Can I Open A Bank Account With Bad Credit?

Published on: 12/10/2019

Even with bad credit, you may be able to open a bank account, giving you a secure place for your money and the freedom to pay bills online or by check. However, while most banks typically don’t check your credit history or credit score, they may check your ChexSystems report, which monitors your banking history.

If you’re worried about how your credit and banking history might affect your chances of opening an account, this post helps you understand how most banks evaluate applicants and what to do if your application gets denied.

Table of contents

- Can bad credit prevent you from opening a bank account?

- How banks evaluate your application

- What to look for in a checking account

- Improving your ChexSystems score

- Why was your application denied?

- What to do after a denied bank application

- Take control of your credit

Can bad credit prevent you from opening a bank account?

Bad credit included on a credit report should not prevent you from opening a bank account. Most banks don’t approve or deny new accounts based on your credit score or credit report. Instead, banks use a different tool — a checking account consumer report — that details your banking savings and checking account history, not your credit history. However, if a bank denies your application, you still may have options for opening an account.

How banks evaluate your application

Although your credit history doesn’t factor into a bank’s evaluation, banks do consider these four main factors when you apply for an account:

- Previous banking history

- Any past closed bank accounts

- Any identity fraud or suspicious activity

- Your ChexSystems reports

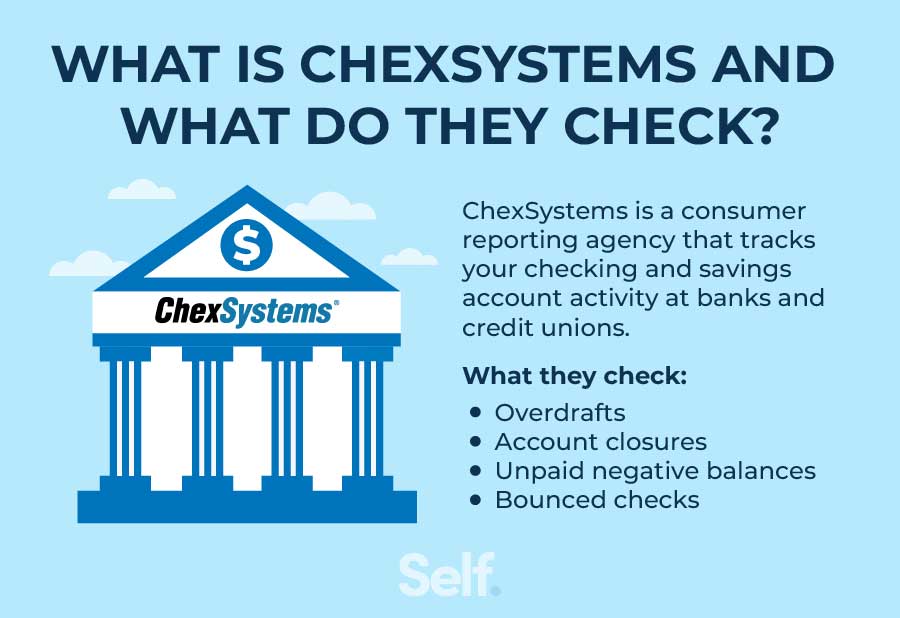

What is ChexSystems?

Many banks use ChexSystems, a completely different banking verification system than a credit bureau, to evaluate your past checking and savings accounts activity. While the three major credit bureaus, Experian, TransUnion, and Equifax, collect information from lenders to include on your credit report, ChexSystems collects information about your previous banking history.

ChexSystems may gather the following information:

- Account, card, or ATM withdrawals abuse

- Account closures or freezes

- Alleged fraud or identity theft

- Overdrafts or bounced checks

- Unpaid negative balances

- How many accounts you recently applied for

It typically takes five years for legitimate items to fall off your ChexSystems report.[1]

What to look for in a checking account

If you have negative information on your Chexsystems report, you may want to consider a second chance bank account. Second chance bank accounts may not check your banking history, and if they do they are willing to give you a second chance. However, they may come with fees and a minimum balance.[2]

When evaluating your bank account options, consider accounts that:

Don’t check ChexSystems reports

More than 80% of banks use an account-screening agency such as ChexSystems to evaluate the risk of prospective account holders.[3] So not all banks check out your banking history. Ask whether the bank you’re considering uses ChexSystems or another similar report. If they do, check if they have second chance account options.

Don’t have hidden or monthly fees

You might want to look for account options with no fees such as monthly maintenance fees, bank fees, transaction fees, service fees, ATM fees or annual fees. Another option is looking into online-only banks, they often have few to no fees since there is no physical branch.

Don’t require minimum balances

You can check to see if the account requires you to maintain minimum account balances. These minimums can cost you since banks may charge you monthly maintenance fees if you don’t satisfy the minimum balance requirement. Such accounts may also require a minimum deposit.[4]

Improving your ChexSystems score

If you believe you have errors on your ChexSystems report, you can request a copy of the report. Then, if you find errors, the Consumer Financial Protection Bureau recommends that you file a dispute both with the reporting company and with the financial institution that provided the faulty information in the first place.[5]

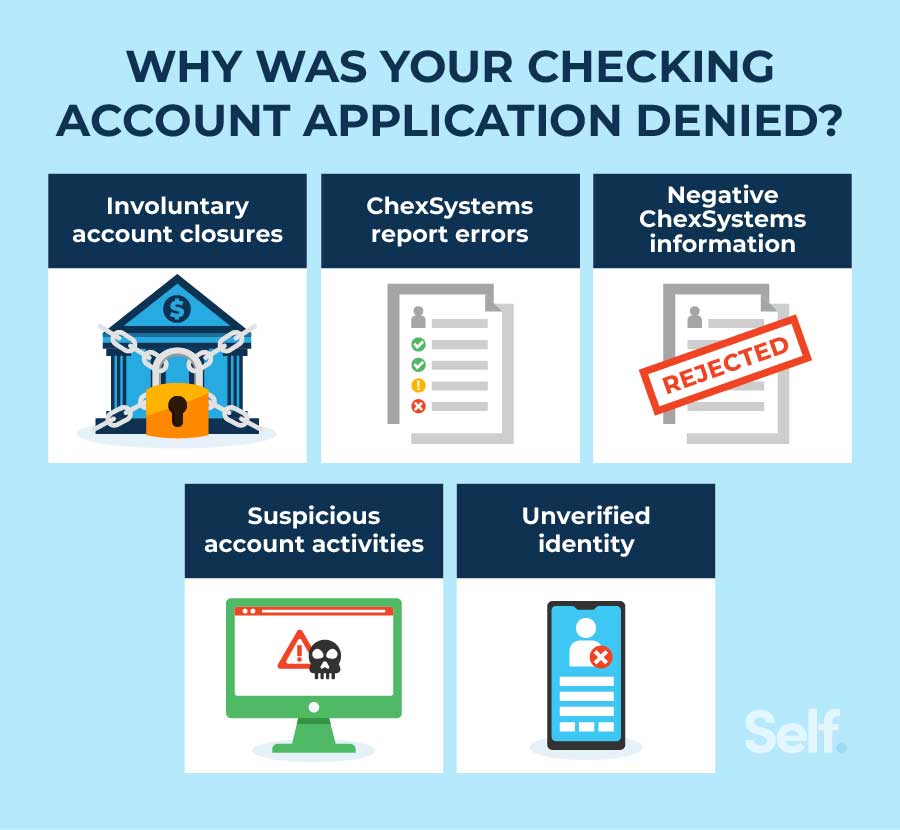

Why was your checking account application denied?

Although banks don’t pull a credit report when applying for a checking account, that doesn’t mean you can get approved automatically. Whether you’ve applied at traditional banks or online banks, we list a few reasons that your application may have been denied:[6]

Involuntary account closures: Your history with bank accounts may include negative balances or outstanding debts that have been closed by previous banks. Late payments on fees, repeated overdrafts and similar factors can lead to account closures, which can appear on your ChexSystems record. Banks are looking for account holders who can avoid overdrafts and pay the fees they owe.[7]

ChexSystems report errors: Banks may deny your application based on errors that have appeared on your ChexSystems report. In some cases, your Social Security number may have been input incorrectly. In others, information belonging to someone with a similar name may have ended up on your report.

Negative ChexSystems information: Your ChexSystems report may contain information such as a record of bounced checks, repeated overdrafts, or other negative activity within the past few years of your banking history.

Suspicious account activities: A background of fraudulent checks or suspicious activity may prevent you from opening a bank account.

Unverified identity: Banks may not be able to verify your identity, especially if you have changed or updated it. Be sure to provide identification documents that include updated information, such as your current legal name and address.

Keep in mind that your banking history may be negatively affected if you had a joint account with someone who experienced any of the above issues.

What to do after a denied bank application

If a financial institution has denied your checking account application, you have the right to request a free checking account report since it is considered an “adverse action” notice. Banks must inform you that you have been denied credit and provide information of which checking account screening company was used and how to contact them. Then you can work on correcting the information or improving your banking activity. Use these options to develop a positive banking history and to find banking options that might best fit your needs.[8]

Open a second chance checking account

If you were denied for a traditional checking account, consider opening a second chance bank account. They are similar to regular checking accounts with a few key differences: They may require monthly maintenance fees, minimum balances or a minimum opening deposit. They’re available from a number of institutions, such as Wells Fargo, Green Dot and Chime.[2]

Try a local bank or credit union

Different banks may interpret your application differently. So, shop around and see which banks may be likely to accept your application. Try a local bank or credit union.

Check your consumer report for errors

Check your ChexSystem report for any errors. Under the Fair Credit Reporting Act (FCRA), you can request a free copy of your consumer report every 12 months or anytime you’ve been denied a checking account for reasons listed on your report. You can order from the following agencies:

There are other checking account reporting agencies as well. If a financial institution denied your application, make sure to request your checking account report from the entity that the financial institution based their decision on.

Also consider checking your credit report for errors. Even though banks don’t typically use credit reports in evaluating account applications, you may see similar errors, such as information belonging to someone with a similar name may have ended up on your report. It pays to correct these as well, so negative information doesn’t result in credit denials and/or higher interest rates.

Consider a prepaid debit card

Prepaid cards are not linked to a bank checking account or a credit union. You are spending money you placed or “loaded” onto the card, so you can’t typically access any amount above your limit. It could be possible to go over your limit because of mismatched timing on your transactions. Therefore, it’s important to be aware that some cards can charge you overdraft fees if you overspend and make too many debit card purchases.

In addition, you may face other fees, including reloading fees, inactivity fees, setup fees or monthly fees. Plus, some businesses may not accept prepaid cards.

Take control of your finances

Even though your credit report isn’t likely to be a factor when you apply for a bank account, your credit is still an important aspect of your financial health. Many of the habits that can help you maintain a positive banking history can help you with your credit, too, such as:

- Avoiding missed or late payments

- Paying your bills on time

- Monitoring your balances and purchases to avoid overspending

- Tracking your bank and credit card statements for any usual activity

Following these habits may help you stay on top of your finances and may also open the door to more financial opportunities and set you up for a positive financial future.

Sources

- Experian. “What Is ChexSystems?” https://www.experian.com/blogs/ask-experian/what-is-chexsystems/. Accessed April 5, 2022.

- Experian. “What Is Second Chance Banking?” https://www.experian.com/blogs/ask-experian/what-is-second-chance-banking/. Accessed April 5, 2022.

- National Consumer Law Center. “Account Screening Consumer Reporting Agencies: A Banking Access Perspective,” https://www.nclc.org/images/pdf/pr-reports/Account-Screening-CRA-Agencies-BankingAccess101915.pdf. Accessed April 5, 2022.

- Forbes. “Bank Account Minimum Deposit And Minimum Balance Requirements,” https://www.forbes.com/advisor/banking/bank-account-minimum-deposit-minimum-balance-requirements/. Accessed June 23, 2022.

- Consumer Financial Protection Bureau. “Checking account denials,” https://files.consumerfinance.gov/f/documents/cfpb_adult-fin-ed_consumer-guide-to-being-denied-a-checking-account.pdf. Accessed April 5, 2022.

- Experian. “Why Was I Denied a Checking Account?” https://www.experian.com/blogs/ask-experian/why-was-i-denied-a-checking-account/. Accessed April 5, 2022.

- Consumer Financial Protection Bureau. “My bank or credit union closed my checking account. Will this hurt my credit?” https://www.consumerfinance.gov/ask-cfpb/my-bank-or-credit-union-closed-my-checking-account-will-this-hurt-my-credit-en-1819/. Accessed April 8, 2022.

- Consumer Financial Protection Bureau. “Denied for a bank account? Here’s what you should know,” https://www.consumerfinance.gov/about-us/blog/denied-bank-account-heres-what-you-should-know/. Accessed June 23, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).