How to Use a Paid-in-Full Letter (+ Template)

Published on: 07/27/2025

You can send or receive a paid-in-full letter to confirm you no longer owe money to a creditor or debt collector. For example, if you are about to make your final payment to a creditor or debt collector, you may want to send a paid-in-full letter as proof of payment.

Although you can show copies of cashed checks or credit card statements to show that you’ve made payments on a debt, a paid-in-full letter can demonstrate that your debt has been paid off in full and that you owe no more payments, interest or any applicable fees or penalties on your debt.

This post explains what a paid-in-full letter is, including an example, how it works, and how you can use one to offer written confirmation that you’ve paid your debt in full.

What is a paid-in-full letter and how does it work?

A paid-in-full letter refers to a letter that you either write to a creditor or ask a creditor to send to you that confirms you have paid the debt you owed in full. Whether you are making your last payment or have already paid off the debt, this letter offers validation that you owe nothing more to the creditor.[1]

The letter, along with copies of your payments, like cashed checks and credit card statements, serves as proof that you’ve paid the debt off. It’s useful as a regular record-keeping practice, and you can also use this letter to dispute inaccuracies on your credit report that indicate you owe a debt or to ask for verification about a debt you don’t recognize.

When is a debt considered paid in full?

A debt is considered paid in full when the entire principal, or the initial amount of the debt, is paid back, along with any applicable interest, fees or penalties.[2]

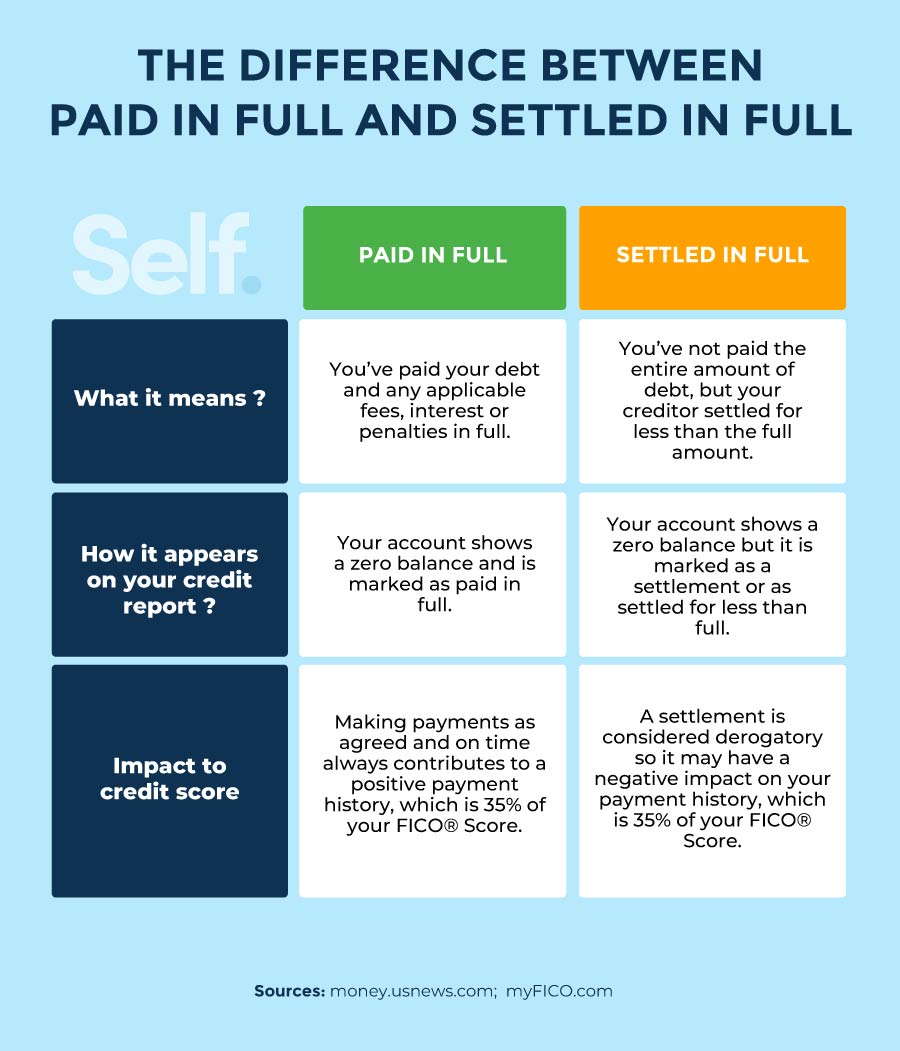

There are other ways to close debt accounts, but each option has a different impact on your credit and finances. Here are the key differences between them:

- Paid in full: You pay back the full amount of your debt, including the principal and any interest, fee or penalties. You are no longer obligated to make payments, and your credit score usually receives a positive impact, especially if the payments you made towards the debt were on time.[2]

- Settled in full: You pay back some of the debt, but less than the entire balance. This is usually an amount that’s agreed upon between you and the creditor or debt collector. Settling an account can negatively affect your credit score because it means that you were unable to fully repay your debt.[2]

- Closed: Your creditor can close your account because of delinquency if you don’t make payments on what you owe. Accounts closed for delinquency typically stay on your credit report for seven years from the date of the first missed payment.[3]

How do I write a paid-in-full letter?

When you make a final payment on a debt or you want to request proof that you made all the payments on your debt, follow these steps to write a paid-in-full letter.[4]

What information should be included in my paid-in-full letter?

When writing a paid-in-full letter to a creditor or debt collector, you’ll want to include any information you have about the debt and properly document your information by including:

- Your name and contact information (current address and phone number)

- The date

- The original creditor’s name and address

- The name of the debt collection agency that contacted you and when you were contacted (if applicable)

- The account number of the original debt

- The original amount of the debt

- Final payment proof (canceled check, for example)

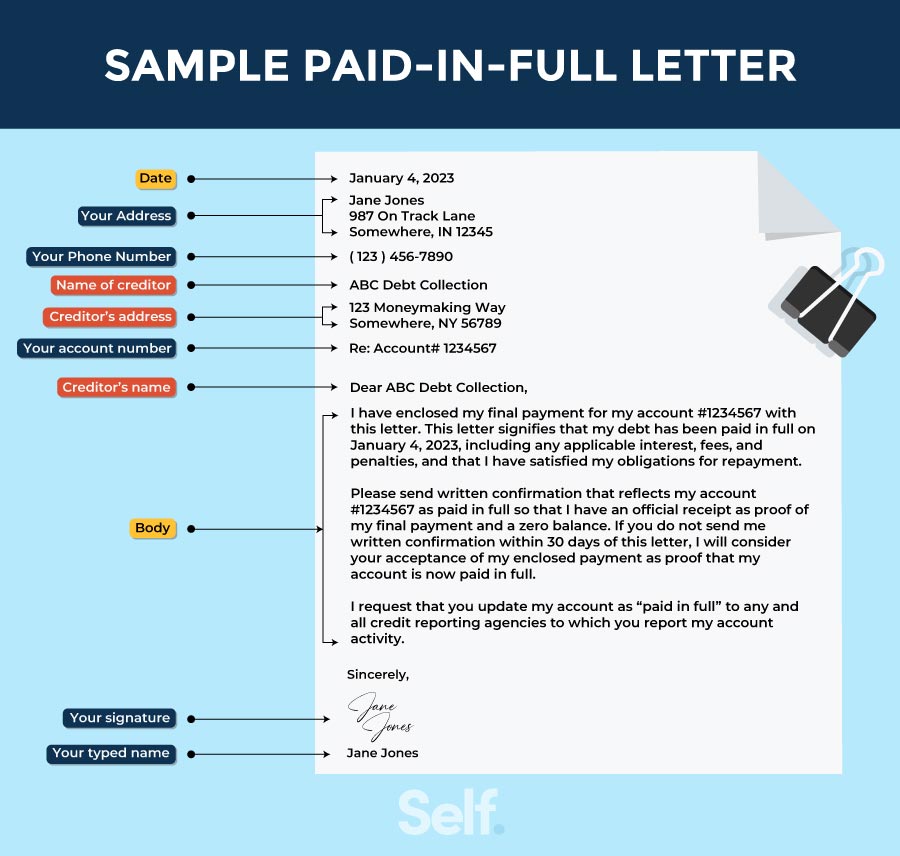

Paid-in-full letter sample

Here’s an example of a paid-in-full letter you can follow:

[Your name]

[Your return address]

[Date]

[Creditor name] [Creditor address]

Re: [Account number for the debt]

Dear [Creditor],

I have enclosed my final payment for my account [account number for the debt] with this letter. This letter signifies that my debt has been paid in full on [date], including any applicable interest, fees and penalties, and that I have satisfied my obligations for repayment.

Please send written confirmation that reflects my account [account number] as paid in full so that I have an official receipt as proof of my final payment and a zero balance. If you do not send me written confirmation within 30 days of this letter, I will consider your acceptance of my enclosed payment as proof that my account is now paid in full.

I request that you update my account as “paid in full” to any and all credit reporting agencies to which you report my account activity.

Sincerely,

[Your name]

Should I pay in full or settle in full?

Generally, if you’re able to afford it, you should opt to pay in full. Paying your debt in full not only means that you pay back everything you owe and don’t have to worry about negotiating with a lender, but it also contributes to your positive payment history, one of the most important factors in your credit score, accounting for 35% of your FICO® Score.[2],[5]

If you can’t afford your debt, settling in full is always an option. Debt settlement can save you money down the line, which is especially helpful if you need it for other expenses. It does, however, generally damage your credit to settle, both from the settled account staying on your credit report and any payments you might have missed during your negotiations with the creditor.[6]

How does having a debt paid in full affect my credit?

Paying your debt off in full generally has a positive impact on your credit score, once your credit report updates.[7] If you paid your debt while it was in collections, keep in mind that different credit scoring models may treat paid collections differently. Some newer credit scoring models, such as FICO® Score 9, FICO® Score 10, and VantageScore® 3.0 and 4.0, do not factor paid collections into your credit score calculation, while older models may still consider them.[8] [9]

Payment history is the most important factor in determining your credit score.[5] Making on-time monthly payments to pay down your debt generally has a positive impact on your credit score, just like any other on-time payments.

Check your credit report for paid-in-full updates

To see the status of your paid-in-full account or see its impact on your credit, you can obtain a copy of your credit report so you can monitor it for changes. Your credit report is usually updated once every 30 to 45 days, so don’t worry if you don’t see a change right away.[10]

You can get a copy of your credit report from each bureau for free every week at AnnualCreditReport.com. You can also get a copy through any of the major credit bureaus (Experian, Equifax and TransUnion) for a fee. Some institutions that provide financial services, like credit cards and banks, may also partner with the credit bureaus to offer access to free credit scores and credit monitoring tools as part of your accounts with them.

A paid-in-full account generally has a positive impact on your credit. A settled account generally stays on your credit report for up to seven years from the date of your first delinquency, but its negative impact diminishes over time.[11]

Tips for proving your debt is paid in full

Sometimes a situation might arise where you have to prove you’ve paid your debt in full. While this won’t necessarily happen, it’s good to be prepared just in case. Here are some ways to prove your debt is paid in full if a debt collector or creditor contacts you about it:

- Use a paid-in-full letter. Whether the letter is written by you like the sample above, or the paid-in-full letter is from your lender, confirming that the debt was paid in full, provides great, concrete evidence that you’ve paid off your debt.

- Show bank statements/receipts/records of payment. These financial records show you’ve made payments towards your debt and the sum you’ve paid overall.

- Use certified mail. Using certified mail verifies that your letter was received by the creditor or debt collector. For added verification, you can also use a return receipt.

- Send copies only, not originals. It’s important to hold onto your original documents because they provide proof of authenticity.[11]

Should I close an account that was paid in full?

No, you shouldn’t close an account that was paid in full, especially if the account is in good standing, meaning you’ve made on-time payments and met the terms for your agreement with the creditor.[12] An open account in good standing stays on your credit report for up to 10 years, continuing to have a positive impact in that time.

Closing an account in good standing might decrease your credit utilization ratio (CUR) if it’s a revolving credit account and it can over time decrease your length of credit history, both of which may impact your credit score. Your CUR refers to the ratio of your total revolving debt divided by your total revolving credit limits. Aim for maintaining a CUR between 10% and 30%; while there is no set point when your credit utilization starts negatively affecting your credit, the negative impact can become more pronounced at around 30%.[13]

Can I remove a paid-in-full account from my credit report?

Typically, you can’t remove accurate information from your credit report, regardless of whether it’s good or bad.[14] Though the information can remain on your credit report for years, its impact, positive or negative, lessens over time.[11]

A paid-in-full account is generally considered positive, but it can involve some negative items, like if you’ve missed any payments towards your debt or made late payments. Here are some of the more common types of negative information you might find on a credit report, and how long the information remains on your report even after the accounts are paid in full:

- Late payments: Seven years from the date of first delinquency

- Bankruptcies: Seven years for Chapter 13 bankruptcies and 10 years for Chapter 7 bankruptcies

- Foreclosures: Seven years

- Collections: Up to seven years plus 180 days from the date the account first became past due with the original creditor [15]

- Public record: Seven years[11]

Strategies to pay off debt

Getting out of debt is hard. Trying to find the right way to approach debt repayment can be very overwhelming, especially if you’re dealing with a lot of debt. Depending on your financial situation and what works best for you, here are a few debt management strategies to consider.

Debt snowball method

The debt snowball method involves paying the smallest balance first, then working your way up to repaying your higher balances. If you have debt spread across multiple credit cards or need to pay down an intimidating amount of debt, using the debt snowball method can offer motivation as you tackle each balance. The more you pay off, the more money you have to put towards the next payment, creating the “snowball effect.”

While this method can be helpful, keep in mind that it does often result in a longer-term repayment time, meaning you may incur more interest charges than if you went with another strategy.

Debt avalanche method

The debt avalanche method involves making bigger payments on high-interest debt first. It allows you to pay off your total debt in the fastest and least expensive way possible, by shortening the length of debt and resulting in less interest over time.

This repayment method may be harder to use if you struggle to stay motivated, but its long-term benefits can make it well worth it, especially if you’re dealing with high-interest credit cards that can build up interest charges fast.

Credit counseling

If you feel lost, talking to a credit counselor might be a way to get back on track. The right credit counselor can not only advise you on how to manage your debt, but can also get involved with your creditors, negotiating lower interest rates, reduced monthly payments and other assistance on your behalf.[17]

How to build credit after delinquency

Dealing with debt collectors and creditors can be a scary experience. But, no matter how difficult it may seem, there’s always a way to get back on track.

Wherever you are in your credit-building journey, Self has tools to help you succeed. Get started with us today, and take the next step forward on your road to financial recovery.

Sources

- Consumer Financial Protection Bureau. “A debt collector contacted me about a debt I already paid. What should I do?” https://www.consumerfinance.gov/ask-cfpb/a-debt-collector-contacted-me-about-a-debt-i-already-paid-what-should-i-do-en-1399/#:~:text=If%20you%20don%27t%20have,ve%20paid%20off%20the%20debt.

- U.S. News & World Report. “Paid in Full vs. Settled in Full: Which Is Best For Debt?” https://money.usnews.com/credit-cards/articles/paid-in-full-vs-settled-in-full-which-is-best-for-debt.

- Experian. “Closed Credit Card Accounts Showing on Credit Report,” https://www.experian.com/blogs/ask-experian/revolving-accounts-paid-in-full-closed-but-still-on-report/.

- Consumer Financial Protection Bureau. “What should I do when a debt collector contacts me?” https://www.consumerfinance.gov/ask-cfpb/what-should-i-do-when-a-debt-collector-contacts-me-en-1695/.

- MyFICO, “How Payment History Impacts Your Credit Score” https://www.myfico.com/credit-education/credit-scores/payment-history.

- Experian, “Will Settling a Debt Affect My Credit Score?” https://www.experian.com/blogs/ask-experian/will-settling-a-debt-affect-my-score/,

- Equifax, “Why Your Credit Scores May Drop After Paying Off Debt” https://www.equifax.com/personal/education/credit/score/articles/-/learn/why-credit-scores-may-drop-after-paying-off-debt.

- MyFICO, “Understanding FICO Score Versions” https://www.myfico.com/credit-education/credit-scores/fico-score-versions.

- Experian, “Can Paying Off Collections Raise Your Credit Score” https://www.experian.com/blogs/ask-experian/can-paying-off-collections-raise-your-credit-score/.

- TransUnion. “How Long Does it Take for a Credit Report to Update?” https://www.transunion.com/blog/credit-advice/how-long-does-it-take-for-a-credit-report-to-update.

- myFICO®. “Chapter 7 & 13:How long will negative information remain on my credit report?” https://www.myfico.com/credit-education/faq/negative-reasons/how-long-negative-information-remain-on-credit-report.

- Experian. “Should I Close Accounts After Paying Debts Off?” https://www.experian.com/blogs/ask-experian/should-i-close-accounts-after-paying-debts/t.

- myFICO®. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be.

- Consumer Financial Protection Bureau. “Is it possible to remove accurate, negative information from my credit report?” https://www.consumerfinance.gov/ask-cfpb/is-it-possible-to-remove-accurate-negative-information-from-my-credit-report-en-1249/.

- Credit Karma, “How Long Do Collections Stay on Your Credit Report?” https://www.creditkarma.com/credit/i/long-collections-credit-report.

- Ramsey Solutions, “How the Debt Snowball Method Works” https://www.ramseysolutions.com/debt/how-the-debt-snowball-method-works.

- FTC, “Coping With Debt” https://consumer.ftc.gov/sites/default/files/articles/pdf/pdf-0037-coping-with-debt.pdf.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).