Cities Where You Need To Work The Most Hours To Pay Rent

Published on: 06/01/2020

Amid the economic fallout triggered by coronavirus, many residents are struggling to pay rent. While the pandemic has resulted in financial hardship for many Americans, housing affordability has been a persistent issue in several parts of the country due to the rise in rental costs outpacing wage growth. This is especially true in some of the largest U.S. cities, many of which are bearing the brunt of COVID-19.

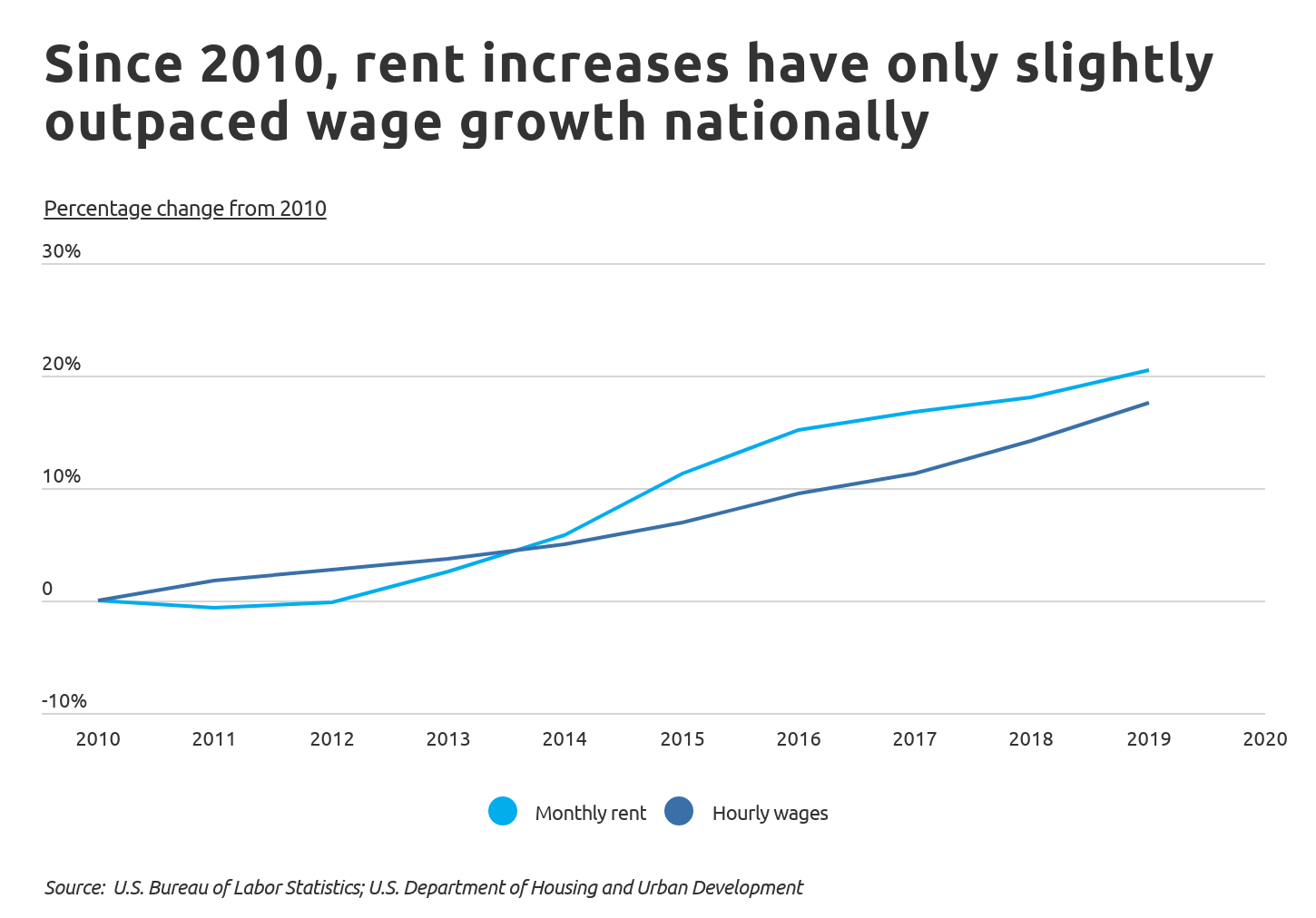

At the national level, rent increases have only slightly exceeded wage growth over the past decade. According to data from Zillow and the U.S. Bureau of Labor Statistics (BLS), between 2010 and 2019, the median monthly rent nationwide increased by 20.5 percent, while the median hourly wage only rose by 17.6 percent. New data from the U.S. Department of Housing and Urban Development (HUD) reported fair market rents to be approximately $980 for a one-bedroom and $1,200 for a two-bedroom rental in 2020. Meanwhile, the most recent median hourly wage estimate from the BLS is $19.14.

The 28 percent rule, a common rule of thumb, suggests that renters should spend no more than 28 percent of their income on housing. Using the 28 percent rule, a person in the U.S. earning the median wage would have to work 42.2 hours per week in order to afford a one-bedroom rental, or 51.8 hours per week to afford a two-bedroom rental.

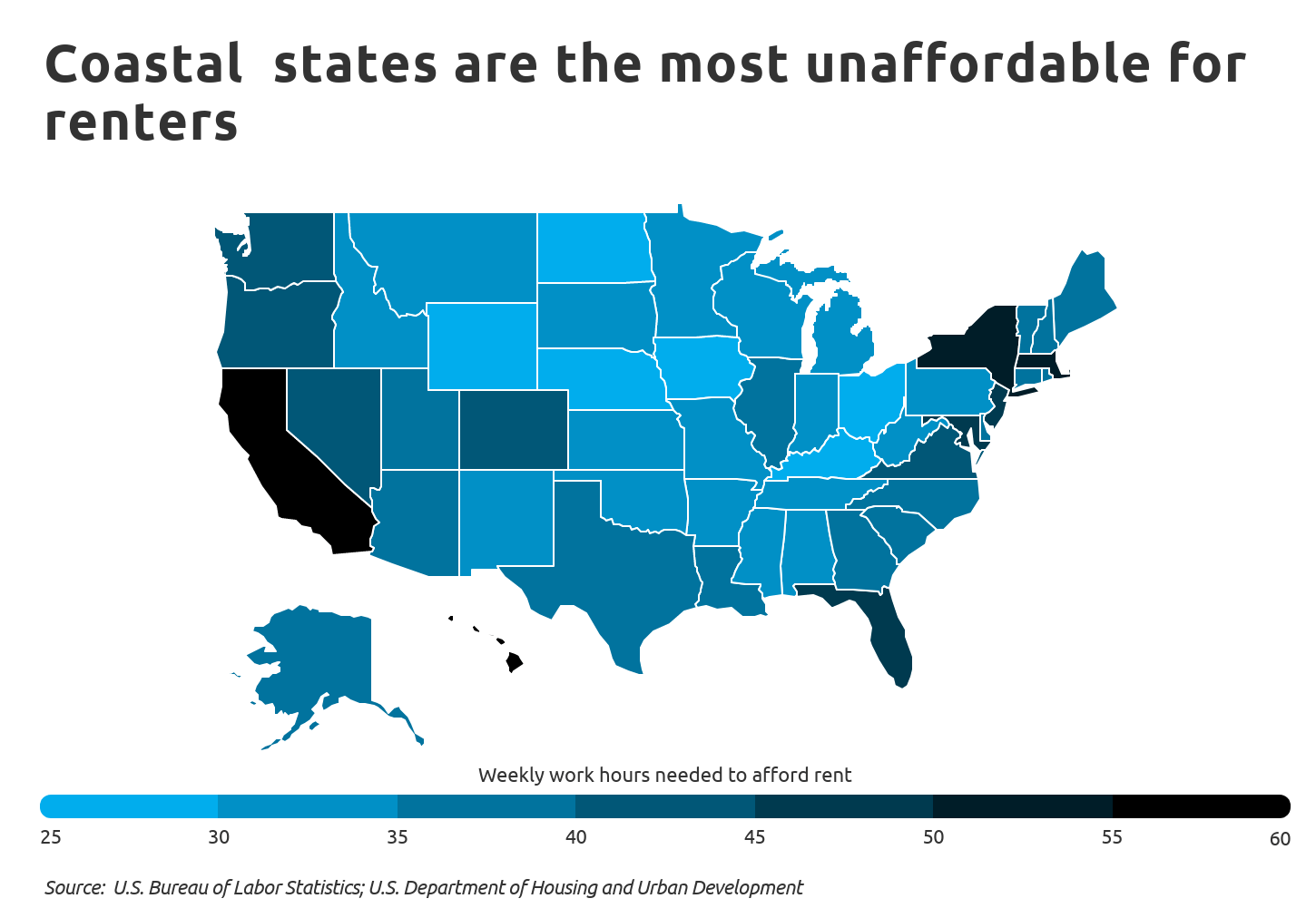

In certain states and cities, the gap between wages and rents has skyrocketed, leading to much greater housing affordability issues. Overall, coastal states are the least affordable for renters. In Hawaii, California, New York, and Massachusetts, someone earning the median hourly wage would need to work between 50 and 60 hours a week to afford a one-bedroom rental without being considered cost-burdened. By contrast, states in the Midwest and the South have the most affordable housing. Based on median wages and housing costs, workers in states like Iowa, Ohio, and Kentucky can afford a one-bedroom rental while working fewer than 30 hours per week.

RELATED: Especially during challenging times, it’s important to stay on top of your credit. Read through our comprehensive guide on what you can do to build good credit.

Even more than at the state level, housing affordability varies widely at the local level. To find the metropolitan areas where residents would need to work the most hours to pay rent, researchers at Self Financial analyzed rental price statistics from HUD and wage data from the BLS. Only metros with at least 100,000 residents were included in the analysis. Additionally, metros were grouped into the following cohorts based on population size to improve relevance: large metros (1,000,000 residents or more), midsize metros (350,000-999,999 residents), and small metros (less than 350,000 residents).

Here are the small, midsize, and large metros where individuals need to work the most hours to pay rent.

Large Metros With the Most Unaffordable Rents

Photo Credit: Alamy Stock Photo

15. Denver-Aurora-Lakewood, CO

- Hours needed to afford rent (1-bedroom): 45.5 hours per week

- Hours needed to afford rent (2-bedroom): 56.6 hours per week

- Fair market rent (1-bedroom): $1,260

- Fair market rent (2-bedroom): $1,566

- Median hourly wage: $22.81

- Median annual wage: $47,440

- Year-over-year change in rent prices: +4%

Photo Credit: Alamy Stock Photo

14. Washington-Arlington-Alexandria, DC-VA-MD-WV

- Hours needed to afford rent (1-bedroom): 45.7 hours per week

- Hours needed to afford rent (2-bedroom): 52.0 hours per week

- Fair market rent (1-bedroom): $1,500

- Fair market rent (2-bedroom): $1,707

- Median hourly wage: $27.08

- Median annual wage: $56,320

- Year-over-year change in rent prices: +3%

Photo Credit: Alamy Stock Photo

13. Dallas-Fort Worth-Arlington, TX

- Hours needed to afford rent (1-bedroom): 46.3 hours per week

- Hours needed to afford rent (2-bedroom): 55.7 hours per week

- Fair market rent (1-bedroom): $1,093

- Fair market rent (2-bedroom): $1,314

- Median hourly wage: $19.44

- Median annual wage: $40,430

- Year-over-year change in rent prices: +9%

RELATED: If you're just starting to build credit or simply want to improve your credit score, a credit builder loan can be a great option.

Photo Credit: Alamy Stock Photo

12. Riverside-San Bernardino-Ontario, CA

- Hours needed to afford rent (1-bedroom): 46.7 hours per week

- Hours needed to afford rent (2-bedroom): 58.5 hours per week

- Fair market rent (1-bedroom): $1,030

- Fair market rent (2-bedroom): $1,289

- Median hourly wage: $18.17

- Median annual wage: $37,780

- Year-over-year change in rent prices: +5%

Photo Credit: Alamy Stock Photo

11. Austin-Round Rock, TX

- Hours needed to afford rent (1-bedroom): 46.8 hours per week

- Hours needed to afford rent (2-bedroom): 55.9 hours per week

- Fair market rent (1-bedroom): $1,134

- Fair market rent (2-bedroom): $1,356

- Median hourly wage: $19.98

- Median annual wage: $41,560

- Year-over-year change in rent prices: +3%

Photo Credit: Alamy Stock Photo

10. Portland-Vancouver-Hillsboro, OR-WA

- Hours needed to afford rent (1-bedroom): 48.7 hours per week

- Hours needed to afford rent (2-bedroom): 56.5 hours per week

- Fair market rent (1-bedroom): $1,289

- Fair market rent (2-bedroom): $1,495

- Median hourly wage: $21.80

- Median annual wage: $45,350

- Year-over-year change in rent prices: +4%

Photo Credit: Alamy Stock Photo

9. Seattle-Tacoma-Bellevue, WA

- Hours needed to afford rent (1-bedroom): 51.1 hours per week

- Hours needed to afford rent (2-bedroom): 62.4 hours per week

- Fair market rent (1-bedroom): $1,590

- Fair market rent (2-bedroom): $1,943

- Median hourly wage: $25.65

- Median annual wage: $53,360

- Year-over-year change in rent prices: +11%

Photo Credit: Alamy Stock Photo

8. Orlando-Kissimmee-Sanford, FL

- Hours needed to afford rent (1-bedroom): 53.1 hours per week

- Hours needed to afford rent (2-bedroom): 62.3 hours per week

- Fair market rent (1-bedroom): $1,064

- Fair market rent (2-bedroom): $1,248

- Median hourly wage: $16.50

- Median annual wage: $34,320

- Year-over-year change in rent prices: +5%

Photo Credit: Alamy Stock Photo

7. New York-Newark-Jersey City, NY-NJ-PA

- Hours needed to afford rent (1-bedroom): 56.6 hours per week

- Hours needed to afford rent (2-bedroom): 65.1 hours per week

- Fair market rent (1-bedroom): $1,613

- Fair market rent (2-bedroom): $1,856

- Median hourly wage: $23.48

- Median annual wage: $48,840

- Year-over-year change in rent prices: +6%

Photo Credit: Alamy Stock Photo

6. Miami-Fort Lauderdale-West Palm Beach, FL

- Hours needed to afford rent (1-bedroom): 57.7 hours per week

- Hours needed to afford rent (2-bedroom): 72.7 hours per week

- Fair market rent (1-bedroom): $1,243

- Fair market rent (2-bedroom): $1,566

- Median hourly wage: $17.76

- Median annual wage: $36,930

- Year-over-year change in rent prices: +8%

Photo Credit: Alamy Stock Photo

5. Boston-Cambridge-Nashua, MA-NH

- Hours needed to afford rent (1-bedroom): 59.5 hours per week

- Hours needed to afford rent (2-bedroom): 72.6 hours per week

- Fair market rent (1-bedroom): $1,850

- Fair market rent (2-bedroom): $2,256

- Median hourly wage: $25.62

- Median annual wage: $53,300

- Year-over-year change in rent prices: +5%

Photo Credit: Alamy Stock Photo

4. San Diego-Carlsbad, CA

- Hours needed to afford rent (1-bedroom): 59.6 hours per week

- Hours needed to afford rent (2-bedroom): 77.5 hours per week

- Fair market rent (1-bedroom): $1,566

- Fair market rent (2-bedroom): $2,037

- Median hourly wage: $21.66

- Median annual wage: $45,050

- Year-over-year change in rent prices: -1%

Photo Credit: Alamy Stock Photo

3. Los Angeles-Long Beach-Anaheim, CA

- Hours needed to afford rent (1-bedroom): 60.9 hours per week

- Hours needed to afford rent (2-bedroom): 78.6 hours per week

- Fair market rent (1-bedroom): $1,517

- Fair market rent (2-bedroom): $1,956

- Median hourly wage: $20.52

- Median annual wage: $42,680

- Year-over-year change in rent prices: +9%

RELATED: One of the most frequently asked questions we get is: how long does it take to build credit? You should plan on at least six months to establish credit from scratch, but the answer depends a lot on your financial situation.

Photo Credit: Alamy Stock Photo

2. San Francisco-Oakland-Hayward, CA

- Hours needed to afford rent (1-bedroom): 65.5 hours per week

- Hours needed to afford rent (2-bedroom): 80.8 hours per week

- Fair market rent (1-bedroom): $2,179

- Fair market rent (2-bedroom): $2,687

- Median hourly wage: $27.42

- Median annual wage: $57,040

- Year-over-year change in rent prices: +5%

Photo Credit: Alamy Stock Photo

1. San Jose-Sunnyvale-Santa Clara, CA

- Hours needed to afford rent (1-bedroom): 68.0 hours per week

- Hours needed to afford rent (2-bedroom): 82.1 hours per week

- Fair market rent (1-bedroom): $2,458

- Fair market rent (2-bedroom): $2,970

- Median hourly wage: $29.80

- Median annual wage: $61,980

- Year-over-year change in rent prices: +5%

Methodology & Detailed Findings

Rental price statistics used in this study are from the U.S. Department of Housing and Urban Development’s 2020 Fair Market Rent Survey. Median hourly and annual wage statistics are from the U.S. Bureau of Labor Statistics’ 2019 Occupational Employment Statistics Survey.

To determine the number of weekly work hours needed to afford rent, Self Financial’s researchers assumed that individuals would work 52 weeks per year and spend no more than 28 percent of gross income on rent—a common benchmark used for housing affordability.

Locations were ranked based on the number of weekly work hours needed to afford a one-bedroom rental. In the event of a tie, the number of weekly work hours needed to afford a two-bedroom rental was used.

Similar to the statewide trends, the large metros with the least affordable rents tend to be located on the coasts, with the top four located in California. Fair market rents in San Francisco and San Jose are more than twice the national level. Most of the large metros with the most expensive rents also had year-over-year rent increases that exceeded the national average of 3.6 percent, with the notable exception of San Diego, which experienced a percentage point decline in median rental costs.

With unemployment reaching record highs as a result of COVID-19, tenants around the U.S. have pushed for rent relief. Governments at the federal, state, and local level are implementing assistance programs, such as temporarily suspending evictions. The long-term effects of COVID-19 on wages, employment, and housing costs remain to be seen, but the crisis has further underscored many renters’ precarious financial situation.