How to Buy a House with Low Income

Published on: 02/16/2021

If you thought the COVID recession would make homes more affordable, think again. After a brief dip in the second quarter of 2020, average U.S. home-sale prices headed back in the direction they’ve historically gone: upward.

The third-quarter figure of $387,000 was the highest average since the same quarter of 2018, according to the Federal Reserve Bank of St. Louis.[1]

In an economy being stabilized by stimulus checks and in which eviction moratoriums are keeping renters housed, that’s encouraging news for homeowners — but less so for everyone else. It remains a seller’s market.

This raises the question of how you can afford a home if you’re in a lower income bracket. “Low income” shouldn’t carry a stigma, and it isn’t the same thing as having bad credit — which is good news because credit can be an important ingredient in qualifying for a mortgage loan.

As we’ll see, different kinds of loans require different credit thresholds, and there are a variety of opportunities for prospective homebuyers with a modest gross monthly income — but good credit — to purchase a home. There are even ways to buy a home with no credit at all.

In this article

- Steps to take toward low-income homeownership

- Programs and grants for homebuyers with low income

- Home loans for homebuyers with low income

- Mortgage options for homebuyers with low income

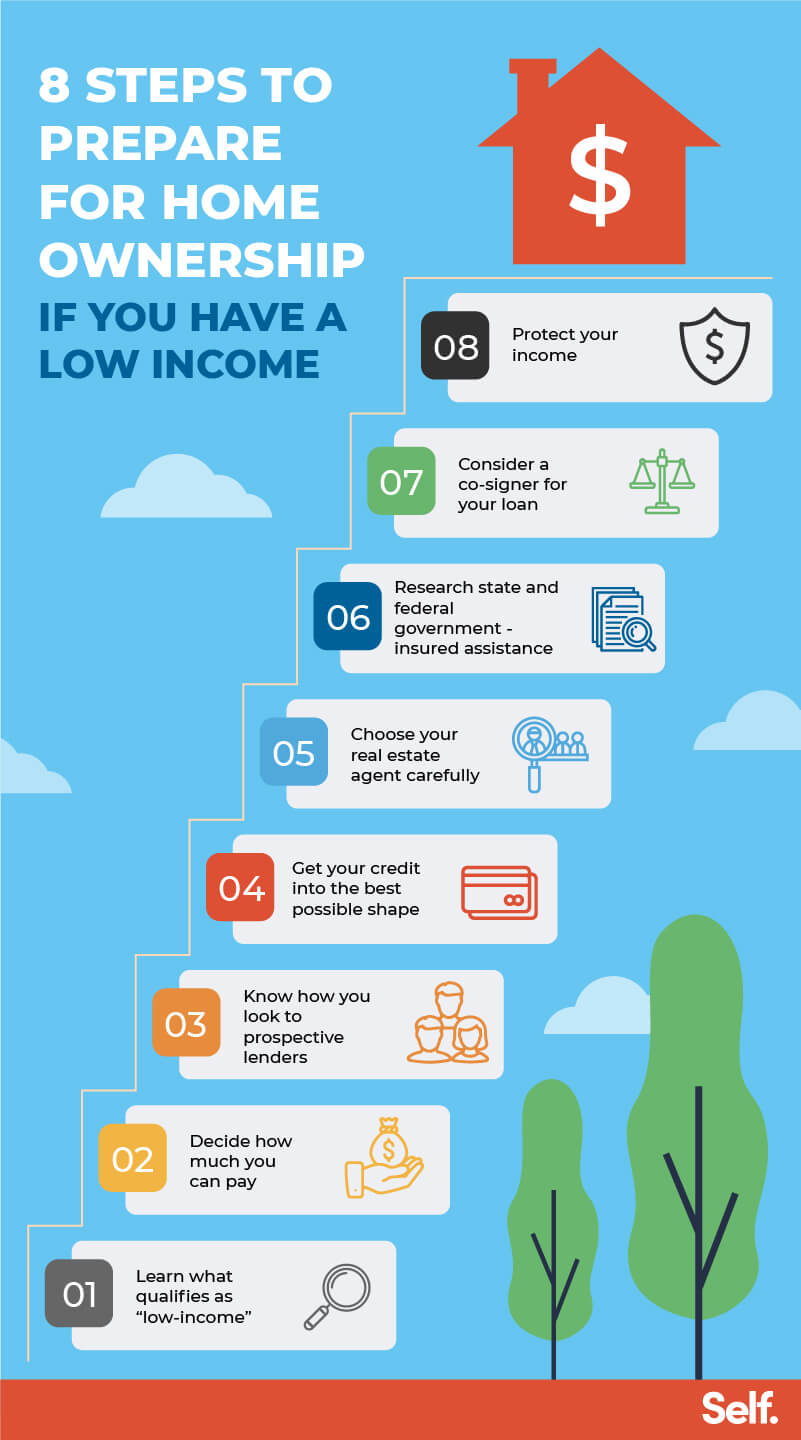

Steps to take toward low-income homeownership

There are plenty of advantages to owning a home. First and foremost, you build equity through mortgage payments. If you’re renting, you’ll never see the money that goes to your landlord again.

If you’re buying a new home, on the other hand, you’re investing money into your home, which you’ll get back if you sell — and potentially more, if your home value increases.

And home prices have increased. Since bottoming out during the Great Recession, home prices have steadily risen while rental rates rose more slowly during the same period. Owning a home now is even more desirable but, seemingly, less accessible, especially as the market effects of the pandemic become clearer.

Fortunately, there are ways to open the door to homeownership for low-income families.

That doesn’t mean it’s a step to be taken lightly. Before deciding to buy a home, you’ll need to analyze your ability to qualify for a loan and make payments, know what size you can afford in the area you want to buy, and factor in costs like homeowner’s insurance, repair and maintenance, property taxes, etc.

Here are a few ways to get started.

1. Learn what qualifies as “low-income”

Where you’re buying matters. A lot. As of August 2020, median home values ranged from $107,064 in West Virginia to $646,733 in Hawaii.[2]

Naturally, lenders take this into account. Many programs run by the U.S. Department of Housing and Urban Development (HUD) are among those that base income limits on the median income in the area where you’re trying to buy.

Depending on where you live, that could be higher than you think. Not surprisingly, median incomes track fairly closely with median home values.

West Virginia wages rank near the bottom of the list, just ahead of Mississippi, and Hawaii ranking in the top five as of 2019. The District of Columbia and adjacent Maryland ranked 1 and 2 for household incomes.[3]

2. Decide how much you can pay

How much can you realistically put toward a down payment, and what can you afford to pay in monthly installments? (Tip: Each $100,000 you borrow will pencil out to about $500 in monthly payments.)

A mortgage lender can review your financial situation and tell you how much they’d be willing to lend you through the mortgage preapproval process. But you don’t have to wait for a visit to a lender to get an idea of what you can afford.

The government has long recommended spending 30% on housing costs; anything more than that is considered “cost-burdened.” Levels above 50% are seen as “severely cost-burdened.” [4]

3. Know how you look to prospective lenders

Consider how you stand in each of the following areas:

Credit history. It’s important to know your credit score and what it means.

An exceptional credit score is 800 or above, and anything 670 or higher is considered good to very good. But you can get approved for a mortgage with a “fair” credit score of 620 or better. In some situations, even less.

Under federal law, you can access your credit report for free once a year.

Employment status. Mortgage lenders will get in touch with your employer directly to confirm your employment status. If you’re self-employed, they can use your tax return.

The longer you’ve been on the job, the safer a risk you’re considered, but your line of work is also important: Some careers represent better risks than others.

Also, it's better to be employed full time than part time or on contract; the more stable your income, the better.

Debt-to-income ratio (DTI). Your income is important, but so is your debt level. You can qualify more easily, even on a modest income, if you’ve paid off your car (for example).

It also helps if you don’t have many other outstanding obligations such as student loans, spousal support, or credit card balances.

How much you can raise for a down payment. Obviously, the more you can afford to pay upfront, the smaller a loan you’ll need — which will make you more attractive to lenders.

Do you have a nest egg you want to invest? Proceeds from the sale of a previous home? An inheritance? All these can help you qualify by making larger down payments.

Other factors. Some banks may consider assets like an annuity income, bonus income, commissions, stipends, or even the use of a company car when considering your application.

These are the factors mortgage lenders evaluate when deciding whether to work with you. They also consider the condition and history of the home you’re looking to buy.

4. Get your credit into the best possible shape

First, take a look at your credit report and address any errors you find there.

While you’re in the market for a home, you should steer clear of incurring any new, large debts, including big purchases with your credit cards. Don’t max out your cards. In fact, reduce what you owe to less than 30% of your available limit.

They’re often overlooked, but there are other ways to improve your credit that don’t require using plastic. You could boost your credit score just by paying your monthly bills on time.

Also look for ways to increase your income, especially your stable income, before you seek to qualify for a mortgage. Pay down debt and reduce expenses wherever you can.

Do you have extra streaming services or cable channels you can eliminate? Can you reduce your heating/air conditioning bill? Do you have internet add-ons you don’t need?

What about unused subscriptions? Companies love to hook you on “free trials,” knowing you might forget about them and let automatic payments begin once those trials are concluded. Look for any such subscriptions you don’t need and eliminate them.

5. Choose your real estate agent carefully

Make sure the real estate agent you decide to work with knows the local housing market and is familiar with local and national homebuying programs for low-income borrowers.

Check the internet for information about agents you’re considering, including Yelp reviews. Google them and check out LinkedIn and professional sites to learn about their backgrounds.

Word of mouth is a great tool, as well: Get referrals from homeowners who’ve worked with local agents in the past, and interview prospective agents to see if they’re a good fit in terms of personality, approach, and the services they offer.

6. Research state and federal government-insured assistance

Nonprofit and government programs offer housing resources and aid to people with low incomes. Start researching to find the lowest interest rates and the greatest amount of help. You can start with the options listed in the sections below.

7. Consider a co-signer for your loan

Having someone co-sign your loan potentially can help you clear the underwriting hurdle. Most likely, you’ll turn to a family member or perhaps a close friend.

A co-signer is worth considering if you have poor credit, you’re carrying a high debt-to-income ratio, you have yet to build a good credit history, or you don’t have an income that’s considered stable enough to qualify.

Before you take this step, however, remember that it’s a big ask. No one should co-sign a mortgage or any other loan (student loan or car loan) unless that person is willing and able to pay back the entire sum. They’ll be on the hook if you can’t pay.

Also, be aware that co-signing a loan will affect the co-signer’s credit as much as it will yours. A co-signer is integrally involved in the process of obtaining the loan, and the lender will need to obtain their financial information, just like yours.

The co-signer also will need to be present at the closing to sign alongside the primary applicant.

8. Protect your income

Once you’ve got a loan in your pocket, it’s important to ensure that you’ll be able to make the monthly payments. Many borrowers turn to products such as mortgage protection insurance for this security.

An important note: It’s critical to know the difference between mortgage life insurance and mortgage insurance.

Mortgage life insurance protects your family from having to worry about making mortgage payments in the event of your death.

Unlike other life insurance, there are usually no health questions, screenings, or exams required. On the flip side, it tends to be costlier than regular life insurance for people in good health.

Mortgage life insurance runs concurrently with your mortgage and lasts the same number of years. Unlike typical life insurance, in which you name a spouse or someone else as your beneficiary, the mortgage company is the beneficiary in this kind of plan. It’s typically sold by your lender and, if so, can be rolled into your payment plan.

Be prepared to see your payments stay the same even as your payout decreases along with your mortgage balance. It’s also worth keeping in mind that suicide within the first two years can void the policy.

Mortgage insurance is a different product altogether. Its purpose is not to protect you; it’s to lower the risk for the lender.

If your down payment is less than 20% of your home’s purchase price, you’ll usually be compelled to buy mortgage insurance. It’s also generally required to get USDA and FHA loans.

Mortgage insurance takes different forms:

Private mortgage insurance — With a conventional loan, you’ll pay private mortgage insurance. You likely won’t have to pay anything upfront, and this type is typically cheaper than FHA mortgage insurance if you have good credit.

FHA loans — The Federal Housing Administration requires FHA mortgage insurance on its loans. You make an upfront payment as part of your closing costs, and thereafter pay a monthly fee with your mortgage payment. Or you can instead roll your upfront cost into the amount you pay each month, which will increase as a consequence.

USDA loans — These are similar in structure to FHA loans, but they’re administered by the U.S. Department of Agriculture.

VA loans — In these loans offered by Veterans’ Affairs, veterans pay only a funding fee at closing. There are no monthly payments.

The fee is based on your type of military service, disability status, and amount of your down payment. Other factors: Are you buying or refinancing? Is this your first VA loan?

You can learn more about these loans and their terms in the sections below.

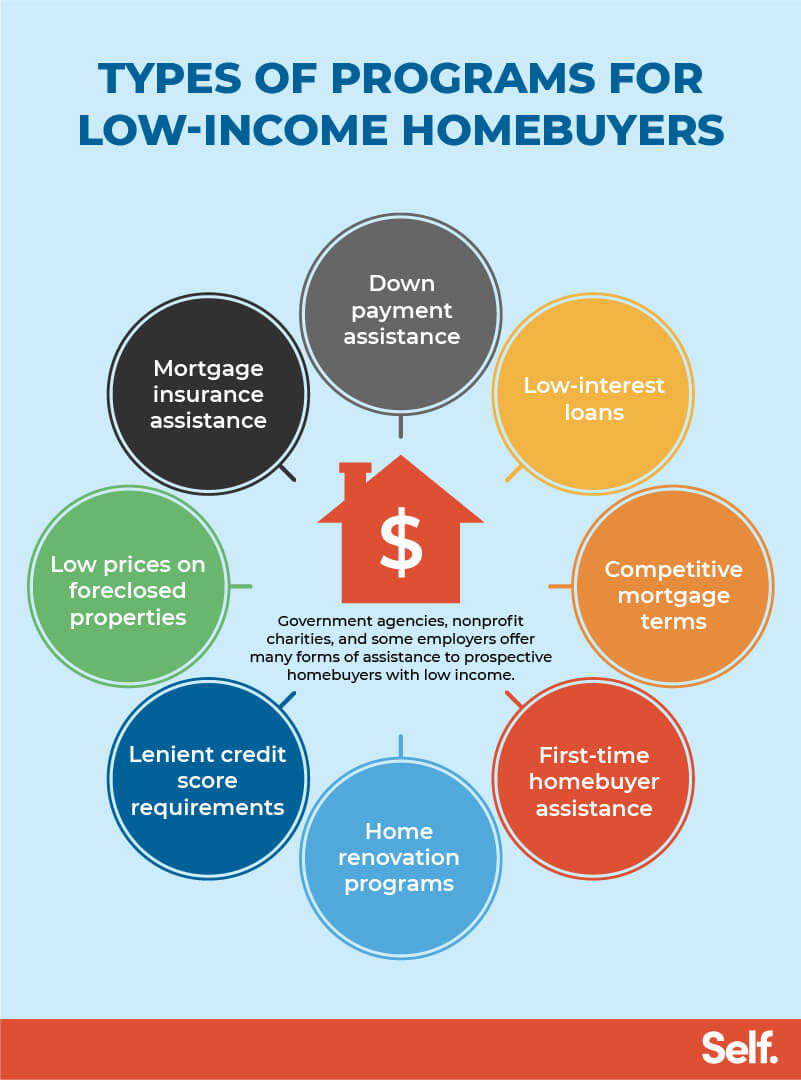

Programs and grants for homebuyers with low income

A number of federal and state government programs and grants are available to help low-income homebuyers. Here are some you might want to explore.

State and local homeowner assistance programs

Local programs often offer grants for first-time and low- to moderate-income buyers. These often provide upfront aid but can also include other features.

- First-time homebuyer programs, which can open up eligibility with lower down payment requirements and lower credit scores

- Competitive mortgage programs and assistance with closing costs for single-family or multifamily homes

- Home renovation programs, which create opportunities for buyers to buy less expensive fixer-uppers that can then be remodeled

- Home-buying education programs for renters and prospective homebuyers

Down payment assistance programs

Offered by government agencies as well as employers, charities, and other organizations, these often take the form of grants or loans and are usually subject to income limits.

These are available in all 3,143 counties in the U.S., and available amounts average about $12,000. According to one estimate, 87% of single-family homes and condos in the U.S. would qualify.[5]

National Homebuyers Fund

This nonprofit organization offers financial assistance for homebuyers, such as the down payment assistance grant, which can cover up to 5% of mortgage loan closing costs. The best part: These are grants, which means they don’t have to be repaid.

Rural Housing Guaranteed/Direct Loan Program

Affordable housing loans are available to low-income individuals who can’t obtain financing through other means. Homes must be in areas with populations smaller than 35,000; be less than 2,000 square feet; and not have an in-ground swimming pool or be designed to produce income.[6]

HUD Home Ownership Voucher Plan

Eligible lower-income families in public housing can use their HUD subsidy to make a monthly mortgage payment. The program is generally limited to first-time homebuyers, and at least one family member must have been employed at least 30 hours a week for at least one year.

Fannie Mae Ready Buyer

ReadyBuyer can give first-time homebuyers up to 3% in closing cost assistance on Fannie Mae-owned properties up for foreclosure. Homes are priced competitively to sell quickly, and larger homes are often available for less.

Homebuyers can access foreclosed homes online at the HomePath site. Although HomePath was replaced by the HomeReady program in 2014 (see below), the website still offers info about Fannie Mae foreclosed homes across the country.

Dollar Homes

This HUD program for families in public housing, often called “the eBay of homes for sale,” offers homes for sale to low- and moderate-income families for as little as $1 each. Eligible homes must have a market value of $25,000 or less and have been on the market for six months.[7]

Homeownership and Opportunity for Everyone (HOPE) program

HOPE helps facilitate the purchase of Section 8 housing units by providing funds to homeownership programs run by resident groups, nonprofits, and similar entities.

Home loans for homebuyers with low income

The federal government offers a variety of loan options for low-income homebuyers that can allow them to purchase a home. Agencies such as the Federal Housing Administration, Veterans’ Affairs, and the U.S. Department of Agriculture all have loan programs that can help you purchase a home for less.

FHA loans

The Federal Housing Administration guarantees that it will cover the lender’s losses if you default on the loan. Such loans typically require as little as 3.5% down with a credit score of 580.[8]

FHA 203(k) loans

Otherwise known as rehab mortgage insurance, this is an FHA loan with an added feature: It allows homebuyers to finance the purchase price and rehab costs together in a mortgage applied to a lower-priced fixer-upper. Rehab costs can range from around $5,000 up to a virtual rebuild on the existing foundation.[9]

USDA loans

Specifically for low-income buyers in rural areas and some suburban areas, USDA loans carry several requirements. Among them: a monthly payment less than 29% of your income; proof of dependable income; and debt payments that don’t exceed 41% of that income (unless you have a good credit score above 680).[10]

VA home loans

A zero-down, low-interest option for low-income veterans and servicemembers, these loans require no mortgage insurance. It works like this: Loans are provided through private lenders. But Veterans Affairs guarantees a portion of the loan, which allows those lenders to provide more favorable terms.

Fannie Mae HomeReady loans

Fannie Mae offers financing up to 97% with just 3% down, along with cancellable private mortgage insurance for low-income buyers.[11] Credit scores should be equal to or more than 620, and first-time homebuyers must take a course in homeownership education.

Freddie Mac’s Home Possible loans

These facilitate homeownership for low- and moderate-income borrowers in typically underserved communities, by offering loans for just 3% down. Do-it-yourself buyers can apply sweat equity to their down payment and closing costs, and co-borrowers who don’t live there can be included for a borrower’s one-unit residence.

Good Neighbor Next Door HUD loans

This program offers a considerable subsidy for pre-kindergarten through 12th-grade teachers, firefighters, police officers, or emergency medical technicians. You can get a 50% discount on the fair market value of a home, but you must commit to live there for 36 months.[12]

Native American Direct loans

The VA offers this program for Native American vets and their spouses, allowing them to buy property on federal trust lands with no down payment or private mortgage insurance. Interest rates start at 3% for 30-year fixed mortgages, and vets can repeat the process for another residence in the future.

Mortgage options for homebuyers with low income

FHA Section 245a mortgage program

This program is tailored to fit low-income borrowers who expect their income to increase over time. Monthly payments increase gradually, as well, starting low to allow borrowers access to an affordable loan, then allowing them to build equity in their homes as payments rise.

FHA energy-efficient mortgage

This FHA program allows families to save on utility bills by using the borrower’s mortgage to help pay for energy-efficient home improvements.

This program insures the cost of the mortgage (for purchasing or refinancing), plus the cost of energy-efficient improvements made to the home. The borrower only has to qualify for the loan amount used to purchase or refinance the home.

Conclusion

Buying a home isn’t as simple as most other purchases. Even buying a car can seem simple by comparison. You’ll have to negotiate issues from the size of your down payment, your credit score, and mortgage insurance to your employment history, closing costs, and, of course, where and how big your home will be.

If you’re a low-income homebuyer, you’ll face a lot of other questions, too. Stereotypes suggest that low-income individuals have bad credit, that homeownership is out of reach for low-income residents, or that they can only afford small homes or fixer-uppers in blighted neighborhoods. But none of that is necessarily true.

The fact is that even if your income is low, you have a wide range of options to help you qualify and succeed. Learning about those options can seem daunting, but it can be more than worthwhile. It can open up opportunities to reduce your costs and payments, giving you access to programs that make homeownership accessible.

There’s no reason you can’t own your own home. You just have to know how to get there.

Sources

Federal Reserve Bank of St. Louis. “Average Sales Price of Houses Sold for the United States, https://fred.stlouisfed.org/series/ASPUS,” Accessed January 6, 2021.

The Ascent, A Motley Fool Service. “Average House Prices by State in 2020, https://www.fool.com/the-ascent/research/average-house-price-state,” Accessed January 6, 2021.

Kaiser Family Foundation, KFF.com. “State Health Facts: Median Annual Household Income, https://www.kff.org/other/state-indicator/median-annual-income,” Accessed January 6, 2021.

CNBC. “Here’s how much of your income you should be spending on housing, https://www.cnbc.com/2018/06/06/how-much-of-your-income-you-should-be-spending-on-housing.html,” Accessed January 6, 2021.

Realtor.com. “Down Payment Assistance Programs Are Free Money, So Why Aren’t You Applying? https://www.realtor.com/news/real-estate-news/free-money-12000-payment-arent-applying/,” Accessed January 6, 2021.

USDA Rural Development. “Single Family Housing Direct Home Loans, https://www.rd.usda.gov/programs-services/single-family-housing-direct-home-loans,” Accessed January 6, 2021.

U.S. Dept. of Housing and Urban Development, HUD.gov. “About Dollar Homes, https://www.hud.gov/program_offices/housing/sfh/reo/goodn/dhmabout,” Accessed January 6, 2021.

My Mortgage Insider. “Low Credit Score Home Buyers In 2021 Could Qualify Because of this new FHA Policy, https://mymortgageinsider.com/new-fha-policy-for-low-credit-home-buyers-7494/,” Accessed January 6, 2021.

U.S. Dept. of Housing and Urban Development, HUD.gov. “203(k) Rehab Mortgage Insurance, https://www.hud.gov/program_offices/housing/sfh/203k/203k--df,” Accessed January 6, 2021.

USDAloans.com. “Explaining the USDA’s DTI Ratio, https://www.usdaloans.com/articles/usda-loans-and-dti/,” Accessed January 6, 2021.

FDIC.gov. “Standard 97 Percent Loan-to-Value Mortgage, https://www.fdic.gov/consumers/community/mortgagelending/guide/part-1-docs/fannie-standard-97-percent-loan-to-value-mortgage.pdf,” Accessed January 6, 2021.

U.S. Dept. of Housing and Urban Development, HUD.gov. “About Good Neighbor Next Door, https://www.hud.gov/program_offices/housing/sfh/reo/goodn/gnndabot,” Accessed January 6, 2021.

About the author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial – a financial technology company with a mission to increase economic inclusion by helping people build credit and savings. Connect with her on Linkedin or Twitter.