Do You Have To Pay Taxes on Unemployment Benefits?

Published on: 01/26/2023

Yes, you have to pay taxes on unemployment benefits. Because unemployment benefits are counted as income, you will need to pay federal income taxes. However, depending on where you live, you may not need to pay state or local income taxes.[1]

You may be wondering about taxes on unemployment benefits because in March 2021, Democrats passed the American Rescue Plan Act, which waived federal tax on up to $10,200 of unemployment compensation, per person, on their 2020 tax return.[2] This was a temporary measure to help during the pandemic and no longer applies in the tax years of 2021 and beyond.

So in this guide, we explain how unemployment taxes work, how to pay your unemployment taxes and what to do if you’re not able to pay off the total amount.

Table of contents

- You must pay federal incomes taxes on unemployment

- You might pay state income taxes on unemployment

- You might pay local income taxes on unemployment

- How to pay unemployment taxes

- What to do if you can’t pay your taxes

- Does filing for unemployment affect your credit score?

- Understand how unemployment benefits work

You must pay federal income taxes on unemployment

Because unemployment benefits are counted as your income, all unemployment recipients will be taxed at a federal level. How much you will pay will depend on factors, such as your filing status, your tax bracket and how much taxable income you have. Because each tax situation is unique, you can learn more about how to pay taxes on your unemployment assistance by contacting the Internal Revenue Service online at www.irs.gov.

You might pay state income taxes on unemployment

Depending on where you live, you may have to pay state income taxes on your unemployment benefits in addition to federal income taxes. Most states tax unemployment benefit payments, though some states don’t tax them at all.

Below is a list of which states tax on unemployment benefits and which states don’t as of January 2023.[3]

| Does the state tax unemployment benefits? | How much will you be taxed? | |

|---|---|---|

| Alabama | Yes | 2% to 5% |

| Alaska | No | |

| Arizona | Yes | Flat rate of 2.5% |

| Arkansas | Yes | 0% to 4.9% |

| California | Yes | 1.1% to 14.63% |

| Colorado | Yes | Flat rate of 4.55% |

| Connecticut | Yes | 3% to 6.99% |

| Delaware | Yes | 2.20% to 6.60% |

| Florida | No | |

| Georgia | Yes | 1.0% to 5.49% |

| Hawaii | Yes | 1.40 to 7.90% |

| Idaho | Yes | 1% - 6% |

| Illinois | Yes | Flat rate of 4.95%. Railroad Unemployment is exempt. |

| Indiana | Yes | Flat rate of 3.15% |

| Iowa | Yes | 4.40% - 6% |

| Kansas | Yes | 3.1% to 5.7% |

| Kentucky | Yes | Flat rate of 4.5% |

| Louisiana | Yes | 1.85% to 4.25% |

| Maine | Yes | 5.8% to 7.15% |

| Maryland | Yes | 2% to 5.75% |

| Massachusetts | Yes | Flat rate of 5% |

| Michigan | Yes | Flat rate of 3.90% |

| Minnesota | Yes | 5.35% to 9.85% |

| Mississippi | Yes | 0% to 5% |

| Missouri | Yes | 0% to 4.95% |

| Montana | Yes | Flat rate of 6.75% |

| Nebraska | Yes | 0% to 6.64% |

| Nevada | No | |

| New Hampshire | No | |

| New Jersey | Yes | 1.4% to 10.75% |

| New Mexico | Yes | 1.7% to 5.9% |

| New York | Yes | 4% to 11.70% |

| North Carolina | Yes | Flat rate of 4.75% |

| North Dakota | Yes | 0% to 2.90% |

| Ohio | Yes | 0% to 3.90% |

| Oklahoma | Yes | 0.25% to 4.75% |

| Oregon | Yes | 4.75% to 9.9% |

| Pennsylvania | Yes | Flat rate of 3.07% |

| Rhode Island | Yes | 3.75% to 5.99% |

| South Carolina | Yes | 0% to 6.5% |

| South Dakota | No | |

| Tennessee | No | |

| Texas | Yes | 0.23% to 6.23% |

| Utah | Yes | Flat rate of 4.85% |

| Vermont | Yes | 3.35% to 8.75% |

| Virginia | Yes | 2% to 5.75% |

| Washington | No | |

| West Virginia | Yes | 2% to 5.75% |

| Wisconsin | Yes | 3.54% to 7.65% |

| Wyoming | No |

You might pay local income taxes on unemployment

Depending on where you live, you may also have to pay local taxes on your unemployment benefits. This varies from city and county. Contact your state’s unemployment agency to find out what taxes might apply to you.

How to pay unemployment taxes

If you’re receiving benefits, you will receive Form 1099-G[4] from the Department of Revenue, which reports your total taxable income from government payments in the calendar year. This tax information has to be included in your federal tax return, just like any other source of annual income.

Taxes follow a pay-as-you-go system. You either withhold taxes throughout the year or pay quarterly.[5] If you fail to pay your taxes on time or don’t pay the right amount, it can trigger an underpayment penalty. On the other hand, if you pay too much throughout the year, it results in an overpayment, meaning you’d receive a tax refund.[6]

The first step to paying unemployment taxes is understanding how much you owe. After you figure out how much you owe, you can determine how much you need to withhold from your payments or how much to pay quarterly in estimated taxes. The IRS provides a tax withholding estimator tool that can help you estimate withholding.[7]

After you know how much you should withhold, consider the options you have for staying on top of your taxes, which we explain in the next sections.

Contact your state’s unemployment agency to discuss withholding options

Similar to how, at your previous job, your company might have withheld money for taxes and made those payments for you, you can request that the state does the same with your weekly unemployment benefit payments. According to the Department of Labor, the state can withhold 10% of your unemployment benefits, and pay it to the IRS on your behalf. You can also request tax withholdings for state or local tax if they apply to you.[8]

If you need to change your federal tax withholdings, you can complete a Form W-4V. This form is used to request federal income tax withholdings, such as your Social Security benefits and unemployment benefits.[9] Changing your state tax withholdings varies by state so contact your state’s department of revenue to discuss your options.

Pay estimated taxes quarterly

Another way to stay on top of your taxes is to make estimated tax payments to the IRS and your state tax agency every quarter throughout the year. You can do this in combination with withholding so you don’t run into issues like an underpayment penalty.[6]

Here is a list of when quarterly taxes are typically due according to the IRS[5]:

| Payment period | Due date | |

|---|---|---|

| 1st quarter | January 1 to March 31 | April 15 |

| 2nd quarter | April 1 to May 31 | June 15 |

| 3rd quarter | June 1 to August 31 | September 15 |

| 4th quarter | September 1 to December 31 | January 15 of the following year |

If these due dates fall on a Saturday, Sunday or legal holiday, the payments are due the next business day. If you’re not sure how much you would need to pay, you can fill out form 1040-ES, which helps you calculate estimated taxes.[10]

There are a few ways to pay your quarterly taxes:

- You can pay electronically using the EFTPS: The Electronic Federal Tax Payment System is a free portal provided by the U.S. Department of the Treasury that allows you to securely pay your taxes online.[11]

- You can make a payment by phone: The IRS allows taxpayers to pay by phone by calling 800-829-1040.

- You can send Form 1040-ES by mail: You can fill out and mail a paper copy of Form 1040-ES, along with a check in the amount of your payment, to the IRS. The address you send it to depends on what state you’re in.

What to do if you can’t pay your taxes

If you’re struggling to pay your taxes, you have options.[12] The IRS advises that you should pay as much of what you owe as you possibly can and make the payment by the due date. If you leave the debt unpaid without communicating with them, you may be charged interest on any unpaid balance and might be subject to failure-to-pay penalties.

If you can’t pay your taxes when they’re due, you might be able to:

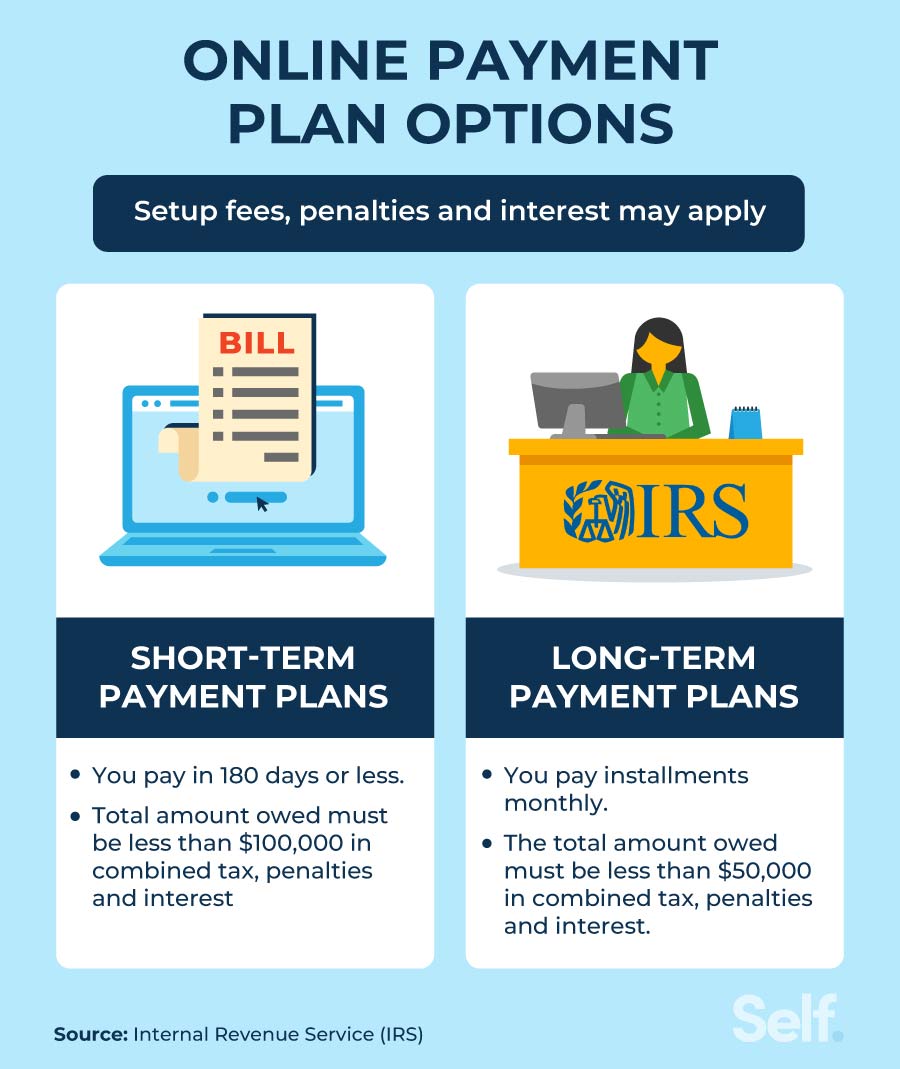

- Pay over time through a payment plan. The IRS offers short- and long-term payment plans. You can apply for them online and will be notified immediately if your request is approved. Low-income taxpayers may be able to have fees associated with their plans, like the setup fee and any late payment fees, waived.

- Reach out to a tax attorney or the IRS. You can contact the IRS for help toll-free at 800-829-1040.[13] Depending on your situation, it might be appropriate to look into legal services and retain an attorney to negotiate with the IRS on your behalf.

Does filing for unemployment affect your credit score?

Unemployment benefits can be extremely helpful in your time of need, but it can be nerve-wracking to think of how they affect you financially. Fortunately, filing for unemployment benefits doesn’t directly affect your credit score. Credit reports won’t update information about your employment status at all — while you may notice information about employers listed on your credit report, it will only appear if you’ve used that information on credit applications.[14]

Understand how unemployment benefits work

The unemployment benefits you receive depend on the type of program paying the benefits. These programs vary, from state unemployment insurance benefits, to disability benefits, to federal benefits paid by the District of Columbia Trust Fund.[1]

No matter where your unemployment benefits come from, if you received unemployment compensation during the year, it’s counted in your adjusted gross income and you have to include it when you file your taxes. If you end up skipping the federal or state taxes you owe, you may receive a bigger bill than you’re prepared for next spring.

While you’re receiving benefits, be sure to check with your state’s unemployment agency to make sure you’re in compliance with its regulations, so you can avoid having to pay back your unemployment benefits once you’re employed again.

Sources

- IRS. “Topic No. 418 Unemployment Compensation,” https://www.irs.gov/taxtopics/tc418. Accessed September 28, 2022.

- IRS. “Exclusion of up to $10,200 of Unemployment Compensation for Tax Year 2020 Only,” https://www.irs.gov/forms-pubs/exclusion-of-up-to-10200-of-unemployment-compensation-for-tax-year-2020-only. Accessed September 28, 2022.

- Kiplinger. “Taxes on Unemployment Benefits: A State-by-State Guide,” https://www.kiplinger.com/taxes/state-tax/602307/taxes-on-unemployment-benefits-a-state-by-state-guide. Accessed September 28, 2022.

- IRS. “Instructions for Form 1099-G (01/2022),” https://www.irs.gov/instructions/i1099g. Accessed September 28, 2022.

- IRS. “Pay As You Go, So You Won’t Owe: A Guide to Withholding, Estimated Taxes, and Ways to Avoid the Estimated Tax Penalty,” https://www.irs.gov/payments/pay-as-you-go-so-you-wont-owe-a-guide-to-withholding-estimated-taxes-and-ways-to-avoid-the-estimated-tax-penalty. Accessed September 28, 2022.

- IRS. “Underpayment of Estimated Tax by Individuals Penalty,” https://www.irs.gov/payments/underpayment-of-estimated-tax-by-individuals-penalty. Accessed September 28, 2022.

- IRS. “Tax Withholding Estimator,” https://www.irs.gov/individuals/tax-withholding-estimator. Accessed September 28, 2022.

- Department of Labor. “Withholding Tax Information,” https://oui.doleta.gov/unemploy/taxinfo.asp. Accessed October 5, 2022.

- IRS. “Form W-4V,” https://www.irs.gov/pub/irs-pdf/fw4v.pdf. Accessed September 28, 2022.

- IRS. “2022 Form 1040-ES,” https://www.irs.gov/pub/irs-pdf/f1040es.pdf. Accessed September 28, 2022.

- EFTPS. “EFTPS,” https://www.eftps.gov/eftps/. Accessed September 28, 2022.

- IRS. “Options for taxpayers who need help paying their tax bill,” https://www.irs.gov/newsroom/options-for-taxpayers-who-need-help-paying-their-tax-bill. Accessed September 28, 2022.

- IRS. “Federal State Local Employment Tax (FSLET) Customer Services,” https://www.irs.gov/government-entities/federal-state-local-governments/federal-state-local-employment-tax-fslet-customer-services. Accessed September 28, 2022.

- Experian. “Does Filing for Unemployment Affect Your Credit?” https://www.experian.com/blogs/ask-experian/does-filing-for-unemployment-affect-your-credit/. Accessed September 28, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).