they start proceedings.

An eviction judgment against a renter and any resulting civil judgments to recoup unpaid rent will stay on public records — and can negatively affect credit reports and scores — for up to seven years.

Sometimes the tenant can have the eviction record deleted, depending on the circumstances. First, however, the renter needs to pay off past debts, pay current debts on time, and rebuild credit. These steps can help prove to future landlords that you are trustworthy and ensure rental options will be available down the road.

Sources

- Experian. “How Long Does an Eviction Stay on Your Record?” https://www.experian.com/blogs/ask-experian/how-long-does-eviction-stay-on-report/. Accessed July 28, 2021.

- FindLaw. “How Long Does the Eviction Process Take?“ https://www.findlaw.com/realestate/landlord-tenant-law/how-long-does-the-eviction-process-take.html. Accessed September 28, 2021.

- Avail. “Steps in the Eviction Process: How Does Eviction Work?” https://www.avail.co/education/articles/steps-in-the-eviction-process-how-does-eviction-work. Accessed July 28, 2021.

- Tobener Ravenscroft. “How To Get An Eviction Off Your Record (6-Step Guide),” https://www.tobenerlaw.com/how-to-get-evictions-off-your-record/. Accessed Aug. 3, 2021.

- Experian. “How Long Does It Take for Information to Come Off Your Credit Reports? https://www.experian.com/blogs/ask-experian/how-long-does-it-take-information-to-come-off-your-report/. Accessed August 16, 2021.

- Lawhelp.org. “Landlords: Judgments, Writs, and the Eviction Process,” https://www.lawhelp.org/dc/resource/landlords-judgments-writs-and-the-eviction-pr. Accessed July 28, 2021.

- Experian. “Collections on Your Credit Report,” https://www.experian.com/blogs/ask-experian/credit-education/report-basics/how-and-when-collections-are-removed-from-a-credit-report/. Accessed August 16, 2021.

About the Author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).