What Is Annual Income and How To Calculate It

Published on: 02/06/2026

Calculating how much money you make in a year might seem straightforward. It’s easy to assume that your income is simply what you get paid for your job.

But there’s more to it than that. The job market has shifted, with more people earning income through contract or gig work than before. Some measures of the gig economy include any worker who engages in non‑standard work in any capacity — online or offline, on a regular or occasional basis, and for primary or supplemental earnings — including people who hold traditional jobs alongside gig work.[1]

Not all of these income types have the same effect on your annual income or your taxable income, and that’s before deductions come into play. So what exactly is annual income and how do you calculate it?

Key points

- Annual income is the total amount you earn in a year from all sources, including wages, salary, self-employment earnings, and recurring unearned income.

- Calculating annual income involves adding together your different income streams, such as hourly pay, salaries, bonuses, dividends, and other regular payments.

- Understanding your annual income is useful because it affects tax preparation, financial planning, and legal obligations like alimony or child support.

What is annual income?

Annual income is the total amount of income you earn in a calendar year or fiscal year before taxes and deductions. If you live with a spouse or family members, you may need to combine your annual salary and additional income with theirs to arrive at what is known as your household income.

You also may have heard about “gross annual income” or “gross pay,” which is the amount of money you make in one year before deductions are factored in.[2] This stands in contrast to your net income.

What is net annual income?

An individual’s net income is their income after taxes and deductions. This is your actual take-home pay and what you have left at your disposal.

In business, net income is any remaining capital gains after all operating expenses have been paid.

Income comes in many forms, from a salary to interest on your savings account.

Types of income

There are three types of income: earned income, unearned income, and portfolio income. The main distinction is that earned income is compensation for work, while unearned income is generated through other means. Here’s a closer look.

Earned income

Earned income is the total amount of money you actively earn from working. (If you’re traditionally employed, it’s taxed by the government through withholdings before it is sent to you. If you are self-employed, you may need to estimate how much you will owe and file quarterly taxes.)

Earned income can take the form of wages, salary, commissions, overtime pay, tips, or bonuses. Self-employment also counts as a source of income. So do things like long-term disability and union strike benefits.[3]

Portfolio income

Your portfolio income is income from your investments (in fact, it’s sometimes referred to as an investment portfolio). Portfolio income includes such things as stock dividends, interest, royalties from investment properties, or capital gains.

Portfolio income such as income from capital gains is often taxed at a lower rate than earned income, and it’s also not subject to Medicare or Social Security tax.[4]

Unearned income

Unearned income, also known as passive income, is money you receive without actively earning it. It isn’t compensation for services rendered or goods provided. For example, receiving gifts and contributions, such as inheritances can be a source of unearned income. So is spousal support and VA benefits.

Other sources of unearned income include Social Security, welfare and unemployment benefits, lottery or gambling winnings, and gifts.[5]

How to calculate your annual income

If you know your weekly income or monthly income, it’s relatively simple to arrive at your annual income.

To calculate your gross annual income, check your paystub for the most recent pay period and find your gross pay (before taxes and deductions). Multiply that amount by the number of pay periods in a year — 12 for monthly pay, 26 for biweekly pay, or 52 for weekly pay.

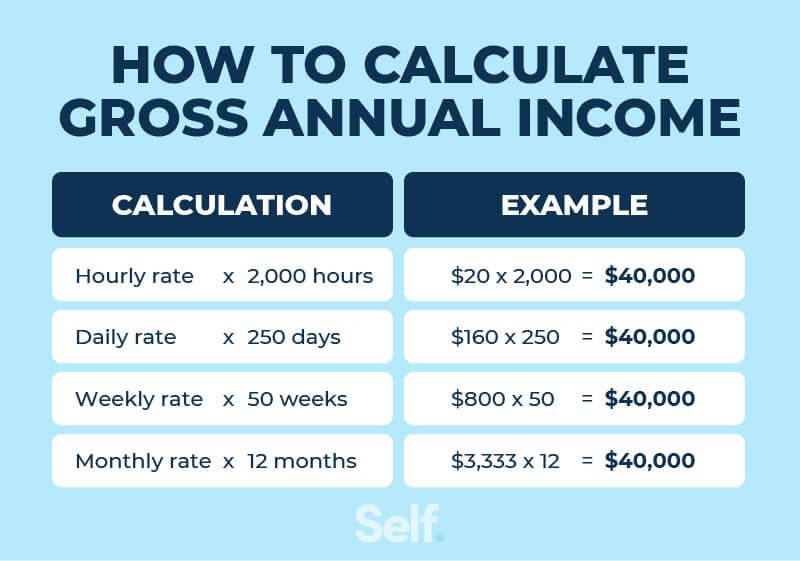

Here is a common formula to use in calculating your earned income based on how you get paid, assuming you work an average of 40 hours per week or 50 weeks per year.

- Hourly: rate x 2,000

- Daily: rate x 250

- Weekly: rate x 50

- Monthly: rate x 12

These numbers may vary depending on the number of hours you work and your hourly wage if you’re an hourly employee. Salaried employees may have to take a look at your pay stubs to figure out your yearly salary.

Remember that your wages are just one source of income. To calculate your total annual income, you will need to add things such as bonus pay, tips, stock dividends, public assistance payments, etc.

Annual income calculation example

If you’re still curious about how to calculate your annual income, here is an example:

Assume Michelle is an hourly employee who earns $20 an hour at her full-time job. Let’s say she works eight hours per day, five days per week, and 50 weeks per year (assuming two weeks of unpaid vacation per year). To calculate her income:

Hourly: $20 earned per hour multiplied by 2,000 working hours in a year = $40,000

(8 hours x 5 days x 50 weeks = 2,000 working hours)

Daily: $160 earned per day multiplied by 250 working days in a year = $40,000

(8 hours x $20 hourly rate = $160 earned per day)

(5 days x 50 weeks = 250 working days)

Weekly: $800 earned weekly multiplied by 50 working weeks per year = $40,000

($160 per day x 5 days = $800 per week)

Monthly: $3,333 earned per month multiplied by 12 months per year = $40,000

Note: “$3,333” was rounded to the nearest whole number.

($40,000 divided by 12 months = $3,333)

Why calculating your annual income is useful

Knowing your annual income can be useful in a variety of situations, starting with tax preparation. It can help you determine your tax deductions and file income tax returns.

It’s also necessary if you’re paying alimony or child support. When determining the level of support you’re responsible to pay, courts can consider earned income along with recurring unearned income such as stock dividends. Other factors may include corporate contributions to your retirement, partnership distributions, bonuses, and deferred compensation.[6]

Those are legal requirements, but you also may want to know your annual income for discretionary reasons. You may wish to apply for a credit card or loans from other kinds of lenders, such as a car loan or mortgage; knowing your annual income helps you demonstrate your ability to make monthly payments responsibly.

Knowing your income is also an important starting point when deciding how to budget and save money. And just in general, it’s helpful to know how much you’re earning.

For one thing, you can compare your earned income with that being offered by other employers to know whether you’re getting fair compensation or might be able to do better by applying for a job elsewhere. Other companies may also offer benefits (such as health insurance) and bonuses that your current employer doesn’t provide, so it’s helpful to know where you stand when weighing a job offer.

Use your annual income to budget and plan

Whether you are filing taxes or filling out a credit card application, knowing your annual income is helpful. Once you know the different elements involved and how to calculate them, you can be better prepared to deal with your personal finances on many levels.

Understanding your annual income can help you create a budget and plan for your financial future.

Sources

- Gig Economy Data Hub. “How Many Gig Workers Are There?” https://gigeconomydata.org/basics/how-many-gig-workers-are-there.html. Accessed January 7, 2026.

- Indeed. “Gross Annual Income: Definition and Examples,” https://www.indeed.com/career-advice/pay-salary/gross-annual-income. Accessed November 17, 2021.

- Investopedia. “What Is Earned Income?” https://www.investopedia.com/terms/e/earnedincome.asp. Accessed November 17, 2021.

- WCG Inc. “Three Different Types of Income – Know the Tax Rates.” https://wcginc.com/kb/three-types-of-income/. Accessed on November 19, 2025.

- Investopedia. “Unearned Income,” https://www.investopedia.com/terms/u/unearnedincome.asp. Accessed November 17, 2021.

- Moskowitz Law Group. “What Counts as Income When It Comes to Child Support?” https://www.divorcelawyers1.com/blog/what-counts-as-income-when-it-comes-to-child-support/. Accessed on November 19, 2025.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.