How To Save Up For a Car

Published on: 01/12/2022

Budgeting is important if you’re thinking about buying a car. Along with a new home, it’s one of the two biggest purchases you’re likely to make in your lifetime.

The average price of a new car topped $41,000 in July 2021, up from less than $40,000 just a month earlier[1], $34,000 in 2017 and $20,000 in 1997.[2] Meaning the cost of a new car has over doubled (not counting inflation) in less than a quarter-century.

But how do you save up for a new car and the associated expenses? You’ll probably want to set a goal and start saving money from your paycheck for a down payment.

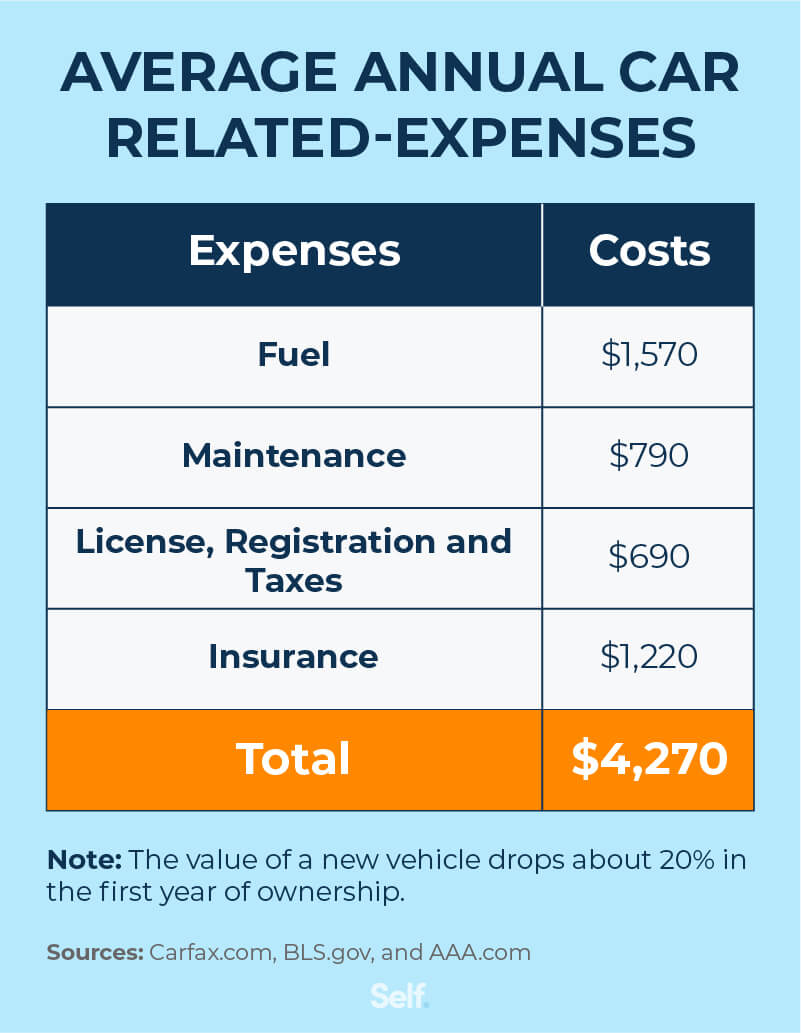

The car down payment is just the beginning. There’s also your monthly car payment, assuming you get an auto loan. Then there are fuel costs that average $1,570 a year[3]; license, registration and taxes that add up to an average of $690 a year; maintenance of nearly $790 a year; and insurance costs of approximately $1,220 a year.[4] Add everything up, and the average cost of new car ownership was $4,270 a year.

Of course, you don’t have to buy a brand-new car. Since cars depreciate up to 20% the moment they’re driven off the lot, you may want to consider a used vehicle.[5] Leasing is also an option. The type of car you want to buy will impact how you save—and how much you save.

We’ll look at car-related expenses and weigh the pros and cons of buying or leasing a new or used car so you can plan how to save up for a car.

1. Evaluate your current earnings and spending

How are you using your money and what are your spending priorities? Where does a car rank on that list of priorities?

If you find there isn’t enough room for car expenses in your current budget, you’ll need to make some adjustments before you buy. Spending less money is one option. It’s worth looking for expenses that aren’t necessities and trimming them from the list.

However, you can consider the other side of the ledger, too: your income. Can you maximize it by investing or setting up a side hustle? These are questions worth asking as you determine how much and how quickly you can save for a car.

2. Decide on leasing or buying

The clearest difference between buying and leasing is that, at the end of a lease contract, you won’t own anything. On the other hand, leasing can cost you substantially less, so you might be able to afford a more luxurious vehicle while you have it.[6]

Other factors to consider include the following:

Leasing

- A newer car is likely covered by a manufacturer’s warranty

- A newer car is less likely to have issues

- Some leases may include free oil changes and other regular maintenance. You’ll also have a smaller sales tax bill

- The lease contract may limit the number of miles you can drive and if you go over that amount, you’ll pay a premium that can be as much as 50 cents for each added mile

- You’ll also be charged for any dents, scratches, and other damage to the car at the end of the lease period[6]

Buying

- You can sell it or trade your car in whenever you want, which adds flexibility in case your financial situation has changed and you can no longer afford your loan payments or monthly expenses

- You’ll have equity in the vehicle, although depreciation will affect this over time

- You’ll have the freedom to customize your car

3. Choose from a new or used car

Another big choice you’ll face is whether to buy new or used. Your monthly budget may help make that decision for you: You may not have enough money in your bank account to afford a new vehicle. If you do have a choice, there are a few factors to consider.

Financing is available whether you buy new or used, but new-car buyers are much more likely to take out loans (85%) than used-car purchasers (37.5%). New-car loans are typically more costly: around $35,700 with a $563 monthly payment in 2020 compared to approximately $21,400 on a monthly payment of $397 for a used car.[7]

New cars, which come with costs like title and taxes, simply cost more upfront than used cars do.

New

- You usually won’t have to worry about unexpected repairs due to wear and tear

- You won’t have to spend time researching the car’s history or enlisting the services of your own mechanic to check under the hood

- Newer cars tend to be more fuel-efficient, so you’re likely to save money on gasoline

- New cars come with the latest technology

Not all new cars are created equal: Some depreciate faster than others. Vehicles like the Tesla Model 3, Toyota Tacoma, Kia Telluride, and Ford Ranger lost less of their value over the first year than other models.[8]

Used

- You are likely to save money by buying a used car

- Unlike new cars, which are sold at a dealership, you can get a used car through a private party, used car lot, rental car agency, etc.

- If you finance your car, you’ll be less likely to owe more than what it’s worth, because the biggest chunk of depreciation takes place right after you drive it off the lot

- You’ll also pay less in sales tax and insurance

- Most used cars are sold as-is and without a warranty[9]

4. Set a budget for car-related expenses

Car costs go beyond the sticker price. When setting a budget for a car purchase, you will want to take other expenditures into consideration.

Down payment

How much you want to put down will be dictated by three factors: What the dealer will accept, what you can afford, and what’s in your best interest. Some dealers will offer “no money down” deals, but it still may be a good idea to put 20% down to offset the significant depreciation you’ll incur during your first year as an owner.[10]

Registration

All states require that you register a new car, most often at a flat rate, and that you renew your registration annually. Some states charge registration based on the value, weight, or age of your car.[11]

Insurance

Most states have a minimum requirement for liability insurance to pay for medical costs and property damage if you’re at fault in an accident. In these states, you will need to have insurance in order to register your vehicle. You may want to add protection on your own beyond the minimum, and if you’re leasing your car, your lender may require more than the minimum mandated by your state.[12]

Title

A certificate of title proves you own the car. It contains information such as the vehicle’s make, model, year, and 17-digit vehicle identification number (VIN); the odometer reading at the time of the sale; and the lienholder if you’re financing or leasing the car. A lender will transfer the title to you once you’ve paid off your car loan. Title transfer fees vary by state.[13]

Tax

Car sales taxes vary by state and county or municipality and are typically calculated as a percentage of the sales price. For example, you’ll pay 6.25% in Texas, 4.15% with a $75 minimum in Virginia, and 7% in Indiana. You’re in luck if you live in Montana or New Hampshire, neither of which has any car tax.[14]

5. Cut unnecessary costs

When budgeting for buying a car, look for ways to cut any unnecessary costs you see in your budget. To save money, trim expenses such as dining out, streaming services, and subscriptions. Use coupons and take advantage of points rewards, cash-back opportunities, and free membership savings. There are a number of apps to help you save money.

6. Open a savings account

Open a separate car savings account to put money aside toward the purchase price of a car. Creating a specific account for this purpose will keep you from touching the money for any other reason. Making it a savings account, rather than a checking account, will help you avoid this temptation, especially since there won’t be any debit card associated with the account.

7. Set up automatic contributions

You can set up automatic savings transfers to save your goal amount each month. If you’re not ready to save a lump sum, try small savings techniques until you can commit to saving more every month. For example, round-up apps round up to the next highest dollar automatically after you make a purchase, and put the difference into your savings account automatically.[15]

8. Sell or trade-in your current car

Many dealers offer you a lower price if you trade your car in for a new one. Compare the offer to the Kelley Blue Book price for your car before making a deal. You will often be able to get more for your old car on the open market than the dealer is willing to give you. Selling it can give you extra cash to put toward your purchase.

9. Negotiate a price

Many car dealers operate differently than other merchants: They’re willing to negotiate the sale price. Keep in mind that this isn’t true for all dealers. In recent years, set-price dealers like Carmax and Carvana have become popular with buyers who prefer not to deal with the stress of haggling.

Do your research, shop at the right time (when sales are slow or when dealers are trying to clear out inventory for the new model year), and consider buying a car that’s in low demand (perhaps because it’s not “trendy”). But don’t be pressured. You have the upper hand, and you can always walk away.

Preparing to buy a car

Buying a car is a complicated process, and being prepared by saving up and doing your research ahead of time can make it far less daunting. Establishing a budget, trimming expenses, finding ways to save, and earning extra cash through a side gig are all options.

Another way of saving money is by building good credit because that will earn you lower interest rates and trim the size of your payments. Your credit score matters.

When it comes to taking out a loan, many dealers will offer in-house financing, but compare loan terms and interest rates before signing on the dotted line. Buying a car is a protracted process that can take several hours, and you may be so eager to drive off the lot that you’ll accept a deal that isn’t in your best interest.

In some cases, a credit union or other lender will be able to offer you a better interest rate than a dealer can or will.

If you take advantage of all your options, you can make the best deal—and get the best car—possible for yourself.

Sources

- Yahoo. “Average new car price hits record $41,000,” https://news.yahoo.com/average-new-car-price-hits-record-41000-130015214.html. Accessed October 6, 2021.

- Washington Post. “Have cars actually gotten more expensive over time?” https://www.washingtonpost.com/cars/have-cars-actually-gotten-more-expensive-over-time/2017/03/13/5c5b9d30-081b-11e7-bd19-fd3afa0f7e2a_story.html. Accessed October 6, 2021.

- U.S. Bureau of Labor Statistics. “Consumer Expenditures,” https://www.bls.gov/news.release/cesan.nr0.htm. Accessed October 15, 2021.

- AAA. “What Does It Cost To Own And Operate a Car?” https://www.aaa.com/autorepair/articles/what-does-it-cost-to-own-and-operate-a-car. Accessed October 15, 2021.

- AAA. “Average Annual Cost of New Vehicle Ownership,” https://www.aaa.com/autorepair/articles/average-annual-cost-of-new-vehicle-ownership. Accessed October 6, 2021.

- Consumer Reports. “Leasing vs. Buying a New Car,” https://www.consumerreports.org/buying-a-car/leasing-vs-buying-a-new-car-a9135602164/. Accessed October 6, 2021.

- Debt.org. “Auto Loans: New & Used Car Financing Options,” https://www.debt.org/credit/loans/auto. Accessed October 6, 2021.

- AARP. “Pandemic Auto Shortage Influencing Debate Over New vs. Used Cars,” https://www.aarp.org/auto/car-buying/info-2021/pandemic-influencing-new-and-used-car-debate.html. Accessed October 6, 2021.

- U.S. News. “New Cars Vs. Used Cars,” https://cars.usnews.com/cars-trucks/new-cars-vs-used-cars. Accessed October 6, 2021.

- Money Under 30. “Car Loan Calculator: How Much Car Can I Afford?” https://www.moneyunder30.com/car-affordability-calculator. Accessed October 6, 2021.

- National Conference of State Legislatures. “Vehicle Registration Fees By State,” https://www.ncsl.org/research/transportation/registration-and-title-fees-by-state.aspx. Accessed October 6, 2021.

- U.S. News. “How Much Car Insurance Do I Need?” https://www.usnews.com/insurance/auto/how-much-car-insurance-do-i-need. Accessed October 6, 2021.

- Car and Driver. “How Much Is a Car Title?” https://www.caranddriver.com/research/a32798893/how-much-is-a-car-title/. Accessed October 6, 2021.

- Factory Warranty List. “Car Tax by State,” https://www.factorywarrantylist.com/car-tax-by-state.html. Accessed October 6, 2021.

- Forbes. “How To Automate Your Savings,” https://www.forbes.com/advisor/banking/how-to-automate-your-savings. Accessed October 6, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.